Jul 04, 2019

Strategy Bulletin Vol.228

South Korea export restrictions highlight Japan’s superior position in the int'l division of labor

- The competitive edge of products only Japan can supply

(1) The growing strength of Japan’s “only one” products

The ability to supply scarce products has become critical to success in a world where the division of labor among countries involves countless mutually dependent relationships. In conjunction with the US-China trade war, ARM has suspended the provision of technology that is essential for the design of semiconductor devices to Huawei. This action is making it very difficult for Huawei to develop new products.

The shift in the Abe administration’s trade stance regarding South Korea

Japan recently stopped preferential treatment for exports to Korea of fluorinated polyimide, hydrogen fluoride and photoresists. These products are vital to the production of semiconductor devices and organic EL displays. Pushing Korea to take actions to resolve the problem involving wartime forced labor is the goal of these moves. If Korea fails to act, Japan may expand export restrictions a second and perhaps even a third time. Japan supplies more than 90% of the world’s fluorinated polyimide, hydrogen fluoride and photoresist. Without these critical materials, companies in Korea will be forced to halt the production of certain items. However, there are concerns about damage to Japanese companies as orders from Korea fall for other parts and materials used to manufacture these items.

On the other hand, stopping production in Korea could shift the output of these items to companies in Taiwan and China. Higher demand for Japanese parts and materials could therefore offset a downturn in Korea. As a result, Korea must face the reality that materials, parts, machinery and other goods made by Japanese companies are creating a bottleneck in Korea’s output of semiconductors and smartphones. Korea and China are the world’s primary suppliers of these two products. Furthermore, northeast Asia is the world’s only manufacturing cluster for smartphones, televisions, PCs, LCDs, semiconductors and other high-tech products. The reason is that Japan accounts for the majority of the supplies of many critical products. This is why Japan is the nucleus of this manufacturing cluster. Products made in Korea, Taiwan and China can generally be replaced by products from companies in other countries. But Japan is a supplier of items that no other country can produce.

Supplying “only one” products gives companies pricing power and therefore higher profitability. In the past, Japan lost the price wars for smartphones, semiconductors and other products. Japan responded by becoming a supplier of scarce, “only one” products in many market sectors that require outstanding technologies and quality. Now the competitive strength of these products is becoming even greater due to their critical roles in the creation of products for 5G telecommunications and the age of the IoT. Japan’s superiority within the international division of labor is therefore likely to become even more pronounced as a result.

High-tech bargaining power is the reason for Japan’s increasing clout

Japan has joined the United States in turning its back to free trade, a step that is both surprising and disappointing. Many people are worried that Japan’s action may trigger enormous side effects. In a July 2 Wall Street Journal article titled “Trump Goes to Japan and Japan to Him,” Walter Russell Mead says that Japan’s decision to mix politics with trade marks a dramatic shift in national strategy. “Since regaining sovereignty after World War II, Japan has been among the most reliable supporters of the rules-based multilateral world system. Tokyo’s willingness to walk away from the constraints of the old system suggests that, from Japan’s viewpoint, the Age of Trump marks a transition, not an interlude.”

It is impossible to say whether or not Japan has made a policy shift on a historic scale. Japan’s position is that simply terminating the preferential treatment of exports to Korea is nothing more than a revision within the boundaries of WTO rules. However, even though there are legitimate reasons for Japan’s action, this is the first time in the postwar era that Japan has used economic sanctions and intimidation in an attempt to solve a political problem. Consequently, this move is certain to be regarded by other countries as the beginning of measures by Japan to increase its global clout.

Japan’s action has significant political ramifications. Nevertheless, another key fact is that Japan is establishing a position that allows using economic intimidation to influence other countries. For many years Japan was the target of economic intimation, primarily in the form of US-Japan trade friction and the prolonged strength of the yen. Today, advanced technologies give Japan a very powerful bargaining chip. At some point, the world will come to understand the enormous significance of Japan’s advantageous position.

