Jun 27, 2018

Strategy Bulletin Vol.201

The Big Picture for the US-China Trade War

President Trump’s successful policies and the outlook for trade friction (winners and losers)

(1) President Trump is earning higher marks

The strategic significance of the Trump initiatives

President Trump is playing an increasingly greater role in the global economy and global markets. The president is displaying his true skills more and more and producing a series of accomplishments. In the United States, his approval rating has improved by about 10 points from around 35% in 2017. Most significantly, he has an overwhelming approval rating of 80% among supporters of the Republican Party.

As always, members of the media and many political observers have a negative view of the president’s activities. They believe he is motivated by the desire to win elections, become more popular, be the center of attention and feed his egoism (putting the interests of white people, rich people, businesses, America and Christians first). However, looking at the people who control US politics through rose-colored glasses makes it impossible to ascertain the essence of the president’s actions. President Trump has been remarkably faithful to promises made during the election regardless of praise and criticism. “America first, make America great again” is obviously at the heart of the president’s strong willpower. Furthermore, the president’s actions should be viewed as measures based on a clear strategy rather than haphazard decisions.

The need to determine the logic behind the president’s policies

Very little commentary is worth reading amid the widespread criticism of President Trump that is based on prejudice. Several columns by Rana Foroohar of the Financial Times are well worth reading. One is the June 11 column ”Trump trades on the protectionist mood・・・we have entered a fundamentally new world. Economics and national security will come closer together” Another is the June 17 column “Trump is the master of the message・・・the American president really doesn’t give a hoot about what the Davos crowd thinks. He has done exactly what he said he would do while running for president” In addition, a June 24 column by Sankei Shimbun editor Hideo Tamura “President Trump’s resolute stance and how the US-Japan trade war will affect Japan.”

According to Ms. Foroohar, President Trump ignored the opinions of the elite who gathered in Davos while precisely executing his election promises. The president’s tough stance regarding China and illegal immigration has strengthened the backing of labor unions, small and midsize company owners and agricultural states that are supporters of his. Also, he has started a trade war with good timing because the US economy is healthy with a growth rate of more than 3%. She believes that the economy’s strength can easily offset any negative effect from trade, going on to say that the Trump administration’s policies have been successful and support is growing. Ms. Foroohar believes the view that President Trump is destroying the framework for trade is a mistake. Before President Trump’s election, the multi-national trade system was undergoing creative destruction due to the emergence of China and changes sparked by the digital economy. She believes the international division of labor is about to advance to a new age. In his column, Mr. Tamura says the WTO has been useless for correcting the unfair trade practices of China. He calls China a serial rule-ignoring offender. Mr. Tamura says the priority should be to make the United States stronger because only a superpower with coercive power can make China follow the rules.

During his first year in office, President Trump produced enormous economic benefits by focusing on deregulation and tax reform. The Obama administration viewed the economy sometimes as an enemy due to its idealism. But President Trump used deregulation to strengthen ties between Washington and the business community and greatly improve business sentiment. Late in 2017, the United States enacted its largest-ever tax reform package that some people even call reckless. These reforms will probably significantly increase the US economy’s ability to grow, which will offset any negative effects of trade war with China. Furthermore, US stock prices are up by about 30% since President Trump’s election. As a result, we can say there were enormous economic accomplishments during the president’s first year.

