Mar 29, 2018

Strategy Bulletin Vol.197

Rapid stabilization is likely due to the success of the Trump initiative

- Expected concessions by North Korea and China and why Japanese stocks are extremely undervalued

(1) Trump’s resolute stance is rapidly altering East Asia

The Trump administration is seizing the initiative

After the Pyongyang Olympics ended, the world has witnessed a rapid succession of events involving the Korean Peninsula. Major events include discussions by North and South Korea, the announcement of a meeting between the United States and North Korea, and Kim Jong-un’s abrupt trip to Beijing for a meeting with China’s leaders. At the same time, the Trump administration is increasing pressure on China and may impose trade sanctions. These actions triggered a US-China trade war.

The key point is that all of these changes in East Asia are the result of the Trump administration’s forceful initiatives. Maneuvering by North Korea and China is nothing more than a response to rising US pressure. The Trump administration will determine what happens next. Even before North Korea had missiles with nuclear warheads that can reach the United States, the country started seeking a way to hold talks with the United States. This was a sign that Kim Jong-un could no longer endure economic sanctions and US military pressure. Also, as I will explain later, in a pseudo-trade war between the United States and China, China will be the one that will have to make all of the concessions.

Upcoming events will depend on the objectives and actions of the Trump administration. The Trump administration clearly has three long-term goals that it will never abandon: eliminating North Korea’s nuclear weapons, preventing China’s economy from becoming more powerful as it continues to benefit from a “free ride,” and reinforcing US hegemony. China and North Korea have only one course of action. The two countries must continue compromising until they obtain US approval and aim for a temporary period of stabilization. But the Trump administration must compromise, too. A nuclear-free North Korea and an end to China’s free ride are both long-term objectives. For these objectives to be realized, the Trump administration should not adopt policies that impair economic growth or public safety over the near term. These points lead to the conclusion that there is no possibility for the time being of direct hostilities in the form of military action against North Korea or a trade war with China.

Compromise is the only option for North Korea and China

North Korea must demonstrate through significant actions its desire to eliminate nuclear weapons. And China must be willing to provide concessions at trade talks until the United States is satisfied. Financial markets have been volatile recently. However, investors will probably react very positively to the reductions in geopolitical and trade risk resulting from concessions from North Korea and China.

(2) A powerful stock market rebound in Japan from current lows

Fundamentals had nothing to do with the first quarter plunge in Japan’s stock prices – Market forces will probably start raising prices in April

No one foresaw the big downturn in Japanese stocks during the first quarter of 2018. The Nikkei Average’s first quarter low of ¥20,618 was about 15% below the quarter’s high of ¥24,124. The global shift to a risk-off sentiment caused by the worldwide plunge of the markets pushed the dollar-yen rate from the ¥110 level to less than ¥105 over a very short time. The drop in US stocks sparked by the VIX shock in February is what started the global downturn. But this was simply an internal technical event and a supply and demand factor. Late in March, worries about the Trump administration starting a trade war further weighed on stock prices. Furthermore, the Abe administration’s approval rating plummeted following the revelation that documents involving the Moritomo land sale incident had been doctored. The possibility of Prime Minister Abe’s departure gave investors another reason to sell Japanese stocks.

However, concerns about these two incidents will probably dissipate quickly. First, most people agree that any US-China pseudo-trade war certainly would be stopped with concessions by China. Second, there is now little doubt that there were no improper activities by the prime minister and his wife concerning the sale of government land to the Moritomo school. If these concerns go away, stock prices will probably climb with the support of robust global economic fundamentals, strong corporate earnings and internal market forces involving technical factors and supply and demand. A record-high short selling ratio, one of the largest ever sell-offs by foreigners (both cash and futures) and other developments show that internal market forces are currently extremely negative. Japanese stocks are probably poised to stage a powerful rally starting in April. If this rally begins, we can naturally expect to see the yen, which appreciated as stock prices fell, reverse course and begin weakening from the current ¥105 to the dollar, which may be the yen’s absolute ceiling.

