Oct 15, 2018

Strategy Bulletin Vol.210

Merely a technical downturn that has created a springboard for higher prices

- Uncertainty created by VP Pence’s US-China cold war declaration will disappear within a few weeks

Technical factors triggered the recent stock market drop; rising US interest rates and Fed monetary policy are not significant risks

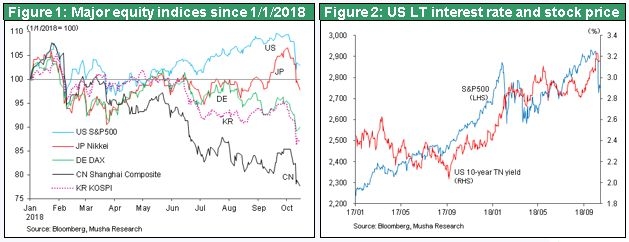

Q) Stock prices worldwide started falling rapidly on October 4. In the United States, the S&P 500 plunged 8% in one week. In Japan, the Nikkei Average dropped 9% and TOPIX was down 8% from the October 2 peak, which was the highest level in 27 years. Many people point to similarities between the past week and what happened earlier this year in February.

Musha) I think the two stock market downturns are almost identical. The reason is that fundamentals had nothing at all to do with either downturn. In both cases, technical factors were what pushed prices down sharply. But there is one difference. Unlike in February, this time prices fell as the US-China friction is increasing to the point where a simple trade war has clearly become a cold war. As I will explain later, stock prices started falling on October 4, the day that US Vice President Mike Pence effectively declared that a US-China cold war has started. I think this is causing uncertainty to increase.

Q) Some people believe the February downturn was triggered by rising long-term interest rates following the announcement of employment statistics. US interest rates are moving up now just as in February. What is your view of the link between interest rates and stock prices?

Musha) We need to look at the effects of interest rates from two perspectives. First, higher interest rates prompt investors to alter their portfolios. But there is no need to worry about this because portfolio repositioning ends quickly. A change in the interest rate assumptions of hedge funds will probably produce in a major shift in their portfolios. The result could be a chain reaction of stock sales. In February and October, the increase in long-term interest rates surpassed the consensus outlook. I think that portfolio rebalancing in response to interest rates was what caused a chain reaction of selling. On the other hand, just as in February, I think the main villain behind this selling was CTA, risk-parity and other algorithm trading.

The second effect is what we need to worry about. Higher interest rates negatively impact the economy and may even slow down economic growth. Issues involving hedge fund positions alone will not lead to a prolonged bear market. The critical point is determining if higher interest rates could stop economic growth in the United States. Right now, this is very unlikely to happen. Consequently, we can conclude that the recent drop in stock prices was nothing more than a technical correction rather than a major shift in the direction of stock markets.

Q) President Trump believes the Fed’s interest rate hike is what sparked the stock market downturn. The president’s economic policies have probably played a big role in the strength of US stocks until now. So was President Trump’s remark about the interest rate hike simply an election-season statement by a president who places importance on stock prices?

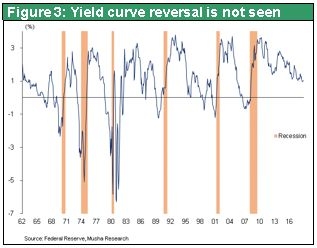

Musha) I don’t know what President Trump’s true intent is. But there is no doubt that we should adopt a negative view of the president’s statement as meddling with the Fed’s policies. This was probably not just a careless remark. The president is worried because excessive monetary tightening (higher interest rates and a reduction in assets) would make sustained economic growth difficult. Musha Research believes this is a legitimate concern. A technology revolution is under way that is boosting productivity and enabling companies to supply more goods and services. The result is a constant surplus of labor, capital and supply. In this environment, the primary risk is that restrictive macroeconomic policies suppress total demand and create deflation. Therefore, stepping up monetary tightening is more risky than monetary easing.

Fed Chairman Jerome Powell has repeatedly made statements demonstrating that the Fed’s stance is consistent with this view. Rather than following economic theories, the Fed will determine its policies while responding swiftly to changes in actual economic conditions and data. The current relationship between the real economy and interest rates differs greatly from what it was in the past. This is why most people agree that using ideas that were accepted as common sense in the past will not result in suitable policies today. The assumption for the natural (neutral) interest rate is now much lower. The US government and the Fed are both firmly committed to doing whatever is needed to avoid a recession caused by excessive monetary tightening that causes a yield curve reversal. Investors have no need to be overly worried about risk involving monetary policies.

Investors will realize that a US-China cold war will have only a limited impact on the economy and financial markets

Q) Investors’ fears about trade friction are one more reason for the October drop in stock prices.

