Apr 24, 2018

Strategy Bulletin Vol.198

Storm clouds dissipate as the sun shines on Japan’s superiority

(1) A big improvement in Japan’s stock supply-demand dynamics

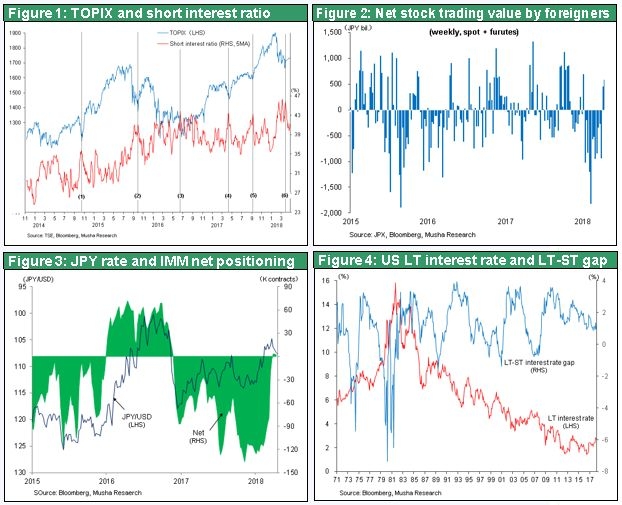

Japanese stock market technical indicators have recorded a dramatic improvement. First, the short-sale ratio, always a leading indicator of stock market lows and rallies, rose to an all-time high of 50% at the end of March and then plummeted. Second, sales of Japanese stocks by foreigners were a record-high ¥9,000 billion in February and March. However, foreigners will probably buy back these holdings because the majority of these sales were linked to the sale of futures. Third, Japanese companies are reporting strong earnings. Falling stock prices have reduced the PER to less than 13, returning this multiple to the level prior to the start of Abenomics. Fourth, the net yen short positions has totally disappeared, which eliminates a source of concern about stocks. Fifth, US long-term interest rates are almost at the psychologically important 3% level. All in all, the technical indicators are in place for a powerful rally.

If we want to believe the February and March stock market crash was linked to fundamentals, the cause would have to be statements by President Trump that raised the risk of the destruction of international trade due to conflict with North Korea or a trade war with China. The March 23 plunge in stock prices worldwide and the free fall of the Nikkei Average factored in these fears. For the time being, though, there is no possibility of a conflict or trade war. As a result, the March drop in stock prices has created a base for a complete reversal in supply and demand.

(2) How should we view President Trump’s East Asia geopolitical initiatives?

President Trump’s initiatives are very likely to be successful

Determining how to assess the geopolitical initiatives of President Trump holds the key to the outlook for the stock market. Musha Research believes that there is no longer any risk that these initiatives will trigger turmoil from a short-term perspective. Moreover, prospects for success are excellent from a long-term perspective as well. But some people think otherwise. In the April 28 issue of Toyo Keizai magazine, Bill Emmott stated that China is in a superior position regarding both a trade war and tension with North Korea. He thinks President Trump’s policies will fail. But if we believe that actions by the Trump administration were responsible for creating and worsening the North Korea and China trade war problems, then simply stopping these actions should end these problems. President Trump has said there will be no meeting with North Korea unless there are good prospects for results. Also, he will immediately leave this meeting if it becomes clear during discussions that there is no hope for any meaningful results.

The reason that Kim Jong-un will still rule North Korea

The most important point regarding North Korea is whether or not Kim Jong-un can avoid a collapse of his regime accompanied by his death. This is precisely what happened in Libya to Colonel Gaddafi and in Romania to President Ceausescu. In fact, it is quite possible that this violent ending will not occur. There was recently a secret trip to North Korea by Mike Pompeo, the former CIA director who is in line to be the next secretary of state. Mr. Pompeo has an extremely hawkish stance regarding North Korea. But in his testimony to Congress, he said that he does not want to see a regime change. There are two key differences between Kim Jong-un and the deposed leaders of Libya and Romania. First, North Korea functions as a shield for China, an enormous and autocratic country. The collapse of North Korea would pose a direct threat to the regime of Chinese President Xi Jinping, who also rules by using the Communist Party and a personal dictatorship. Second, no one wants to see North Korea become a vacuum with an outlook no one can predict. Keeping Kim Jong-un in power may be in the best interests of all countries involved. Furthermore, if Japan makes enormous World War II reparation payments to North Korea, the country could end its policy of simultaneously working on building nuclear weapons and a stronger economy.

