Dec 14, 2016

Strategy Bulletin Vol.173

2017 will be shaped by a strong US economy, strong president and strong dollar

- Anticipating a powerful stock market rally and economic boom in Japan

The emergence of a strong United States is likely to be the dominant event that defines 2017. The perception of a strong US economy and strong president will bring about a fundamental correction in the underestimation of the United States. We will see that the G-Zero concept that was widely accepted at one time is actually erroneous. Under the leadership of President-elect Trump, the strength of the US economy that has been out of sight thus far will emerge. The dollar will appreciate significantly as a result. Shock waves from a stronger dollar will in turn probably trigger changes linked to the unique characteristics of each country and region of the world. Countries that are US creditors and net exporters to the US will be at an advantage. Countries that have US debt will be at a disadvantage. Within a year or two, the yen is likely to fall below ¥130 to the dollar. A weaker yen will probably fuel a powerful upturn in earnings and stock prices in Japan. Due to these events, investors can expect the Nikkei Average to climb above ¥30,000 over the next year or two.

(1) Sound US fundamentals and bold fiscal initiatives

US economic fundamentals have never been stronger than they are now. Mr. Trump will inherit this robust economy and oversee a big economic boom in the United States that extends into 2018. All five of the following key indicators of US economic fundamentals are now at historic highs: (1) record-high corporate earnings backed by the information/internet revolution; (2) the competitive edge of US companies backed by the world’s highest level of innovation; (3) low interest rates accompanied by substantial funds available for investments (high volume of savings); (4) improving public-sector financial soundness; and (5) the ability to hold down inflation. Slowing economic growth is the only problem. Some US regions and population segments are not benefiting from economic growth. But this problem can be easily solved by implementing necessary measures. Consequently, Mr. Trump will be able to enact fiscal and deregulatory measures that speed up economic growth. This view is what is causing financial markets to move up.

An economic benefit on a massive scale

The chain-reaction of benefits from faster economic growth fueled by fiscal programs is the center of attention. Most significant is the enormous scale of proposed tax cuts: (1) a corporate income tax reduction from 35% to 15%; (2) a reduction from seven to three steps (12%, 25%, 33%) in personal income taxes, lowering the highest tax rate from 39.6% to 33%; (3) an extension in the tax reduction for capital gains and dividends; (4) elimination of the inheritance tax, and other actions. Mr. Trump is also advocating a reduction from 35% to 10% on overseas profits that multinational companies bring back to the United States. The aims are to increase tax revenue and return overseas income to the United States. Overall, these measures would amount to an estimated $5 trillion over a 10-year period, which is 2.8% of the US nominal GDP. Plans also include $1 trillion of infrastructure spending and more defense expenditures. All of these actions indicate that the US economy will easily achieve long-term growth since the 1990s of 3% . By comparison, the average US GDP growth rate has been 2.1% since the global financial crisis (2011-2015).

Deregulation in the energy and financial sectors will probably further contribute to stimulating business activity. There is even a significant possibility that the US economy is in the midst of booming growth of 4% to 5% in 2018 leading up to the midterm elections. However, this vigorous growth will eventually cause inflation and growing budget deficits, which are serious impediments to growth. Long-term interest rates will rise as a result and the US will ultimately enter a recessionary period.

With unemployment at only 4.9%, the US economy is already at full employment. Faster inflation will combine with enormous budget deficits to create growing worries about the economy starting in 2018. Nevertheless, a stronger dollar will probably be a very effective remedy for inflation and rising interest rates. If the dollar continues to appreciate, the expected economic boom is likely to last during Mr. Trump’s entire four-year term. Obviously, a stronger dollar translates into more US global financial clout. This would reinforce the global hegemony that Mr. Trump wants.

