Jan 29, 2018

Strategy Bulletin Vol.193

Assessing the Robust US Stock Market and Economy and President Trump’s First Year

(1) Chaotic US public opinions and off-the-mark criticism of Trump

The media hate President Trump

Media reports are overflowing with criticism of President Trump. There are many examples. Reports say the president is dividing the US public by fueling antagonism, widening the gap between rich and poor, destroying the global reputation of the United States, creating turmoil in the Middle East (such as by moving the embassy to Jerusalem), and engaging in foul-mouthed rhetoric with North Korea. The media also point to the president’s all-time-low approval rating. There is also pessimism about the United States in addition to these negative media reports.

Exactly who is President Trump and what does he plan to accomplish while overcoming this criticism? We need to understand his true nature, which is not evident by listening solely to criticism of isolationism and putting America first, protectionism, and discrimination. Economics are at the heart of the president’s positions. Perhaps the goal is achieving US superiority. President Obama embraced idealism, non-economic principles and the redistribution of wealth. President Trump’s views are the exact opposite. In a sense, one view is dovish idealism and the other is hawkish realism.

The rationality behind the emergence of President Trump

President Trump’s election victory was inevitable because many voters favored him. Solutions to three issues illustrate this point. First are economic issues such as the income gap, white laborers who have been left behind, the accumulation of excess capital and savings, and the loss of animal spirits. President Trump is tackling these problems by using Keynesian policies, the creation of effective demand and deregulation. Second are geopolitical issues such as a sense of crisis involving international relations, the increasing power of China, the US hegemony crisis and the deterioration of international order. President Trump is responding with bilateralism, the rebuilding of international institutions and the use of strength for peace. Third are issues involving value systems which are idealism, liberalism and the redistribution of wealth. Placing too much importance on idealistic tokenism (political correctness) is a prime example. Here, the president is strictly enforcing laws and placing importance on self-responsibility and libertarianism. He is also dramatically changing people in many key positions (like a supreme court justice) and using Twitter in response to media companies that use existing values as the basis for criticism.

(2) An outstanding economic performance amid intense Trump criticism

The remarkable health of the US economy and stock markets

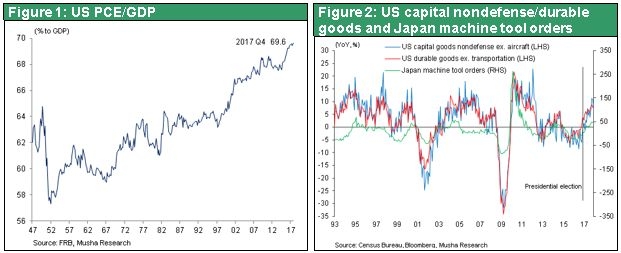

The vitality of the US economy is gaining momentum despite the intense criticism of the Trump administration. Economic growth has been consistently at an annual rate of about 3% since he took office in January 2017. Consumer spending is strong and investments, a key driver of the economy, are beginning to increase at a faster pace. Significant growth has occurred in orders for both durable goods and capital goods. The primary reasons are investments to replace people with machines due to the tight US labor market, the new industrial revolution and the full-scale emergence of investments for the Internet of things. Economic growth will receive a further boost from the Trump administration’s deregulation campaign and tax reforms.