Any positive effect of Kim Jong-un’s flattery of Trump would not necessarily be harmful

At the very least, North and South Korea, the United States, China, Russia and Japan all want to see an end to the state of war on the Korean Peninsula that has existed since the Korean Armistice Agreement. Every country is doubtless thinking that this opportunity should not be wasted. This is why a reversal of the situation is unlikely. Mr. Emmott believes that US-North Korea talks will put the United States in a difficult position and give China the advantage because an agreement to eliminate nuclear weapons will be impossible. But this conclusion is both hasty and distorted.

Flattery by North Korea may influence President Trump. And there is also a possibility that the elimination of North Korea’s nuclear weapons will not happen. In addition, there is a possibility that North Korea will gain a degree of influence over South Korea. This would definitely not please Japan. However, even in this case, the end of the state of war on the Korean Peninsula would be good news for the global economy, the Japanese economy and stock markets.

China will continue to give concessions in US trade negotiations

The US-China trade war will probably be a series of slippery and evasive concessions from China and the acceptance to some degree of these concessions by the United States as negotiations go on and on. It is useful to point out the error of Mr. Emmott’s belief that China has the upper hand in this trade war. He explains several reasons in his Toyo Keizai magazine article for China’s strong position. First, China’s position is stronger because the reliance of its GDP on trade has dropped in half from more than 60% 10 years ago to over 30% now. Second, the United States would suffer greatly from import restrictions while China, with its autocratic government, would be able to largely ignore these restrictions. Third, China can isolate the United States from other countries by criticizing its protectionist policies. But Mr. Emmott’s errors about the US-China trade war are even more obvious than his misunderstanding of the North Korea problem.

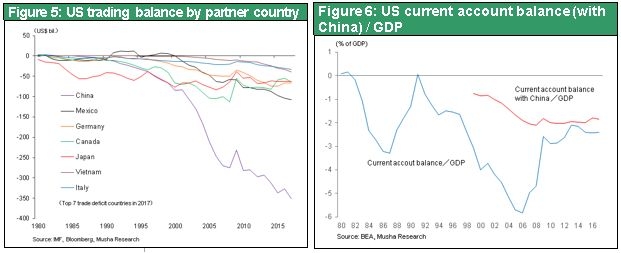

Mr. Emmott is overlooking a number of critical points. First, a trade war cannot significantly harm the US economy or people involved with this war because the conflict is triggered entirely by US demands. Second, China must give in to US demands because China has reaped enormous benefits from its unfair trade practices. Third, US initiatives to end China’s unfair trade practices will cover a variety of activities and go on for many years. Looking back at US-Japan trade friction demonstrates this point. This is why we will not see the United States take any drastic actions like the 1930 Smoot-Hawley Act. Fourth, preventing a currency devaluation is the primary US objective of trade friction with China, just as when there was trade friction with Japan. At this point, there is no objection from China. Fifth, Germany, Britain, France and all other Western countries agree that China’s economic growth has been fueled by unfair actions such as the theft of intellectual property. As a result, there is very little possibility that the United States would end up isolated from other countries.

China will not be allowed to continue its cheating

Peter Navarro, the brains behind President Trump’s trade policies, wrote in a Wall Street Journal op-ed on April 16 that China’s trade is not mutually beneficial because of the country’s false enormous competitive edge backed by unfair activities. Mr. Navarro noted in the April 16 issue of Wall Street Journal:

Yet since joining the World Trade Organization in 2001, China has come to dominate traditional manufacturing. By 2015 it accounted for 28% of global production of autos, 41% of ships, more than 50% of refrigerators, more than 60% of televisions, and more than 80% of computers and air conditioners.

As is evident in government documents such as China 2025, China increasingly threatens to dominate the industries of the future: artificial intelligence, autonomous vehicles, blockchain systems, robotics, high-tech ship manufacturing and more. These technologies have profound strategic implications.

