Jul 06, 2018

Strategy Bulletin Vol.202

The US-China Trade War and China’s Achilles Heel

- A 2015-style crisis in China will not happen this time

(1) Nightmares about the combined effects of a trade war, plunge in the yuan’s value, and simultaneous downturns of Chinese stock prices .Trump’s attacks are definitely making the outlook more uncertain

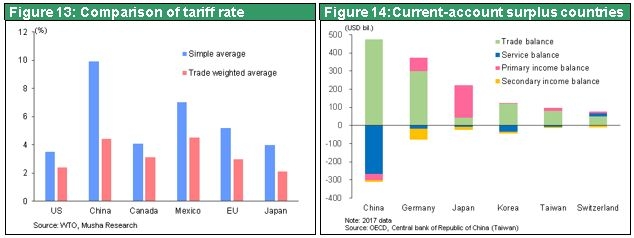

Trade friction dragged by the Trump administration, and most all its trade war with China, is creating turmoil in the world’s financial markets. In China, the primary target of the Trump administration, a negative cycle of declines in the yuan and stock prices has started. The yuan has depreciated 6% since the end of March when trade friction began, the biggest drop since 2015. Furthermore, the Shanghai Composite Index has plummeted 17% since March. Speculative selling by global investors triggered by “China risk” is starting to spread to the stocks of industrialized countries like Japan and the United States, too. On July 6, President Trump announced additional sanction tariffs of 25% on $34 billion of imports from China. China immediately responded by announcing retaliatory tariffs of the same magnitude. Worries are growing about these apparently endless exchanges of punitive actions. The simultaneous downturns in China’s stock prices and currency bring back memories of the so-called China shock that happened when stock prices plummeted between the summer of 2015 and early 2016. Fears of another China shock are growing. If the US-China trade war results in a series of tit-for-tat acts of revenge, damage to the global economy could be greater than anyone expects. In an environment like this, financial markets are obviously highly vulnerable to selling pressure.

(2) But a major crisis will not happen now

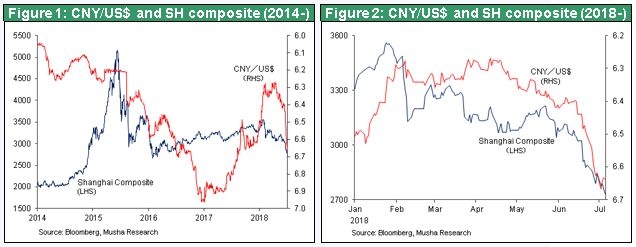

A severe market collapse and economic downturn can probably be avoided because there are major differences between the current environment and 2015. First, unlike in 2015, China’s fundamentals are relatively sound. As you can see in Figures 3 to 6, the Chinese economy was in severe adjustment phase in 2015. Many microeconomic indicators moved down, such as real estate investments, railroad cargo, steel production and electricity generation. The downturn was even worse than during the global financial crisis that started in 2008. But now, these economic indicators are all consistently boosting.

Trade friction will have a significant impact on the Chinese economy. High tariffs will make its products less competitive and, as friction heats up, uncertainty about China will grow while the interest in making investments in the country will fall. However, China is responding quickly. On July 5, the required reserve ratio was reduced by 0.5%, demonstrating the government’s growing sense of crisis about a trade war. The Chinese government does not want to see another 2015-style increase in negative sentiment caused by a chain reaction consisting of a weaker yuan, falling stock prices and a large volume of non-performing loans. As a result, China will probably seek a compromise in order to stop trade friction retribution.

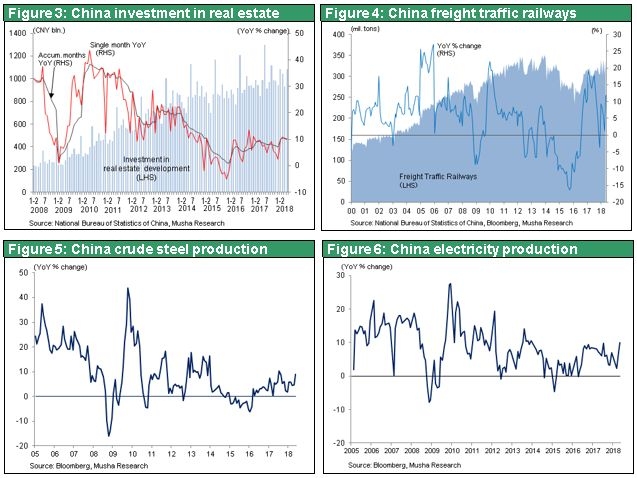

A second major difference between 2015 and now is that China is effectively controlling capital. Since the second half of 2016, China’s foreign exchange reserves have been steady at about $3.1 trillion, during a period of almost two years. In 2015, China wanted the yuan included in the IMF’s special drawing rights (SDR) currency basket. To accomplish this goal, China was rushing to disclose statistics involving foreign currency and international lending and borrowing as well as to ease capital controls. Since China’s economy was weak at that time, announcing these statistics revealed the weakness of the country’s foreign currency situation. Moreover, the elimination of restrictions on the movement of capital sparked rapid growth in capital outflows. China responded to this crisis with economic stimulus measures and strict capital controls. Taking these actions ended foreign currency concerns and worries about a drop in the yuan’s value. Consequently, this second difference shows that China is now making effective use of lessons learned in 2015 about crisis management.

