Dec 11, 2017

Strategy Bulletin Vol.191

Japan’s return from wonderland – 2018

The mysteries of Japan

Japan today is truly a wonderland. Water (money) is flowing from downstream to upstream, but everyone thinks this is normal. As a result, what should have been a fertile and well irrigated region instead became a desolate wasteland. At the same time, this reverse flow produced an increasing volume of unused water behind the upstream dam. People downstream have grown weary of living in a land that produces no crops. They have become convinced that their homeland is a barren place with no hope for a brighter future. This environment causes people to lead modest lives defined by resignation and timid goals. Opinion leaders thought that economic growth was impossible. Rather than seeking profit distributions, opinion leaders urged the public to share the burden of this environment among themselves. Water is money. For many years in Japan, money constantly flowed from sectors with high returns to sectors with low returns. But now the people of Japan have at last come to accept the delusion that the reversal of this flow is instead correct.

Some people say that growth is a fantasy – For example, Yukio Edano

The most popular politician in Japan today is Yukio Edano, the leader of The Constitutional Democratic Party of Japan. In a book published in September 2012 titled “What Must Be Said No Matter How Much People Try to Stop Me” (Toyo Keizai), Mr. Edano said that the fantasy of growth expectations should be discarded. Here is an excerpt from this book: “Responsible politicians should tell voters even what they don’t want to hear. Trickle down, in which earnings of large companies benefit employees and midsize and smaller companies, does not match the situation today. Japan is a country with a mature and declining population. Economic concepts of the past must be abandoned and people must accept the fact that growth is impossible. Politics needs to shift from the politics of distributing earnings to the politics of distributing burdens. Growth is a fantasy. Japan cannot achieve mature affluence without going through the process of redistributing burdens.”

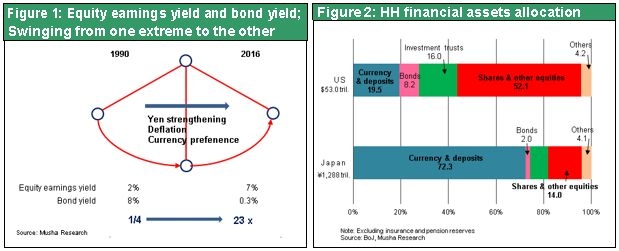

Japan’s return from wonderland (reverse money flow and excessive savings) has started

For more than a decade, Japan has been a barren wasteland. Economic growth was impossible and there was no improvement in living standards. But the cause was not a lack of water (money). Japan had an ample supply of water. The problem was that water was moving upstream and collecting behind an enormous dam. Starting in the 1990s to 2000s, after the Cold War, trade friction with the United States and the yen’s unusual strength combined destroyed Japan’s prior value creation business model. Companies were no longer able to create value. In other words, they ran out of water. However, Japanese companies started building a revolutionary new business model about 10 years ago. This new model is producing a dramatic improvement in earnings, as will be discussed in the next report.

The absence of value creation (purchasing power) was not the cause of Japan’s slow economic growth. Constantly pushing created purchasing power into the future was the true cause. After all, saving money is equivalent to delaying purchasing power. Excessive savings is the reason for Japan’s slow growth. Becoming economically barren was not Japan’s inevitable fate.