(2) A strong dollar is good for US interests

Today’s unprecedented environment for a stronger dollar

A stronger dollar is more firmly aligned with US interests now than at any time since the transition to floating foreign exchange rates. There are several reasons for this view. First, there is a mutually complementary division of labor within the international division of labor. US companies with monopolistic influence are gaining control over global markets. A stronger dollar will probably enable the US to make purchases at lower prices and make sales at higher prices (an improvement in terms of trade). Second, Trumpnomics will increase inflationary forces, just as Reaganomics did. Third, a stronger dollar will better enable US multinational companies to use M&A and other activities to make acquisitions overseas. Fourth, a stronger dollar will quickly increase the global influence of the United States. For instance, the United States will be in a better position for defense expenditures, will increase its global stature, and raise its share of the global GDP.

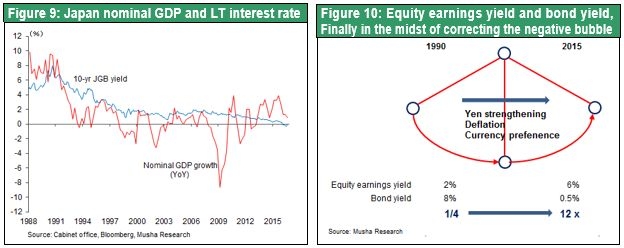

The US position within the international division of labor will strengthen to the point where the dollar will not have to depreciate. The competitive superiority of US companies is very clear. For business and personal activities alike, people around the world (except in China where companies abuse intellectual property rights) rely on platforms (internet, smartphones, cloud computing, etc.) of US companies for information network infrastructures. The fact that the U. S. is particularly strong in the financial area is abundantly clear. Figure 1 shows the overseas retained profits of large US companies according to the Wall Street Journal. These retained profits at US multinationals total a remarkable $2.5 trillion. The size of these overseas earnings clearly show that the earning structure of US companies today depends on direct investments and the export of services rather than the sale of actual goods.

The structure of the US balance of payments has improved dramatically

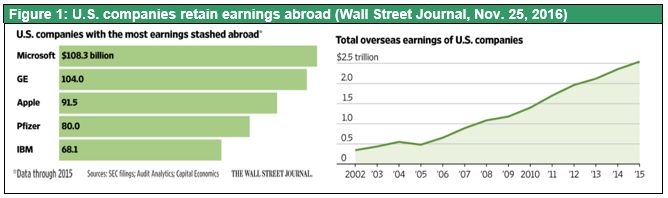

This strength of the United States is producing a big improvement in the international balance of payments. During the past decade (2005-2015), the US current account deficit has fallen from $806.7 billion (5.7% of GDP) to $463.0 billion (2.6% of GDP). Two categories are largely responsible. One is services such as financial services, intellectual property right fees and business services. During this decade, the service balance has almost quadrupled, rising from positive $68.6 billion to $262.2 billion. The other is the primary income balance, which includes items like direct investments and portfolio investments. This balance has increased 170% from positive $67.6 billion to $182.3 billion. However, the US trade deficit has remained about the same, moving from $782.8 billion in 2005 to $762.6 billion in 2015. If the service and primary income surpluses continue to grow at an annual rate of 12.5% ($136.2 billion to $444.5 billion, more than triple) and the trade deficit remains flat, the United States will switch to a current account surplus after six years. There would be a huge shock if the United States, which has the world’s key currency, can achieve a current account surplus. If the United States starts to come close to this surplus, there would most likely be a sudden drop in the supply of dollars from the United States to other countries (Figure 2).

Market dominance and control over prices at US companies will make a stronger dollar an advantage

If the dollar continues to appreciate in this environment, the speed of the US current account balance improvement may increase. Only US companies are able to supply platforms for network infrastructures. Since US companies would want to maintain their dollar-denominated income as the dollar strengths, companies would probably raise local-currency prices of services provided overseas. Users would be forced to accept price hikes because there are no alternative service providers. At the same time, the dollar-denominated prices of most of the labor-intensive products imported by the United States would decline as the dollar rose. Prices would fall automatically for imports denominated in currencies of exporting countries. But even for dollar-denominated imports, countries would be forced to use the increased export prices (from the standpoint of local currencies) resulting from the stronger dollar for cutting prices in order to prevent losing market share to other countries.

