The problem with generalizing sovereign risk

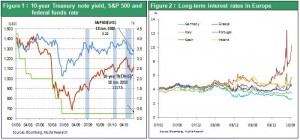

The crisis in Greece has focused attention worldwide on government budget deficits. Major countries are rushing to enact austere fiscal policy measures. In the UK, for example, the conservative government led by David Cameron plans to raise the value-added tax and take other austerity measures. With budget deficits of the world’s largest countries at unprecedented levels, there is an urgent need for action. But we must not generalize the current situation as simply a sovereign risk problem. Financial markets are worried about a financial crisis in Greece and other smaller EU countries. Sovereign risk is not the source of concern. Long-term interest rates have dropped sharply in such major countries as the US, UK, Japan and Germany. All have unprecedented budget deficits. Obviously, the possibility of an economic slowdown is a greater source of fear in financial markets than sovereign risk. Declining yields on government bonds in major countries have two possible outcomes. First, lower yields may be evidence that investors are becoming even more averse to risk. Second, lower yields may fuel a resurgence in risk-taking. I believe that government policies are needed to ensure that lower yields spark more risk-taking.

The U.S. government’s fears about the “Hoover moment”

There is a crisis mentality in the Obama administration as slow growth in employment causes its approval rating to fall as the mid-term elections approach. The U.S. Treasury Department is warning other countries about the dangers of hastily introducing restrictive fiscal policies. But the Fed’s advance warning about the risk of a slower economic growth is prompting markets to prepare for a possible economic downturn. Following the June 23 FOMC, the Fed’s statement left the impression that the economic outlook is weaker and there will be no interest rate hike in the near future. Expectations for a direct path to a V-shaped recovery will have to be pushed back. There will be no increase in the appetite for risk for a while. With no imminent increase in US interest rates, we will probably have to wait a little longer for the expected risk-taking decline in the yen to occur. But the Fed’s announcement of concerns about the economic outlook, before these concerns started surfacing in financial markets, had the effect of settling down markets. During the Great Depression of the 1930s, presidents Hoover and Roosevelt made the mistake of switching to austere fiscal policy too soon. This error made the depression last even longer. U.S. financial authorities are determined to avoid repeating this so-called “Hoover moment.” Adopting this stance is increasing confidence in financial markets.

The world needs a significant upturn in productivity at companies in the US or all industrialized countries

The US economy has completed its sharp rebound phase, which is normally the first stage of an economic recovery. That means the US economic growth rate will be generally flat for a while. Many factors point to a small decline in this growth rate in the second half of 2010: (1) the end of government stimulus measures (tax cuts, tax credits for home buyers, Fed purchases of government bonds and mortgage-backed securities, etc.); (2) the slowing pace of job creation; (3) no signs of the next positive cycle due to declining income and capital at companies; and (4) a negative contribution to economic growth from net external demand because of the euro crisis and strength of the dollar.

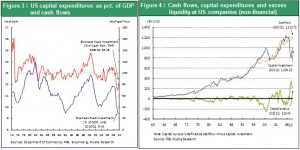

But there is no need for disappointment. The reason is that the economy is benefiting from a significant upturn in productivity at companies (the source of economic growth) even more than from government policies. Excess liquidity at companies has reached unprecedented levels as a result. Companies have ample resources to fund growth. Furthermore, private-sector demand has been suppressed to a point so low that it cannot decline any more. Consumer spending (automobile demand is at the lowest point in 30 years), investments (private-sector capital expenditures are at a record-low 9.4% of GDP) and housing (sales of single-family homes are at the lowest point in 50 years) have all dropped to historic lows. In May, sales of new homes fell to an annualized pace of 300,000, down 33% from April. This is clearly a major bottom. The May downturn was caused by the rush to purchase homes by the end of April when tax credits for home buyers ended. The housing market cannot decline any more.

Going more slowly will clearly create the possibility of producing economic growth that is more sustainable

Above all, growth in corporate productivity must be used to generate the greatest possible amount of demand. There are many potential channels for creating this demand: (1) higher wages, (2) job creation backed by higher production, (3) demand creation backed by fiscal policies, (4) the asset effect as stock prices rise, and other channels. The first two channels cannot create demand quickly. The asset effect requires support from government financial policies. Regardless of the channel, the demand creation problem will be resolved over time. Consequently, there is no need to worry because a base for long-term sustained growth is now firmly in place.