Dec 26, 2018

Strategy Bulletin Vol.216

The Real Reason for the Drop in Stock Prices

The emergence of AI trading with highly accurate forecasts

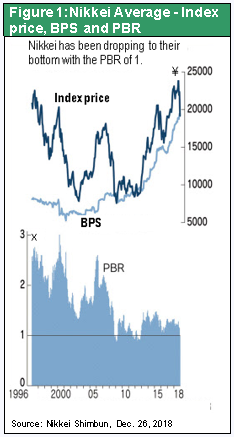

The recent sharp downturn in stock prices revealed the true nature of the market today. The Christmas plunge in stock prices took ¥1,010 off the Nikkei Average and raised the DJIA decline in December to 14%, which is almost the largest ever drop in one month. A December 26 article by Ken Kawasaki in the Nikkei Shimbun titled “Bewilderment about a multi-faceted stock price downturn – Is a PBR below one too far?” contains an analysis of this downturn that is on target. The article ends with remarks by Howard Marks, a well-known US investor. Mr. Marks believes that the time to buy is when the negative sentiment and falling valuations cause panic selling that produces rarely seen bargains.

It is inconceivable that this downturn is a sign of an impending economic downturn on the scale of the global financial crisis that began in 2008. Fundamentals cannot be used to justify the plunge in stock prices in the United States and Japan. If fundamentals are not the cause, then we need to look at internal stock market forces. Since President Trump’s election victory two years ago, stock prices rose by a remarkable 50%. As prices were still climbing, the October 4 speech by Vice President Mike Pence at the Hudson Institute declaring the start of a cold war with China caused geopolitical uncertainty to increase. In his Wall Street Journal column, Walter Russell Mead said that the United States and China had reached the point of an all-out conflict. He believes that economists and investors are overlooking the magnitude of this shift in the Trump administration’s stance. People are underestimating the significance of the beginning of an age where national security takes precedence over the economy. These remarks increased worries about financial markets.

In this environment, AI trading has probably been a major reason for market volatility. Is this a typical Black Monday where stock prices fall because of internal market forces rather than economic fundamentals? There are definitely similarities. On the previous Black Monday, a new type of computer trading called portfolio insurance triggered a 23% self-fulfilling plunge in stock prices in a day. Today, there are investment groups specializing in AI. By using sophisticated AI and databases, they have dramatically improved the accuracy of market forecasts just as weather forecast accuracy has increased. These AI investors are beginning to have a massive impact on financial markets.

One of my friends is an investor specializing in AI who is always a winner. Individual investors and investors using conventional quants or trading systems cannot compete with these new AI specialists. In 2018, AI investment groups have been responsible for countless abnormal price movements. They have defeated the established tactics of veteran investors in every respect while inflicting heavy losses. After the Black Monday in 1987, there was no recession and stock prices recovered over the following two years. A similar recovery is very likely to happen this time as well.

Stock markets are still shrouded in fog. But there is probably no need to alter the view that the long-term upward trend in stock prices will continue. There are only two potential events of a magnitude that could end this extended bull market and the longest postwar period of economic expansion: (1) The US-China trade war and (2) US monetary tightening. However, it is still far too early to adopt a pessimistic view of the economy.

A US-China compromise will be achieved eventually

All US demands to China involve unfair activities. Most people believe additional US tariffs can be avoided because China’s only option is to accede to all of these demands. China meets only 8% of its semiconductor demand with their domestic production and buys most of its semiconductors from US companies. In turn, the United States relies on China for the majority of its imports of smartphones, PCs and other high-tech products. Neither country can destroy this relationship of mutual dependence. To exert pressure on China, the United States has no choice other than to focus on the high-tech sector with selective manner. As a result, a full-scale confrontation will probably be avoided. Investments in China by multinational corporations are falling quickly. From a political standpoint, the administration of President Xi Jinping needs to stop this decline and concentrate on propping up the economy. Debt at private-sector companies in China is climbing, procuring dollars has become difficult and there are other challenges. Nevertheless, China still has considerable leeway for more public-sector spending and monetary easing.

For these reasons, the US-China trade war is very unlikely to trigger a global recession for the time being. However, the 2019 National Defense Authorization Act includes a provision for prohibiting dollar-denominated transactions with Chinese companies like Huawei. Using this provision could cause the immediate collapse of targeted Chinese companies and start a global financial crisis. But the Trump administration is not very likely to threaten China to this extent.

No worries about liquidity – The Fed has enormous discretionary power

Rising US interest rates and monetary tightening by the Fed are another source of concern. But the Fed has considerable freedom to determine its own actions, so there is no need to worry about Fed doing anything that would harm the economy. A speech by Fed chairman Jerome Powell in early December made it clear that the end of this cycle of interest rate hikes is not far away. The reason is the lack of any acceleration of inflation. Although wages continue to climb at an annual rate of almost 3%, rising productivity means that there is very little pressure on companies to boost prices. The current US environment of economic strength, low inflation and low interest rates is too good to true and even difficult to believe. However, this situation is precisely what has increased the Fed’s discretionary power so dramatically.

Stock prices fell sharply following the December interest rate hike because investors had expected a monetary policy shift. Falling stock prices caused downturns in interest rates and the dollar. The Wall Street Journal has been a consistent critic of quantitative easing. But in an editorial immediately before the December FOMC meeting, this newspaper reversed its position by publishing an editorial advocating a switch to a dovish monetary stance. In a sense, this was like creating a problem in order to receive credit for the solution. Mr. Powell instead betrayed these dovish expectations by demonstrating his confidence in the economy. But these matters are not significant. With inflation under control, the Fed can take any action that is needed. For example, the Fed can stop raising interest rates, start lowering interest rates, suspend quantitative tightening (downsizing its balance sheet), or even return to quantitative easing. Even though interest rates have come up, the long-term interest rate of about 3% is still only half of the US nominal economic growth rate of 6%. This is well below the level where interest rates would start weighing on economic growth. As a result, the conditions do not exist for a deterioration of the credit cycle, which is a possibility that worries investors.

Stock markets will once again test the upside in 2019

Early in 2019, stock prices will probably settle down and the dollar will slowly strengthen as uncertainty about the US-China trade war dissipates. Signs of weakness in US economic indicators are starting to appear, in part because of the drop in stock prices. To stimulate animal spirits, the Fed may temporarily stop interest rate hikes, balance sheet downsizing and other monetary tightening measures. Taking these actions may briefly cause the dollar to weaken. However, the dollar would probably start appreciating again as stock investors interpret the Fed’s actions as a signal to increase risk exposure.

Signs pointing to a long-term strengthening of the dollar are becoming even more pronounced

Investors should pay attention to two forces behind the dollar’s long-term appreciation. First, the dollar’s position as a vital currency for global business transactions is increasing steadily. Iran, North Korea and eventually China are likely to encounter serious problems involving the dollar. If a country confronts the United States and ends up being prohibited from using the dollar, its economy will quickly shrink. The entire world is aware of this situation and the Trump administration is making frequent use of the dollar’s clout in its relations with other countries. Second, the dollar is becoming stronger in practical terms as well because of highly competitive US industries and the improving US current account balance. Demand for the dollar is backed by the currency’s growing share of international credit and investments. Consequently, upward pressure on US interest rates from the growing budget deficit will probably not be significant.