In large part because of China’s dominance in manufacturing, the U.S. last year ran a bilateral trade deficit in goods of $375 billion, or more than $1 billion a day. Contrary to the textbook model, whereby currency adjustments help rebalance trade, the U.S. trade deficit with China has been persistent—more than $4 trillion cumulatively since 2002—and growing. Why is the China sole winner? The answer is that China’s faux comparative advantage is the result of its state-directed investments, nonmarket economy, and disregard for the rule of law.

The problem’s taproot is Chinese intellectual-property theft and the forced transfer of foreign technology as a condition of accessing China’s market. These illicit practices, including widespread cyberespionage, allow Chinese companies to move rapidly up the innovation curve at much lower cost than their foreign competitors, which must recoup the cost of research and development through higher prices. To protect its market, China erects high tariff barriers—e.g., its auto tariff is 10 times that of the U.S. China has high nontariff barriers, too, including intrusive licensing requirements and foreign-ownership restrictions that keep the playing field tilted in favor of Chinese companies.

Germany is becoming a victim of China’s technology thefts

European countries too are becoming more wary of China. On April 17, there was a Reuters article concerning Germany’s “boiled frog syndrome” due to its growing dependence on China. The article covered the theft of technologies and the difficult position of German companies. German companies were among the first to start operations in China and China-German trade rose to a record-high 187 billion euros (about ¥24,700 billion) in 2017. This is far higher than the Chinese trade volume of Britain and France, which is about 70 billion euros for each country. The article notes that a dramatic shift is taking place in how “Germany Inc.” regards the Chinese market. Under the leadership of President Xi Jinping, the country has started to backtrack on moves to open up markets. Furthermore, Chinese companies are shifting their value chains upstream much faster than Germany had anticipated. At a conference of corporate executives in Berlin, Michael Clauss, the German ambassador to China, warned that an “earthshaking change” is taking place in Germany’s relationship with China.

China established a cyber security law in 2017 that created tighter national government controls on the internet. Controls include virtual private networks, which foreign companies in China use for confidential communications with their head offices. Recently, a number of German companies have been complaining of pressure from China to accept Communist Party members as directors of joint ventures in China. There are also concerns that the Made in China 2025 strategy directly threatens the superiority of German manufacturers. This strategy has 10 key sectors, including robotics, aerospace and clean-energy cars.

The German government has been avoiding a collision with China because of the rising dependence of German companies on the Chinese market. “There is a big gap between what people in Germany say about China and what they are actually thinking,” says Bernhardt Bartsch of the Bertelsmann Foundation. Some German government officials even joke that the new meaning of win-win is two wins for China. “We hoped that close economic ties would encourage China to open its markets, but this expectation was obviously a mistake,” said one of these officials. The German government as well has started to revise its stance regarding China.

(3) The superiority of Japan’s geopolitical position

The Trump initiatives originated with Prime Minister Abe

Prime Minister Abe’s April trip to the United States to see President Trump reaffirmed their very close relationship. There is no doubt that the Abe diplomacy of Japan is more closely aligned with the Trump diplomatic initiatives than the diplomatic positions of any other country are. Prime Minister Abe was the first person to raise alarms about China and North Korea. During the Senkaku Islands dispute, there was a consensus in Europe, the United States and other countries that China and Japan were both responsible for this problem. When the second Abe administration started, Prime Minister Abe’s nationalism, symbolized by a visit to the Yasukuni Shrine, sparked criticism in Europe and the United States as well as in China. But now both Western countries and critics are sharing the view of Prime Minister Abe.

Prime Minister Abe has significant influence concerning President Trump’s Asia policies. The prime minister’s approval rating may increase quickly if President Trump’s East Asia diplomatic initiatives succeed and people abducted from Japan by North Korea are rescued. The increasing possibility of a US-China cold war is making Japan a much more important ally for the United States. But China is trying to placate Japan. One move was the resumption of an economic dialogue with Japan for the first time in eight years. As the United States and China fight for hegemony, Japan will play an important role in determining the outcome. This is why Japan’s geopolitical position has become much more advantageous. Former Prime Minister Hatoyama adopted a policy of appeasing China by maintaining a certain distance from the United States. It was a mistake that turned out to be fortunate by making the United States and China aware of the significance of Japan’s geopolitical position.