Some people suspect that China plans to use a weaker yuan in order to offset the effects of trade friction. But this is probably not true for two obvious reasons. First, currency depreciation can easily produce a crisis. Second, weakening the yuan would anger the United States, resulting in a much weaker position for China concerning trade negotiations. Furthermore, People’s Bank of China Governor Yi Gang has stated that China will not deploy the yuan as a weapon in the US trade conflict.

(3) The Trump administration’s modus operandi aims for a deal (intimidation and negotiations), not the start of a recession (blockage of global supply chains) that would anger backers of the United States

Demands that the Trump administration is making to China are harsh. The US-China battle for hegemony is at the heart of the conflict between the two countries. Most likely, the ultimate goal of the United States is restructuring the global supply chain, which currently relies on China too much. The United States even wants to block China’s Made in China 2015 initiative that aims to give China high-tech hegemony. But this is a demand that China will not accept.

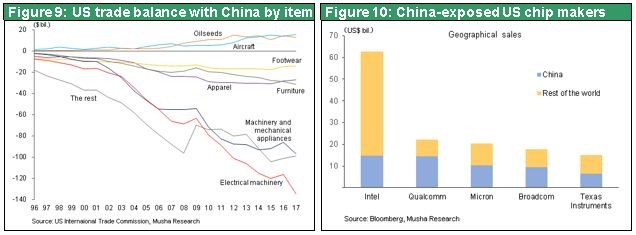

Nevertheless, common sense tells us that the Trump administration does not want to destroy US-China trade relations by demanding that China quickly accede to all demands. Today, China is the nucleus of the global supply chain. A head-on conflict with China would therefore deal a severe blow to the US economy. A court in China issued a preliminary injunction that bans Micron Technology, a US manufacturer of semiconductor devices, from manufacturing and selling some of its products in China. This was the result of litigation by United Microelectronics Corporation (UMC) of Taiwan alleging that Micron Technology violated its patent rights in China. The possibility that this action is linked to China’s revenge concerning US trade friction cannot be rejected. The biggest assembly base for high-tech products is China. As Figure 10 shows, China is the largest market for US semiconductor companies. For example, Qualcomm has the highest reliance with 65% of sales in China and China accounts for 51% of the sales of Micron Technology. Reshaping the global supply chain now centered on China will ultimately be necessary. This process will also involve a major shift in the business models of US companies and require many years. Hasty or impetuous actions to alter the supply chain would be suicidal for the United States as well.

Past activities clearly show that President Trump’s primary approach to diplomatic matters has always been to make a deal. The president looks for common ground that leads to a compromise while both flattering and threatening counterparties. He has used this approach repeatedly with China and North Korea. To receive China’s cooperation concerning North Korea, President Trump rejected Congressional opposition and eased sanctions on ZTE. For negotiations with North Korea in Singapore, the president suddenly changed his stance and praised Kim Jong-un who had insulted the president many times. The result was the assurance of political system of North Korea without complete, verifiable and irreversible nuclear disarmament. These and other actions by President Trump show that initial radical demands are nothing more than tools to gain an advantage during negotiations.

China, like the United States, has few options. One option is economic growth measures and monetary easing in order to reduce financial tension. A second option is to use capital controls to close pathways that could lead to a crisis. A third option is to give in to US demands at trade negotiations until the United States is satisfied. There are no other alternatives.

Financial markets are unsettled by uncertainty involving retaliations to punitive trade measures. However, if this uncertainty goes away once all of these trade measures and the associated revenge have been enacted, investors will probably regain their composure and confidence.

(4) A 2015-style severe crisis will eventually happen because of negative events in China involving foreign currency and capital

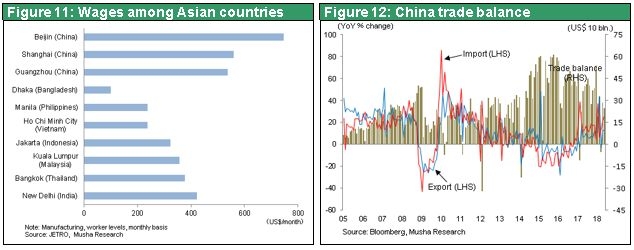

Other than trade friction, how can the United States limit China’s growing strength? Prohibiting China from devaluating the yuan is probably the most critical aspect of the US stance regarding China. The reason is that the yuan is regarded as China’s Achilles heel. Extreme appreciation of the yen is what finally forced Japan to give up during US-Japan trade friction. The United States is most likely making foreign exchange rates a focus of its actions targeting China. Wages in coastal China are already well above wages in ASEAN member countries. Additionally, salaries of engineers in China’s high-tech sector are believed to be even higher than in Japan. China has undeniably become a high-wage country.

