Oct 02, 2018

Strategy Bulletin Vol.209

The Japan/US mega-economies and stock price boom are realities

The opposition party victory in the Okinawa governor’s race will weaken the yen and push up stock

(1) The remarkable strength of Japanese and US stocks means that no one can ignore the fact that these economies are healthy

US stocks are consistently rising to new highs and Japanese stocks are the highest in 27 years

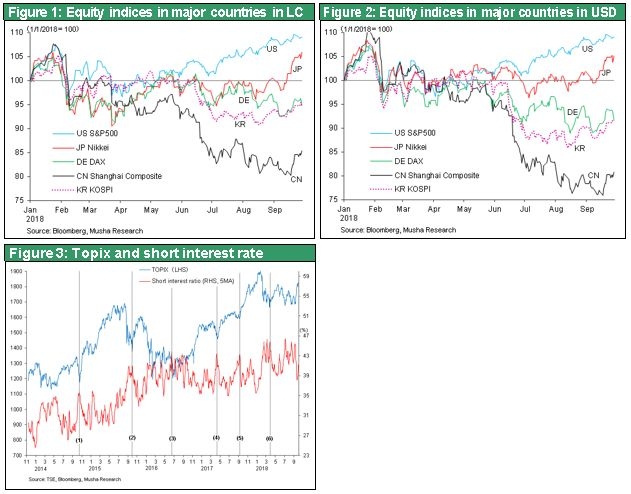

Stock markets in Japan and the United States have been staging a prolonged rally. In the United States, stock prices are up more than 40% since President Trump’s election victory in November 2016. Stock prices fell 12% in February during the VIX crash but came back to the pre-crash level by August and reached a new high. No other stock market in the world has performed better. In Japan, the rally started later than in the United States. But the Nikkei Average has been surging after surpassing the key ¥23,000 level. At the end of September, the average climbed to ¥24,286 during intraday trading, the highest point in 27 years. The strong stock performance in the US and Japan clearly contrasts with those of China, emerging countries that are on a downward trend, and the Europe that are disturbed by Italian political unrest.

Supply-demand dynamics and negative sentiment have been overshadowing sound fundamentals

Sound fundamentals are by far the most important reason for the US and Japanese stock market rallies. As I will explain later, investors have been ignoring the extremely strong economic fundamentals of Japan and the United States for a long time. Investors were paying too much attention to negative factors regarding supply and demand and market sentiment. For years, this thinking stood in the way of risk-taking. In Japan, the short interest ratio on the Tokyo Stock Exchange reached an all-time high in August. Short-term foreign speculators have been consistently selling Japanese stocks since February. These investors were probably motivated by visions of a global economic downturn caused by slowing US economic growth as interest rates rise, the US-China trade war, a major emerging country crisis, and other events.

In the United States, bond funds have accounted for almost all of the new money placed in mutual funds during the past few years. Investors made almost no additions to their equity mutual funds, perhaps because of a sense that stock prices were too high. But these negative expectations were discredited when the February VIX shock had no impact at all on the US economy.

The time has come for pessimism to go away

At the end of September, the Dow-Jones Industrial Average was at a record high and the Nikkei Average was at its highest point in 27 years. This was accomplished in an environment of negative market sentiment and supply-demand balance. Reaching these high levels demonstrates that investors have finally reached the point where they can no longer overlook the strength of economic fundamentals.

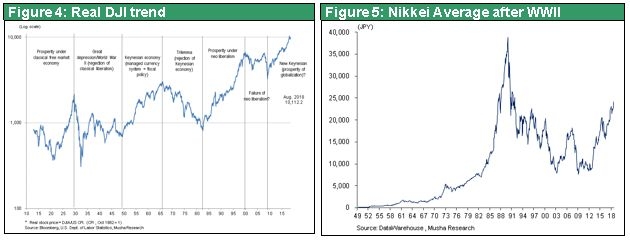

US stock prices have started baking in a new era of prosperity

As described later, the soundness of fundamentals is at an unprecedented level and scrutiny is necessary. Leading such a fundamental conditions, stock prices seem to have started indicating a powerful long-term trend. As you can see in Figure 3, US stocks have very likely started a new prolonged period of strength. This figure shows the real DJIA, a figure that I have been following for 30 years. Since the global financial crisis in 2009, the real DJIA has obviously started a new upward phase. In the past, the real DJIA has accurately represented the rise and fall of the US economic regime.