(2) President Trump’s trade war with China

The first step of rebuilding US hegemony

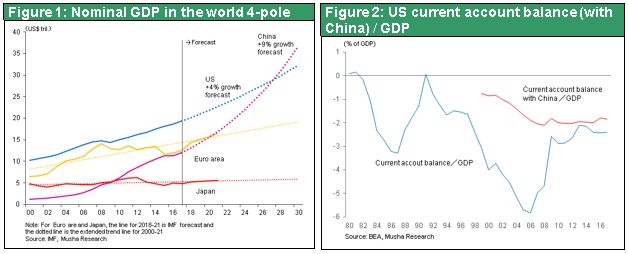

Now that President Trump has established a sound base for the economy, he has turned his attention in his second year to a geopolitical initiative: restoring US hegemony. He has quickly shifted his focus to how to suppress China, which is challenging US hegemony and attempting to surpass the United States. GDP growth in four major regions of the world (US, China, Japan, Europe) illustrates this point. China’s economy surpassed the Japanese economy in 2009 and is now on the verge of surpassing the eurozone economy. If the US and Chinese economies continue growing at the present rate, China’s economy will pass the US economy in 2027. If this happens, global hegemony will transfer from the United States to China, which will have more economic and military power than the United States. A crisis mentality is increasing rapidly in the United States. Holding down Chinese economic presence has become one of the highest priorities of the Democratic Party and the US public. The most important method to accomplish this is a trade war.

The United States has played an excessive role in China’s economic growth. In an easier word, America played that role by supplying milk to China. The US trade deficit with China was $375 billion in 2017, approximately half of the total US trade deficit that year. Additionally, during the past decade, the US current account deficit with China has consistently been almost 2% of the US GDP. Since the total US current account deficit is 2.4% of GDP, China accounts for well over half of this deficit. Simply put, this deficit means that 2% of the income of all Americans is transferred to China to pay for the trade deficit. This transfer has fueled China’s economic growth. Stopping this transfer of income is the biggest goal of US-China trade friction. Free trade and a variety of unfair trade practices are what allowed China to rapidly build up its US trade surplus. Now the United States is asking China to correct this situation.

The threat of Chinese state capitalism and goal of global high-tech leadership

The high-tech sector is the key to the trade war. The development of 5G wireless communication technology will determine who leads the global high-tech industry of the future. Today, 5G progress has reached a critical stage. The United States is determined to prevent China from winning the high-tech competition. The United States even wants to block the Made in China 2025 initiative that was created to give China high-tech hegemony.

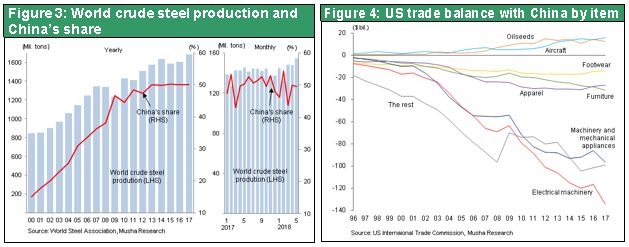

During the first decade of the 21st century, used virtually unlimited amounts of state capital and subsidies to boost its share of global steel production from the 10% level to 50%. China used a similar approach in the solar panel industry to overcome competitors in Japan, the United States, and Europe and capture a global market share of 80%. China has also become the world’s largest suppliers of liquid crystal displays with a share of more than 30%. In the electric vehicle battery market, CATL, which was established only seven years ago, has passed Panasonic to become the world’s largest supplier. CATL’s market capitalization is more than ¥2 trillion. In the mobile communication device market, China’s ZTE and Huawei have a global market share of 41% and are much larger than the US, Japanese and European competitors.

China is channeling its resources on becoming a high-tech country. China expects its labour intensive light and heavy industries to decline and shift operations to other countries. The plan is to use the latest technologies to gain global high-tech leadership. The United States is determined to prevent China from succeeding. This is why a US-China trade war may never end. On June 15, the United States enacted a 25% punitive tariff (effective starting on July 6) on imports worth about $50 billion because of China’s violations of US intellectual property rights. China retaliated with revenge tariffs. Furthermore, U.S. has started considering additional tariff of 10 to 25%% on $100 to200 billion of imports. Also, the United States could be considering limits on measures that virtually prohibit imports from China, such as the ZTE sanctions. The sanctions were subsequently eased, but there is opposition to this move in the US Congress.

