Jan 21, 2019

Strategy Bulletin Vol.218

A buying opportunity created by a downturn with positive implications

(1) True to expectations, the sharp drop in stock prices at the end of 2018 was a “benign downturn” driven by technical factors

Many supply-demand and valuation indicators are saying that the market has reached a major bottom

Question: Throughout 2018, Musha Research stated that no deterioration in economic fundamentals was occurring that could justify a big drop in stock prices. You said that technical and other internal market forces were responsible for falling stock prices. Is this still your position?

Musha: Yes. I issued Strategy Bulletin Vol. 216 on December 26 immediately after the Christmas plunge in stock prices. The title is “The Real Reason for the Drop in Stock Prices.” I explained that internal market forces are behind this downturn and that this drop is similar to Black Monday (October 19, 1987), when stock prices plummeted 23% in a single day. In fact, the Christmas downturn took about 20% off the Dow Jones Industrial Average from the peak to the bottom. The DJIA then bounced back about 3,000 dollars over the next three weeks, offsetting half of the yearly drop. I believe the market is in a phase of buying back stocks. After all, when investors sell stocks for technical reasons, they subsequently buy them back for technical reasons.

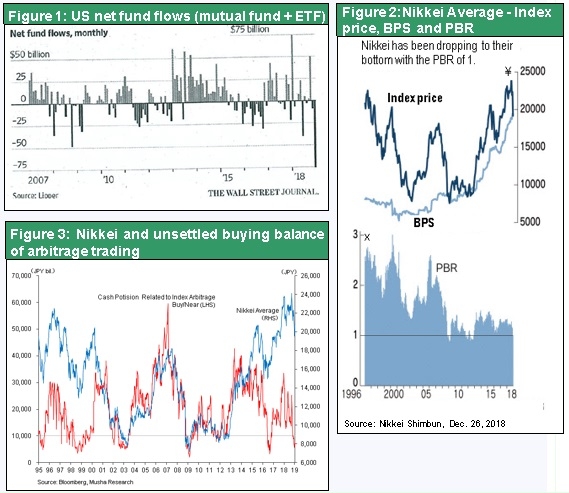

The stock price drop in December was similar in scale to sell-offs that happened after the collapse of Lehman Brothers. Figure 1 shows monthly net inflows and outflows for US equity mutual funds and ETFs. Net outflows in December 2018 set a new record of $75.5 billion, far more than in any month during the global financial crisis. Paralyzed by fear temporarily, investors refused to buy anything. This created a highly abnormal environment. However, this is an extreme overreaction, assuming that another Great Recession is not imminent. As a result, we can regard the current situation as an unprecedented buying opportunity.

As you can see in Figure 2, the PBR of Japanese stocks was less than one at the end of December. The only other times we have seen this historically low valuation were during the global financial crisis and immediately before the start of Abenomics. Figure 3 shows that the Tokyo Stock Exchange buying balance of arbitrage trading has declined to the ¥500 billion level, which is very low compared with prior years. This demonstrates the record-low level of sales of futures by speculators, which are mainly foreign investors. In the past, the long arbitrage trading balance fell to the ¥500 billion level only in March 2003, January 2009 and June 2016. All three times, this was a signal of an impending powerful rebound in stock prices.

(2) No change in the Fed’s market-friendly policies

Question: The trade war is one cause of the worldwide stock market volatility late in 2018. US monetary policy is another cause. The yield of the US 10-year Treasury note is holding steady at around 2.7%. What is your outlook for the Fed’s actions over the next two months?

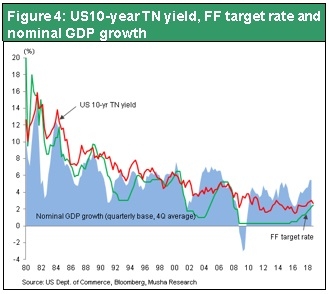

Musha: I don’t think the Fed’s actions will have a significant effect regardless of which direction the Fed moves. Everyone is now braced for the interest rate to climb to 3.2% and for this to trigger a negative credit cycle. But in the United States, the nominal GDP growth rate is almost 6% and corporate earnings are continuing to climb at a double-digit pace. Clearly, 3.2% is not a level that would have a negative impact on the US economy. Furthermore, it is quite evident that the Fed no longer needs to hike interest rates because inflation is not a problem.

Right now, the Fed is in a position where it can do anything that is needed to support economic growth and support stock prices. The Fed could even go back to quantitative easing or start lowering interest rates. Taking either of these actions would immediately energize the stock market. The Fed has this flexibility because prices are under control. Some people are critical of the Fed’s excessive support of financial markets. They think this creates a moral hazard and could produce an asset bubble. However, the fact that inflation is not a problem signifies that there is still slack on the supply side. During this economic phase, monetary policies that boost demand are not a mistake.

