Jan 31, 2019

Strategy Bulletin Vol.219

The Historic Significance of the January 31 FOMC Decision

(1) An unequivocally market-friendly stance with no quantitative easing exit in sight

No interest rate hike and no quantitative tightening

The Fed made no change to interest rates on January 30 and strongly indicated that more interest rate hikes are off the table for the time being. Separately, the Fed stated that it “is prepared to adjust any of the details for completing balance sheet normalization in light of economic and financial conditions.” At a press conference in December 2018, Fed Chairman Jerome Powell said that balance sheet downsizing was going as planned and there was no plan for any revisions. Now this policy has been changed. And Reuters, the Nikkei Shimbun and other media companies are saying that the Fed may finish reducing the size of its balance sheet sooner than expected.

The favorable truths that give the Fed a free hand

The previous Strategy Bulletin (Vol. 218) included the following statement:

“Furthermore, it is quite evident that the Fed no longer needs to hike interest rates because inflation is not a problem. Right now, the Fed is in a position where it can do anything that is needed to support economic growth and support stock prices. The Fed could even go back to quantitative easing or start lowering interest rates. Taking either of these actions would immediately energize the stock market. The Fed has this flexibility because prices are under control. Some people are critical of the Fed’s excessive support of financial markets. They think this creates a moral hazard and could produce an asset bubble. However, the fact that inflation is not a problem signifies that there is still slack on the supply side. During this economic phase, monetary policies that boost demand are not a mistake. I think that recent events have proven that policies to increase demand are correct.” Subsequent events have demonstrated that this statement was precisely on target.

(2) Quantitative easing is a new monetary regime rather than a moral hazard

Is the new regime something to fear?

The critical point is whether or not to believe the position that quantitative easing is not sustainable because it is financial alchemy with significant negative side-effects. If we embrace this view, then the Fed has listened to the devil by adopting a market-friendly monetary policy and pushing back normalization. For some time, although there are still doubts, Musha Research has said that quantitative easing has very likely become the new monetary regime. Musha Research also stated that there is no need for normalization of the exit from quantitative easing. The January 30 FOMC decision made it even clearer that the Fed’s stance is moving even farther away from the normalization of this exit.

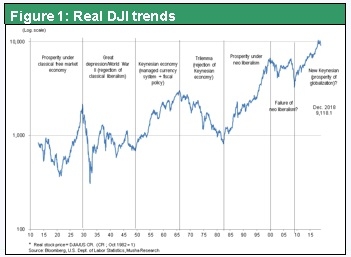

How the currency issuing mechanism has changed

Quantitative easing can be considered the new monetary regime because it is nothing at all like the old regime of simply printing more money. The ups and downs of the US economy and the Dow Jones Industrial Average over the past century clearly show the shift that has taken place in the monetary regime (the mechanism of printing more money). Figure 1 and 2 shows the real (inflation-adjusted) DJIA in order to illustrate the change in the value of stocks in terms of purchasing power. There were three major bull markets during the past century and we are now in the midst of the fourth one:

1) 1910s-1920s, when stock prices increased against a backdrop of classical liberalism (economic freedom) and the gold standard;

2) 1950s-1960s, when stock prices increased in a Keynesian economic environment as the world shifted from a system of currencies managed by individual countries to a system in which countries printed more money;

3) 1980s-1990s, when stock prices increased as liberalism took hold worldwide at the same time as the world abandoned managed currencies and switched to an economic structure that relied heavily on the US dollar;

and now,

4) The current bull market started in 2010s. This time, the bull market is fueled by a market-centric framework underpinned by quantitative easing (a new way to create more money) and by methods of supplying money using stocks and other means that reflect the degree of tolerance of financial markets. Overall, this approach may become a new global Keynesian system in which the public sector is the driving force behind the creation of demand. The world is entering an age in which creating demand by using a combination of monetary easing and government spending has become both essential and appropriate. This is an age that requires Abenomics and the macroeconomic policies of President Trump and that legitimizes these policies. By comparison, look at the economic picture in the European Union, where there strict limits on government budget

deficits.