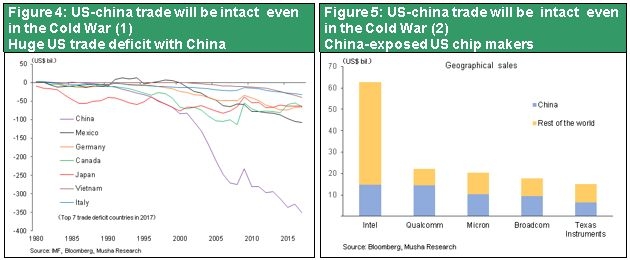

Musha) Trade friction has certain aspects that may cause problems. On October 4, Vice President Pence gave a speech at the Hudson Institute that was very critical of China. Criticism of China was not limited to trade and the economy as in the past. The vice president talked about China’s unfairness regarding politics, the military, information and technology. A Wall Street Journal op-ed by Walter Russell Mead said that the vice president had announced the start of Cold War II. We can regard the vice president’s remarks as a US policy switch to a stance of containing China in every way possible. This is also the view of Musha Research. Mr. Mead wrote that the United States and China have finally entered a phase of serious confrontation. He believes that economists and investors do not realize the gravity of this shift in the Trump administration’s stance. People are underestimating the impact of the start of an age in which national security has priority over the economy. I believe Mr. Mead’s views are right on target.

Q) So this will be a matter of national security instead of just a trade war?

Musha) China is aiming to replace the United States as the world’s superpower. Once China’s ambitious had reached this point, the United States obviously could not allow this to happen. For many years, Musha Research has been saying that it would be only a matter of time until the United States started implementing policies that view China as the enemy. Now that time has finally come. Now US-China relations have gone beyond trade and the economy to encompass national security. If there are problems, US initiatives could even have a negative impact on the economy in the near future. This is what is making financial markets nervous. Perhaps hedge funds utilized this nervousness for manipulative sales to briefly push down stock prices and earn profits.

I expect that the fog created by this problem will dissipate within the next few weeks or months. No one knows what the result of the US switch to treating China as an enemy will be, so this will create instability. Nevertheless, for the time being, I don’t think this US stance will destroy the economy or US-China business relations. Once investors realize this, confidence will probably return to financial markets. As I have explained before, the United States cannot completely cut off China because of China’s position at the center of the global supply chain. China as well cannot shut out the United States. This would be suicide because China relies on the United States even more. The yuan has depreciated about 10% since the start of 2018. China’s weaker currency therefore offsets the 10% US hike on tariffs on imports from China. From a long-term standpoint, we will probably see a big decline in China’s position in the global supply chain. However, in the near future, I think the US-China cold war will have only a small effect on the Chinese economy.

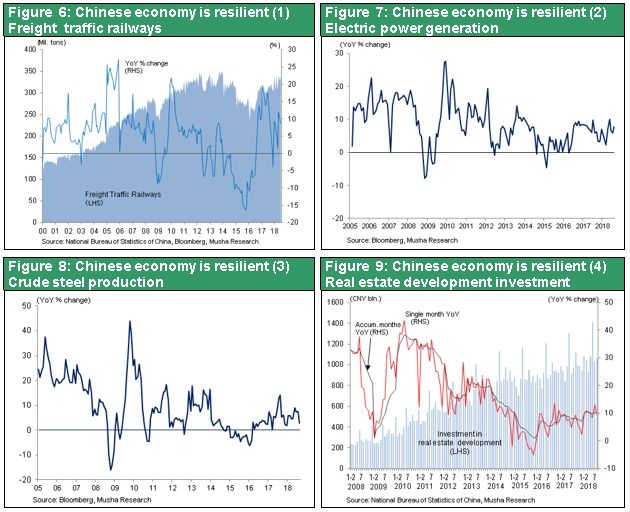

Determining an outlook for how this cold war will alter total demand in China and the United States is the most important point. I think there will be no change in US demand. But the cold war may affect China somewhat. The United States is bashing China and rejecting the country’s role as the world’s factory. Signs are emerging of a big slowdown in investments in China as companies are no longer able to make new investments. China’s machine tool orders to Japanese manufactures are decreasing and there are other signs of a downturn. Furthermore, China is imposing tight restrictions on foreign currency. For example, there may be a limit on how much foreign currency Chinese travelers can take out of the country. Also, the Chinese government could intervene to have a negative effect on sales of foreign products, especially US merchandise. Taking these actions would slightly reduce China’s total demand. At the same time, though, China is taking actions to prevent an economic slowdown. For instance, the reserve ratio on deposits has been cut several times and there are large public-sector spending programs. A severe economic decline in the midst of a trade war would dramatically erode the public’s confidence in the government. As a result, China will probably do whatever is necessary to prevent a decline in the economic growth rate. At some point, people will come to realize that the trade war will not severely impact the Chinese economy. Worries will decline and, after about one or two months, I think the economic outlook will become very clear.