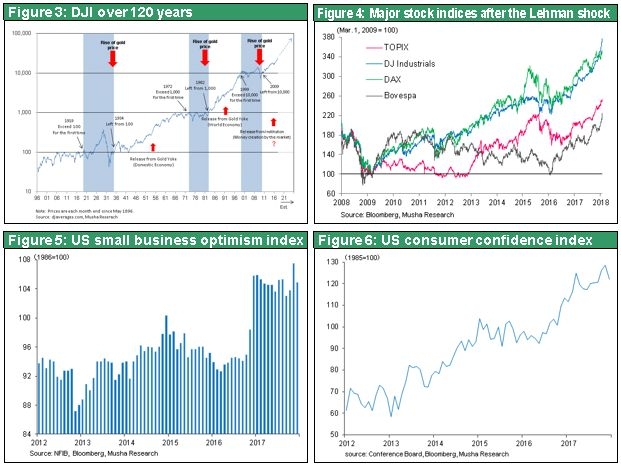

Stock prices have staged a record-setting rally. The Dow Jones Industrial Average has surged from $18,800 around election day in November to $20,000 in January 2017, when President Trump took office, and is now well above $26,000. This is a rally of 38% since November 2016 and 30% since the inauguration. A business executive optimism index is also at a record high. The consumer confidence index has improved significantly, too. Most likely, not a single person expected this level of economic strength during the president’s first year in office. What are the reasons for this big positive change? What were the mistakes of critics and pessimists? Let’s begin our discussion of President Trump’s first year by seeking the answers to these questions.

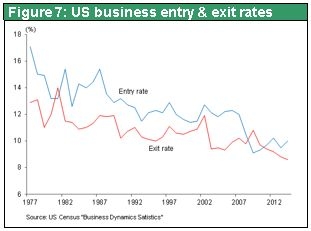

A rapid upturn in corporate sentiment and the expected improvement in the business startup rate

Economic measures enacted by President Obama to deal with the global economic crisis were basically correct. The US economy achieved a spectacular recovery. But President Trump believed that these measures alone were inadequate. He believed the economy could become even stronger and that the United States could use a robust economy to support US interests and increase US influence worldwide even more. Looking back at the president’s actions during the past year shows that his views were right. No one can deny that these actions have produced results. The Obama administration greatly tightened regulations. More regulations exerted downward pressure on corporate sentiment that resulted in a sharp decline in the business startup rate. Animal spirits disappeared. But there is almost no doubt that animal spirits will once again increase due to the Trump administration’s policies.

Extensive deregulation, the return of lobbyists, and stronger ties between companies and the government

The Trump administration is doing everything possible to reduce and remove regulations. For example, there is now a policy that requires eliminating two current regulations whenever a new regulation is established. In addition, the president is naming individuals devoted to deregulation to head many government agencies, such as the Consumer Financial Protection Bureau, the Securities and Exchange Commission and the Commodity Futures Trading Commission. This commitment to deregulation was also apparently critical to the decision to replace Fed chair Janet Yellen, who had an excellent reputation, with Jerome Powell. Fed vice chairman Randal Quarles, who was nominated by President Trump, is making progress with the significant easing of the Volcker Rule and capital restrictions. These events are encouraging risk-taking at financial institutions and in financial markets. Despite opposition from environmentalists, the president approved construction of the Dakota Access Pipeline. Lobbyists have been playing a central role in rapidly shortening lines of communication between companies and the government. Compared with the Obama era, the difference is like night and day.

An unprecedented tax cut and favorable treatment of companies

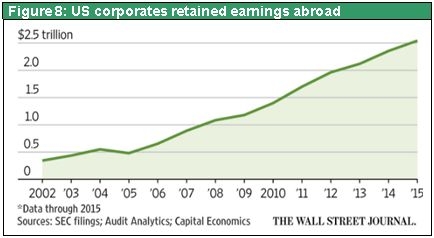

The first major tax reform in 30 years is probably the most significant economic accomplishment of the Trump administration. Reforms include an enormous tax cut totaling $1,074 billion over the next five years and $1,456 billion over the next decade. This is far more than the five-year $747.3 billion tax cut signed by President Reagan in 1981. Tax reforms are centered on measures that benefit companies: (1) A corporate tax rate cut from 35% to 21%; (2) An investment tax cut (immediate 100% depreciation of most capital expenditures over the next five years); (3) No tax on overseas earnings and no tax on dividends received from overseas; (4) Lower tax (reduced from 35% to 15.5%) on the return of earnings that companies are holding overseas, as a transitional measure; (5) A tax cut for small and midsize companies (no tax on 20% of income); and (6) A tax cut for individuals (lower maximum tax rate, higher deduction for children, higher minimum for estate tax and other reductions).