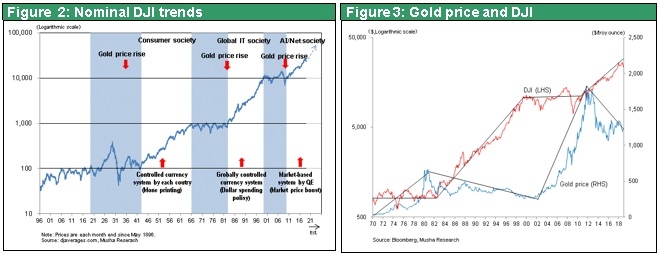

Figure 2 shows the nominal DJIA. The average has increased tenfold about every 20 years, rising from $100 to $1,000 in period 2) and from $1,000 to $10,000 in period 3). Now we may be in a 20-year period when the DJIA rises from $10,000 to $100,000. Furthermore, these 20-year periods of tenfold stock price growth tend to coincide with the emergence of a new monetary regime triggered by sharp upturn in the price of gold. These upturns happened in 1934, 1980 and 2011. All three times, the price of gold settled down following the emergence of a new monetary regime. Therefore, a spike in the price of gold is apparently the sign of the imminent death of a monetary regime.

(3) The inevitability of quantitative easing – Why credit growth is necessary

Their goals of monetary policy, and the mission of the Fed, are to keep prices at a suitable level and create as many jobs as possible. This is the so-called dual mandate. Alternately, this mandate can be expressed as the goal of maximizing economic growth without exceeding the limits of sustainability. How can this be accomplished? The answer is by controlling the total amount of credit, which is equivalent to the total amount of purchasing power. In the past, central banks controlled the volume of credit by using interest rate policies to raise or lower the amount of bank lending. Now, the banking system is no longer the source of credit creation. Rising prices of assets, especially stocks, have instead become the primary means of creating credit. As a result, governments must implement policies that influence asset prices and conduct quantitative easing by printing massive amounts of money. No one can deny that policies for artificially boosting stock prices are a form of alchemy. However, the asset bubble (or hike in asset value) these policies produce may be sustainable.

These points raise the question of why credit creation using alchemy is needed in the first place. To answer this question, we must study advancement of technology and the social division of labor over many years. Basically, rising productivity due to technological progress results in a growing surplus of labor and capital. An increase in the supply of goods is another way to view this process. The result is insufficient demand in relation to supply. Ending this imbalance requires policies that boost demand, which is why credit creation initiatives are essential.

Monetary schemes are somewhat like the shell of an insect. As an economy grows and advances along with improvements in technologies and productivity, the old shell (monetary regime) becomes incompatible and must be replaced by a new shell. The gold standard restricted the ability of countries to print money. But the start of the Great Depression in 1929 forced the world to shift to the managed currency system. Similarly, when the US was struggling with a recession around 1980, the Reaganomics policy of printing a large volume of dollars (the global currency) triggered a recovery. Making this possible was the end of the dollar’s convertibility into gold in 1971. These events led to the new Bretton Woods system (the era of global managed currencies).

There is still no consensus on the causes of the global financial crisis that started in 2008. Many people blame this crisis on excessive risk taking in financial markets and the creation of an asset bubble. But this is only a one-sided perspective. The true cause is a dramatic drop in aggregate purchasing power that occurred because asset prices fell too far due to a shortage of money. Producing an enormous volume of money in order to significantly boost prices of assets (stocks, bonds, real estate), and thereby restoring and increasing purchasing power, is what ended the crisis. Tracing events back from this solution makes the cause of the crisis obvious. Some people think the increase in asset prices was unnatural and that the quantitative easing that fueled higher prices created a moral hazard. This position was backed by many people in the academic community and by government financial authorities as well as market participants. For example, this is the stance of former Bank of Japan governor Masaaki Shirakawa and former Reserve Bank of India governor Raghuram Rajan. But if we ascribe to this view, we must conclude that the current period of economic expansion is also unnatural and is only a temporary event. Mr. Shirakawa said that using monetary easing to create demand is unhealthy because it simply steals demand from the future and therefore has only a brief benefit. But this view is way off target. Supply capacity is what determines whether or not the level of demand is proper, not Mr. Shirakawa. Inflation is the key indicator. The absence of inflation is a sign of a surplus on the supply capacity, which means there is a need for more demand.

(4) Are financial markets or stock prices the real target of quantitative easing?

