May 29, 2019

Strategy Bulletin Vol.225

Overwhelming US superiority is emerging with regard to the Huawei problem and the US-China trade war

A war of attrition as the US clears a path to victory

The US-China trade war has reached a critical point as the overall strategy of the United States becomes clear. The ultimate US objective is crushing China’s ambition for hegemony. Accomplishing this goal requires the suppression of the Chinese economy in three ways: (1) Holding back the activities of Huawei, which has become one of the world’s leading advanced technology companies; (2) Altering the framework that allowed China to use unfair activities for economic growth (theft of intellectual property, mandatory technology transfers, discrimination against foreign companies, government subsidies to Chinese companies and other measures); and (3) Terminating the enormous trade and other deficits with China that have been fueling the Chinese economy. The primary US actions have been tariff hikes and sanctions targeting Huawei. Naturally, the United States does not want to start a global recession or destroy the Chinese economy. The US stance is most likely to remove obstacles in the path to victory by using the above three measures to suppress China and then settle in for a war of attrition.

Huawei cannot be allowed to have superior technologies

The severity of Huawei sanctions is surprising. But these actions nevertheless demonstrate the resolve of the US government. Apparently, the United States has decided to effectively shut out Huawei, which has become one of the world’s preeminent 5G equipment suppliers. For manufacturing base stations, Huawei ranks first with a 31% share of the global market. Furthermore, Huawei has grown rapidly in the smartphone sector to overtake Apple and capture the number two position worldwide. The United States has used the National Defense Authorization Act, which became law in August 2018, to prohibit US government agencies from purchasing Huawei equipment. On May 16, 2019, the US government started prohibiting US companies from supplying products to Huawei. Panasonic, ARM and other companies have subsequently cut ties with Huawei due to this US action.

Developing new products has become extremely difficult for Huawei because of these measures. Huawei has said it can develop internally the semiconductor devices that it can no longer purchase form US suppliers. In fact, one of Huawei’s group companies is HiSilicon Technology, which is very skilled at designing semiconductor devices. However, creating new devices will be very difficult without access to the technologies of ARM. Furthermore, although Huawei can still use Google’s Android smartphone OS for free, Huawei will be unable to conduct global business operations without the ability to use Google’s app technologies. To exert more pressure on Huawei, the United States still has the options of prohibiting bank transactions and the use of the dollar. HSBC and Standard Chartered have already stopped providing global financial services to Huawei and only Citigroup currently serves Huawei, according to the Wall Street Journal (December 21, 2018). The very limited possibilities for responses by China mean that Huawei will probably face major barriers to conducting business operations.

Are these severe US sanctions justifiable? Is Huawei really guilty of its alleged misdeeds? The company has apparently violated the Iran sanctions, but there is no significant evidence of the existence of a “spy chip” or the use of a back door to steal information. Therefore, we cannot completely reject the possibility that these accusations are false. However, the United States has two reasons that can justify (in fact, must justify) this harsh treatment of Huawei. First, China’s National Intelligence Law, which was enacted in 2017, creates a problem because Chinese people are required to act as spies if asked to do so by the government. Also, the United States was never going to allow Chinese companies to take over the internet platform. Second, Huawei has used unfair trade practices to become the powerful company it is today. Now that the decision has been made to shut Huawei out of the global market, the United States will probably make no change at all in its stance.

Huawei’s decline is not bad news for Japanese companies

President Trump has said that Huawei sanctions are part of the agenda for trade talks with China. As a result, a sudden change in these talks that produces an agreement could include the removal of some Huawei sanctions. If this happens, Huawei would probably be forced to make big changes to its business model.

Annual sales of Japanese companies to Huawei are more than ¥600 billion. Although these companies cannot avoid the direct negative impact of the sanctions, there is no need to worry too much. As Huawei’s shares of the base station and smartphone markets decline, other companies will benefit as they capture this lost market share.

Trade war tariff hikes will not significantly slow US economic growth

The United States is also clearly superior to China with respect to tariffs. Punitive tariffs are a way to stop China’s unfair trade practices. Consequently, these tariffs will be reduced or eliminated once these unfair activities end. Furthermore, we can conclude that the trade war tariffs will have only a small impact on the US economy but inflict severe damage on the Chinese economy. On the US side, the Trump administration has imposed a 25% tariff on imports from China worth $250 billion. Moreover, the United States is prepared to slap a 25% tariff on all imports from China, which total about $540 billion, unless China agrees to end its “free ride” (by protecting intellectual property, ending mandatory technology transfers, stopping corporate subsidies and ending the foreign capital discrimination). Taking this step would add $135 billion to the annual expenses of US importers of Chinese goods. If all of this additional cost is passed on, the resulting price increases would be equivalent to 0.8% of annual US consumption. If prices stay high for two years, it would raise annual inflation by 0.4 percentage point. However, the negative impact on US consumers would very likely be greatly reduced by price cuts by Chinese exporters, a weaker Chinese yuan, the transfer of production from China to other countries and other activities.

The $135 billion additional cost of imports also means an increase in US government revenue by the same amount. This supplemental tariff income could be used to fund measures to offset losses of US companies and others caused by the trade war. Any Chinese retaliatory tariff hikes would have only a minimal effect on the US economy because annual exports to China of $121 billion are equivalent to only 0.6% of the US GDP. The United States may even use monetary easing to offset the effects of the trade war. For these reasons, from the US standpoint, the trade war does not pose the risk of triggering a serious economic downturn.

