Aug 21, 2018

Strategy Bulletin Vol.205

Trade War Midway Report: Approaching the point where the US succeeds and China retreats

- Avoiding a collision will trigger a relief rally starting in the fall

The United States is showing that it means business in the trade war and China is clearly becoming alarmed. On the other hand, the US-China trade war that started with US tariff hikes is not likely to create serious problems for the global economy and financial markets. The US economy is in excellent shape; there are still no signs of a recession on the horizon. China plans to achieve a certain level of economic growth and stabilize its financial markets by using various measures. For the time being, there is no need to worry about the possibility of a disruption of the global supply chain.

President Trump’s strong-arm tactics are likely to succeed. First, the US economy is obviously strong enough to absorb negative influences coming from the trade war. Second, whether the United States picks a fight with China or any other country, the other country will eventually have to concede defeat for the following two reasons. (1) The United States is the biggest customer of other countries and the customer always comes first. (2) The power of the dollar as the world’s only currency for settling payments is clearly evident to everyone.

A sharp picture is starting to emerge of a long-term trend in which the US economy is the world’s only winner and the Chinese economy declines. An enormous reversal is about to happen in the global supply chain, which has been dominated by China. The beneficiaries will be Taiwan, Vietnam and other countries.

For these reasons, financial markets will focus solely on the strength of the United States for the time being. First, the US economy will continue to expand. Second, the dollar’s strength will increase, creating difficulties for emerging countries to procure dollars. Third, a strong dollar is in the best interests of the United States. A strong dollar improves the trade balance by holding down increases in prices of imported goods while boosting the overseas purchasing power of US companies. These factors will probably fuel growth of the global economy. Consequently, a financial market environment conducive to risk-taking is likely to start emerging this fall.

(1) The United States is flexing its muscles and China is starting to have regrets

The United States has started a war with China for hegemony

A trade war with China has started. This is the core of the Trump administration’s policies. By launching a trade war with China in the second year of his administration, President Trump has started taking actions aimed at preventing Chinese hegemony. During the campaign, Mr. Trump said he would designate China a currency manipulator on his first day in office. Now he is finally acting on that pledge. The United States has a sense of rejection concerning China’s unfair economic growth and pursuit of hegemony. But at last, all the sectors that detest the president – the media, the Democratic Party and academia – unanimously agree with this rejection.

No more US nice-guy stance regarding trade, military power, diplomacy and foreign exchange

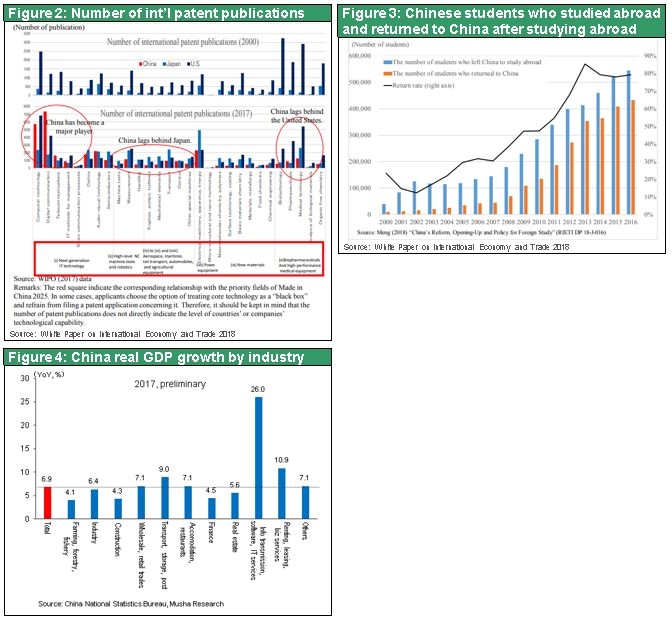

Since February, the Trump administration has been making demands to China regarding trade and enacting a series of tariff hikes and other punitive measures. There is apparently no limit on steps to strengthen these measures: the use of Section 201 of the Trade Act of 1974 to impose emergency import restrictions on solar panels and large washing machines from China; import tariffs on steel and aluminum; the demand for a Chinese plan for reducing its US trade surplus; import tariffs on imports from China worth about $50 billion; additional tariffs on Chinese imports totaling $200 billion; and more. One is a halt to the use of internet spying to steal technologies, the requirement that US companies transfer technologies to China and the use of unfare subsidies to Chinese companies. Stopping the Made in China 2025 plan for global high-tech leadership is another demand. But President Trump probably has even more demands for China.

