Feb 15, 2019

Strategy Bulletin Vol.220

Unease about pessimism in China, Investment Opportunity to Come after Compromise b/w the US & China

China Pessimism Weighing on Japanese Stocks

World stock prices seem to have hit a major bottom over Christmas 2018. Among others the U.S. market, which would usually set the global stock market's mega trend, delivered a return to half the value lost successfully. If one follows the maxim that a half-price return is a full-price return, then it can be said that this means that the market is now entering into a great rising wave. The biggest factor is that the Fed has shifted significantly towards market-friendly policies. Nevertheless, market pessimism remains strong in the Japanese market. The cause can be said to lie entirely in China pessimism. I've been asserting the future prospect of a US-China confrontation and of the Chinese economy falling into difficulties since the publication of my book “The End of Lost 20 Years - the Japanese Economy Seen in Geopolitical Terms” (Toyo Keizai). Therefore, although the current China pessimism is developing as I expected, the excessiveness of the current China pessimism is very unsettling.

China Pessimism is Being Exaggerated

There are four sources for this flood of China pessimism, but all of them are being excessively exaggerated at the moment. The first is the struggle for supremacy between the United States and China, with the United States refusing to allow China high-tech hegemony. Huawei is a symbol of this, but it is not immediately resulting in a head-on collision. There is a large degree of interdependent division of labor between China and the United States, and it is just as impossible to envisage that, either on the United States Trump administration’s side or on the Xi Jinping government’s side, choices would be made that would lead to a Great Depression.

The second is the US-China trade war which, because it is bound to follow economic interests, will conclude with China making concessions and introducing reforms such as intellectual property rights. The process of global companies shifting their production from China to other countries is inevitably going to occur, but in any case, currently shelved investment will resume at some stage. Semiconductor investments are temporarily halted due to the friction between the United States and China and the uncertainties surrounding the situation, but the temporary cessation will spur semiconductor supply and demand in the near future and result in the creation of the next investment boom. The same is true for machine tools. The fact that orders for capital goods are already depressed has the possibility of becoming a driving force for improvement in the future.

China’s Economic Policy Concentrating on Economic Reflation, and Supporting the Bubble

The third is the deceleration of domestic demand in China. Reorganizing zombie enterprises by means of applying restraints such as sudden slowdowns in M1, and reform measures like holding down infrastructure investments has become a brake (on the economy). This policy stance was accompanied by negative results such as the decline in automobile sales triggered by the ending of support measures, the maturing of the smartphone market, and so on. However, the policy axis has already shifted from reform to leverage, and domestic demand will recover gradually.

The fourth most serious pessimism is about the collapse of the Chinese bubble, deepening the financial crisis, but the authorities responsible for the management of foreign exchange etc. are acting in a fully responsive manner, and so this is unlikely to materialize for the time being. China is absolutely unable to countenance or accept the sort of collapse of the bubble that was experienced in Japan. In the case of Japan, the resource of bubble was 100% domestic excess savings and so that collapse did not result in the nation’s economic system being impaired. However, since China is largely dependent on foreign capital, the collapse of the bubble would likely cause capital outflows and currency collapse and could easily lead to a systemic crisis. Consequently, the policies of last resort to avert this outcome, in the form of cross-border capital controls, policy support for asset prices such as stock price and real estate values, etc., will undoubtedly be implemented.

Japanese Companies Increasing the Volume of their Investment in China in this Phase

Once the excessive pessimism is finally over, the tailwinds for Japan will become apparent and obvious: (1) in response to the pressure from the United States, the protectionist stance and discriminatory preferential treatment of domestic enterprises in China is likely to be radically changed for the better; (2) there will be a rapid about-turn from anti-Japanese to pro-Japanese propaganda within China itself, and these measures will provide huge support for the business of Japanese companies with China. China’s Foreign Minister Wang Yi has proposed that “Although the attitude of the Chinese side towards Japan is recovering and improving, Japan's impression of China is not improving. Highlighting the improvement in the national sentiment on the Japanese side is important and, if the number of visits to China made by Japanese school trip increases, I think this will probably prove to be useful in improving sentiment” suggesting that China is now starting to make very friendly overtures towards Japan. For example, given the relative size of domestic demand, which is overwhelmingly large in China, with automobile sales of 17.2 million in the United States versus 28 million in China, the business opportunities of Japanese companies are clearly huge regardless of the friction between the United States and China.

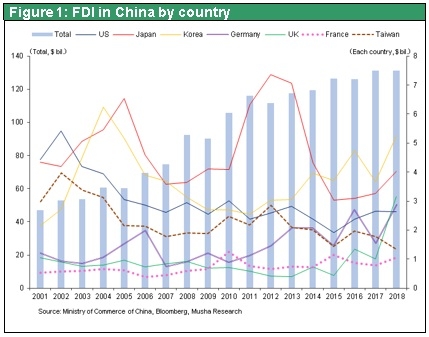

The Figure 1 below, which shows the trends in direct investment made by foreign countries in China, was prepared by Mr. Kiyoyuki Seguchi, Research Director at the Canon Institute for Global Studies, and it illustrates that some Japanese corporations, disgusted and discouraged by the anti-Japanese rioting that followed the Senkaku nationalization in 2012, subsequently and drastically reduced the level of their investments in China and adopted a policy of removing their production bases from China and relocating them in other countries. These Japanese companies are now said to be trying to significantly revitalize their investment activities in China. It goes without saying that this investment is focused heavily on domestic demand in China.

Automobiles and Consumer Goods, High Tech to Be Beneficiaries

The China's mandate to implement new energy vehicle policies is likely to result in significant changes in the automobile sector. This development will, as the overwhelmingly one-sided shift from EV (electric vehicles) to hybrids gathers pace, be beneficial to Japanese manufacturers who have an overwhelmingly large accumulation of technical expertise and experience in hybrids. Toyota is aiming to expand its share by providing PHV technology. In contrast to the hard-hit US and Korean companies who are currently struggling, the share of Japanese manufacturers has risen. Japanese automobile companies are set to greatly increase their investments in China.

In the field of consumer goods, “made in Japan” fever is rising as the popularity of products made in Japan boasting safety and security, high quality, and sophistication soars. The criticism aimed against Japan in China has now quietened down, and undercurrent of desire for Japanese-made goods is growing ever stronger. Some Chinese companies are even starting to manufacture their products in Japan now specifically because of the powerful attraction of having “made in Japan” on the label. This “made in Japan” influence is proving to be particularly powerful in the cosmetics and baby goods markets. Exports of cosmetics to China were 210 billion yen in 2017, a 50% increase from the previous year, and growth continued at the same pace in 2018.

Japanese companies involved in high-tech basic, peripheral, and infrastructure are now overwhelmingly in an advantageous position. Japanese companies are now supporting the high-tech hardware mega-players in China, Taiwan and Korea.

I would like to emphasize the possibility that the China factor could well turn out to be the cause of positive surprise in the Japanese stock market in the future, of which detailed analysis will be given on another occasion.