Positive responses to tax reforms at companies are increasing

Many people believe these tax reforms are irresponsible because they will increase the deficit and make the income gap even greater. For the time being, though, these reforms will have significant economic benefits. Time will tell if there is a negative impact on the deficit and income gap. A large number of companies have announced plans to bring back overseas profits, boost investments, hire more people, raise wages, pay bonuses and increase contributions to pension plans. For example, one or more of these actions is planned at Walmart, Boeing, American Airlines, Wells Fargo, ATT, Verizon, Bank of America, Citicorp, JP Morgan Chase, Comcast, Disney and Starbucks. Over the next five years, Apple plans to bring back overseas earnings totaling $250 billion (28 trillion yen), resulting in taxes of about $38 billion (4.2 trillion yen). Apple also announced its intention of making $30 billion of investments in the United States (including $10 billion for data centers), add 20,000 jobs and raise from $1 billion to $5 billion its contribution to an Advanced Manufacturing Fund.

More money for defense and infrastructure projects, too

In January, the Trump administration started taking actions aimed at fulfilling the president’s campaign promise of making $1 trillion of investments in infrastructure projects over the next decade. The president also plans to increase defense spending even more.

The success of translating words into actions

President Trump is also doing what he said regarding activities that do not involve the economy. One goal is to increase the defense budget to achieve peace through strength. This strategy is already producing benefits in Asia. A coalition of 20 countries that leaves out China and Russia has been formed for a maritime blockade of North Korea. Also, the Islamic State has been destroyed and terrorism within the United States suppressed. The media are critical of the president’s plan for a border wall, restrictions on illegal aliens, limiting the entry of people from Islamic countries and other steps. But about half of the US population appears to support these measures and there has been some progress. For instance, there are reports of a steep drop in illegal aliens entering the United States from Mexico.

Bilateralism, concealing the real enemy and the potential of a trade war with China

President Trump is focusing on bilateral trade negotiations rather than multi-national frameworks like the Trans-Pacific Partnership and North American Free Trade Agreement. But this policy is concealing the real enemy: China. President Trump knows that multi-national cooperation will be unable to hold down the growing economic strength of China. Investigations and negotiations have started that may lead to the use of Section 301 of the Trade Act of 1973 against China. The United States has already used Section 201 of this act to enact emergency import restrictions (safeguard measures) on imports of solar panels and large washing machines. US Trade Representative Robert Lighthizer, who has a reputation as a tough negotiator, has said that China’s WTO membership was a mistake. This statement is almost a declaration of a trade war against China due to widespread unfair trade practices. At the January Davos World Economic Forum, President Trump said that the United States may begin negotiations aimed at rejoining the TPP. This demonstrates that the president is considering a return to multi-national agreements while using bilateral negotiations to significantly raise pressure on China and assessing the results. This is precisely the strategy of attacking in other places in order to conceal the real enemy – China.

Erosion of the influence of international organizations is taking place at the WTO as well as at the United Nations, where China and Russia have Security Council veto power and are flagrantly attempting to make changes. The Trump administration probably has a major objective in mind concerning the rebuilding of these organizations. Viewing President Trump as simply an individual who believes in unilateralism, isolationism and protectionism is a mistake.

(3) The rationality of President Trump’s policies and why he may become a great president