Simply put, US exports (and services provided overseas) have monopolistic positions and considerable control over prices. On the other hand, producers in many countries are competing in markets to export goods to the United States, so these manufacturers have little control over prices. Due to this imbalance, the stronger dollar is probably bringing about a big improvement in the US terms of trade. This is a world that does not agree with the widely accepted economic assumption of a perfectly competitive market.

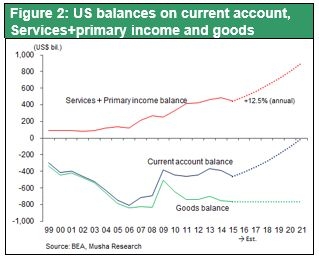

Figure 3 shows the change in the export ratio of US manufactured goods (exports/manufacturing added value) and the dependence on imports (domestic demand for goods/import). Both figures were below 20% until about 1970 but are now in the 80% range. That means the U.S. economy was basically meeting its own needs 40 years ago but is now completely dependent on the international division of labor. Furthermore, this situation is irreversible. In this world of mutually dependent trade, US companies are focusing on products with substantial added value and no price-based competition, such as platforms for networks and financial services. The United States imports the low-value-added, labor-intensive products where many countries compete for market share and exports value-added items with monopolistic market shares. It should be obvious that a stronger currency is advantageous for a country with this type of industrial structure.

A stronger dollar creates only minor problems for the United States. Price is a key competitive factor for very few US products, so the dollar’s appreciation will have only a small impact on the ability of US companies to compete. Some people point to the decline in overseas earnings when converted into dollars. But US companies can probably offset this decline by raising prices. To illustrate this point, let’s assume that the Wall Street Journal raises its price in yen. For the Wall Street Journal, Musha Research paid ¥94,500 in 2012, ¥112,800 in 2013 and ¥129,600 in 2014, which reflects the change in the yen-dollar exchange rate. The price rose 19% in 2013 as the yen depreciated 18% against the dollar and the price was up 14% in 2014 as the yen depreciated another 8%.

The misunderstanding that Mr. Trump wants a weaker dollar

There is a misunderstanding about Mr. Trump’s foreign exchange stance. He has criticized China, stating that he will designate the country a foreign exchange manipulator. Mr. Trump has also criticized NAFTA and TPP. These statements involving trade protectionism appear to make Mr. Trump a supporter of a weaker dollar. But this is inconsistent with the policy mix that he advocates. Mr. Trump will therefore eventually have to allow the dollar to appreciate. Monetary tightening, increased spending, and more defense spending along with an economical-geopolitical policy mix are all very similar to Reaganomics. The result will be another period of dollar appreciation.

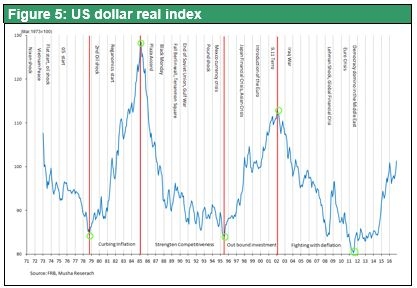

Extreme dollar appreciation occurred during the Reagan era. The dollar staged an effective upturn of 50% during the seven year period between its 1978 bottom and the 1985 Plaza Accord. At that time, US financial authorities had decided to adopt a stance of magnificent benign neglect. However, the dollar’s upturn during Reaganomics severely eroded the ability of US companies to compete and sparked rapid growth in the trade deficit. Increases in the trade deficit and the budget deficit created political problems. The dollar made a big turnaround following the Plaza Accord for a correction of the dollar’s strength. There are differences between that period and the situation today. As I stated earlier, US companies dominate some market sectors for products with significant added value. As a result, perfect competition does not exist in these sectors. Consequently, there will probably be only little growth, if any, in the US trade deficit even if the dollar moves up because the Mundell-Fleming model will not apply. This will further increase pressure for a strong dollar.

