Investor sentiment holds the key to today’s unusual uncertainty

Pessimism is once again becoming widespread. Fueling this pessimism most of all is deteriorating investor sentiment as stock prices fall. We have seen a major technical correction in the wake of the powerful rebound in stock prices (S&P 500 up 80%) following last year’s bottom. The S&P 500 fell 16% to a low of 1022 on July 2 from its April 23 peak of 1217. At its current level, the market has given back one-third of its recent rally. The result is growing pessimism, especially among ordinary investors. On July 16, The Wall Street Journal reported that a survey of 55 economists revealed that 64% believe the economy will improve over the next year and 9% expect a downturn. Despite this strong optimism, a public opinion poll showed just the opposite. Only 33% of the general public expects an improvement and 23% expects the economy to worsen. This probably explains why Fed chairman Ben Bernanke’s recent statement in Congressional testimony that the economic outlook is “unusually uncertain” caused pessimism in financial markets to become even greater. On July 22, the day after his remarks, the Dow Jones Industrial Average plunged 100 points. At this point, we need to determine exactly why this negative sentiment is so strong and why Mr. Bernanke believes the outlook is unusually uncertain.

There are probably two reasons for the “unusually uncertain” remark. First, the significant progress thus far in the recovery at the microeconomic level should have sparked improvements in jobs and other economic indicators. But we are still waiting for these improvements. Second, negative sentiment is increasing rapidly due to repercussions of the Lehman shock, the plunge in stock prices triggered by the Greek debt crisis and the uncertain outlook for the global economy. But I believe both of these problems can be solved over time.

The U. S. economic is extremely lean, and fundamentals pose few problem

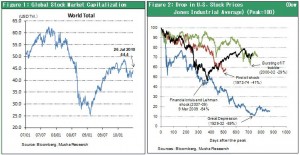

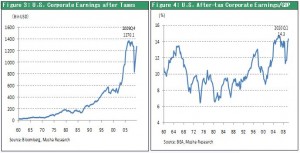

The optimism of economists shows that there are no significant concerns with respect to fundamentals. Corrections in corporate activity, household spending and the housing market are finished. There is nothing left to cut in all three sectors. In addition, a major recovery is taking place in corporate earnings (Figures 3 and 4), which is a significant source of economic growth. The result is an unprecedented amount of liquidity on balance sheets. Rebound in employment remains sluggish. Moreover, recovery in consumer spending is weak and the economic growth rate is briefly slowing now that companies have completed investments to restore inventories. Furthermore, the drop in U.S. housing demand following the end of the U.S. first time home buyer tax credit program is increasing concerns about an end to economic growth once economic stimulus measures are phased out. However, it is not at all unusual to have no recovery in employment during the initial phase of an economic recovery. As Table 5 shows, employment starts to increase nine months after the beginning of an economic recovery on average based on past recoveries. Moreover, we must remember that a jobless recovery is taking place because of the dramatic productivity recovery propelled by economic globalization and the Internet revolution.

The economy is currently being held back as falling stock prices cause investor sentiment to weaken, which raises the savings rate and lowers consumer spending. But there is absolutely no need to worry about this process as long as the drop in stock prices can be kept in check.

A double dip can occur only if stock prices drop because mistaken U.S. government policies erode investor confidence

No economic recovery can take place when stocks are falling. Consequently, the only source of concern about the outlook is the possibility of a negative cycle created by mistaken U.S. government policies that erode investor confidence and spark a bear market. There are two potential causes. First is an absence of decisive actions by regulatory authorities and obstacles created by the U.S. Congress. Second is either market rejection, an upturn in interest rates or a downturn in the dollar. Right now, there is absolutely no reason to be worried about any of these problems. Fed chairman Bernanke has stated that he is prepared to take additional actions if necessary. This could include a reduction in interest paid on banks’ holdings of reserve balances, the resumption of asset purchases, a continuation of low interest rates or other measures. Mr. Bernanke is an expert on the Great Depression. There is no doubt that he is concerned about any indirect effect of asset prices (and especially stock prices). In addition, pessimists are constantly worried about the Fed’s inability to take more actions to quell a drop in the dollar, rising interest rates or other market turmoil. But this has not been a problem at all. In fact, the dollar has been strengthening as interest rates fall. This can be interpreted as a demand from financial markets for more central bank intervention and risk-taking.

Two reasons that the U.S. will not experience Japanese-style deflation

I think there is no danger of the U.S. suffering from Japanese-style deflation for two reasons. First, prices fell in Japan mainly because companies cut costs in response to the extreme strength of the yen. (See Key Strategy Issue No. 287.) Second, the U.S. will create “interest rate arbitrage” as Japan didn’t. I have already issued a report about the first reason, so I will discuss only the second reason here.

Bernanke’s determination to prevent asset deflation

Japan’s long-term interest rates declined steadily during the country’s “lost 20 years.” Falling interest rates were an indication that investors expected the Japanese economy to remain stagnant far into the future. However, this is very peculiar from the standpoint of conventional economic principles. After all, low interest rates normally increase investments because of the lower cost of capital. Low interest rates should also increase risk-taking as the theoretical value of financial assets increase. As a result, falling interest rates should act as an automatic stabilizer that triggers an economic recovery.

But this did not happen in Japan. The automatic stabilizer was blocked as a mistaken problem took hold in the country: persistent asset deflation. In Japan, an unusual gap in asset returns continued for many years. In other words, the interest rate arbitrage role of financial markets was no longer functioning. Enormous gaps exist in returns today: long-term interest rate of 1%, dividend yield of 2%, return on stock investments of 6% and real estate cap rate of 7%. So why aren’t investors rushing to earn high returns on stocks and real estate? The reason is that investors realize that the superficial return of 6% on a stock investment will evaporate if the stock price drops more than 5%. Mistaken government policies have played a big role in convincing investors that prices of assets in Japan will keep declining forever. Consequently, Mr. Bernanke’s decision to create a strong impression by using the words “unusually uncertain” most likely reflects his determination to prevent a Japanese-style deflationary mentality from taking hold in the U.S. This is very good news for stocks.

U.S. stocks are in a sweet spot

If the U.S. can avoid Japanese-style deflation, we are in the midst of a sweet spot for buying U.S. stocks. As Figure 6 shows, U.S. stock prices are closely linked to the yield curve (spread between long and short-term rates) cycle. Stock prices have increased when a short-term interest rate hike narrowed this gap and retreated when the gap widened as short-term interest rates fell. Right now, the yield curve (gap) is peaking. We are very likely to see the yield curve flatten as declining long-term interest rates and the inevitable upturn in short-term interest rates cause the interest rate gap to narrow. This will produce a financial climate that can support a powerful stock market rally.