In August, President Trump signed the Fiscal 2019 National Defense Authorization Act, which contains the defense budget and policies. The act also includes measures concerning China. The primary measures are forbidding the use of products made by ZTE, Huawei and other Chinese high-tech companies; making the Committee on Foreign Investment in the United States (CFIUS) more powerful; and prohibiting China from participating in the Rim of the Pacific exercise (RIMPAC). In February, President Trump signed the Taiwan Travel Act that effectively recognizes diplomatic relations with Taiwan. There is no doubt that the United States wants to contain China in every way possible. Furthermore, Treasury Secretary Steven Mnuchin issued a warning to China about the yuan’s recent weakness.

As consternation increases in China, the only course of action will be a series of placation measures and stop-gap economic measures

President Xi Jinping, who thought he was good friends with President Trump, is undoubtedly surprised at the ferocious China bashing by the United States. China’s responses to US initiatives seem to have been criticized at the annual Beidaihe conclave attended by older leaders this year. This criticism appeared in the form of a change in party-led propaganda within China. All words venerating President Xi Jinping disappeared. Statements about pride in China’s progress with industrial technologies were removed, too. These actions softened China’s stance regarding the United States while preserving outward appearances of the usual resolute position. It seems that China wants to look for a pathway to quieting down trade friction.

Everyone can see that the ultimate objective of the United States is reconstructing the global supply chain, especially in the high-tech sector, which currently relies too much on China. During the first decade of this century, China used massive public-sector investments and subsidies to raise its global share of steel output from the 10% level to about 50%. Just as in the steel industry, China’s solar panel manufacturers beat US, Japanese and European competitors and raised their global market share to about 80%. And now China also ranks first in LCD production with a global market share of more than 30%. Moreover, CATL, which started operations only seven years ago, has passed Panasonic to become the world’s largest producer of automobile batteries. In the mobile communication device market, China’s ZTE and Huawei have a combined global market share of 41%, far higher than the market shares of US, Japanese and European companies. Now China has set its sights on making high-tech the nucleus of its economy. China wants to be the world leader in a variety of the most advanced technologies. But there is no way that the United States will allow this to happen.

(2) The trade war will have only a small negative impact on the global economy and markets

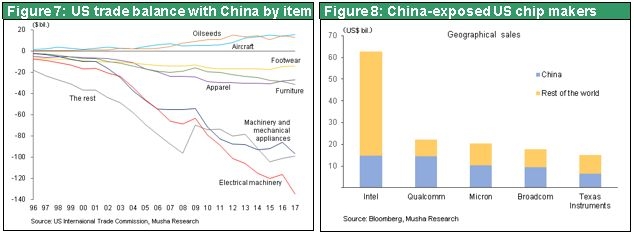

Selective price increases in the United States but only a negligible macroeconomic effect

At this stage, tariff hikes are having only a negligible effect from a macroeconomic perspective. Prices of solar panels, washing machines and steel have increased. China’s retaliatory tariff increases have caused the price of US-grown soybeans to plunge because they are no longer price competitive. But President Trump says he will create a subsidy for farmers, so the impact will probably be small. If manufacturing activity returns to the United States because of a drop in imports from China, higher tariffs would result in growth in US industrial output.

Higher US tariffs will obviously raise prices of goods imported from China. Four outcomes are possible: (1) retail prices are increased to offset the higher tariffs; (2) exports from China are shifted to other countries; (3) China cuts the FOB prices of its exports; or (4) US demand for Chinese products declines. Although the fourth possibility is the biggest concern, the robust US economy would limit any downturn in demand. Furthermore, in the current environment with minimal upward pressure on prices, the effect of a domino-effect upturn in consumer prices would probably be very small. Incidentally, even if all revenue using the maximum estimate ($250 billion of imports x 25% = $62.5 billion) from the higher tariff on imports from China is passed on to US consumption, this amount is equal to a mere 0.4% of all US consumption by individuals.

Stock prices in the United States are high, having moved up about 40% during the period of slightly more than one year following the November 2016 election. The February VIX crash dropped stock prices 12% but prices have already rebounded to cover most of this downturn. As a result, US stock markets are the best performers in the world.

The US economy is the world’s only winner and no recession is in sight

Signs that the US economy is the world’s only winner are becoming increasingly pronounced. Among industrialized countries, only the United States has an economy with the potential of reaching an annual growth rate of 3% to 4%. Moreover, the United States is virtually at full employment with an unemployment rate below 4%. After a period of sluggishness, inflation has climbed to about the Fed’s 2% target. Inflation is stubbornly low in Japan and Europe even though interest rates are generally zero. With consistently low long-term interest rates, banks in Japan and Europe can earn only a miniscule interest margin. As a result, credit creation has effectively come to a halt and these two regions are mired in a liquidity trap.

