Jun 29, 2017

Strategy Bulletin Vol.183

There is no reason not to buy Japanese stocks

- New stock market leaders are replacing older ones in Japan too

(1) A historic industrial revolution and shift in the biggest names of the US stock market

The ongoing industrial revolution of historic magnitude

The performance of stocks shows that the world is in the midst of a historic industrial revolution. Innovative technologies like IT, smartphones and cloud computing are combining with globalization to produce unprecedented growth in productivity. Earnings at companies are rising dramatically due to the resulting sharp drop in the need for labor and capital. In The Second Machine Age, MIT professor Eric Brynjolfsson and Andrew McAfee declare that the second industrial revolution has started. During the first industrial revolution 200 years ago, the invention of machines resulted in the replacement of manual labor with the power of machines. Rapid improvements in productivity generated economic growth and raised living standards. The Second Machine Age explains that inventions in the fields of information and communication products and IT systems are fueling another industrial revolution. This time, the result is the replacement of mental labor with machines.

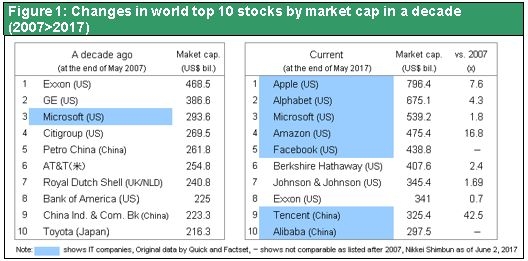

The clear shift in the most valuable companies in the United States

The leading companies of this new age are the internet platform providers. Many new business models have been created that involve the creation, operation and use of the internet infrastructure that is propelling the global economy to a new stage. Almost all of these new models originated in the United States. In fact, US companies account for all of the world’s internet platform providers. The only exception is companies in China, where the government is protecting and fostering this business sector. At the end of May, the world’s largest companies in terms of market capitalization were Apple, Alphabet (Google), Microsoft, Amazon and Facebook. Ten years ago, the top five were Exxon, General Electric, Microsoft, Citigroup and AT&T. Four of these companies are traditional blue-chip firms dating back to prewar days in the banking, oil, communications and electrical equipment industries. A dramatic shift has clearly occurred in recent years in the biggest names of the US stock market.

Changes in market capitalization of US automakers is an excellent illustration of this shift in stock market leadership. Electric automobile manufacturer Tesla Motor was established 13 years ago and posted sales of 76,000 vehicles in 2016. But this company’s market capitalization is now higher than those of GM and Ford, which sell more than 100 times more vehicles. This demonstrates that electric vehicles are the future of the automobile industry. Automakers will have to greatly alter their business models. And the stock market has apparently very early on factored in the expectation that Tesla rather than the traditional automakers will be at the forefront of this business model transition. In June, the CEO of Ford and General Electric departed to take responsibility for slumping stock prices. These actions demonstrate the decline of older leading companies and the emergence of new ones.

Market capitalization gives us a glimpse into the future

“Banks are the conductors of the economy that make new combinations possible,” is the words of Joseph Schumpeter. The meaning is that bank financing is what creates a blueprint for the future by supporting innovation. But the days when loan portfolios of banks determined the allocation of capital have ended. Today, the big shift in the composition of stock market capitalization is what is depicting a blueprint of the future. Tesla Motor, which has the highest market capitalization in the automobile industry, will probably use this financial power to create new business models.

(2) The replacement of leading companies is taking place in Japan too – Global niche players with superior technologies are growing

Old leaders are fading away in Japan

In Japan, the five companies with the largest market capitalization are Toyota, NTT, NTT Docomo, SoftBank and Mitsubishi-UFJ Bank. All of the companies except SoftBank have been leaders for many years. Moreover, there has been no change in Japan’s top five over the past decade. However, the market capitalizations of these companies have decreased more than 20%. This is an unmistakable sign of the weakening of these leading companies even though they have not yet been replaced.

The emergence of new leaders

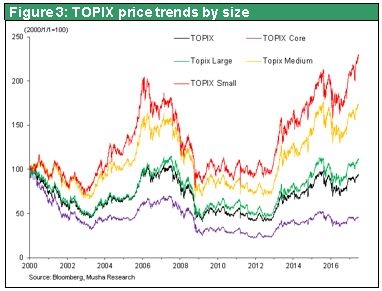

There is no need to be disappointed in Japan. Many small and midsize companies are growing steadily. The TOPIX is down 8.9% between the end of 1999, which was immediately before the peak of the IT bubble, and May 2017. The cause is the 55.0% drop in the TOPIX Core 30, the largest component of this index. But the TOPIX Large 70 was up 6.7%, the TOPIX Mid 400 was up 67.9% and the TOPIX Small (500 companies) was up 121.5%. During this same period from the end of 1999 to May 2017, the US S&P500 rose 64.2% on a dollar basis and 77.7% on a yen basis, well below the performance of the TOPIX Small. Although it is not readily apparent, Japan as well is entering a period in which the leading names will be replaced. The technology revolution is forcing all companies to redefine their business models. In this environment, small and midsize companies with few ties to the past have a big advantage over older big companies.