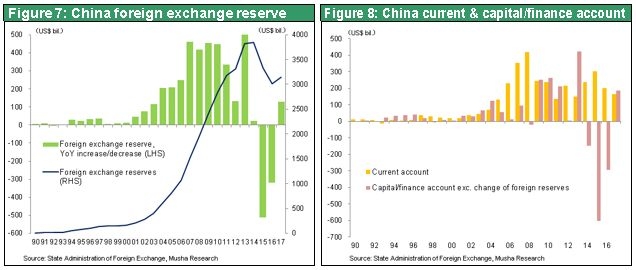

The inability to devalue the yuan will make China’s exports much less competitive. Furthermore, a big shift in investments to high-tech industries is taking place in China. In the past, the investments that fueled China’s economic growth were mostly in three sectors: infrastructure, real estate and equipment used in smokestack industries. All three require large amounts of steel, cement and labor. Contrary to this, high-tech investments raise imports because of China’s overwhelming dependence on overseas suppliers for machines, basic materials, parts and other items. China’s trade surplus has already been falling at an annual rate of more than 20% during the past few years. At this rate, China may no longer have a trade surplus after a few more years and could also have a current account deficit.

If this happens, the pressure will increase on foreign investors, who have made massive investments in China, to take their money out of the country. Enormous capital inflows are what allowed China to post such strong economic growth. This is why China has a surprisingly weak external balance sheet. This weakness is what greatly sets Japan, which also has a trade surplus, apart from China. For these reasons, a dramatic drop in the yuan’s value is very likely to happen at some point in the future when worries about the yuan reemerge. A drop in the yuan’s value may trigger the collapse of the asset bubble in China, which could then start an economic and financial crisis. Until this happens perhaps three to five years from now, the United States will probably retain its resolute opposition to any depreciation of the yuan.

To determine the outlook for China, investors should keep an eye mainly on changes in the country’s trade surplus and foreign exchange reserves.

(5) Now may be an excellent time to buy Japanese stocks

Stock prices in Japan plunged at the end of June. The most probable explanation is speculative selling using trade friction as an excuse. However, trade friction is very likely to wind down. In addition, as is shown below, Japan will be a beneficiary of a US-China trade war. In the second half of 2018, the health of the global economy and the US economy will probably improve even more. Once investors see numbers that confirm this improvement, we can expect to see another “Goldilocks market” in the US and Japanese stock markets.

Investors should focus on Japan’s advantages

China’s rapid industrialization and shift of emphasis to the high-tech sector is making the country an even greater competitor for Korea, Taiwan and Germany. Furthermore, China’s Alibaba and Tencent are challenging US companies for predominance in the internet platform field. However, Japan obviously has almost no competition with the United States and there is very little competition with China either. In fact, the growth of China’s high-tech sector will probably create a complementary relationship with Japan as a supplier of equipment, components and materials required by high-tech companies in China.

Japan has an extremely advantageous position within the international division of labor. For instance, US and Japanese companies control the market for semiconductor production equipment (US 60%, Japan 40%). China will have to rely on Japan if it becomes unable to buy US equipment. President Trump is considering a punitive tariff on automobiles that would include Japan’s exports. As the figure below shows, Japan has the world’s lowest tariffs. This includes automobiles, where Japan has no tariff compared with 2.5% in the United States passenger cars (pickup truck is25%), 10% in the EU, 8% in Korea and 25% in China. Furthermore, the annual US output of Japanese automakers is 3.77 million vehicles, more than double Japan’s annual exports of 1.74 million vehicles to the United States.

Japan has a very small trade surplus and the primary income balance accounts for the majority of the country’s current account surplus. Other countries should be pleased with Japan’s income surplus because it is derived from investments, job creation and other industrial activities overseas. But people condemn a trade surplus because it takes jobs away from other countries.

All this is telling a clear cut conclusion. The global supply chain that Japanese companies have constructed under difficult trade friction with the US and very strong yen is now much larger and more advanced than the overseas supply chains of other countries. Having established this supply chain, Japan is no longer the target of trade friction. Japan today is an “advanced country” concerning US trade friction. Consequently, Japan is in an extremely advantageous position because the country has already experienced US trade friction and very prepared the actions needed to end this friction.