The United States alone has rising long-term interest rates, allowing banks to increase loans as they earn an adequate spread between long-term and short-term interest rates. The result is a big improvement in the earnings of US financial institutions. This period of US economic growth will almost certainly continue until at least June 2019, which is when the upturn will surpass the current postwar record of 10 years. Despite the strength of the US economy, upturns in both prices and interest rates are not significant. That eliminates the possibility of a switch to a tight-money policy and the bursting of an asset bubble, either of which would terminate this prolonged economic upturn. Underpinning US economic power is its position far ahead of other countries in the new industrial revolution, which is driven by the internet, cloud computing, smartphones, artificial intelligence, and many other technologies and products.

Economic support measures will keep the Chinese economy healthy for a while

To avoid the negative effects of the US-China trade war, China has quickly enacted monetary easing. This is in turn speeding up the upturn in real estate prices, which had been mostly flat. In addition, China has started increasing infrastructure spending, such as for an express rail way to the country’s far west. All these measures demonstrate that China is using the lessons learned in 2015 when a sharp economic downturn sparked a currency and financial crisis.

Dialogue between the two presidents will probably prevent the nightmare of a supply chain shutdown

The biggest worry of all is the collapse of the global economy caused by a disruption of the global supply chain. But this will not happen. It is hard to imagine that the Trump administration rushes for everything and destroys US-China trade relations. China is the world’s largest assembler of high-tech products. Furthermore, companies in China are the biggest customers for US semiconductor manufacturers. For example, China accounts for 65% of the smartphone chip sales of Qualcomm and 51% of sales of these chips at Micron Technology. There is an ultimate need to end this supply chain’s excessive reliance on China. However, making this change will require many years because it will require a big shift in the business models of US companies. Since any rash actions by the United States would be suicidal, the current international division of labor must be maintained for the time being. This is true even if companies worldwide slash investments in China and rapidly shift production to Taiwan, Vietnam and other locations.

The conclusion is that, in terms of the short-term outlook, the US-China trade war will probably have only a minor impact on the global economy and the US economy.

Moreover, US-China discussions are under way, including the recent US visit by a high-ranking official of China’s Commerce Ministry. This shows that a channel exists for a dialogue between the presidents of the two countries.

(3) This is why Trump’s strong-arm diplomacy will succeed

Unprecedented US economic strength will easily absorb the negative effects of the trade war and prevent a decline in the president’s support

This discussion leads to the question of why President Trump’s coercive diplomacy will succeed. The first reason is the overwhelming superiority of the US economy, as I explained earlier. Vibrant economic growth will allow the United States to easily absorb the negative impact of the trade war. This will prevent a drop in the president’s approval rating. During the period of slightly more than a year since President Trump was elected, US stock prices have climbed about 40%. Stock prices plummeted 12% during the February VIX crash but have subsequently rebounded enough to cover almost all of this downturn. No country has an economy performing better than the US economy. As I noted earlier, the United States is far ahead of other countries regarding the new industrial revolution fueled by the Internet, cloud computing, smart phones, artificial intelligence and other leading-edge technologies.

The dollar is becoming even stronger as the world’s only currency for international settlements

The second reason is that China or any other adversaries picked by President Trump for fight basically have no choice other than to concede to the president. Two points are behind this reason. First, the United States is the world’s biggest customer because its annual imports of $2.9 trillion are 3.6% of the world’s GDP. Exporting countries cannot ignore the wishes of this crucial customer. Naturally, the customer always comes first.

The dollar’s increasing strength as a vital currency for international settlements is the second point. Turkey, Iran, North Korea and eventually China will probably experience serious problems involving the dollar. If a country is prohibited from using the dollar due to a fight with the United States, the country’s economy will come to a stop. The Trump administration’s policies are frequently utilizing the widespread knowledge of this obvious fact. Moreover, the strong dollar is becoming even more powerful because of the competitive superiority of US industries and the improving US current account balance. In fact, the use of the dollar has been rising rapidly in recent years as a percentage of international credit and international investments.