(3) Impact of the China trade war and winners and losers

Uncertainty is increasing, but the war will not trigger a recession

The consensus among economists is that increasing trade friction will have only a negligible effect on the US and global economies. There is uncertainty due to the possibility that retaliatory trade sanctions may go on and on. These activities may temporarily disrupt markets. Financial market participants are watching to see how much President Trump will demand and at what point he will compromise.

Even if all tariffs are raised, and the higher tariffs are entirely passed on to consumers through price hikes, the US consumer price index would increase by only 0.2%. This would have an insignificant effect on the GDP. Moreover, this effect of higher tariffs on the US economy would be even smaller if the US shifted its imports to countries where expenses are lower, and there are no tariffs. The effect on corporate earnings would also be small for the same reasons. The Fed and other US financial authorities are maintaining a bullish stance regarding the economy. Once trade sanctions and retaliatory measures have been enacted, the resulting elimination of uncertainty is likely to restore the confidence of financial markets.

A bigger negative impact on China

However trade friction will have a significant impact on the Chinese economy. Hiking tariffs will make China less competitive. As uncertainty increases due to rising trade friction and China becomes less appealing for investments, China’s already sluggish investments in real estate and other sectors would probably decline even more. China’s quick decision to lower the required reserve ratio to 0.5% with the effective date of July 5 reflects increasing crisis awareness of financial authorities. Lowering interest rates would weaken the yuan. The resulting drop in stock prices combined with the bad debt problem could spark erosion of confidence similar to what happened in 2015. The Chinese government will probably seek a compromise because it has no desire for trade friction retribution to reach this level.

There is likely to be a sharp line between the winners (countries and companies that receive benefits) and losers (countries and companies that suffer negative consequences) of a US-China trade war. Winners will be the United States, Japan, and Taiwan. Losers will be China, Germany, and Korea.

Japan’s superiority concerning trade friction

As China rapidly shifts emphasis to the high-tech sector and increases the use of advanced technologies in many industries, competition with Korea, Taiwan, and Germany are becoming more heated. In the internet platform field, China’s Alibaba and Tencent are challenging US companies for predominance. However, Japan obviously has almost no competition with the United States, and there is very little competition with China either. In fact, the growth of China’s high-tech sector will probably create a complementary relationship with Japan as China buys Japanese equipment, components, and materials.

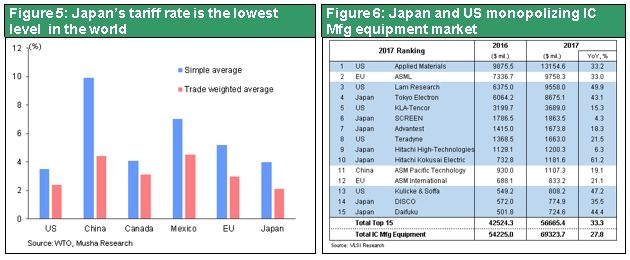

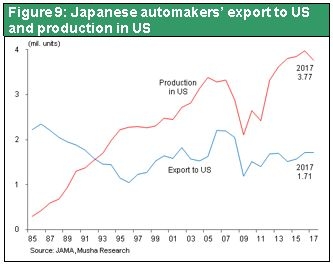

Japan has an extremely advantageous position within the international division of labor. For instance, the global market for semiconductor production equipment is divided between the United States (60% share) and Japan (40% share). If China is unable to buy US equipment, the only alternative will be to rely on Japan. President Trump is considering punitive tariffs on automobiles that would include Japan’s exports. As you can see in Figure 5, Japan has the lowest tariffs in the world. For automobiles, Japan has no tariff, but there are tariffs of 2.5% in the United States, 10% in the EU, 8% in Korea and 25% in China. Furthermore, the annual US output of Japanese automakers is 3.77 million vehicles, more than double Japan’s exports of 1.74 million vehicles to the United States.