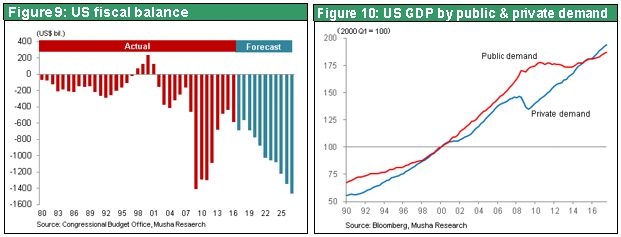

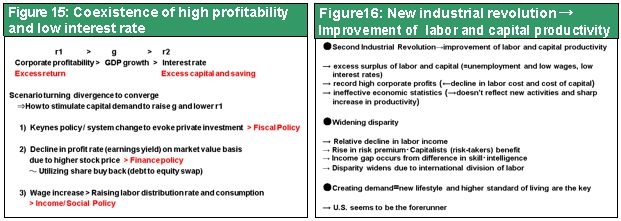

Economic policy rationality – (1) The urgent need to create effective demand

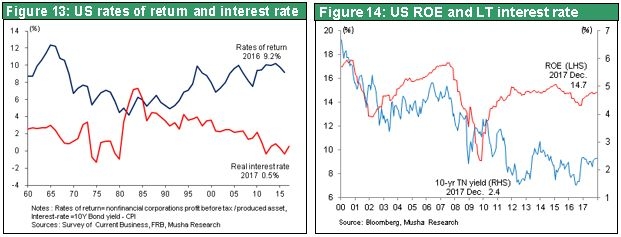

President Trump’s economic policies have excellent prospects for success. The reason is that these policies incorporate two fundamental factors that underpin the dynamism of the US economy. The first factor is the critical need for creating effective demand in order to sustain the new industrial revolution. Advances in the fields of semiconductors and communications have generated progress on a magnitude of 10 times over five years and 100 times over 10 years. This has fueled an unprecedented increase in productivity that has generated a massive amount of wealth. However, interest rates have declined as companies accumulated a growing amount of idle savings from the portion of earnings that they are unable to use. Furthermore, the growth in the supply of goods resulting from rising productivity has brought down prices. This is why there is a vital need to convert surplus capital into effective demand. Creating more effective demand and narrowing the gap between supply and demand will result in higher inflation as well as an increase in interest rates as the demand for physical and financial investments grows.

Effective demand creation is the prescription for high earnings, low interest rates and low inflation

The Fed and economists alike are perplexed by economic strength and high earnings accompanied by low inflation and interest rates. Textbooks in economics tell us this situation should not exist. But this is no longer a mystery. The new industrial revolution has raised industrial productivity, which caused earnings to increase and the supply of goods to grow. The result was a surplus of capital and labor. Doing nothing about these two surpluses is dangerous. Falling interest rates along with idle capital signify that companies are not using the money they earn. Unused money is a self-denial of capitalism. Government initiatives are the only remedy. Fiscal, monetary and income measures are needed in order to bring idle capital back into the real economy. The emergence of the Trump administration, which has clear policies for converting surplus savings into demand, therefore provides a sound justification for the stock market rally of almost 40% since President Trump’s election victory.

Economic policy rationality – (2) Responses to financial market changes

Structural change in financial markets is the second fundamental factor that underpins the dynamism of the US economy. Surplus capital has fundamentally altered the role of financial markets today. In the past, financial markets were a channel that allowed household savings to fund corporate investments. Now that role has been reversed. Simply put, the biggest roles of financial markets are the return of corporate earnings and the provision of risk capital. Stock markets (and stock prices) are vital channels for performing these roles. This is why the Trump administration’s financial deregulation and other steps to encourage risk-taking are right on target.

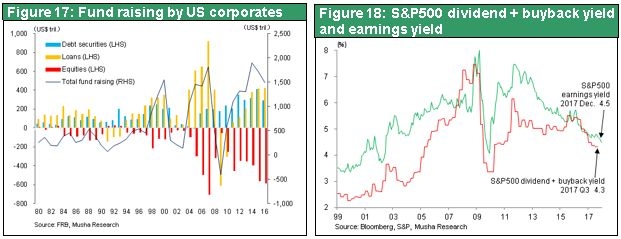

Financial markets have become a place where companies distribute earnings

Around 2000, there was a transition at US companies from a shortage of funds for investments (insufficient free cash flows) to a surplus of savings (more free cash flows than needed). Many companies bought back stock and raised dividends to return these surplus funds to the economy. For more than the past decade, US companies have had a shareholder distribution rate of almost 100% through dividends and stock repurchases. For example, a company with an average earning yield of 5% (5% profit on stock price) has paid a dividend of 2% and used 3% of earning to buy back stock. Taking these steps prevents the accumulation of idle capital. This level of earnings distributions demonstrates the effectiveness of pressure from shareholders and the use of suitable corporate governance systems.