- The stock market rally up to 1929 was due to prosperity under a system of classical liberalism during the gold standard.

- During the 1930s and 1940s, stock prices moved down because the Great Depression and World War II rejected classical liberalism.

- During the 1950s and 1960s, there was prosperity based on Keynesian economics in an environment of managed currencies and the Bretton Woods system.

- During the 1970s, Keynesian economics were rejected due to rapid increases in inflation, the twin deficits (budget and current account deficits) and unemployment, the so-called “trilemma.”

- During the 1980s and 1990s, there was prosperity that began with Reagan administration deregulation and the emergence of a neo-liberal economic model.

- Between 2000 and 2009, the bursting of the IT bubble and subsequent global financial crisis rejected the neo-liberal economic model. And there was concern as to whether the confusion after this rejected neo-liberal economic model will last long.

- Since 2010, a new upturn has clearly started. But we do not yet know how we should define the economic model and characteristics of this period of strength. But there is no doubt that this is a period of innovation when US internet platformers, backed by remarkable technological advances and the new industrial revolution, are earning profits by establishing networks on a global scale. In the past, long-term stock upturns have continued for up to 20 years. As a result, we may still be only in the first half of the current period of stock rally.

Japan’s long-term upturn has been ongoing since 2012

Stocks in Japan have been staging a historic rally along with US markets. At the end of September, stocks rose to the highest level since the bursting of Japan’s asset bubble 27 years ago. Since the start of Abenomics about five years ago, this extended rally has boosted stock prices by about 150%, which equates to roughly 20% every year. And the long term rise is still continuing. Furthermore, this rally has taken place amid widespread pessimism that has now reached the point of being ridiculous. Rising stock prices are proof that investors are no longer able to ignore Japan’s prosperity under the new regime of the Japanese economy. Musha Research believes this new regime is a framework for creating value by using two elements: (1) specializing in outstanding technologies and quality in order to avoid price-based competition and (2) establishing an international division of labor within companies (see Strategy Bulletin No. 208 and other bulletins for more information about this subject). If stocks in Japan continue to climb at an annual pace of 20%, the Nikkei Average will be in the ¥27,000-¥28,000 range by the end of 2018, the ¥32,000-¥33,000 range by the end of 2019, and ¥38,000 to ¥40,000 by the end of 2020, which would be an all-time high.

(2) No end in sight for the historic economic boom in the United States

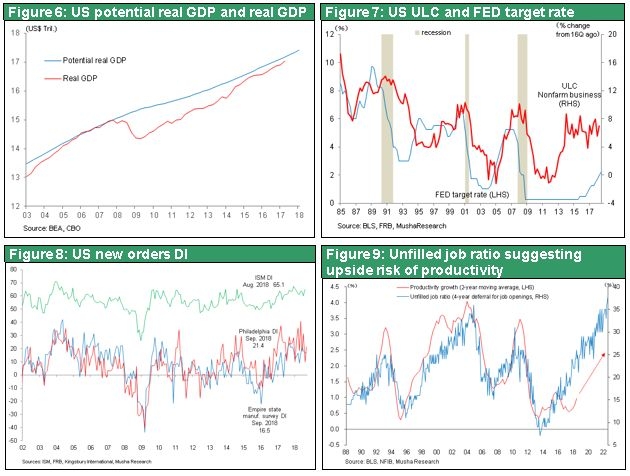

The unprecedented economic boom and rejection of the “new normal” and “secular stagnation” views

Signs that the US economy is the world’s only winner are becoming stronger and stronger. The United States alone among developed countries is now within reach of an annual economic growth rate of 3% to 4%. Moreover, with an unemployment rate under 4%, the United States is basically at full employment. In addition, with prices finally starting to move up, the Fed’s 2% inflation rate goal has almost been achieved. Inflation has not started to increase in Japan and Europe even though interest rates are still virtually zero. With long-term interest rates staying low, interest margins for banks are very small. The result is a liquidity trap because the credit creation process has come to a stop. Only in the United States is there an adequate gap between long and short-term interest rates as long-term rates climb. This environment has greatly improved the earnings of financial institutions as banks extend more loans. After the global financial crisis, some economists thought the world had entered a phase low growth that was the “new normal” (a view led by Mohamed El-Erian). Others regarded the post-crisis economy as “secular stagnation” (a view led by Lawrence Summers) or “the end of American prosperity” (a view led by Robert Gordon). But the current situation has rejected all three positions.