Japan has a very small trade surplus, and the primary income balance accounts for the majority of its current account surplus. While other countries should be pleased with Japan’s income surplus because this creates jobs outside Japan. On the other hand there are reasons for the trade surplus being condemned because it deprives local employment. The global supply chain that Japan constructed when the yen was strong is much larger and more advanced than the supply chains of other countries. Having established such supply chain, Japan is no longer the target of trade friction. Consequently, Japan has many advantages because the country has already experienced US trade friction and finished taking the actions needed to end this friction.

Taiwan is another beneficiary of a trade war

The Trump administration is increasing its support of Taiwan. The Taiwan Travel Act, which was rejected in September 2016, was unanimously approved by the Senate on February 28, 2018. This move effectively recognizes US-Taiwan relations and signals a rapid shift of the US Congress to a more hardline stance regarding China. Also, US IT companies are starting to shift their orders for equipment needed for the IoT to companies in Taiwan.

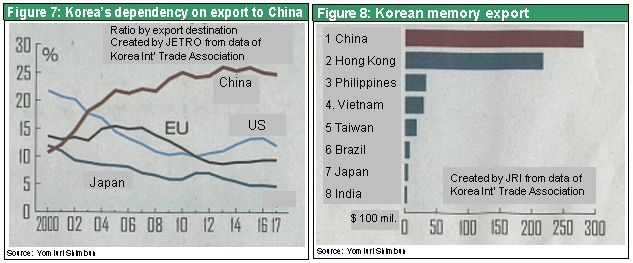

Concerns about the Korean economy are growing

A US-China trade war is likely to result in major damage to the economies of Korea and Germany because of their high reliance on trade with China. In Korea, exports are 32% of GDP (compared with 13% in Japan) and China accounts for 25% of all exports. Almost all of Korea’s exports of semiconductor memory chips, the country’s largest export category, go to China (including Hong Kong). A reduction in US imports from China caused by trade friction would have an enormous impact on Korea. In addition, China’s high-tech shift means that Chinese companies will be entering the market domains of Korean companies.

Germany would be damaged by an additional 20% US tariff on automobiles imported from the EU as a retaliatory tariff in response to prior retaliation to President Trump’s punitive tariffs. Demands for corrections to the current automobile tariffs of 2.5% in the United States, 0% in Japan and 10% in the EU would be detrimental to Germany.

(4) Why trade friction can be justified

What is the reason for creating trade friction with allies?

One aspect of President Trump’s actions is incomprehensible. Why is there a need to create trade friction with allies? Furthermore, the president is using pressure and threats on a bilateral basis rather than for trade with many countries. This cannot be justified by geopolitical reasons.

Protecting US blue-collar jobs

There must be a reason for trade friction other than holding back China’s growing influence. Most important is the protection of US jobs, especially for the restoration of the manufacturing sector (chiefly automobiles) in the Midwest. Preserving jobs is especially crucial for lower-skilled white workers in the Midwest who are most vulnerable.

NAFTA created a framework that enabled US manufacturers as well as Japanese, German and Korean manufacturers to transfer operations to Mexico. One result was the rapid growth of Mexico’s automobile industry and the outlook for a steep increase in Mexico’s automobile exports to the United States. Mexico produced 2.26 million vehicles in 2010, including 1.86 million for export. Production was 3.46 million (2.76 million for export) in 2016 and 3.77 million (3.10 million for export) in 2017. Based on the plans of major automakers, Mexico’s automobile production is expected to rise to 5.8 million vehicles in 2020. NAFTA is viewed as the villain that triggered this “great escape” of automobile production from the United States. Now President Trump wants to renegotiate NAFTA to stop the loss of factories to other countries. The Trans-Pacific Partnership has a local content ratio of 45%, far below the 62.5% of NAFTA. Due to this lower ratio, concerns that the TPP would further increase the loss of US factories were one of key reasons for President Trump’s decision to pull the United States out of this partnership permanently.