I think that recent events have proven that policies to increase demand are correct. We have witnessed a dramatic stock market pullback that was followed by a shift in the Fed’s stance and then a powerful stock market recovery. After the start of the global financial crisis, the Fed embarked on quantitative easing that was at the time regarded as a forbidden action for central bank. Adopting this policy led to the current bull market. Unfortunately, some people have the twisted view that this bull market is unhealthy and cannot be sustained precisely because it is the result of this forbidden behavior by the Fed. These people believe the big drop in stock prices that happened in 2018 justifies their views. There is no doubt that sustained economic growth and rising stock prices are the result of friendly monetary policies. On the other hand, the absence of any signs of an imminent shift in these policies is an inconvenient fact for these pessimists. At the same time, optimists welcome the lack of any signs of a policy shift.

(3) Positive prospects for a US-China agreement as the Chinese economy remains stable

Question: US stock prices surged in response to reports in the Wall Street Journal and other media that US Treasury Secretary Steven Mnuchin discussed lifting some or all tariffs imposed on Chinese imports. The Treasury Department quickly denied these reports. But this appears to be a sign that the United States and China are moving closer together.

Musha: We are seeing progress with US-China high-level trade talks. China is showing signs of making significant concessions to the United States. Furthermore, China is easing restrictions on foreign companies involving investments and the ownership of Chinese companies. I think the likelihood of a compromise between the United States and China is increasing and a complete breakdown in talks will not happen. President Xi Jinping is worried about worsening sentiment about investments and the growing risk of a severe recession. Doing nothing about the confrontation with the United States is not an option. Furthermore, President Trump wants a big accomplishment as he looks ahead to the 2020 election. This is why I believe that prospects for a US-China compromise are excellent.

The shift of investments from China to Taiwan, ASEAN countries and Mexico

Question: Nidec Corporation recently lowered its earnings forecast for the current fiscal year. The company said the US-China trade war is starting to have a severe impact on China’s economy. Demand at its customers is down as companies that buy Nidec products make big cuts in their inventories. Is this sign of trouble at one company a reason for concern?

Musha: There have already been many arguments like this. The trade war was expected to trigger substantial declines in investments in China machinery and electronics industries. After all, the trade war is part of the Trump administration’s initiatives to prevent China from serving as the world’s factory. Naturally, stopping the excessive concentration of manufacturing in China also means that other areas of the world will have to replace some of China’s output. That means we can expect to see investments in countries other than China to boost production capacity. Nidec, for instance, has announced its intention of speeding up investments in manufacturing facilities outside China.

Question: Investments are increasing in Mexico and other countries.

Musha: Slowing economic growth in China will not cause a global economic downturn. As China declines, I think we will see more investments in other countries as substitutes of expenditures originally planned for China. In the second half of 2018, no one had any idea of the broader outcome of the trade war. But people thought only the Chinese economy would be impacted. Now, I think the outlook will improve as trade friction quiets down to some extent.

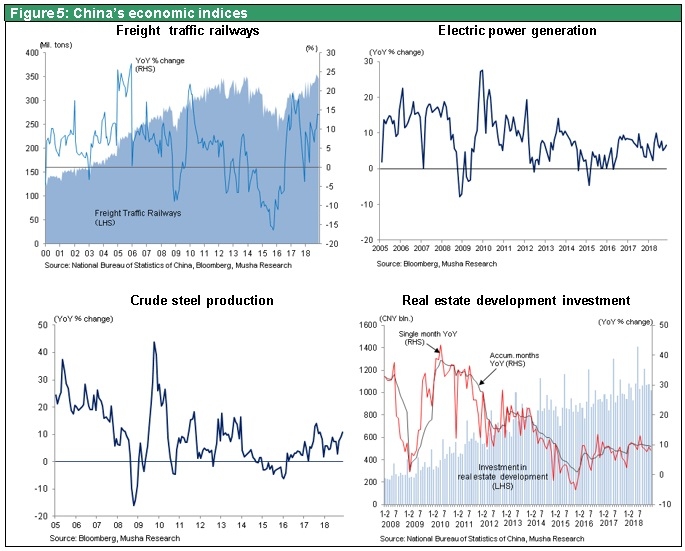

I think China’s economic stimulus measures will generate substantial upward pressure on the economy. As you can see in Figure 5, China’s microeconomic indicators are not bad. In the semiconductor and smartphone categories, the product cycle and 4G have finally reached the end. Soft demand, as people and companies wait for the next generation of products, is holding down sales. But I do not think this situation will continue much longer.

(4) Actions of foreign investors and outlook for the dollar/yen exchange rate

Question: Foreigners were selling massive amounts of Japanese stocks as stock prices fell at the end of 2018. You talk with foreign investors frequently. What is their current stance regarding Japanese stocks?