Japan has lost its high-tech core and now has an enormous advantage and price control in niche markets

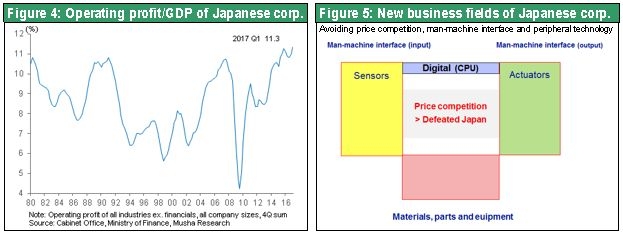

Japan does not have a single company that ranks among the global high-tech mega-players. The leaders are US and Chinese internet platform holders, Samsung Electronics in Korea, Taiwan Semiconductor and Foxconn in Taiwan, and Huawei in China. Investors may unmistakably conclude that Japan’s lack of mega-players means the country is being left out of the global high-tech stock boom. However, Japanese companies have very strong positions in the markets for the core and peripheral technologies that back up products and services of the mega-players. The market is small for each product involving these technologies. But Japanese companies can easily preserve their superior technologies and the ability to determine prices in these markets. As a result, price competition is rare. Within the international division of labor, Japan has established a strong position as a supplier of high-tech niche hardware. This position has made a substantial contribution to the recovery in earnings at Japanese companies (Figure 4). Consequently, even though big companies account for most of the output of high-tech products in Japan, these products are targeting a large number of niche core and peripheral technologies.

At one time, Japanese companies used highly competitive prices to become the world’s dominant manufacturers of high-tech products. Then Japan lost this position because of trade friction, a stronger yen and competition from companies located mainly in Korea, Taiwan and China. Now Japanese companies no longer use prices to compete (having lost the price competition battle). Instead, these companies are posting higher earnings by specializing in niche categories where their products have superior quality.

Electronics is one illustration of an industry where Japan targets niche markets (Figure 5). Japanese companies are no longer competitive as producers of key finished digital products like semiconductors, LCD TVs, smartphones and PCs. The cause is the inability to compete based on prices. With no involvement in these finished products, Japanese companies are instead growing by focusing on interfaces that are vital for the functioning of “digital brains.” Japanese companies have become leaders in the production of input interface sensors (for sight, sound, smell, taste, etc.) and output interface actuators. These actuators are motors and other parts that perform muscle-like functions. Japanese companies are also leaders in supplying materials, parts and equipment required by key digital products.

Competing in these market sectors requires a diverse array of distinctive technologies that other companies cannot match. Japan has an advantage because of its skill in combining materials by using different substances, techniques and other approaches. By shifting to a focus on these activities, Japanese companies now have business models centered on categories where superior technologies and quality eliminate the need for price-based competition. Moreover, Japanese companies can probably use this same business model for success in service sectors and other business fields. This is Japan’s core strength. In the coming years, more use of the Internet will give people even more freedom to do what they want. Demand for products and services with even higher quality and more advanced technologies will increase as a result. This demand will be a perfect match with the strengths of Japanese companies.

(3) There is no reason in sight not to buy Japanese stocks

The reasons to worry about US stock prices are disappearing one by one

All three major US stock indexes are at or near all-time highs. Despite this strength, pessimists are voicing their concerns loud and clear. They believe that slow inflation and low long-term interest rates are signs of economic weakness. Pessimists also think stocks are overpriced and that the current period of economic growth has been too long. With unemployment of only 4.3%, the United States is undeniably at full employment. Some people think unemployment is down because of a downturn in the labor participation rate. However, the United States has added a record-high 14 million jobs during the current period of growth. There is no doubt that the supply of workers is steadily becoming tighter. This leads to the question of why the limited supply of workers has not pushed up wage hikes and inflation to the Fed’s inflation target of 2%.

The cause may be a structural change in the US labor market. Most of the new jobs have been created in sectors with low productivity and low wages. Job creation has not been significant in high-productivity sectors. The Internet and high-tech revolution has rapidly lowered the need for intellectual workers. But demand for manual labor has increased at the same time. Ten years ago, the Internet accounted for only 3% of US retail sales. Now, the Internet has a 9% share and this share is expected to rise to 30% after another 10 years. Growth in e-commerce has created a severe shortage of drivers and other people at parcel delivery companies. A similar situation exists in Japan. Job creation and wage growth are high in low-wage sectors and low for jobs that require mental work. We are seeing an inverse correlation between income and job creation. As I noted earlier, the first industrial revolution replaced manual laborers with machines. Now the Internet and AI industrial revolution is going to replace these mental laborers with machines. This is why there is no need to worry about the slow pace of wage growth and inflation.

