Dec 13, 2018

Strategy Bulletin Vol.215

Seven Questions about the US-China Trade War and Stock Prices

No change in the long-term upward direction of stock prices and no need to worry about a US recession in 2019

Question 1) Dark clouds are still hanging over the stock market. Even though we are almost at the end of 2018, stock prices have not yet reached the bottom this downturn. Is there any change in the stance of Musha Research that this is not the end of the prolonged bull market?

Answer 1) Our position is the same as before. Risk-takers have suffered significant losses because of the recent unexpected drop in stock prices and extreme volatility. This is why I think stock prices could recover only at a slow pace. However, stocks that were sold for technical reasons will be bought back for the same reasons. From this standpoint, there is also a possibility of a very rapid recovery in stock prices. Some people think the multi-year bull market has finally come to an end because of the double-top in 2018 with peaks in February and October. But this is not a true double-top pattern. First, the September peak was above the January peak. Second, the October low was not below the February low. As a result, I think prospects are good for the stock market to regain its strength early in 2019.

Fundamentals hold the key to the outlook. Is this really the end of the extended stock market upturn and longest postwar period of economic expansion? There are only two elements of a magnitude sufficient to quash this stock market and economic vitality. One is the US-China trade war. The other is higher interest rates linked to US monetary tightening. After examining these two elements, Musha Research has concluded that it is still too early to adopt a pessimistic view of the economy.

US-China negotiations will not end soon – China must give in and stop its unfair business practices

Question 2) Following talks with President Xi Jinping in Buenos Aires, President Trump agreed to put off for 90 days a tariff increase to 25% on Chinese imports worth $200 billion. Does this signal an improvement in the trade war?

Answer 2) The situation is improving. The US condition for this postponement is conclusions within 90 days regarding five issues: (1) Mandatory technology transfers by US companies; (2) Protection of intellectual property; (3) Non-tariff barriers; (4) Cyberattacks; and (5) Opening China’s service and agriculture markets. If there is no agreement by the deadline, the United States will raise tariffs to 25% on $200 billion of Chinese goods as originally planned. A closer look reveals that all five of these issues involve unfair behavior or WTO violations. If these allegations are true, China must accept the US demands. China may profess to know nothing about these problems and say they are false accusations. If China adopts this position, the country will have to be prepared for severe punishment if evidence of unfair behavior is subsequently exposed. For these reasons, I think China, which has been pretending to be fair, is very likely to accept almost all US demands in order to avoid an additional tariff hike..

No possibility of a breakdown in US-China relations – The United States can only selectively suppress China’s high-tech sector

Question 3) US-China friction has reached a very high level. For instance, the CFO of Huawei Technologies, China’s largest high-tech firm, was arrested in Canada for extradition to the United States. Should we worry about this tension?

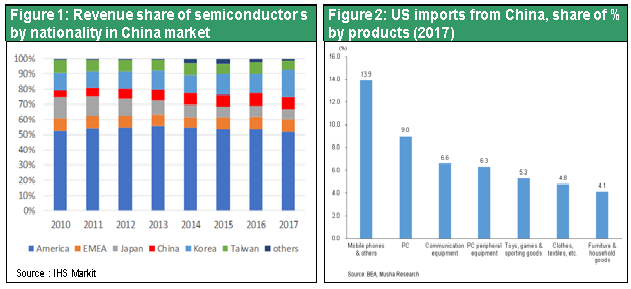

Answer 3) Answer 3) No need to worry excessively. Chinese companies account for only 8% of total expenditures for semiconductors in China. US companies have more than 50% of this market. Stopping the supply of US semiconductors would be instant death for China’s high-tech industries. This is why China must accept US demands. On the other hand, China accounts for more than half of the sales of US semiconductor manufacturers. Furthermore, the United States relies on imports from China for the majority of its smartphones, PCs, TVs and other high-tech products. This reliance means the United States cannot allow relations with China to break down. In other words, the United States can attempt to contain China’s high-tech sector only in a selective manner and China has no option other than to accede.

Use of the 2019 National Defense Authorization Act for holding down China’s semiconductor ambitions

There is an urgent need in China to boost semiconductor production. But the country has made little progress. Four plants of foreign companies are operating or will be completed soon. Intel’s Dalian plant, Samsung’s Xi’an Plant and SK Hynix’s Wuxi Plant are operating, and TSMC plans to start operations at its Nanjing Plant this year. In addition, three Chinese companies are constructing plants, but there are still no firm dates for their completion:

1) Chang Xin Memory Technologies (CXMT) (Hefei, DRAMs)

2) Fujian Jinhua Integrated Circuit (JHICC) (Quanzhou, DRAMs)

3) Yangtze Memory Technology (YMTC) (Wuhan, 3D NAND flash memories)

JHICC is currently prohibited from importing equipment from US and Japanese companies due to litigation concerning the alleged illegal use of Micron Technology technologies. This has stopped progress concerning its new plant (as of November 2018). Investments at the other two plants are also possibly to be pushed back because of the likelihood of the expansion of export restrictions on equipment and materials. The United States will probably step up actions to block China’s plan to make semiconductors. Measures will include restrictions on exporting semiconductor manufacturing equipment to China and prohibiting technology transfers to Chinese joint ventures. The United States is expected to ask Japan and European countries to impose the same restrictions, and the Japanese government and companies will probably agree.

China’s economy will not lose momentum even if investments decline

Question 4) Will a decrease in investments in China caused by the trade war have a negative impact on its economy?