This section examines the views of others in order to clarify opposing arguments. Every time stock prices plummet, we see articles in Toyo Keizai and Economist Weekly about a stock market bubble. On January 22, there were articles in Economist Weekly, by Kazuo Mizuno saying that a bubble is the only way for the global economy to grow, and by Jitsuro Terashima saying that we are seeing the beginning of the end of the Trump bubble and that Japan has no resilience to a global economic downturn. In an article in the February 2 issue of Toyo Keizai, Ryutaro Kono says the US economic recovery relies on a bubble and that this bubble is responsible for US full employment. The essence of these views is plain and simple. Quantitative easing has produced a bubble by boosting asset prices and now relying on this bubble is the only way to achieve growth of the US and the global economy (full employment cannot be achieved). The conclusion is that the current phase of economic growth is unhealthy and unsustainable.

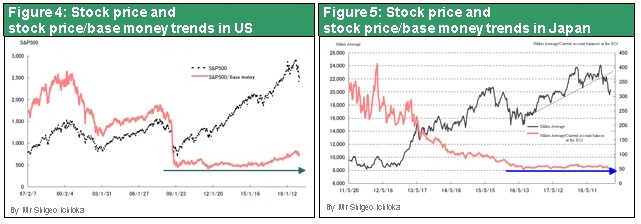

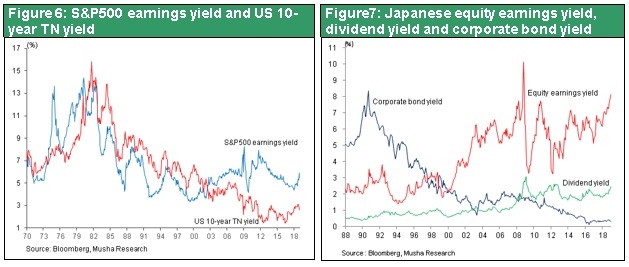

There is no doubt that quantitative easing made a decisive contribution to upturn in prices of stocks and other assets. Furthermore, there would have been no economic growth or increase in the number of jobs without higher asset prices. Figures 4 and 5 by Shigeo Ichioka show the correlation between Japanese and US stock prices and base money. In both Japan and the United States, quantitative easing was clearly responsible for pushing up stock prices following the financial crisis. However, the belief that higher stock prices are an unsustainable bubble is completely wrong. Figure 6 and 7 show the relationship between Japanese and US stock prices and corporate earnings. As you can see, stocks did not become overpriced because the PER did not increase significantly. Consequently, there was no bubble because stock prices moved up along with the growth of earnings. In fact, stocks are still underpriced in relation to interest rates that have been very low for many years. Since 1970, the earnings yield (reverse of PER) of US stocks has generally moved in tandem with the yield of 10-year Treasury notes (Figure 6). However, the earnings yield has been far above the Treasury yield since the start of quantitative easing. The existence of this gap tells us that stock valuations are too low in relation to interest rates.

The undervaluation of stocks in relation to bond yields is even more pronounced in Japan. Quantitative easing and ETF purchases by the Bank of Japan are definitely propping up stock prices. But that does not mean there is a bubble. People who think Japan has a stock market bubble are ignoring the strong earnings of Japanese companies. The price discovery function of Japan’s stock markets had broken down and the Bank of Japan is doing everything possible to restore this function.

Quantitative easing was responsible for the growth of earnings and it was higher earnings that subsequently caused stock prices to climb. If this is unnatural or unhealthy, then the mechanism of using quantitative easing to boost earnings is a mistake and its benefits are unsustainable. We could use the same erroneous thinking to say that economic growth during the 1950s backed by printing unconvertible money was also unhealthy. This thinking also makes growth in the 1980s fueled by a massive volume of dollars harmful to the economy. During these periods of economic growth, no one knew what was right or wrong. Looking back from our current perspective, we can say that these actions produced sustainable benefits over a certain period of time but had significant side-effects. As a result, the monetary regimes that existed at those times had to be replaced.

The world has not yet reached the point where the quantitative easing regime has failed and a new regime is needed. The current quantitative easing regime, in which central banks control the level of overall credit by influencing asset prices, is still doing a good job.

All of the points in this bulletin lead to the conclusion that investors should retain an optimistic stance concerning monetary policies and interest rates.