(3) Criticism of Abe will wane as the whole Morimoto story is revealed

The innocence of the Abe administration will become clear

Although the doctoring of documents by the Ministry of Finance was discovered, testimony to the Diet by former National Tax Agency chief Nobuhisa Sagawa, clearly showed that the prime minister and his wife were not involved. Although suspicions about the doctoring of documents remain, the prime minister’s innocence is now almost certain. As a result, the intense criticism of the prime minister prior to Mr. Sagawa’s testimony will probably die down. This will probably produce a sharp recovery in Mr. Abe’s approval rating.

Takao Yamada is a special senior writer of the Mainichi Shimbun and does not count himself among the prime minister’s supporters. His remarks in “fuchiso,” a column carried in the March 26 newspaper, are well worth reading. In their Diet questions on February 1, members of the Communist Party exposed a three-hour audio recording of negotiations between Yasunori Kagoike, the former president of Moritomo Gakuen, and the Kinki finance bureau. The recording was full of statements by Mr. Kagoike and his wife that placed blame on the finance bureau. (However, these questions in the National Diet and media reports both only focused on the tiny section where Mr. Kagoike implied that he received the encouragement of Mrs. Abe.) Mr. Kagoike read a document from a service provider and persistently asked the finance bureau to take responsibility for complicity with the illegal disposal of trash with regard to civil and criminal laws. Mrs. Kagoike made the following statement after a member of the finance bureau went out of the room: “The Ministry of Finance couldn’t do anything without this document (the service provider’s recording). There isn’t any evidence. Let’s go to the ministry. Politicians’ influence is useless. When I asked XX (a member of the finance bureau) to tell me who is in charge of this matter (at the ministry), I received three names. I made an internal call and immediately a department manager (for office of Individual Issue Co-ordination of Government Assets at the ministry) answered the phone. He said ‘please come at 11:00,’ so that was interesting.” The day before these events, Mr. and Mrs. Kagoike had gone to the Ministry of Finance in Kasumigaseki, Tokyo. They were successful at pointing out the ministry’s inappropriate oversights. Purchase of national land, which had been difficult due to the shortage of money, are now being completed faster. Despite relying on Mrs. Abe and politicians as well, the recording about the Ministry of Finance’s involvement in the incomprehensible plan to build an elementary school on top of industrial waste ended up having the biggest impact. Apparently, this is Mr. and Mrs. Kagoike’s impression of this matter.

There are many serious issues in the world now, including North Korea and the Trump administration’s stance on defense and trade. It is clear that Prime Minister Abe is the only leader who is capable of dealing with these problems. Other candidates to lead the Liberal Democratic Party would be unable to earn the trust of financial markets. For example, Shigeru Ishiba and Fumio Kishida are both making government financial soundness the priority of their economic policies. This is why the recovery in the prime minister’s approval rating will provide significant support for stock prices.

(4) The outlook for a US-China pseudo-trade war – The Trump administration may have established a common ground

US and Chinese actions to seek common ground

The Trump administration has made a big change in US trade policies. Recent actions include higher tariffs on steel and aluminum and demands to China about its trade with the United States. In the 1930s, trade protectionism that began with the Smoot-Harley Act led to a series of retaliatory measures. Global trade decreased and the Great Depression became even worse as a result. Current events are making financial market participants begin to recall this nightmare.

But a US-China pseudo-trade war is almost certain to be resolved for a while by concessions from China. The first reason is that the Trump administration is using a deal-based strategy. The president wants to use intimidation and power to force China to compromise. President Trump initially had big demands concerning NAFTA negotiations and steel and aluminum tariffs, too. But the final settlement was not at all extreme. Now the president is probably using the same approach when he demands a reduction in China’s $100 billion US trade surplus and the imposition of punitive tariffs on $60 billion of imports from China. The objective is to use threats of punitive tariffs to force China to end its unfair trade practices.