A 25% tariff and plunge in US-bound exports is too much for China to bear

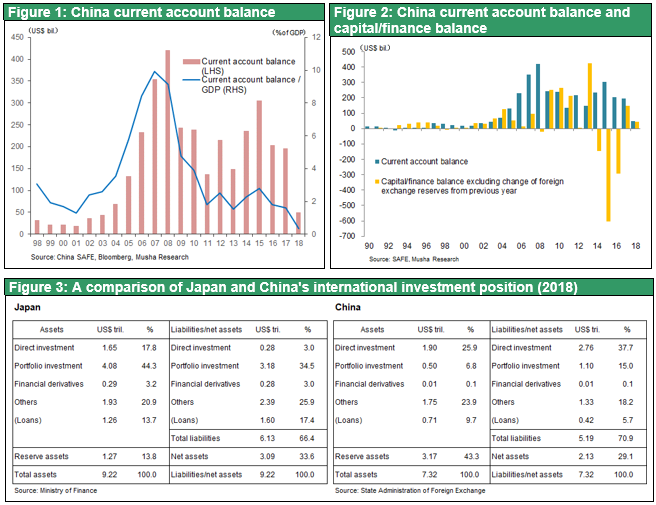

Unlike in the United States, higher tariffs will have a severe impact on China. President Trump is probably correct to say that China cannot withstand a 25% tariff. Although the United States accounts for only about 20% of China’s exports, China has an enormous US current account surplus of $401.1 billion (equivalent to 2% of the US GDP). In 2018, China had a total current account surplus of $49.1 billion (trade surplus was $395.2 billion, including a surplus of $419.3 billion with the United States alone). Clearly, China is almost entirely dependent on exports to the United States for earning foreign currency. A sharp drop in exports to the United States would quickly create a foreign currency shortage in China.

China’s two options for using foreign currency for retaliation are dangerous

Although China has the world’s largest foreign currency reserves, the country relies on foreign capital for about half of these reserves. As a result, China’s foreign currency situation is remarkably fragile. For many years, China’s capital inflows were enormous. But inflows have fallen sharply since 2015 and now there are potential problems involving foreign currency. Consequently, China cannot allow its US trade surplus to fall significantly and will have to give in before tariff increases affect the real economy. A big drop in the US trade surplus would cause foreign currency reserves to plummet and make it difficult for Chinese companies to procure US dollars. This is China’s Achilles tendon and it must be avoided at all costs.

Due to intrinsic risk involving the procurement of dollars, China cannot use foreign currency in two possible ways shown below because any actions would be too risky. The first possible response to US sanctions is to sell US Treasuries. Selling these holdings would have very little effect on the United States due to the strong demand for Treasuries backed by the large volume of domestic savings and to declining long-term interest rates. But selling Treasuries would be too dangerous for China because of the very high probability of negative effects, such as making it difficult for Chinese companies to procure dollars. The second possible response is a devaluation of the yuan. However, any indications that the People’s Bank of China would allow the yuan to decline would almost certainly spark massive speculative sales of the yuan.

China will have to give in while preserving its dignity

The most likely outcome of the trade war is that China will ask for a tariff reduction after accepting US demands and agreeing to enact measures for ending its unfair activities. At some point, China will no choice other than to make a big reduction in its US trade surplus. But a sharp drop in this surplus right now would create a big crisis. This is why China’s only option is to compromise in order to prevent this crisis from starting.

Investors’ worries about how the Chinese government will deal with the trade war have increased significantly. When sanctions were imposed on Huawei, China responded by limiting the supply of rare earths and starting an anti-US campaign. The outlook for an agreement between the US and Chinese presidents is becoming increasingly uncertain. However, President Trump has a reputation as a dealmaker, so an agreement may be reached. The outlook for the Chinese economy will change dramatically depending on prospects for reaching an agreement.

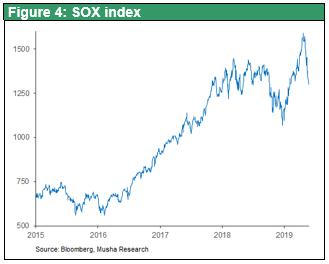

Preventing China’s ability to use a free ride to become more powerful is the objective of the United States. The goal is not the destruction of the Chinese economy. That means a big economic upturn is likely to occur after China accedes to US demands. Once an agreement is reached, the accord could even create more demand. Capital expenditures in China largely came to a halt at the end of 2018 because the trade war made it difficult to determine an outlook for the economy. But at this point, there is almost no risk of a decline in final demand in the United States and China, which has been a source of concern. Therefore, a temporary halt to investments would raise the possibility of a tight supply-demand balance in the future because fewer investments would slow the growth of the capacity to supply goods. The powerful rebound of 40% in the PHLX Semiconductor Sector Index (SOX) since its Christmas 2018 bottom and consistently strength since then may due in part to factoring in

the possibility of an upcoming tightening of supply and demand. If there are increasing signs of an upturn in the US and Chinese economies, the economies of countries like Japan, Germany and Korea that export goods to these two countries will also improve.

The worst-case scenario has been largely factored in

As the US-China battle for trade and hegemony becomes heated, the two countries have no choice but to move up their stock prices, thereby creating credit and expanding demand, and as a result, increasing their global economic presence. US and Chinese stock markets staged powerful rallies during the first four months of 2019 based on expectations for trade talks to reach an agreement. Although no agreement is likely for the time being, stock prices will probably start climbing again if there is a US-China trade accord. For these reasons, the outcome of the trade war will not be a global economic downturn and drop in asset prices. The most likely outcome is a positive effect on stock prices and the economy.

Punitive tariffs and Huawei sanctions are probably the end of the resumption of US hardline tactics for now. Investors can largely visualize the worst-case scenarios for these two actions and global stock prices now reflect the possibility of these scenarios. If this is true, shouldn’t investors reach the conclusion that stock prices have fallen to a major bottom?