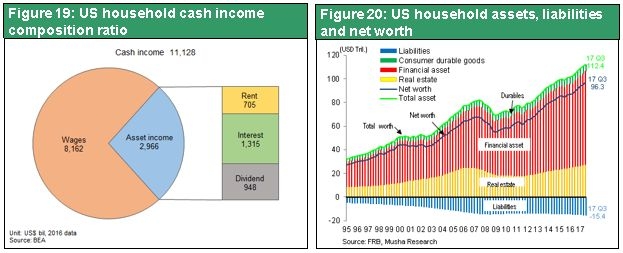

Households are benefiting from corporate distributions

As stock prices rise along with earnings distributions, money goes back into the economy as the growth in the value of household assets gives consumers more purchasing power. In the United States, income from assets is equal to about one-third of wage income based on household cash income (excluding pensions, insurance premium payments by employees and government social security payments). In Japan, income from assets is equivalent to only 10% of wage income. Capital markets are obviously generating much greater benefits for households in the United States than in Japan. Capital markets are also making a big contributing to the growth of US household assets. Net assets of US households (assets minus liabilities) fell 20% when prices plunged during the global financial crisis (from $67.7 trillion in 2007 2Q to $54.8 trillion in 2009 1Q). Net assets then recovered rapidly and totaled $96.3 trillion at the end of 2017 Q3. During this recovery, net household assets rose from 3.8 times to 5.1 times the US GDP and supported the rebound in household spending.

Financial market deregulation is speeding up the growth of the supply of risk capital

Of course, stock markets that include a broad array of companies play a central role in the provision of risk capital. A big change in the composition of the market capitalization of US stock markets has been providing a supply of risk capital, replacing the loan portfolios of banks. This risk capital gives us a blueprint of the future. The United States is developing an enormous number of business models that use the creation and operation of new internet infrastructures to propel the global economy to a new stage. US financial markets are the foundation for all of these activities.

Listed companies are not the only recipients of risk capital supplied through US capital markets. There are a variety of other ways for companies to obtain the money needed to commercialize innovative ideas. For example, there are private equity firms, which invest in privately owned companies, mergers and acquisitions, and junk bond funds. Another defining characteristic of the United States is that individuals who specialized in supplying risk capital are often the people who determine economic policies. Treasury secretaries have come from Goldman Sachs and many venture capitalists (Commerce Secretary Wilbur Ross, former Republican presidential candidate Mitt Romney) have switched to government policy-making positions. People frequently adopt a negative viewpoint regarding the US income gap and the high remuneration of business executives. But if we instead adopt the opposite perspective, the US economy is functioning properly by producing a steady stream of new capitalists who will become major suppliers of money for investments with risk exposure.

(4) High US stock prices are not a bubble

Rising stock prices are eliminating the gap between earnings yields and interest rates

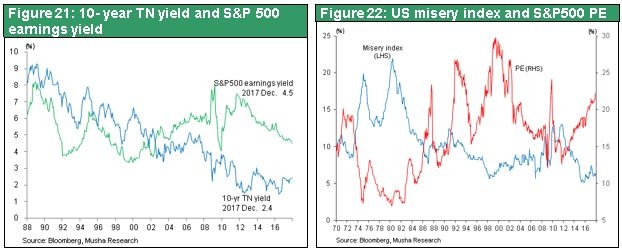

How should we regard today’s high stock prices? Could this be a bubble? Are high prices sustainable? The current earnings yield of stocks and the yield of government bonds indicate that there is no bubble. As stock prices climb, the earnings yield based on the current price declines, which causes earnings yields and interest rates to converge. If government bonds and bank deposits are yielding 2%, then income of 5% from companies through their stock is far superior. Therefore, stock prices should continue to climb until this gap is eliminated. Stock prices may have to more than double from the current level in order to bring earnings yields down to prevailing interest rates.