Low inflation and interest rates are fueling economic growth

Next, let’s look at the belief that low long-term interest rates are a sign of an impending recession. In other words, are people correct to think that falling interest rates are the result of increasing pessimism about the future and a downturn in the demand for funds used for investments? Sentiment among corporate executives in the United States has improved greatly following President Trump’s election victory. The US consumer sentiment index is much higher, too. These big improvements in sentiment about the economy show that there is no reason to think that pessimism about the future is increasing. Then how do we explain low interest rates? There is a surplus of savings on a global scale. In the United States, household and corporate savings have increased significantly. Demand for investment opportunities for these savings has increased, too. But advances in technologies involving the Internet, cloud computing and other fields has greatly lowered the cost of investments. This is what is holding down interest rates. Interest rates are at all-time lows even though the economy is healthy and earnings are strong because of this historic structural shift in savings and investments.

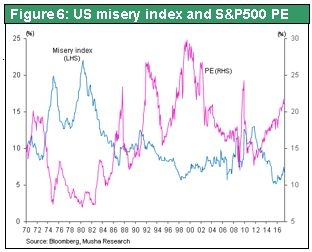

Pessimists also point to the very high valuation of stocks, which now have a PER of 21 compared with an average of 15.5. But the PER alone is not an absolute indicator of overvaluation or undervaluation. Between 1970 and 2000, changes in the US earning yield (the reverse of the PER) mirrored changes in the long-term interest rate. This could lead to the assumption that suitable PER should be determined by the long-term interest rate. Today’s low long-term interest rates therefore justify a high PER. Some people may disagree by saying that the central bank is using quantitative easing to control long-term interest rates. Using low long-term interest rates in this environment to justify a high PER is not reasonable .However, the PER has a strong inverse correlation with the misery index (unemployment + inflation), a highly reliable indicator of economic well-being. In 1980, when the misery index reached a peak of 22% in June, the PER of US stocks fell to an all-time low of 6.96 in April. With the misery index currently at a historic low, no one should be surprised to see an above-average PER.

With the current economic upturn in its eighth year, it is logical to think that a change of direction should not be far away. But in the postwar era, no period of economic growth has died of old age. In the Netherlands and Australia, there have been periods of economic expansion that lasted for 20 years.

Another viewpoint is that all recessions start because of excessive interest rate hikes in response to concerns about inflation. In the postwar years, every recession without exception has been triggered by rising worries about inflation that lead to excessive monetary tightening and an inverted yield curve (short-term rates higher than long-term rates). As long as there is no need for monetary tightening to the point that the yield curve becomes upside-down, there will be no worries about a recession under normal circumstances. Furthermore, in addition to its control over short-term interest rates, the Fed is now able to significantly influence long-term interest rates as well by using tapering (altering the size of its balance sheet). Both the Fed and Bank of Japan have gained the ability to control the yield curve. Due to central bank influence, an inverted yield curve is very unlikely to happen in the near future.

For these reasons, low inflation along with low interest rates create an excellent environment for economic expansion to continue for a long time. The financial market climate is excellent in the United States and Japan because of full employment, high earnings, low inflation and no need for excessive monetary tightening.

China’s return to a managed currency is the biggest source of confidence

The biggest source of concern at this time is slowing economic growth in China and the possibility of another Chinese financial crisis. But there is very little reason to worry. The Chinese economy is stable as the country looks ahead to the fall 2017 National Congress, which takes place once every five years. China is investing in infrastructure projects and boosting real estate investments. The economy is also benefiting from a recovery in exports. Between about 2000 and 2010, China raised its share of global steel production from less than 20% to 50% by making focused strategic national investments that did not take into account profitability at all. Now China is making similar focused investments for growth of the semiconductor and liquid crystal industries. China is determined to create a large high-tech industry. Accomplishing this goal will probably require a prolonged period of investments that go far beyond the normal silicon cycle.

The decline in China’s foreign exchange reserves, which had been creating worries, has come to a halt because of the enactment of controls on capital. By making the yuan an increasingly managed currency, China intends to reduce sources of concern about financial instability. Reckless investments in infrastructure, real estate as well as high-tech and tighter management of capital and the yuan will produce big problems in the future. But for now, these actions are reasons to have confidence in China’s economy.

No reason not to buy Japanese stocks

There appears to be little doubt that the US economy will continue to grow and stock prices will continue to rise for the time being. If this is true, the yen’s decline will become a long-term trend and three determining factors of Japanese stock prices will be filled: (1) Global economic growth and rising US stock prices; (2) A weaker yen; and (3) A recovery of the Japanese economy accompanied by increasing inflation. The valuation of Japanese stocks is currently the lowest in the world. There will also be government actions aimed at encouraging risk-taking. In this environment, there is no reason at all for not buying Japanese stocks. Investors have good reason to expect a Japanese stock market rally that starts this summer and extends into the fall.

Until now, investors worldwide have not been very interested in Japanese stocks because the country has no high-tech mega-players. These investors are now likely to start taking another look at Japanese stocks as they turn their attention to the success of Japan’s high-tech niche players.