(4) The US economy is the only winner and China is on the verge of a decline

The start of a long-term rise of the US economy and decline of China

A long-term trend is emerging that positions the US economy as the world’s sole winner while the Chinese economy weakens. The United States will probably retain its tough stance and target and contain China in every possible way: trade, military strength, diplomacy and foreign exchange. Peter Navarro, who is director of the National Trade Council and a professor at the University of California, Irvine, wrote a book titled “Death by China, Confronting the Dragon – A Global Call to Action.” In this book, he states that China’s Communist autocratic government will always aim for global hegemony and that this will inevitably result in a clash with the United States. Avoiding this confrontation will require eliminating China’s desire to challenge US leadership. To accomplish this, the United States must weaken the Chinese economy, which is the foundation for the ability to increase military strength, while increasing its own military strength. This is precisely why the United States started this trade war.

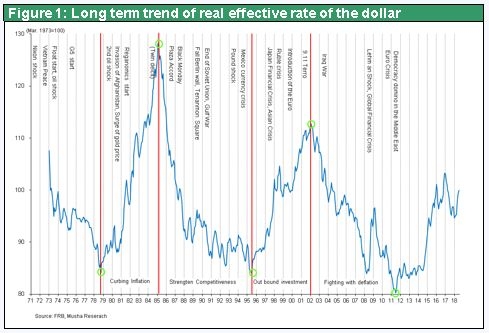

Long term debility in the US=weak dollar is over

The extended US decline (and weakening dollar) has come to an end. When World War II ended, the United States accounted for half of the world’s GDP. After reaching this peak, the US share of the global economy has decreased and is currently 24%, a decline of about 50%. Just after the Cold War ended, the United States staged a comeback as the world’s only superpower. Subsequently, though, US influence weakened steadily as its industries became less competitive, the external current account deficit grew and the dollar entered an extended period of weakness. This is the view that most people have of the United States from a long-term perspective. Now, a fundamental change is about to take place in how people perceive the United States.

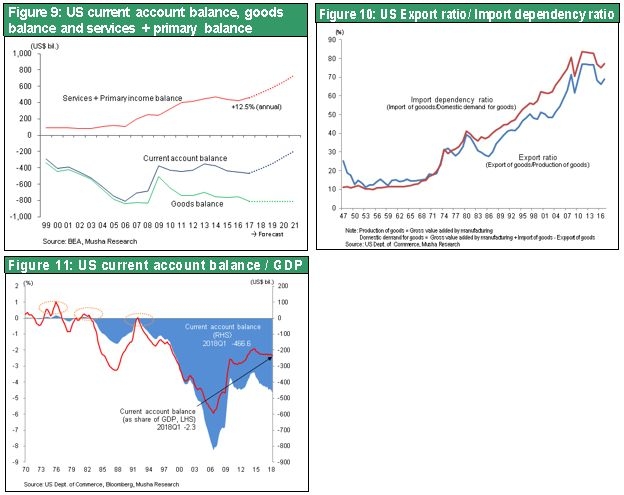

The big decrease in the US current account deficit is proof of the revival of the competitive edge of US industries. The ability of US companies to compete globally has been declining steadily since the 1970s. Factories were moved to other countries as US manufacturing infrastructure crumbled. At the same time, dependence in other countries for various goods increased. Up to about 1970, US manufacturers met about 90% of domestic demand for steel, apparel, televisions, computers, automobiles and many other products. Almost everything was produced and consumed internally. Since then, US reliance on foreign suppliers has increased as globalization advanced. Dependence continued to climb to the point where the United States imports 80% to 90% of the goods it requires. Naturally, the US trade deficit rose rapidly in tandem with the reliance on imports and the dollar became weaker as a result. In 2006, the US trade deficit was $806 billion dollars, which was 5.8% of the GDP. Eventually, the dollar reached an all-time low in 2011 based on real effective exchange rates. Since about that time, the US current account deficit has been decreasing steadily. During the 10-year period that ended in 2017, this deficit fell by about half to $466 billion, which was 2.4% of the GDP. One reason was that the US trade deficit remained basically flat during this period. With reliance on imports now at almost 90%, there is no longer any room for the US trade deficit to go any higher.. Enormous growth in the trade surplus for services and in primary income, from tens of billions of dollars to $400 billion also made a big contribution to reducing the current account deficit.

The US income balance for service exports and primary income has increased dramatically. The cause is the establishment of a model for earning income that is based on global dominance involving intellectual property businesses and internet platform companies. Creating this new highly competitive industrial sector has produced huge benefits. Cutting the current account deficit in half means that the United States has cut in half the growth in its debt. This immediately lowers the supply of dollars. These significant benefits of the competitive US high-tech sector are largely responsible for the steady increase in the dollar’s strength since 2010.