The truth about an excessively favorable environment created by the new industrial revolution

No end is in sight for the current health of the economy. Prices and interest rates are under control despite the economy’s strength. As a result, there is no danger of monetary tightening or the bursting of a bubble bringing stopping economic growth. In June 2019, the United States will almost certainly set a new record of 10 years for an unbroken period of economic growth after the war. Advances in semiconductor and communications technologies are the fundamental reason for this excessively favorable environment. Technology in these fields has advanced by 2.5 times over two years, 10 times over five years and 100 times over 10 years. This progress has fueled unprecedented increases in the productivity of both labor and capital that has produced enormous wealth for companies. Companies have earned more money than they can use, and these excess funds have exerted downward pressure on interest rates. Furthermore, rising productivity has created steady downward pressure on prices by enabling companies to supply more goods and services.

President Trump’s on-target economic policies are another positive factor

However, severe deflation may begin if nothing is done about the surplus of capital and the surplus capacity to supply goods and services. This is why there is a critical need for policies aimed at converting surplus capital into effective demand. The Trump administration’s aggressive spending measures and the Fed’s market-friendly monetary policy are right on target to meet this need. The recently enacted US tax reform package, the first in 30 years, will cut taxes by $1,074 billion over the next five years and ¥1,456 billion over the next decade. This is the largest-ever tax reduction. Provisions to support corporate activity are a highlight of these tax cuts. Most significantly, the corporate income tax rate was lowered from 35% to 21% and capital goods acquired during the next five years can be depreciated entirely in the first year. Many people are critical of these tax cuts, which they view as reckless and a certain to increase the budget deficit and the income gap. But this tax reform will produce major benefits for the economy for the time being.

Still no indications of a recession on the horizon

Deregulation involving financial services, energy, the environment and other areas has dramatically increased the entrepreneurial spirit in the United States. The Obama administration hated collusion between politics and companies. Significantly tighter regulations under the Obama administration created a negative outlook and mindset in the corporate sector. The US business start-up rate plunged as animal spirits evaporated. But a dramatic shift has occurred under the Trump administration. Following his election, the economic optimism index among corporate executives rose sharply. Today, this index stands at a record high, an indisputable sign of the benefits of the Trump administration’s economic policies. President Trump is also enacting powerful reflationary measures. Eventually, these initiatives will fill the supply and demand gap in the future and produce upward pressure on prices and interest rates that will change the direction of the economy. But the likelihood of this happening is still not visible at all on the horizon.

The impact of the US-China trade war will be limited with no significant reduction in overall US demand

There are concerns about the effects of the US-China trade war. However, China, which has been the sole beneficiary of the current structure of trade, will probably be forced to give in to the United States regarding all aspects of this dispute. Furthermore, the trade war will probably have only a small impact on the US economy. The tariff hike raises prices of goods imported from China. But there are four possible outcomes. First is passing on the cost of higher tariffs by raising the US retail prices of Chinese goods. Second is importing these goods from another country to replace expensive Chinese merchandise. Third is a reduction in FOB prices by China. And fourth is a decline in total US demand.

Although a potential drop in total demand is the main source of concern, any downturn caused by higher prices of imports from China will not be serious because of the strength of the US economy. In addition, upward pressure on prices in the United States is under control. As a result, more costly Chinese merchandise will not have a significant effect in the form of a chain-reaction of rising prices for consumer goods. Incidentally, annual US imports from China are about $250 billion. An additional 10% tariff would be only $25 billion, which is a mere 0.18% of US annual consumer spending of $14 trillion. Even if the highest likely tariff of 25% is implemented, the increase in the cost of these imports would be $62.5 billion. If this entire cost is passed on to US consumer in the form of price increases, it would still be only 0.4% of $14 trillion.