Q) Prices of stocks of US and European companies with well-known brands have moved down during the past week or so. The reason is the expectation for China to tighten restrictions on imports of foreign merchandise from these companies. This appears to be a step to prevent the outflow of capital. Does that mean everything is all right in China as long as the government can control the economy?

Musha) China is still capable of greatly increasing government spending. One example is infrastructure investments, which may become a problem in the future. But this ability to stimulate the economy through spending will probably underpin the Chinese economy for the time being. Even real estate investments, which are often viewed as excessive, are continuing to grow at a rate of about 10%. Falling US stock prices and worries about the future will probably not last long. I think stock markets will quickly start to rebound.

The February and October technical corrections will extend this period of economic expansion

Q) US stocks have been gaining momentum recently, so this correction may have just let some air out of the market.

Musha) Investors must keep two points in mind from a long-term perspective. First is the need to quickly close out their positions when signs of an economic slowdown and recession appear. Second is the emergence of a bubble. A bubble could form if investors become too optimistic. The end of this bubble could trigger a recession as financial markets start moving in the opposite direction. Today’s sound fundamentals make a slowdown in economic growth very unlikely. Furthermore, as we saw in February and October, investors are very wary of a bubble. Stock prices move up a little but then pull back sharply.

Markets themselves are preventing the formation of a bubble. This preventive role of financial markets may be one reason to expect economic growth to continue. Investors are worried about higher long-term interest rates and an acceleration of inflation. But lower stock prices will bring down these interest rates. Also, lower stock prices can prevent the economy from overheating, such as by cooling down consumer confidence. This is why I don’t think investors need to be worried about the recent stock market correction.

Overseas investors are about to take another look at Japan

Q) What is your opinion about the stance of overseas investors regarding Japanese stocks?

Musha) I still think these investors do not see the hidden strengths of Japanese stocks. Investors in other countries have not changed their belief that Japan is an inferior member of the global economy. However, Japan ranks among the world’s soundest economies according to analysis by Musha Research. Japan should receive the highest marks in the world with respect to the business models and earning power of its companies.

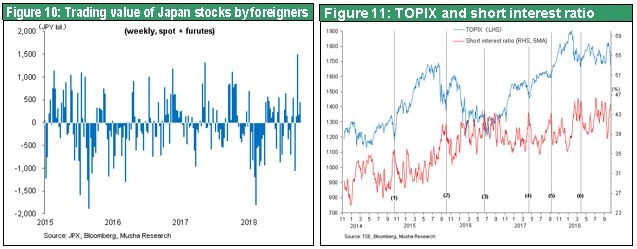

Overseas investors account for 60% to 70% of the trading volume on the Tokyo Stock Exchange. The majority are hedge funds and other short-term investors. Long-term investors are, at best, neutral about their weighting of Japanese stocks. Foreign investors have been net sellers of Japanese stocks in 2018. The recent drop in stock prices has probably created an opportunity for overseas pension funds and other long-term investors to put more money into Japanese stocks.

A different view is also possible. Direct investments in Japan from other countries are much lower than in other countries. Many people have a distorted perception of Japan as a country with high barriers to investments. Japanese companies have made ¥175 trillion of direct investments in other countries in comparison to direct investments in Japan by foreign companies of only ¥29 trillion. This huge gap is regarded as proof of this misperception. We cannot deny the difficulty of making M&A and similar investments due to the closed nature of Japanese companies. However, foreigners have bought a massive amount of Japanese stocks. Foreigners owned about 5% of publicly traded Japanese stocks in 1990, 18% in 2000 and currently about 30%. Japanese investors hold ¥86 trillion of foreign stocks while foreigners hold ¥217 trillion of Japanese stocks. This is precisely the reverse of the direct investment imbalance.

These numbers demonstrate that foreigners are investing in Japan by buying the stocks of companies rather than operating businesses themselves. Another way to express this is that foreigners are involved with businesses in Japan by purchasing Japan’s management and operating skills. I think we can also interpret these investments as proof that foreigners are impressed with the business models of Japanese companies.

The Japanese public is still largely unaware of the excellent reputation that Japanese companies have among foreign investors. Once this becomes better known, individuals in Japan may increase their stock holdings. This would add to the depth of Japan’s stock markets. With a cold war now under way between the United States and China, Japan’s geopolitical stature in the world has become much more powerful. Japan is in a position that holds the key to who will win this cold war. Having an advantageous geopolitical position is certain to be beneficial with respect to Japan’s economy and its financial markets.