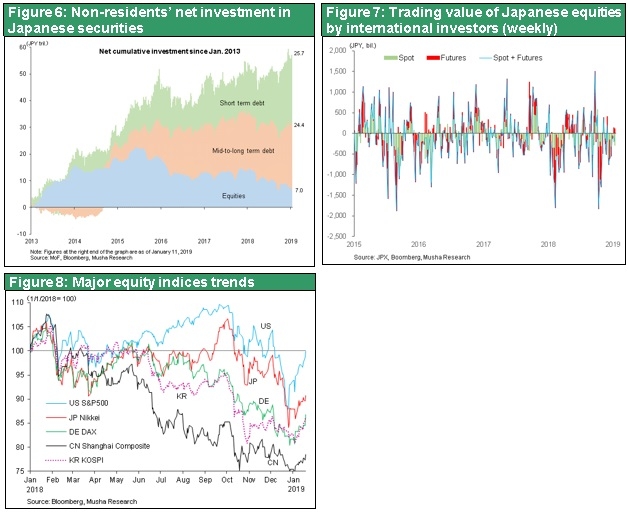

Musha: Foreigners have sold most of the Japanese stocks that they purchased during the Abenomics rally. After the start of Abenomics, foreigners invested approximately ¥25 trillion in Japanese equities. I think they have subsequently sold around 70% of these holdings. Now foreigners have a somewhat negative view of Japan. I think one reason is the belief that the Japanese economy is vulnerable to damage from the US-China trade war and slower economic growth in China. However, for some time Musha Research has been explaining that US measures to suppress China are actually good news for Japan. This is because Japan is in an excellent position to benefit from the US-China confrontation. Once investors become aware of Japan’s advantage, there may be a dramatic shift in how investors view Japanese stocks. Index sales, particularly in futures, account for a significant part of sales of Japanese stocks by foreigners. The current historically low level of the Tokyo Stock Exchange buying balance of arbitrage trading would show that sales of Japanese stocks, futures positions and other activities of foreign investors have hit bottom.

Question: Apparently, the Fed will not hike interest rates again in the near future. How does this affect the outlook for the dollar/yen exchange rate, which is now in the lower ¥109 level?

Musha: The yen may appreciate somewhat. If the Fed pushes back the next interest rate hike, the dollar will probably become slightly weaker for a while. However, I expect a movement of only a few yen at the most. The strength of the US economy will become increasingly evident. I think this strength will cause the dollar to start appreciating again in the middle of 2019.

Question: This is the earnings announcement season for US companies. Stock prices of some financial institutions and other companies that have already announced earnings have increased. One reason is that many US stocks are significantly undervalued in terms of their PER and PBR. Due to this situation, is there a possibility of a value reversal taking place in the stock market this year?

Musha: Yes, it’s possible. But we may also see a rebound in the economically sensitive stocks that have suffered steep declines. In addition, the further drop in prices of value stocks has made this category even more attractive. Consequently, I think every category of stocks will become more attractive. The FAANG stocks are the symbols of the stock market bubble. Investors bid up the prices of these stocks to levels that did not reflect the actual performance of the companies. Although Amazon and other companies appear to have high PERs, the cause is measures to hold down reported earnings. But Apple’s PER is extremely low at only 12. From this standpoint, I believe US stocks are becoming increasingly underpriced even with respect to value. I also think stocks in Japan will become even more undervalued.

Question: The key to the outlook for this year’s stock market in Japan may be the degree to which foreigners, who are the primary buyers of Japanese stocks, become aware of this undervaluation.

Musha: The problem is the inability to eliminate the excessive accumulation of capital on a global scale. When investors sell stocks, they will buy government and corporate bonds if they think the economy is going to become weaker. Governments will use more monetary easing as well as more spending to stimulate economic growth. The existence of surplus capital pushes down interest rates. Then, real demand may increase, partly because of measures to support the economy, resulting in a tighter supply-demand balance. If this happens, I think we will see interest rates and stock prices move up in tandem as the economy expands, just like during the first half of 2018.

(5) Outlook for Japanese stocks

Question: The Nikkei Average is currently about ¥20,500. How high and low do you think this average will go during 2019?

Musha: The economic outlook is very positive because Japan is positioned to benefit from US-China trade friction. This is why I think the Nikkei Average can surpass ¥24,000 this year and perhaps even climb to ¥27,000. Japan has the most undervalued stocks in the world. Furthermore, from a historical standpoint and a medium to long-term perspective, Japan is in one of the world’s most advantageous positions concerning both geopolitics and the international division of labor. Furthermore, Japanese companies have made big changes to their business models. Consequently, I think Japanese stocks could stage a remarkably powerful rally.

One more important point is that Japan alone in the world has experienced no increase at all in financial leverage during the past decade. 2018 was the first year since the global financial crisis when investors became concerned about financial risk. When monetary tightening begins and liquidity starts to become limited, some investors start to view a company’s debt and the cost of leverage as potentially negative factors. For example, some companies, such as General Electric, raised leverage in order to reward investors by buying back stock. But the result was a weaker financial position, credit rating downgrades and higher interest rates on debt. This process may be about to happen at a large number of companies. Rising leverage at other companies could therefore make Japanese companies, which have the world’s lowest leverage, the world’s most attractive investments. Japanese companies are often the target of criticism for their wasteful hoarding of capital. But investors may instead begin to regard the financial soundness of Japanese companies as a reason to buy their stocks. For these reasons, I believe that 2019 will be a year when global investors discover the hidden appeal of Japanese stocks.