The need for a weak dollar to react on the China crisis has ended

One more important point is that the dollar’s decline in 2016 was not a reflection of weak economic fundamentals in the United States. The dollar’s weakness was simply a temporary event. Similarly, the dollar’s decline in 1998 was a temporary event that resulted from monetary easing and an increase in the dollar’s liquidity in response to the ruble crisis. In 2016, the dollar depreciated in response to economic problems in emerging countries, and most of all to the crisis in China. Once the ruble crisis was quelled, the dollar resumed its climb in 1999 as the United States restarted interest rate hikes. This time, a Chinese currency crisis has probably been averted for the time being due to the prevention of an economic free fall and the tightening of controls on capital. Investors should therefore expect to see a resumption of the dollar’s appreciation.

(3) Japan Will Be a Winner and China a Loser as the Dollar Climbs

Worries in China about a negative chain reaction as the dollar appreciates

Most of the negative impact of a strong dollar will most likely happen outside the United States. A strengthening dollar in tandem with an improving US current account balance will make international procurement of the dollar more difficult. Moreover, international liquidity from the standpoint of the dollar will fall as the values of currencies in other countries decrease. This will make it increasingly difficult to procure funds globally. In addition, the global economy will shrink on a dollar-basis and dollar-denominated overseas debt will become more burdensome. Countries will be forced to defend their currencies by raising interest rates. At the same time, countries will have to deal with internal economic problems. All of these events will eventually force countries to increase economic initiatives that rely in fiscal policy.

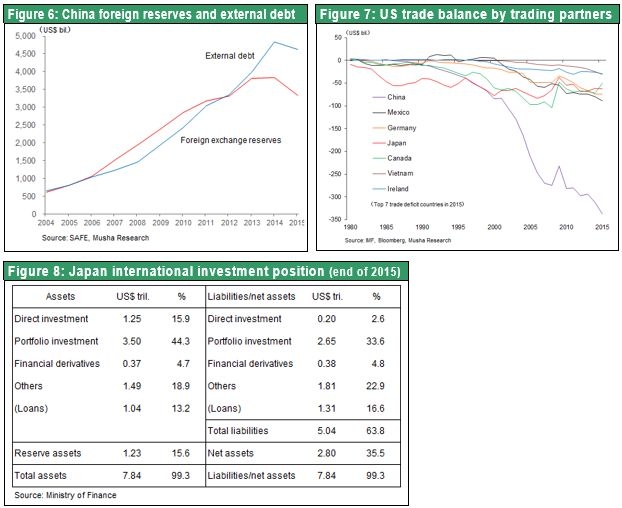

China will probably experience the most serious problems. First, the strong US economy and dollar along with higher interest rates will exert increasing pressure on capital outflows from China. As the yuan falls, there will be a big increase in the burden created by China’s massive external debt, which underpins the country’s economy. China’s external debt is $4.6 trillion, 40% higher than the country’s foreign exchange reserves of $3.2 trillion. This is why the continuation of the dollar’s appreciation and yuan’s depreciation would be a severe blow for China. Losses incurred by creditors or debtors would be the same whether a debt is denominated in dollars or yuan.

Defending the yuan will be China’s only option. But this action is inherently contradictory. Measures to slow the yuan’s decline make Chinese products less competitive because the cost of labor in China becomes even higher in relation to expenses in competing Asian countries. Furthermore, actions to defend the yuan result in tight-money policies. But this stance raises the risk of bursting China’s real estate bubble and increasing financial instability. Holding the currency steady while stimulating internal economic growth will probably require even more fiscal measures. Since China’s financial condition is relatively sound, prospects are good for avoiding a sharp economic downturn over the next few years even if China relies on fiscal initiatives alone to stimulate the economy.

But the currency is not China’s only problem. There will also be challenges from the Trump administration’s trade friction that targets China. China currently accounts for half of the US trade deficit, making the country the primary target of the Trump administration. We are likely to see criticism of China’s unfair trade practices and calls for corrections. Examples of these practices include intellectual property infringements, unauthorized cyberspace access, an extremely closed domestic market, the government’s flagrant preferential treatment of Chinese companies, and acquisitions of overseas technology companies while retaining restrictions on investments in China from other countries. Reducing China’s imports would be difficult due to the need to maintain a level of internal demand that exceeds the country’s actual economic strength. However, there may be increasing difficulties involving China’s exports because of a currency that is stronger than the country’s actual economic strength and trade friction. This is why declines in the trade surplus and net exports may become another limitation on the growth of the Chinese economy.