President Trump has finished dealing with most problems and the midterm election results do not pose a big risk regardless of the result

There is probably no need to be seriously concerned about the impact of the US midterm election on US stocks. As reported in the Wall Street Journal on September 24, 52% of the public support the Democratic Party and 40% support the Republican Party. Nevertheless, the Democrats are unlikely to gain control of both houses of Congress. In the Senate, there are elections for eight Republican seats and 26 Democratic seats, so the Republicans will probably stay in control. A survey indicates that 69% of voters are satisfied with the economy, which is the most important factor for voting decisions. This will help the Republican Party. The most probably outcome is a Republican Senate and Democratic House of Representatives. If this happens, there will be no impeachment of President Trump. A divided Congress would make it more difficult for the Trump administration to enact its policies. But most policy objectives have already been accomplished, so any negative effects will probably be minimal. Consequently, this election outcome will probably not have a significant negative impact on the US economy or stock markets.

(3) Japan’s unprecedented earnings, labor supply-demand balance and low cost of capital

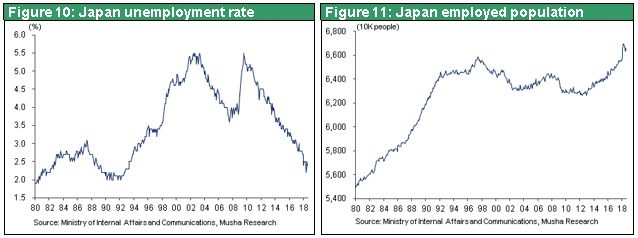

With almost no more potential additions to the labor market, Japan will probably see much bigger wage hikes in 2019

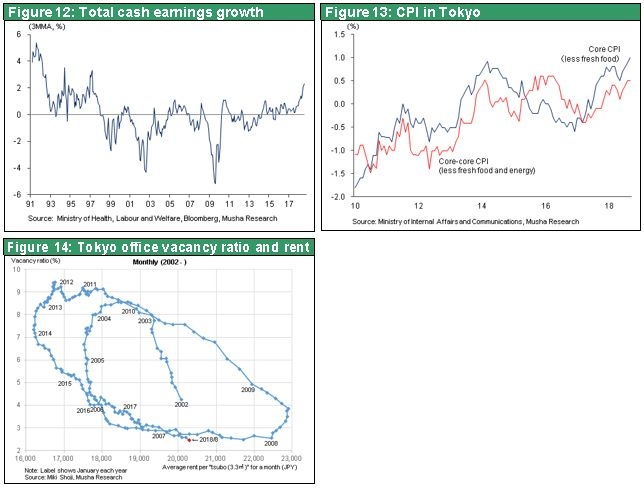

Economic fundamentals are sound in Japan just as in the United States. Japan is in the midst of the longest period of economic growth in the postwar period and its unemployment is 2.4%. This is a record low for Japan as well as the lowest level in the world. The result is an extremely tight supply of workers. Wages are starting to climb significantly for construction workers, truck drivers, part-time workers on hourly wages and other categories of workers. According to a Keidanren survey of 146 large companies, bonuses in the summer of 2018 increased 8.6% (6.1% for the 117 manufacturers in this survey), the highest growth rate since 1959, when this survey has established.

Many factors such as higher real estate, food and energy prices and a weaker yen will push up prices even more

Although the labor market is tight, there is still no significant increase in wages in Japan. The cause is the growth in the number of people with jobs resulting from the increasing labor participation rate. Furthermore, the steady retirement of older workers with high salaries will continue to bring down average hourly wages. In August 2018, the number of full-time employees in Japan was an enormous 950,000 more than one year earlier. However, the cumulative increase in the number of workers since the beginning of 2018 is 1.09 million. Due to this higher growth, Japan was able to avoid a shortage of workers. In addition, the pool of potential additional workers has not dried up, so upward pressure on wages will probably be kept under control.

Nevertheless, it is only a matter of time until the pool of potential additions to the workforce does drop to nothing. When this happens, there is certain to be a sharp increase in wages. This is likely to start to occur in 2019. Rising real estate prices and rent hikes are already fueling inflation. Furthermore, prices of fruit and vegetables are increasing because of a series of typhoons and other weather-related problems. Furthermore, the higher cost of crude oil will soon start affecting prices of fuel at the pump. Increasing prices of imported goods due to the weaker yen will probably also contribute to inflation. As a result, we can expect to see a substantial increase in prices in Japan starting in 2019.

