Jan 12, 2017

Strategy Bulletin Vol.175

A strong dollar is the behind-the-scenes star of Trump politics

Entering an era of a super-strong dollar – The border tax is the final push

Moving closer to establishing a border tax

A border adjustment tax, which is promoted by the Republican Party and President-elect Donald Trump, has emerged as the central component of the new administration’s economic measures. Taxes will be imposed on imported goods and exports will receive favorable tax treatment. With the White House and both houses of Congress under Republican control, there is suddenly an increasing likelihood that this tax will become a reality. Mr. Trump is critical of Toyota’s plan to build a factory in Mexico, twitting “Build a plant in the United States or pay a big border tax.” This statement demonstrates that strong pressure on certain companies to build plants in the United States is linked to the potential establishment of a border tax.

A border tax is a corrective measure for unfair trade, not protectionism

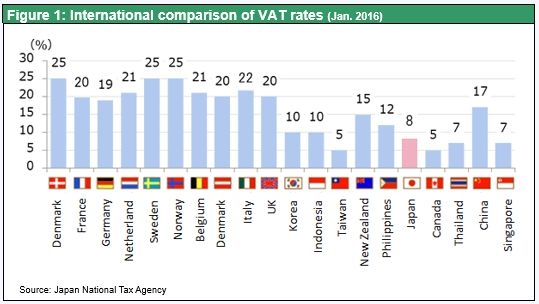

On the surface, a border tax appears to be a drastic step to keep out imports. However, this tax cannot be characterized as simply protectionism. The reason is that the tax is a key element of the House GOP “A Better Way” policy agenda, which advocates free trade. The United States is at a competitive disadvantage with respect to many countries due to the absence of a value-added tax (VAT). This tax is around 20% in Europe, 17% in China, 10% in Korea and 8% in Japan. Countries with a VAT levy this tax on imported goods (the rate is 8% in Japan). On the other hand, companies that export goods receive a refund of the VAT they paid for raw materials, services and other items needed to produce those goods. So these countries are subsidizing exports while imposing a penalty on imports, giving them an edge over the United States. The border tax is intended to end this unfair situation. Obviously, this tax will stimulate domestic manufacturing and investments by suppressing imports and boosting exports. Therefore, the border tax creates expectations for higher economic growth and inflation.

There are small differences between the House GOP agenda and Mr. Trump’s border tax. The Trump proposal calls for a 35% tariff on imports as a penalty on imported goods. House Republicans propose stopping companies from posting the cost of imports as an expense, which is roughly equivalent to the 35% tariff. Nevertheless, the basic concept of the two proposals is exactly the same. Consequently, the two sides can probably easily agree to a compromise. The same is true for the proposal to make earnings from exports exempt from taxation, which equates to a 35% tax cut to encourage exports (assuming a 35% corporate income tax rate). However, the Republicans are proposing a corporate income tax rate cut from 35% to 20%. If this happens, there would be a 20% increase in import duty to penalize imports. Exports would benefit from a 20% tax reduction. There is uncertainty about compliance with the WTO framework and the possibility of provoking retribution from other countries. Despite this uncertainty, the probability of the United States taking these actions is high.

A border tax would obviously make the dollar stronger

Next, let’s examine the economic effects of a border tax. Initially, one would expect the trade deficit to fall because the tax would hold down imports and raise exports. But in a January 9 Wall Street Journal article, Harvard professor Martin Feldstein disagrees. He explains that the trade balance is a reflection of the balance between each country’s investments and savings. Therefore, the trade balance will be the same since a border tax will have no immediate impact on investments or savings. If this is true, there should clearly be a change in exchange rates that offsets the effect of the border tax. Consequently, a 20% corporate income tax and 20% border tax should cause the dollar to appreciate 25%. A stronger dollar would improve terms of trade for the United States (by lowering the real purchasing power of foreign currencies), which would boost US tax revenues. The result would be a big reduction in the US budget deficit. (Professor Feldman estimates that the reduction would be $1 trillion over 10 years.) It is too soon for detailed calculations. However, there is no doubt that the establishment of a border tax, which is an event increasingly likely to happen, would have a larger impact than anything else on the dollar.