Changes in the economic climate influence stock valuations

High valuations of stocks (the PER is now 23 compared with a historic average of 15.5) are used by some people to justify pessimism. However, the PER alone does not determine whether or not a stock is overvalued or undervalued. Between 1970 and 2000, the US stock earnings yield (the reverse of the PER) closely tracked the long-term interest rate. As a result, the proper PER was determined by the long-term interest rate. Since the long-term interest rate today is low, the PER of stocks should be very high. Central banks are using quantitative easing to control long-term interest rates. Therefore, it is possible to argue that low long-term interest rates during quantitative easing do not justify a high PER. But the PER has a strong reverse correlation with the misery index (unemployment + inflation), which is the most reliable indicator of economic well-being. In 1980, the US misery index peaked at 22% in June and the PER of US stocks fell to an all-time low of 6.96 in April. With the misery index now at a record low, no one should be surprised to see the PER rise to well above its average in prior years.

Highly respected investors are wary of high stock prices – Why this is not a bubble

Prominent investors who have been successful for many years, such as George Soros and Jim Rogers, are very worried about today’s high stock prices. Concerns like this among investors of this caliber are nothing at all like what would normally happen during a bubble, which is characterized by a mood of overall optimism and a captivation with stocks.

(5) Is US hegemony in danger? Will the dollar become stronger?

Just as Reaganomics, Trumponomics is consistent with a stronger dollar

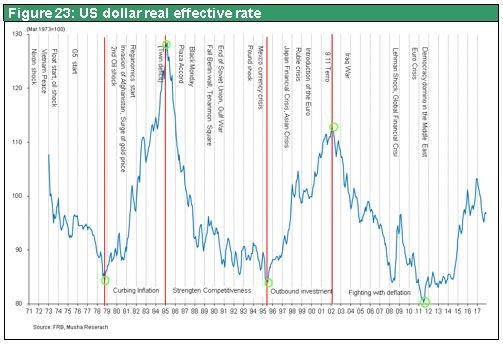

The US economy and economic policies I have explained make a long-term upturn of the dollar very likely. The first reason is President Trump’s policy mix of increasing spending while raising interest rates. This is precisely what happened during President Reagan’s first term and the result was a big increase in the dollar’s value. Between the end of 1978 and the 1985 Plaza Accord, a period of more than six years, the dollar appreciated about 50% in terms of real effective exchange rates. The cause was clearly Reaganomics.

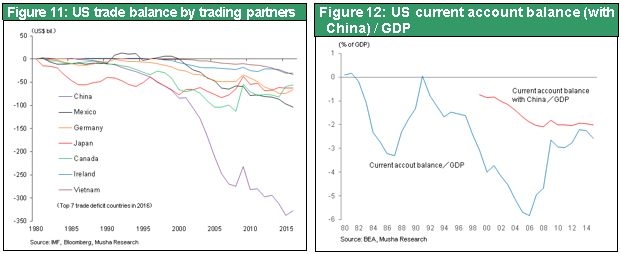

More competitive US companies will improve the current account balance and make the dollar even stronger

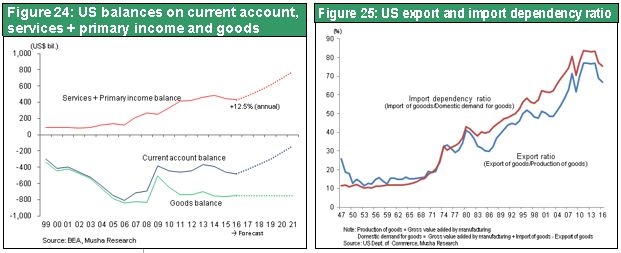

The second reason to expect a stronger dollar is the competitive superiority of US industries, particularly internet platformers. The success of US companies will probably produce a big improvement in the current account balance. If this happens, there may be a shortage of dollars in the future that further contributes to the dollar’s strength. During the past 11 years (2006 to 2017), the US current account deficit has decreased greatly from a peak of $805.7 billion (5.8% of GDP) to $462.0 billion (2.4% of GDP). The main reason was technology service exports and the improvement in the primary income balance due to the overseas earnings of high-tech companies.