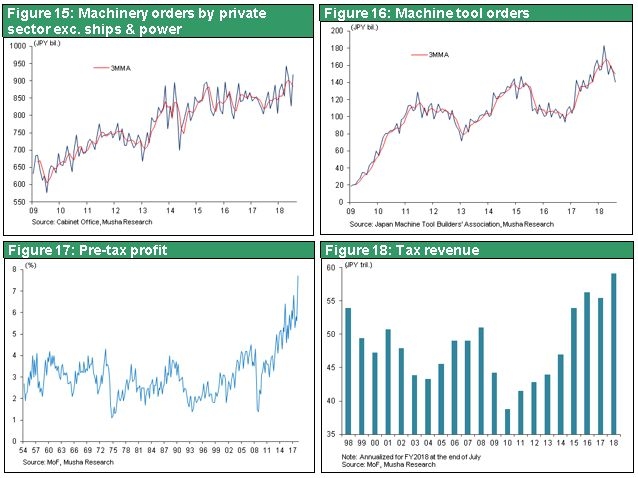

Capital expenditures are particularly strong

Higher capital expenditures are the biggest contributor to Japan’s economic growth. In the second quarter of 2018, real GDP grew sharply at an annual rate of 3.0% and particularly, capital expenditures were up 12.8% at annualized. Companies are making massive expenditures in response to the labor shortage and to utilize information technology. Orders for machinery associated with external demand have stopped increasing because of the US-China trade war. But this has been more than offset by strong demand for machinery within Japan.

Abenomics has been a huge success

A dramatic improvement in the profitability of Japanese companies backed by the establishment of a new business model has been instrumental to Japan’s economic growth. Another important point is the big increase in revenue from corporate income taxes resulting from higher earnings. The Japanese economy is also likely to benefit from upcoming events like the coronation of a new emperor in 2019 and the Tokyo Olympics in 2020. People are worried about the impact of the consumption tax hike in the fall of 2019. However, this time the increasing momentum of economic growth will probably enable Japan to avoid the economic slowdown that occurred after the 2014 consumption tax hike.

The Japanese economy is currently in the midst of a powerful and prolonged period of expansion. This performance is beginning to show to everyone that Abenomics has been a success and the country has finally stopped deflation.

(4) Geopolitical implications of the opposition-party victory in the Okinawa governor election

A governor opposed to the US base relocation to Henoko will weaken the yen and push up stock prices

The election of the opposition-party candidate as the new governor of Okinawa probably makes US officials recall the nightmares during the Hatoyama administration. This creates the possibility of a government in Japan led by this opposition party, which would be more dovish regarding China. A shift in the stance of Japan, the biggest friend of the United States in Asia, would destroy the US global strategy. Asia would fall under the influence of China as a result. To enable the current ruling party, which is committed to the US alliance, to remain in power, the people of Japan would have to be told about the benefits of a free capitalist economy and the US alliance. These are the thoughts that are probably going through the minds of US officials.

Unless US leaders are ignorant, they should be aware of the need to avoid repeating the economic trauma that occurred in Japan in the 1980s and 1990s due to trade friction and increasing pressure to make the yen stronger. This is the thinking that should be at the heart of US policies concerning Japan. The outcome of this Okinawa election has most likely made US officials aware of this point. Even though the United States views Japan as a friend, Japan could easily move away from the United States depending on the direction of its economy and any shift in US policies concerning Japan. Today, as a showdown between the United States and China unfolds, the United States needs the US-Japan alliance even more than Japan does.

The United States has no option other than to treat Japan even better

President Trump has been critical of the level of defense expenditures by other members of NATO. There are also concerns about criticism of Japan, which is the most lightly armed major country in the world with defense spending that is 1% of GDP. But it is obvious that the benefit of the unrestricted use of military bases in Okinawa, the front line for activities involving China, is far more important than the defense spending issue. China is currently making friendly overtures to Japan. At a time like this, the United States must show Japan that it is an even better friend. The implication is the depreciation of the yen and US-Japan cooperation in trade talks. Due to this situation, the only option is to make the strong bond between Prime Minister Abe and President Trump even stronger.