Japan will start benefiting from the strong dollar

As the dollar appreciates, the beneficiaries are likely to be countries manufacturing products that compete with US goods, especially countries that export automobiles to the United States, and countries that hold US debt. In other words, Japan will probably benefit most of all. Clearly, a weaker yen will significantly boost earnings at Japanese companies by raising yen-denominated export prices. Growth in the value of Japan’s external assets will be an even greater benefit. Japan’s net external assets are $2.8 trillion, the highest in the world. A stronger dollar raises the yen-denominated value of these assets. For example, a 10% upward move of the dollar would increase these external assets by $280 billion (¥25 trillion). This increase would provide enormous support for the Japanese economy by boosting the value of the principal of Japan’s overseas portfolio investments, which are about $3.5 trillion, and the income from direct investments and portfolio investments.

(4) Japan’s Virtuous Cycle Will End the Lost 20 Years

An environment that rewards risk-takers will spark a strong Japanese stock market rally

Japan has embarked on full-scale reflationary initiatives consisting of the fiscal and monetary measures that make up the second phase of Abenomics. Wages and rent are rising as supply-demand dynamics improve in the labor and real estate markets. In addition, inflation is poised to increase now that the yen is depreciating and the drop in oil prices has come to an end. Falling real interest rates will generate much more interest in buying Japanese risk assets. During the first phase of Abenomics, the Nikkei Average surged about 140% from ¥8,600 to ¥20,860 between November 2012 and June 2015. The rally triggered by the second phase of Abenomics has very likely just begun from a starting point of ¥16,000. This rally may be powerful enough to propel the Nikkei Average to somewhere between ¥30,000 and ¥40,000 toward 2020.

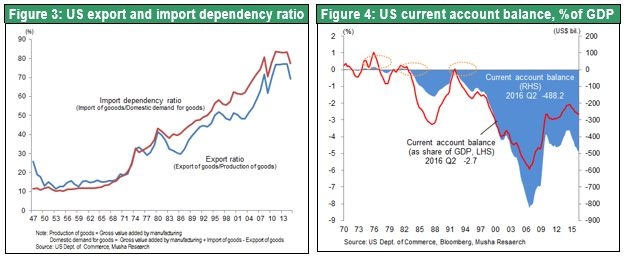

First time in 20 years – Japan’s GDP growth rate is higher than interest rates

Will risk-takers be rewarded or punished? The key to answering this question is the relationship between the nominal GDP growth rate, an indicator of actual economic strength, and the nominal long-term interest rate, which is the cost of economic growth. Incidentally, the relationship between the nominal growth rate and nominal interest rate is equivalent to the relationship between the real growth rate and the real interest rate. As you can see in Figure 9, there is a big difference in the relationship between the GDP growth rate and interest rates before and after the start of monetary easing and other elements of Abenomics. Before Abenomics, interest rates were consistently higher than the GDP growth rate for 20 years (1992 to 2012). This demonstrates that interest rates (credit) were holding down economic growth. Risk-takers were continuously punished and betrayed during these two decades.

Since 2013, Japan’s GDP growth rate has exceeded interest rates. Now interest rates (credit) are having a positive effect on the economy. In this environment, the Bank of Japan embarked on the new monetary policy of yield curve control at the end of September. Holding the yield of the 10-year government bond at zero is the key component of this policy. This has created the outlook for rising inflation in Japan accompanied by a borrowing cost that stays at about zero for many years. Furthermore, long-term interest rates are staging a powerful rebound in the United States after hitting bottom at a very low level. These events have created an extremely favorable environment for risk-taking. It appears that the long-awaited correction of Japan’s negative bubble is about to start.