Unlike during Reaganomics, this time a stronger dollar will not raise the US external deficit

When the dollar appreciated during President Reagan’s first term, the upturn was short-lived because of a steep rise in the current account deficit. The dollar fell more than 30% following the Plaza Accord. But the dollar is unlikely to appreciate and then fall sharply this time during Trumponomics because of two big differences. First is the competitive edge of US industries. When the dollar appreciated in the 1980s, the US external deficit was climbing rapidly because of the weak competitive positions of many US industries. But US industries are very competitive in the environment created by the Trump administration.

The second difference is the dramatic shift in the US reliance on imports. During the early 1980s, the US reliance on imports (value of imports divided by the value of internal demand) was approximately 30%. In other words, about 70% of goods that were needed were manufactured in the United States. As the dollar appreciated, the production of many products was moved to other countries. Today, the US import reliance is almost 90%, leaving no more room to move manufacturing offshore. Even if the dollar appreciates, there is unlikely to be any growth in imports. If this is true, then a stronger dollar will not raise the country external deficit and there will be no factors to prevent the dollar from continuing to climb. In this case, the dollar’s upturn may last for a long time. This is why a prolonged and significant upturn of the dollar may start in 2019 as Trumponomics initiatives begin affecting the economy.

Treasury Secretary Mnuchin’s welcome for a weaker dollar uses a short-term perspective

Treasury Secretary Steven Mnuchin, who also attended the Davos forum, said a weaker dollar would produce short-term benefits. This remark caused the dollar to plunge. The next day, President Trump said that a stronger dollar is in the interests of the United States and that the strength of the US economy justifies a stronger dollar. Although the dollar stopped declining, we need to consider how to interpret these remarks. Secretary Mnuchin’s remarks may reflect the tax reduction for the repatriation of overseas earnings. Companies will undoubtedly prefer to send back money when the dollar is weaker rather than stronger. But President Trump’s explanation is most likely the true US position on the dollar.

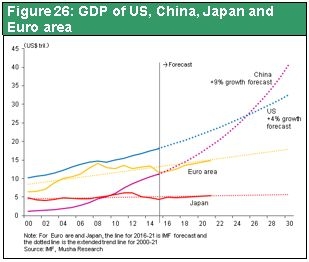

A strong dollar is the key to US geopolitical hegemony

Success of the Trump administration’s economic policies will probably result in the long-term appreciation of the dollar. This extended upturn is very likely to fuel the following virtuous cycle: Stronger dollar = More US global power (overwhelming economic and geopolitical superiority) = Stronger dollar = More US global power. Peter Navarro, a California economics professor, is responsible for determining trade policies. In his book titled “Crouching Tiger: What China’s Militarism Means for the World,” Mr. Navarro said there are no signs of any change in the pursuit of hegemony by China’s autocratic Communist regime. This pursuit will inevitably lead to conflict between the United States and China. Avoiding this conflict will require either weakening China’s economy, which is the foundation for increasing its military capabilities, or making the US military even more powerful. This would prevent China from having any appetite for challenging US hegemony. The China policies of Trump administration will almost certainly reflect this view. A stronger dollar will be critical to widening the gap between US and Chinese economic power to the point where China has no hope of catching up. A big increase in the dollar’s value along with a large decline of the yuan would make it impossible for China to surpass the US economy in the foreseeable future. This would prevent hostilities between the United States and China over hegemony.

How will history view President Trump?

Prospects are improving for the success of the Trump administration’s economic policies. However, if this success also produces geopolitical benefits, then the following prediction of Henry Kissinger in the December 27, 2016 Yomiuri Shimbun may be correct. Dr. Kissinger said that the new president is extraordinary. He has a remarkable political skills and no ties with any organizations. We should regard this as an excellent opportunity for Mr. Trump to become an outstanding president.