A stronger dollar would reestablish US hegemony

All the basic conditions for a stronger dollar have been in place for some time now regardless of whether or not the Trump administration enacts tax reforms and a border tax. As I explained in the previous report, the first condition is the big decrease in the US current account deficit. The cause is increasing limitations on the international supply of dollars. The second condition is a policy mix similar to the days of Reaganomics: more fiscal expansion accompanied by monetary tightening. If a border tax is added to this environment, the expected upturn of the dollar may gain even more momentum. The combination of a dollar shortage and the dollar’s appreciation will probably make the United States even more powerful.

A stronger dollar will be condition that is both essential and convenient for Mr. Trump to achieve his goal of making America great again. From a number of perspectives, a stronger dollar is in the best interests of the United States for the following four reasons.

1. Mutually complementary activities are a key aspect of the international division of labor. US companies with monopolistic control have preeminent positions in global markets. A stronger dollar will allow these companies to buy goods at a lower cost and sell goods at a higher price (improvement in terms of trade).

2. Trumponomics will exert upward pressure on inflation and interest rates, just as Reaganomics did. A stronger dollar will be vital to holding down inflation and interest rates.

3. A stronger dollar will make it easier for US multinational companies to make acquisitions and other investments in other countries.

4. A stronger dollar will quickly enhance US stature in the world. For example, defense expenditures will be easier and the US GDP will become a larger share of the global GDP.

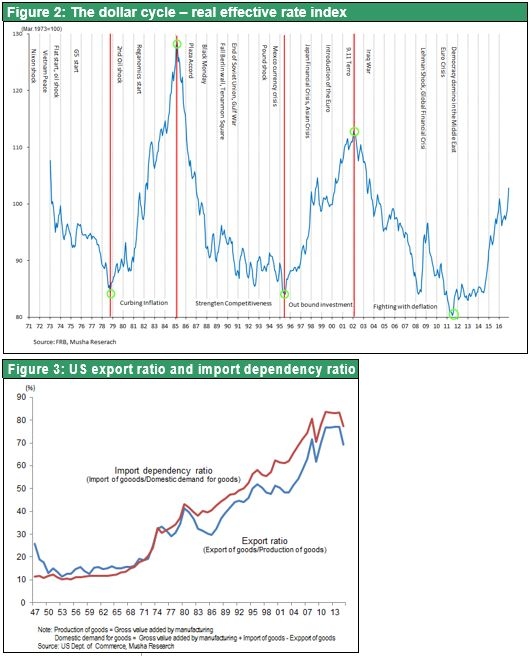

As you can see in Figure 2, the dollar staged its biggest rally since the start of the floating exchange rate era between the end of 1978 and the 1985 Plaza Accord. This upturn of more than six years was fueled by Reaganomics initiatives for stimulating the economy: more fiscal expansion along with monetary tightening. During this rally, the dollar’s real effective exchange rate surged 50%. Another powerful dollar rally is likely due to the similarities between the policies of Mr. Trump and Reaganomics.

But one significant difference exists: the sustainability of a dollar rally due to competitive position of US industries. During the Reagan-era dollar appreciation, US industries were losing their competitive edge. The result was dramatic growth of the trade and budget deficits, the so-called “twin deficits.” Higher deficits prevented the dollar’s strength from becoming a long-term trend. This time, the appreciation of the dollar expected to occur during the Trump administration will take place when US industries are extremely competitive. A stronger dollar will probably reduce the trade deficit, making the dollar move up even more.

One more key point is the big shift in the US dependence on imports. As Figure 3 shows, the 1980 import dependence (imports/domestic demand) was approximately 30%. That means internal production accounted for 70% of necessary goods. As the dollar appreciated, there was a significant shift from domestic to imported goods. However, the US dependence on imports is now almost 90%, which is about as high as this number can go. There is no more room to move production to other countries. This is why there is no reason to expect imports to increase even if the dollar appreciates.

A virtuous cycle is expected to emerge under the Trump administration. A stronger dollar will reinforce US hegemony (overwhelming economic and geopolitical superiority). This will push the dollar even higher and US clout will be further reinforced. Establishing a border tax will further increase the probability that this cycle will begin.