The plan for rebuilding the US manufacturing infrastructure

There is a third objective of the Trump administration’s trade protectionism and trade friction that includes allies: rebuilding the US manufacturing infrastructure. The decline of this infrastructure occurred many years ago. Now Peter Navarro and other Trump administration advisers want to restore this infrastructure. For some time, Mr. Navarro has said he is envious of the manufacturing sectors of Germany and Japan.

Strategic trade policies may reappear

This desire to expand manufacturing is linked to progress with automating production processes by using AI and robots. If a country has no factories, it will be impossible to create more value with higher productivity resulting from this automation. The impending age of AI, robots and the IoT will also be an age where manufacturing holds the key to the creation of value. The Trump administration wants to increase manufacturing within the United States to be prepared for this age. This is probably the third reason for trade friction. As I explain later, the formation and decline of industrial infrastructures are associated with events in the past. The power of government policies is vital to starting a new site for an industry or reversing the decline or emergence of an industry. This is the leading edge of trade theory. Although this has not yet been determined definitively, we may be witnessing the beginning of the reemergence of the strategic trade policies that were used in the 1980s and 1990s during the Reagan, Bush, and Clinton administrations (See next chapter).

Trade friction will make the dollar stronger

Tariff hikes and other trade policies will probably increase upward pressure on inflation that will make the dollar stronger. The effects of trade restrictions and higher tariffs are usually offset by a decline in the currencies of targeted trade partners. No change in competitive positions occurs as a result. This is the orthodox economic view. In fact, the Mexican peso plunged about 20% immediately after the election victory of President Trump, who said he would renegotiate NAFTA. This made factories in Mexico even more competitive. Furthermore, the recent stalemate regarding these renegotiations has caused the Canadian dollar to weaken. Limiting declines in the currencies of other countries is essential in order for President Trump’s protectionism to make US factories more competitive. However, this cannot be done.

If foreign exchange markets eventually obey this orthodox economic view, President Trump’s protectionism will cause the currencies of other countries to become even weaker. The yen would not be an exception. Consequently, enacting trade restrictions and higher tariffs to make Japanese automobiles less competitive would probably result in the depreciation of the yen.

(5) The economic justification of trade friction

What is the problem with free trade?

National economies are sub-systems of the global economy that create the single global economy. As the world rapidly became smaller, the international division of labor spread to all areas of the globe. But this process was accompanied by splits in value systems. The first value is that following the principle of laissez-faire worldwide is good for everyone and that this is an unmistakable trend. The second value is the stance that worldwide freedom is not useful in practical terms because it is the logic of powerful people and a means of exploiting others. Criticism of the Trump administration’s trade protectionism is linked to the belief in the virtues of free trade, which is part of the first value. However, this thinking is outdated and inconsistent with the realities of today as is explained in the following section.

Excerpt of Chapter 3 (pages 173-180) of A study of New Imperialism (Toyo Keizai Shinposha, 2007) by Ryoji Musha

There are essential questions about the glorification of free trade and the principle of laissez-faire. First is a theoretical problem. The free trade stance based on the belief of the relative superiority of the international division of labor is outdated. This view is unable to explain actual situations. Furthermore, this stance at times blocks the optimal distribution of resources and the ability to maximize growth. In academism, this thinking is already no longer persuasive. Second is a practical problem concerning the occurrence of adverse effects of globalism that is premised on free trade as well as increasing criticism of this globalism.