The second reason is that China will be unable to reject US demands. Doing what is needed to prevent a trade war is China’s only option. US-China trade is producing much more benefits for China than for the United States. Consequently, almost any concessions and compromises will be better for China than an all-out trade war. In 2017, the United States had a trade deficit of $337.1 billion with China for goods and services. This is equivalent to 3% of China’s GDP. China must accept the demands of the United States, which is its best customer by far. China has announced measures to retaliate to US steel and aluminum tariffs. But China’s reprisals target only relatively minor products like fresh fruit, nuts, seamless steel pipes and pork. This appears to be an indication that China wants to avoid a confrontation and is willing to compromise.

US demands are clear

On March 26, The Wall Street Journal reported that US-China negotiations have started. US demands include a cut in tariffs on imports of US automobiles (25%), more purchases of US semiconductors and more access to business in China by US financial institutions. Another demand is the end of mandated technology transfers to joint ventures in China. The United States also wants deregulation of the financial sector, a reduction in Chinese government subsidies to companies, measures to make rules more clear and transparent, the removal of the requirement to use jointly owned companies to do business in China, and other actions. President Trump says he will use a carrot-and-stick policy for negotiations. The president will most likely reduce punitive tariffs once he has obtained concessions from China. For these reasons, any actions involving a US-China pseudo-trade war will probably not be significant enough to have a major negative impact on the economies and trade of the two countries.

This is only the beginning of US actions to contain the Chinese economy

Although China is expected to compromise to avoid a trade war, this action alone will not result in the Trump administration accomplishing its objectives. Peter Navarro, a professor at the University of California, Irvine, is Director of Trade and Industrial Policy. In his book Crouching Tiger: What China’s Militarism Means for the World, he says that China’s autocratic Communist government will continue to aim for hegemony and that this will inevitably lead to conflict with the United States. Preventing this will require weakening the Chinese economy, which is the foundation for growth of military strength, while making the US military more powerful. He believes this will stop China from developing any desire to challenge US hegemony.

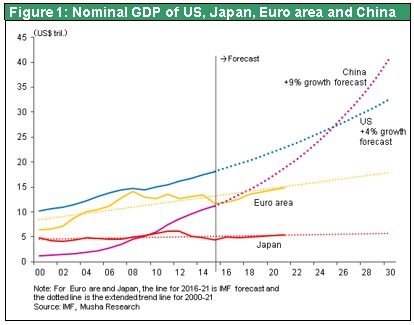

Figure 1 shows trends and forecasts for nominal GDP in four regions of the world. China’s economy surpassed Japan in 2009 and exceeded the level of the eurozone in 2016. At this pace, China’s economy will become larger than the US economy in 2026. It is inconceivable that the United States will meekly allow this reversal to take place by permitting China’s economic “free ride” to continue. These points clearly demonstrate the critical importance of a China trade war from the standpoint of the United States.

No currency devaluation and no high-tech leadership

This leads to the question of exactly how the United States can end China’s free ride and slow down its economic rise. Having learned several valuable lessons from the success of initiatives involving trade friction with Japan, the United States will probably continue to focus on three points. First, make China less competitive by prohibiting the country from allowing its currency to weaken. Second, strictly enforce intellectual property rights. Third, demand that China open its markets to foreign competition. The Made in China 2025 plan includes the goal of establishing global leadership in the high-tech sector, particularly 5G telecommunications technology. China wants to continue economic expansion by gaining powerful positions in global markets by remaining at the leading edge of technological progress. If China accomplishes this goal, there will be no difficulties with measures to deal with the massive volume of bad debt that have so far been pushed back. If China fails to sustain economic growth, its asset bubble will burst and a severe financial and currency crisis will begin. High-tech is obviously the key field that must be defended as the United States and China fight for hegemony. But most people expect the United States to move much more aggressively in defending its high-tech positions.