(2) The idyllic division of labor in the 20th century

As Mr. Mead stated, the “transition or interlude” question is critical. Is the Trump administration’s America-first stance only a temporary phenomenon? Or does this policy signify the start of a turning point in the multilateral world system? Musha Research believes that the global economy is moving farther and farther away from a world order based on idyllic free trade.

The US double standard: Free trade and managed trade

There was consistent Japan bashing during the Reagan, Bush and Clinton administrations. Liberalism absolutely cannot be regarded as the strategic trade doctrine that created the theoretical background for this bashing. Japan did not file complaints with the WTO or resist this bashing in other ways. The country meekly accepted this treatment. This allowed the United States to continue using the double standard of free and managed trade. Now, the United States is also trying to use political intimidation to China, where the economy has grown rapidly due in part to unfair activities. These points lead to two questions. First, why must the United States insist on a double standard? Second, can this double standard be justified from the standpoint of US national interests?

To answer these questions, we need to first of all realize that a drastic change has occurred regarding the premise of classical idyllic free trade, a belief that continues to be accepted by many economists and journalists. The reason is that a fundamental change has occurred in how the international division of labor functions.

Industrialized countries in the 20th century where free trade functions

The unit labor cost and foreign exchange rates were the decisive factors for the international division of labor until the end of the 20th century. These are the chief reasons that Japan came out ahead of the United States and then lost its position to Korea, Taiwan and China. Labor and exchange rates are key factors in a world of horizontal labor division, which means countries share the same product categories. The economics of free trade tell us that this environment should create win-win relationships as individual countries specialize in industries where they have a comparative advantage.

The theory of comparative advantage was created in the 19th century by British economist David Ricardo. For example, even if Britain is superior to Portugal regarding the production of both clothand wine (an absolute advantage), Britain should specialize in cloth and allow Portugal to supply wine. The two goods would then be traded back and forth. Let’s assume that cloth production is 4 tons per worker in Britain but only 1 ton in Portugal and wine production per worker is 3 kiloliters in Britain and 2 kiloliters in Portugal. We also assume that Britain and Portugal both have a labor force of 30,000. If both countries use 20,000 for cloth and 10,000 for wine, the total output is 100,000 tons of cloth and 50,000 kiloliters of wine. But if all 30,000 are used for cloth in Britain and wine in Portugal, production rises to 120,000 tons of cloth and 60,000 kiloliters of wine. Consequently, the two countries would become more affluent by exporting cloth and wine to each other.

The next question is why Britain, which has high productivity, benefits from importing anything at all from Portugal, which has low productivity. The answer is that Portugal’s low wages or weak currency allow the country to produce goods more cheaply than in Britain. Due to price competition with British cloth, wages in Portugal, where cloth industryproductivity is only one-fourth that of Britain, should fall to one-fourth of British wages. However, Britain should import wine from Portugal, even though this is an industry where productivity in Portugal is two-thirds of that in Britain. This is because Portugal’s wages are an even smaller one-fourth of the British level, which means Portugal can produce wine at a lower cost than in Britain.

A world where the laws of one price and factor price equalization function

In an ideal free trade environment, the law of one price will function worldwide and, as a result, identical factors of production (unit labor cost, which is the cost of labor divided by productivity, for example) will be equalized. A doubling of productivity in a country will cause wages to double as well. The result is an equalization of unit labor costs on a global scale.