At times, idealism regarding idyllic free trade receives very strong support. However, ironically, it is precisely at these times that the economic theory of comparative advantage loses almost all of its effectiveness. There are other problems, too. Over the years, there have been changes in a variety of conditions used as the premise for the comparative advantage theory. First, according to an assumption used for this theory, there should be no trade at all between affluent countries that have similar resources or technologies. But contrary to this assumption, the volume of trade among these developed countries is growing. Second, significant changes are occurring in the locations of manufacturing resources. Primary causes include movements of capital, the artificial manipulation of the cost of capital, and even the relocation of engineers and other skilled workers. That means the premises used for comparative advantages can lose their validity easily. Third, even if the volume of trade increases, there will be no significant decline in the differences in wages among various countries. The cost of manufacturing resources will not become more uniform. The conclusion is that the simplistic view that international trade will reduce and even out differences in the cost of manufacturing resources in different countries is not valid (so there is no reason to believe in the Heckscher-Ohlin model). (*1)

To summarize, this means that free trade will not necessarily result in the expected harmonious equilibrium or the highest possible efficiency. Also, it is possible to create comparative advantages artificially.

Losses caused by free trade cannot be overlooked

The result of these factors is that, even in a world where trade is unrestricted, big differences will emerge between strong and weaker countries depending on the industries a country decides to focus on. When David Ricardo conceived the theory of competitive advantage early in the 19th century, agriculture and all other major industries had diminishing returns. Once economies became industrialized, though, major industries made it possible for additional investments to produce bigger returns. In this environment, free trade is not always mutually beneficial. For agriculture and industries that are not very technology or capital intensive, additional returns decline even when new investments are made at existing manufacturing locations. Falling investments prevent the formation of industrial clusters.

The launch of an industry resulting from the increasing reliance on technology and capital requires networks that bring people together. Additionally, these industries have high fixed costs because of the need for a large volume of machinery and other equipment. If there is a monopoly or oligopoly that results in control over prices, marginal income will increase. This signifies that investing more capital will produce higher returns. The ability to earn higher returns led to dramatic progress with the regional concentration of industrial activity worldwide. Semiconductor and IT companies are clustered in Silicon Valley, Detroit is home to the automobile industry, Japan has many high-tech and capital goods companies, Los Angeles is the world’s entertainment capital, and the city of London and Boston are centers for the financial sector. In a world where these industrial clusters exist, there is no longer any validity to the international division of labor associated with comparative advantages under idyllic and equitable conditions.

At the same time, it is no longer possible to reject the theoretical possibility of incurring losses caused by free trade. Professor Eiichi Tomiura made the following warning statement against Graham’s viewpoint. “In industries with diminishing returns, production efficiency will not increase even if markets grow because of trade. But specializing in industries with rising returns results in increasing efficiency as trade boosts production volume. So there is no symmetry. If manufacturing efficiency has a link with personal income, then this lack of symmetry will create increasing gaps between the wealth of individual countries. Therefore, countries focusing on increasing return industries are lucky. Countries focusing on diminishing return industries will have the misfortune of becoming increasingly poor in relation to other countries. (*2)

No comparative advantage exists between two countries with precisely the same resources and level of technology. According to the Ricardo premise, there should be no trade between these countries. However, there will be economies of scale if each country concentrates on different industries. These economies will allow each country to manufacture goods at a lower cost. As a result, trading low-cost goods with each other will produce benefits for both countries. This raises the problem of which countries should have industries with increasing returns and which countries should be delegated with the diminishing return agriculture sector.

Once a country specializes in agriculture, importing industrial goods from other countries becomes less expensive than attempting to start an industry using the country’s own resources. The country’s concentration on agriculture will increase as a result, causing the country to go down the path of economic stagnation. Laissez-faire economics cannot prevent this problem. A country’s government must step in at an early stage to achieve the specialization in a particular industry. In Central and South America, some people believe that the powers of Western Europe intentionally intervened to stop countries from becoming industrialized. Countries were instead forced to focus on agriculture. (*3)

At the beginning of the 20th century, Argentina had one of the world’s strongest economies and highest levels of personal income. But the country subsequently experienced stagnation for 100 years. The most likely cause is the after-effects of its focus on agriculture. If this is true, we can no longer ignore what is hidden behind the principles of free trade and comparative advantage: the logic of a party in a stronger position and the hypocrisy of a party in a stronger position.