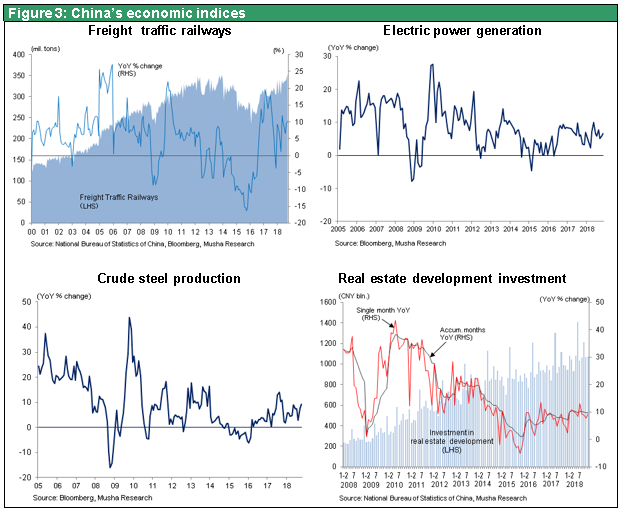

Answer 4) The US-China trade war is definitely having a negative impact on investment activity in China. Orders from China are declining at Japanese manufacturers of semiconductor manufacturing equipment and machine tools. However, China is starting to use fiscal and monetary measures to prop up the economy. China must offset the detrimental effects of the trade war for political reasons. So far Chinese micro data such as railways freight traffic or electricity production are growing steadily unlike during the 2015 China-shock period. According to IMF estimates, tariffs will have only a limited impact. Also, China is doing everything possible to stimulate the economy. This is why I believe the US-China trade war is very unlikely to reduce total demand in the two countries significantly and trigger a global recession. Even if there is no Chinese compromise within 90 days, the United States will probably very carefully examine any negative effects on the US economy before going ahead with a decision to boost the tariff. Consequently, I think many uncertainties have been eliminated.

Stop worrying about US monetary policy and higher interest rates

Question 5) Should we be concerned about US monetary policy and higher interest rates?

Answer 5) This is not a significant reason for concern. The US cycle of interest rate hikes is in the final stage. In his speech made early December, Fed Chairman Jerome Powell said that short-term interest rates are near the neutral level. Monetary tightening may end after two or three more interest rate increases. The reason is that inflation is not speeding up. Wages are continuing to climb at an annual rate of almost 3%. But there is little pressure on companies to raise prices because productivity is climbing, too. This explains why the United States has been unable to reach its 2% inflation target. The US economy is healthy and at full employment with an unemployment rate below 4%. Inflation should increase in this environment, but does not. Simultaneously enjoying a strong economy, low inflation and low interest rates is too good to be true and even difficult to believe. Nevertheless, Mr. Powell’s remarks indicate that this situation will probably remain intact for the time being. As a result, financial markets have started to factor in the end of monetary tightening in the near future.

Long-term interest rates have been moving up because of monetary tightening and rising short-term rates. But now that people are beginning to expend short-term interest rate hikes to end, the US long-term rate has retreated from 3.2% to 2.8% at the end of last week. There is no doubt that the upward trend for long-term interest rates has come to a halt as overheating concerns are now subdued.

Historically, monetary tightening has always been the reason for the end of a period of economic growth in the United States. Naturally, people are worried that this will happen again. But the recent actions by the Fed do not qualify as full-scale tightening. Long-term interest rates have moved up to only about 3%. This is only half of the US nominal economic growth rate of 6%. As a result, interest rates are well below the point where they could slow down economic expansion. In addition, interest rates would have to be much higher to trigger a negative credit cycle.

Japan’s position in the world is becoming more and more advantageous

Question 6) How are these global events affecting Japan’s position among other countries?

Answer 6) I think the current global environment will clearly position Japan as a country that becomes stronger as other countries struggle with disagreements and conflicts. When there was US-Japan trade friction, Korea, Taiwan and China all benefited as Japan struggled with this problem. Now it’s Japan’s turn to profit from friction between other countries. Specifically, I believe Japan will enjoy the following four benefits.

1) Automobiles = In sharp contrast to the challenges faced by US automakers, the Japanese automobile industry is increasing its investments in China. Furthermore, Japanese automobiles are capturing an increasing share of the Chinese market as the share of US automakers stays flat. Toyota plans to increase its market share in China by providing its plug-in hybrid vehicle technology.

2) Consumer goods = The popularity of made-in-Japan products continues to grow in China. Now that criticism of Japan by China has quieted down, the desire among consumers for high-quality, sophisticated products from Japan, which has always been in the minds of consumers, has become even stronger. In fact, some Chinese consumer product companies have started manufacturing products in Japan so that they can put a “made in Japan” sticker on their goods. Cosmetics from Japan are especially popular. In 2017, Japan’s exports of cosmetics to China totaled ¥210 billion, 50% more than in 2016, and have continued to increase in 2018.

3) Tourism = Japan is the most popular foreign destination for Chinese tourists.

4) High-tech key components = Japanese companies are establishing a competitive edge in markets for key high-tech devices, materials and equipment. Overall, companies in Japan are the dominant suppliers of the core and peripheral technologies that are vital to the operations of mega-players in the high-tech hardware industries in China, Taiwan and Korea.

Japan’s will become more important with respect to stock investments, too

Question 7) Will Japanese stocks become more appealing to investors?

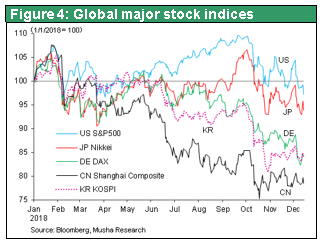

Answer 7) Absolutely. As stock markets worldwide remained generally weak, Japanese stocks posted a return in 2018 that is second only to the return of US stocks. In the words of an overseas Japanese equity fund manager, “Unlike in the past, investors did not pull their money out of Japan even though the market’s performance was bad. That was the silver lining of this cloud. And it was a pleasant surprise.” I expect to see the worldwide popularity of Japanese stocks become even greater in 2019.