No reason to believe that Japan is in over its head

There are questions about whether Japan is over its head regarding North Korea and whether or not to blame Prime Minister’s stance of following the lead of the United States. But these concerns are off target. There is no possibility that the ladder will be pulled out from under Japan. The reason is that Japan will be the provider of funds for building North Korea’s economy, which will be the final solution to the North Korea crisis. If a Korea-Japan peace treaty is signed, Japan may end up paying more than ¥1,000 billion in war reparations. Japan therefore must participate in a resolution to the North Korea crisis.

Geopolitical positioning has significantly affected the health of Japan’s economy in modern era. Now, Japan is on the verge of gaining the most advantageous positioning ever. This points to the start of a period of prosperity.

(4) Japan’s superiority in the international division of labor during a US-China trade war

Proof of Japan’s growing superiority and resilience to trade friction and a stronger yen

Japan now has a very advantageous position within the international division of labor for a number of reasons.

- Japan was not excluded from US steel and aluminum tariffs. But there is no need to worry because no other country can produce the high-grade steel supplied by Japanese steelmakers.

- China is rapidly moving closer to Japan and resumed an economic dialogue with Japan for the first time in eight years because China absolutely needs Japanese technologies. Chinese industries are quickly shifting to high-tech sectors. Competition with South Korea, Taiwan and Germany is increasing as a result. Japan and China have a mutually complementary relationship because high-tech business fields with few competitors account for a large share of Japan’s economy.

- In the international division of labor, Japan has a monopoly in many high-tech niche market sectors. This is making Japan increasingly resilient to a stronger yen and enabling companies to maintain strong earnings.

- Japan has significantly opened core components of its economy to the United States and depends to some degree on the United States. US companies have prominent positions in numerous Japanese markets, including the internet, smartphones, aerospace, high-tech military equipment, MPUs and other semiconductors, financial services, and other fields. Moreover, Japan helps supply funds to the United States by holding more than $1,000 billion of US Treasury securities. Consequently, the situation today differs completely from the days of US-Japan trade friction in the 1990s. From the standpoint of both countries, the relationship is an ideal mutually complementary division of roles. South Korea has completely succumbed to US demands to reexamine the US-Korea Free Trade Agreement. But Japan does not have to do what the United States says. The reason is that Japan is in a position of strength regarding US demands about beef and automobiles. For beef, the United States damaged its own competitive position by abandoning the Trans-Pacific Partnership. Automobiles are not a problem because US vehicles are not popular in Japan. Although Japan’s US trade surplus is large at $68.9 billion, this surplus is only about one-fifth of the US trade deficit with China.

- Japan cannot become the target of trade friction. The country has a very small trade surplus and an income surplus accounts for most of Japan’s current account surplus. Other countries should be happy about Japan’s income surplus because it creates jobs in these countries. A trade surplus is a target of criticism, on the other hand, because it takes jobs away from other countries. Japan’s establishment of a global supply chain as the yen remained strong created a large number of jobs overseas. This is the reason for Japan’s large income surplus. As shown in the current account surplus ranking in Figure 7, Japan’s income surplus is far higher than in other countries. This demonstrates why Japan should be absolutely immune from trade friction and foreign exchange rate volatility.

(5) Japan’s transition from number one to the only one

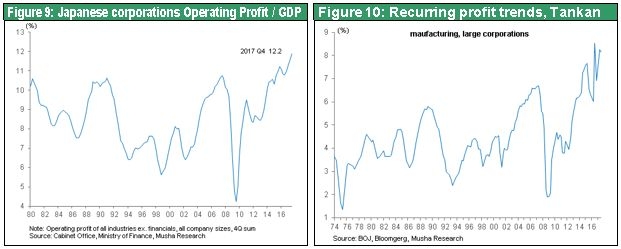

Earnings at Japanese companies have been climbing rapidly. Driving this growth is a business model that is completely in step with the new global business climate in terms of geopolitics, new technologies and industrial innovation, and globalization. The new model has improved profit margins by greatly bolstering Japan’s position within the international division of labor. Japanese corporate earnings continue to rise dramatically. Currently, operating income is at an all-time high of 12.2% of Japan’s GDP. Furthermore, the Bank of Japan Tankan forecasts an 8.52% ordinary income margin in fiscal 2017 at large manufacturers. This is a big increase over the 5.75% margin at the peak of Japan’s asset bubble in fiscal 1989 and the 6.76% margin in fiscal 2006 immediately before the outbreak of the global financial crisis. Japan’s nominal GDP has been basically flat during the past two decades at approximately ¥500 trillion. Why have companies succeeded at raising earnings so much in this no-growth environment?