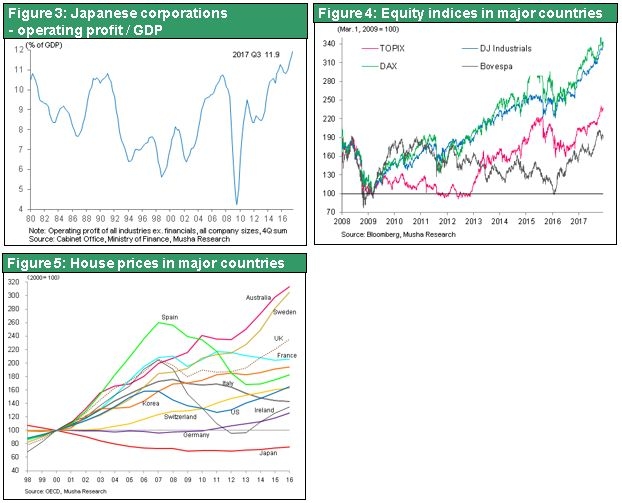

Musha Research believes that Japan’s return from “wonderland” has started. In Japan, about 70% of the financial assets of individuals are sleeping in deposits that produce no interest income. Moreover, people have been taking their money out of stocks year after year even though stock dividend yields were 2% and earning yields were 7%. But now the return from this financial wonderland is finally starting. The emerging benefits of Abenomics have created a crack in the dam that is allowing the massive volume of stored water to rush downstream. This flow is at last beginning to return Japan to financial normalcy with ample downstream capital. These events will probably trigger an enormous shift of capital that brings Japan back to a normal distribution of savings similar to the U.S.: 70% in stocks and mutual funds and 20% in bank deposits. A shift of this magnitude is likely to drastically alter supply-demand dynamics for stocks.

The correction of Japan’s negative bubble – Money moving from deposits to stocks

In 1990, the extreme mispricing Japan resulted in stock prices that were far above their intrinsic values. At that time, the earning yield for stocks was below 2% (equivalent to a PER of more than 50) and the dividend yield was 0.5%. Since the long-term Japanese government bond and deposits were yielding 8%, the degree of overpricing was obvious to everyone. Today, we are witnessing an extreme downside mispricing of Japanese stocks. The earning yield is 7% (a PER of 14) and the dividend yield is 2% compared with no yield at all for deposits and long-term Japanese government bonds. No one can deny that stock prices are far below their intrinsic values. Obvious pricing mistakes like these (upside bubbles and downside bubbles) are always corrected sooner or later. The sharp decline in Japanese stocks that began in 1990 was clearly a mispricing correction. Now we are seeing the beginning of the correction of another enormous stock market mispricing bubble. Creating and bursting bubbles such as housing and stocks are common all over the world. In the US it has happened twice in the last two decades. However, decline of asset prices lasts only a few years and now it has reached historical highs in almost all countries. Forming a negative bubble with declining stocks and real estate prices throughout two decades is a particular phenomenon seen only in Japan. She is the only country that has fallen into this wonderland.

Many factors justify higher stock prices

Everything is in place to justify a return to normally priced stocks. Earnings at Japanese companies have never been stronger. Companies have established business models that are completely in step with the new global business climate (in terms of geopolitical events, new technologies and the new industrial revolution, and globalization). Furthermore, economies are healthy worldwide and global stock prices, already at record highs, are gaining momentum because of China’s high-tech investment boom. Large numbers of Asia’s increasingly affluent middle class consumers are going to Japan to buy high-quality Japanese products. Also, as Japan’s population ages and the number of children declines, indications of a severe labor shortage are beginning to appear. Constant deflation and pervasive, deep-rooted pessimism that characterized Japan’s wonderland are both coming to an end.

Stock indexes in the world’s major countries continue to climb to new highs as the new industrial revolution boosts earnings to record levels. Global stock market capitalization peaked at $62 trillion in October 2007 and then plunged to $26 trillion in March 2009 because of the global financial crisis. Today, this figure is $96 trillion. At this point, there is virtually no doubt that the Nikkei Average is poised to start moving up toward a new all-time high (¥40,000) just as has already happened in other countries. Stocks in Japan are very likely at the starting point of a powerful, long-term rally. The Nikkei Average will probably climb to ¥24,000 to ¥25,000 by the end of 2017, ¥30,000 by the end of 2018 and ¥40,000 in 2020. At the beginning of Abenomics in 2013, when the Nikkei Average was around ¥10,000, I wrote a book titled “A Once in a Century Opportunity for Japanese Stocks Has Come” (Chukei Publishing). Since that time, I have repeatedly said that the Nikkei Average is headed for ¥40,000. Now I think that ¥40,000 will be merely one of many milestones that are passed as stock prices in Japan continue to climb.