The birth of a new trade theory that emphasizes second nature

In the 1980s, Paul Krugman created a new trade theory that targeted the limitations of the classical free trade theory. The aim was to demonstrate that a decline in costs (and thus the increase in returns) due to economies of scale resulting from the regional concentration of industries is the cause of the international division of labor and international trade. Furthermore, he believed that the clustering of industries in specific areas was a type of acquired second nature rather than the innate nature one has upon birth. Second nature is a characteristic acquired during one’s life in conjunction with chance, intentional actions, and other factors. Much like with genes, this second nature is small at first and subsequently determines one’s fate in the future.

But exactly what is the trigger that causes industries to cluster? Silicon Valley has Stanford University and an excellent climate and natural environment that appeal to talented engineers. In Bangalore, India, government policies played a decisive role in attracting high-tech companies. Detroit attracted the automobile industry simply by chance because it was the home of Henry Ford, who is regarded as the founder of the industry. In each case, the first droplet played a critical role. (*4)

This process is similar to the formation of icicles. In winter, large icicles hang from rain gutter in cold areas such as Hokkaido. Why does an icicle start growing in one place instead of any other? The only answer is that formation starts where the very first droplet fell. Perhaps there was a small piece of dirt on a rain gutter that directed the droplet to that location. Another possibility is the uneven application of a coat of paint. For some reason, the first droplet happened at that spot and a tiny icicle formed. The second, third and fourth droplets followed at the same place. After some time, a large icicle was created. Everything was determined by the location of that first miniscule droplet. In the business world, the historical benefits of the regional concentrations of industries raised efficiency and made companies even more competitive. Paul Krugman thinks that the Silicon Valley high-tech cluster and Seattle aerospace cluster are both the result of chance, just like a number chosen by a roulette wheel. The first droplet greatly increases so-called externality. This further increases the advantages of a location where companies and engineers and other employees work in close proximity to each other.

Acquired strengths are what produce the first droplet that determines fate. Assuming this is true, government interventions are necessary at times. For instance, managed trade, trade policies, industrial development measures and other government measures are needed instead of relying on free trade. Government intervention can play a key role in the creation of second nature. On the other hand, once an industry has lost its competitive edge (the icicle has melted), reentering the industry (creating another icicle) will be extremely difficult. Consequently, Japanese companies had to keep doing their best while enduring losses when the yen was strong. This is one reason that foreign exchange rate adjustments are often ineffective.

Furthermore, from the standpoint of external cost reductions accumulated over many years, it may be possible to justify the affiliations among Japanese companies (Keiretsu in Japanese :business relationships spanning many years) as well as the benefits of these affiliations. For example, even if an item is more expensive than elsewhere, purchasing the item within a group of affiliated companies will contribute to long-term earnings with respect to quality, delivery speed, hedging risks and other factors. This business practice is economically rational even though it cannot be justified by using the principles of freedom and market supremacy. These points all lead to the conclusion that there are limits to the ability of the market mechanism to achieve the most suitable allocation of resources.

America’s double standard – Offensive and strategic trade policies

The theoretical limits of free trade were identified and the United States began implementing a new package of strategic trade policies in the late 1980s. This initiative consisted of imperialistic measures spawned by the new trade theory. America’s double standard and an offensive stance were key elements of these measures.

Michael Boskin, a strong backer of free trade, was chairman of the Council of Economic Advisers during the administration of the first President Bush. He once said that potato chips and microchips are the same from the government’s viewpoint. Naturally, this sparked a strong negative response. Free markets where simple and straightforward comparative advantages function do not exist. During the early 1990s, Japan’s highly competitive industries posed a challenge to the United States. The US trade deficit with Japan grew, and Japanese companies took away industry leadership from US companies in major categories like color TVs, video decks, semiconductors, and automobiles. The United States could not allow this to continue.