Remaining options for US placation policies and internal stop-gap measures cannot prevent China’s impending decline

China has been forced to enact a series of stop-gap measures. But these initiatives will eventually produce a financial crisis along with a massive amount of bad debt. China will probably rely on reckless monetary easing, measures to push up asset prices, and accounting and statistical gimmicks to manipulate numbers.

The yuan and its value overseas will be critical to the effectiveness of these stop-gap measures. Prohibiting China from allowing the yuan to fall is the key element of US policies aimed at containing China. This is because the United States may have believed that the yuan is China’s greatest weakness. During trade friction with Japan, the United States finally cornered Japan by making the yen appreciate to an excessive level. Foreign exchange is probably a major part of US policies about China, too.

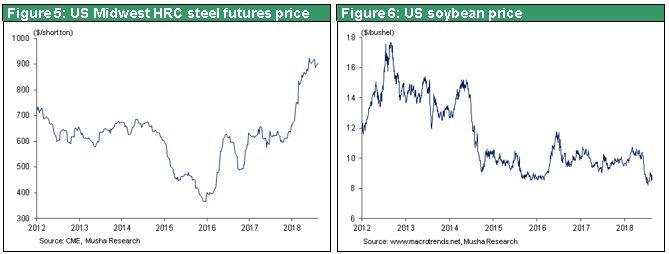

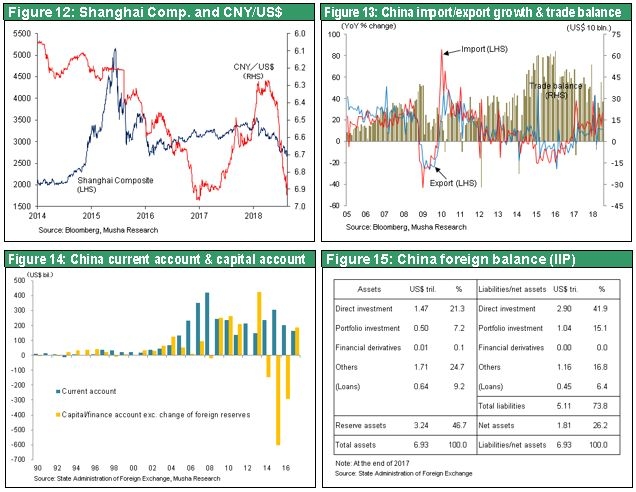

Wages in coastal China are currently far much higher than in the ASEAN countries. In the high-tech sector, wages of some engineers are even higher than in Japan. China has unquestionably become a high-wage country. Costly labor means that China’s ability to compete in export markets will fall sharply, assuming that China is unable to devalue the yuan. Investments have been the primary source of economic growth in China. In the past, investments were made chiefly in the infrastructure, real estate and heavy industry sectors. All three require large volumes of steel, cement and labor. Now China is making a big shift in its investments to the high-tech sector. These investments are certain to raise imports significantly because China relies on Japan and other countries for machinery, materials, components and other goods. China’s trade surplus has already continued to decrease more than 20% per annum over the past few years. After a few more years, the trade surplus may be far lower and there may even be a current account deficit. In fact, China reported a current account deficit of $28.3 billion in the first half of 2018, but this is considered to be one-time events.

If this happens, there will be increasing pressure for investors to start pulling out the enormous volume of foreign investments that have been made in China. Rapid growth of the Chinese economy would not have been possible without these foreigners investments. As a result, China has a remarkably weak external balance sheet. As you can see in Figure 15, net external assets are only 56% of foreign exchange reserves. This signifies that external debt which must be repaid provide the funds for about half of China’s huge foreign exchange reserves. In addition, there are increasing concerns about the ability of China to recover vast amount of loans that it recklessly extended to other countries. Worries include Venezuela as well as countries like Pakistan that received loans in association with the One Belt, One Road initiative.

The return of US imperialism

The points I have made in this report lead to the conclusion that there is a high risk of the return of currency instability in China that at some point causes the yuan to plummet. If the yuan collapses, China’s asset bubble would burst and an economic and financial crisis would probably start. This could happen three to five years from now. Until a crisis begins, the United States is likely to stick to its policy of refusing to allow China to devalue the yuan. There could even be a crisis involving the Chinese government due to the failure of its policies. This is why prospects for success are excellent for actions by the Trump administration to contain China. This success will probably be the beginning of a new age of imperialism for the United States as the world’s only superpower.