Japan as the only one

A big shift in the business models of Japanese companies has fueled earnings growth. The old business model had the goal of being number one. Until the late 1980s, Japan’s manufacturers captured leading global positions in their respective markets by using advanced technologies and competitive prices. This was the era of “Japan as number one.” Subsequently, this business model was destroyed by Japan bashing by the United States, the yen’s extreme strength, and competition from companies in Korea and other Asian countries with products that copied or matched Japanese products. For many years, Japan ruled markets for core digital products like liquid crystal displays, personal computers, smartphones, semiconductors and televisions. But now, Japanese companies are no longer active in these markets.

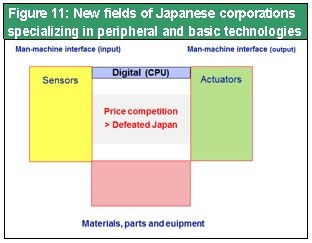

For growth, Japanese companies turned their attention to the peripheral and base categories. Functions of digital products rely on more than simply semiconductors and other key components. Sensors and interfaces are also necessary. Sensors input information that semiconductors process. Actuators (motors) and other interfaces transform conclusions reached by semiconductors into motion. Manufacturing core digital products requires materials, parts, devices and other basic items. Japan ended up losing the largest market domain: core and finished electronics products. Now the country is using success in the peripheral and base categories to grow.

The world is finally witnessing the start of massive investments to build the infrastructure needed for the age of the internet of things, when almost everything is linked to a network. At the same time, China plans to make huge investments in the high-tech sector. Investments are what sustain economic growth in China. Stopping investments would halt economic growth that could spark an economic crisis. This is why China has embarked on an ambitious investment program targeting high-tech industries.

Japan is very well positioned to benefit from the high-tech boom. No other country has an industrial structure with peripheral and base technologies, which are both needed for innovation and progress. China, South Korea, Taiwan and Germany are all investing in the high-tech sector itself. But they are relying on Japan for the peripheral and base categories. Due to this positioning, Japan’s electronics companies have an unparalleled capability to supply the best possible solutions to companies worldwide as the global innovation boom unfolds. This strength is likely to start producing substantial benefits after 2018.

(6) The outlook for stock prices

Three positives: Favorable supply-demand, improving geopolitical climate, Japan’s global superiority

One source of concern is the sustainability of the Trump and Abe administrations, which are both unpopular. President Trump’s approval rating will probably improve if his initiatives succeed, resulting in higher stock prices and more economic growth. Nevertheless, investors should retain a bullish stance even if President Trump is impeached and removed from office. This is because the dice have already been rolled. The United States is moving from a gentleman-like role to functioning as the boss monkey of the world. Consequently, the departure of President Trump would change nothing.

Approval of the Abe administration may increase, too. No reasons are in sight for a further decline in public support. Voters are fed up with the recent procession of spurious scandals. No evidence of a crime by the prime minister has been discovered despite more than one year of overblown media reports and fierce criticism by opposition parties. We suspect everyone would view that Prime Minister Abe is the only leader in Japan they can trust in the current global environment.

President Trump and Prime Minister Abe share several characteristics. First, their policies are producing benefits, especially for the economy, stock market and business sector. Second, declines in their approval ratings are linked to scandals. Third, most of their critics are the media and some bureaucrats, two groups about to lose their vested rights. Fourth, there is clearly no factual basis for an academic justification of critics. Examples include free trade that is now out of date (first criticized by Paul Krugman, a leading critic of President Trump) and the inability of the equilibrium model to explain the existence of low interest rates and low prices. Also, GDP statistics are unable to reflect productivity gains due to the technology revolution. In addition, a major reason that President Trump and Prime Minister Abe are the targets of criticism is that both are reformers working on real issues affecting people’s lives.

If the initiatives of President Trump and Prime Minister Abe produce economic growth and resolutions to geopolitical issues, we can expect to see big improvements in their approval ratings.

Three positive forces have come together at once for Japan’s stock market: favorable supply-demand dynamics, positive developments involving the geopolitical climate and Japan’s global superiority. As a result, stocks in Japan may be about to stage a powerful rally after spring.