There were forceful US interventions involving Japan-US semiconductor friction and other issues. Subsidies to support selected industries and protective tariffs produced surplus earnings and gave these industries a global competitive advantage. In addition to the imposition of protective tariffs, the use of managed trade was justified as a means of reducing trade protectionism and opening up markets in other countries. There are many examples of these actions: the Omnibus Trade and Competitiveness Act, the “Super 301” trade retaliation provision, the Anti-Dumping Act, Structural Impediments Initiative SII, numerical import targets contained in Japan-US semiconductor agreement, a results-oriented stance, unilateralism and demands for voluntary export restraints, among others.

Collectively, these measures are called strategic trade measures. All have the same defining characteristic: an offensive stance. Demands for trade protectionism come primarily from companies that have weak competitive positions and simply want a way to defend themselves. However, US strategic trade measures in the 1990s were the result of demands from highly competitive multinational corporations that were aiming for global growth. Money was not their only goal. These companies wanted actions in a broad range of fields, including the protection of services and intellectual property. As a result, these were offensive trade measures with the objective of backing up the overseas expansion of US companies. (*5)

In the second half of the 1990s and early in the following decade, interest in trade policies declined rapidly against a backdrop of the internet revolution, US dominance in the financial sector and other events. Having established industries with an overwhelming competitive advantage, the United States appeared to return to a position of supporting idyllic free trade. The US government remained passive even as Daimler-Benz purchased Chrysler and both General Motors and Ford posted huge losses. There were no strategic trade measures due to a variety of criticism. Most significant was the arbitrary nature of any selections of industries to receive support and the difficulty of measuring the benefits of trade measures.

However, the legacy of strategic trade measures is enormous. Today, stronger demands for opening domestic markets of trading partners, deregulation, the protection of intellectual property and the promotion of unrestricted business practices are commonplace. But the logic is contradictory. The United States is asking other countries to open their markets and eliminate restrictions in order to broaden opportunities for US companies. At the same time, though, the United States is pointing to the internal damage caused by free trade. The US government is also aware that interventions may be necessary from time to time.

The United States has “first droplets” in a large number of leading-edge industries and many industries that have increasing returns. Even though the US is aware of this strength, the government is attempting to justify idyllic free trade that can exist only in an environment of diminishing return industries. The logic behind this position is derived from strategic trade measures rather than the principle of free trade. Therefore, this stance may be similar to a wolf concealing himself underneath a hood ( the wolf in the fairy tale Little Red Riding Hood). The United States has a double standard, although we cannot say whether or not this position is intentional.

Friedrich List, a 19th century German economist, made the following observation about British hegemony. “The objective of Britain is to constantly develop the industry and commerce to the point that can always overcome any competition from other countries. Britain then uses this position to become stronger both militarily and politically. Depending on the time and place, Britain uses freedom, power, and money, and the suppressed the freedom for its own interests.” Mr. List’s words appear to be a perfect description of the United States today. This is precisely what should be called imperialistic policies.

(*1) Eiichi Tomiura (1995), The Economics of Strategic Trade Measures, Nihon Keizai Shimbunsha, Chapter 2, The Emergence of Strategic Trade Measures

(*2) Eiichi Tomiura (1995), same as (*1)

(*3) Eiichi Tomiura (1995), page 105 of (*1)

(*4) Paul Krugman (1991), Geography and Trade, The MIT Press, Japanese translation (1994) Datsu Kokkyo no Keizaigaku, Toyo Keizai Shinposha

(*5) Eiichi Tomiura (1995) page 53-60 of (*1); trade theory can be divided into the following four types based on the stance regarding trade and positioning with regard to government intervention: (1) Mercantilism – emphasis on trade, large government interventions; (2) Free trade – emphasis on trade, rejection of government intervention; (3) Protectionism – limit trade, allow government industrial measures and other interventions; (4) Strategic trade measures – emphasis on trade, allow government interventions, focus on demands for trading partners to open up domestic markets and other demands