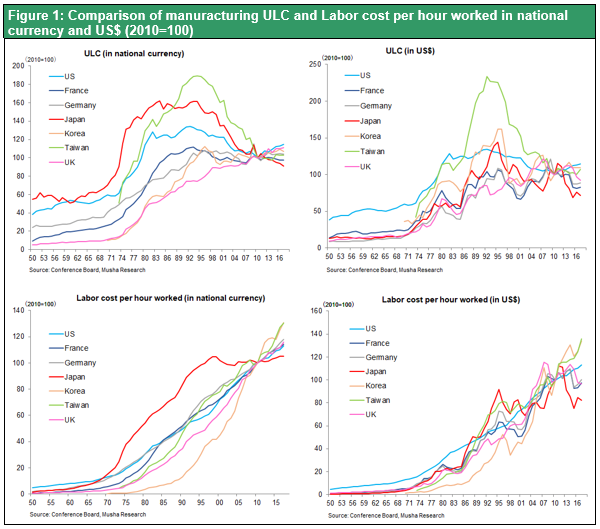

As you can see in the figure, the labor markets of industrialized countries are basically consistent with the law of one price. People receive the same wages for the same level of productivity. Boosting wages without a corresponding improvement in productivity will trigger higher inflation that weakens a country’s currency. This process will cause wages to revert to the global average. In addition, the appreciation of a country’s currency without a corresponding improvement in productivity will lower wages in that country to bring wages in line with the global average.

The persistent strength of the yen between about 1990 and 2012 exerted consistent downward pressure on wages and made Japan the only country in the world that was mired in deflation. In general, fluctuations in exchange rates stay within roughly 30% of a currency’s purchasing power parity. But the yen at one point climbed to an abnormal valuation that was twice its purchasing power parity. As a result, the wage cost of Japanese companies had doubled compared to the international level. To offset the yen’s strength, Japanese companies had to cut their workforces, shift to hiring temporary workers, move operations to other countries and take other actions. Taking these actions dramatically lowered the cost of labor and allowed Japanese companies to remain competitive, although just barely. However, the wages of Japanese workers were sacrificed to accomplish this feat. In fact, the multi-year decline in wages is what brought about Japan’s deflation.

We are probably correct to conclude that the yen’s strength is responsible for the big drop in wages in Japan even though Japan’s productivity improved faster than in most other countries. This figure shows a comparison hourly wages in dollars and local currencies and the unit labor cost for manufacturers. As you can see, dollar-based wages in Japan increased significantly even though yen-based wages fell considerably. The higher dollar-based cost of labor is what held back Japan’s ability to compete.

(3) Division of labor in the 21st century and the importance of government policies

Big changes in the 21st century

The international division of labor, which has justified free trade as was explained earlier, has become very different in the 21st century.

- Countries are now focusing on specific industries. As more countries specialize in certain product categories, price competition with other countries has largely disappeared. For instance, the four northeast Asian countries account for almost all of the world’s production of high-tech products. Also, the United States and China dominate the internet platform. Price competition no longer exists in these types of environments.

- Fixed expenses have become by far the largest component of expenses for high-tech products, software and other products using advanced technologies. Higher fixed expenses mean that cumulative investments in the past (R&D, sales network, acquisitions) are the majority of a company’s expenses. Companies have almost no exposure to variable expenses, which are vulnerable to macroeconomic factors like wages, inflation and foreign exchange rates. Low exposure prevents macroeconomic policy moves from producing any benefits at all. Once a country becomes a high-tech powerhouse, no other country can take away this position regardless of how much the powerhouse country’s currency and wages climb. This is a business environment defined by hysteresis (long-lasting benefits from past events) and increasing returns. Moreover, ending this winner-takes-all environment will not be easy. This is why government policies are becoming a decisive factor regarding fixed expenses.

- The international division of labor for production processes within companies has become widespread. For instance, a company may use Singapore to process a US database, package the final product in Japan and then sell it in Europe. Allocating added value among different countries depends on the prices a company sets for internal operations in these countries. Companies generally assign almost all of added value to their home countries.

- All processes directly using labor are becoming automated. Due to AI and robots, companies no longer need to build factories in emerging countries with low wages. Mother factories now fulfill vital roles. But the United States cannot benefit from AI and robots because of the country’s relatively small number of producing lines. This probably explains importance the Trump administration (Peter Navarro and others) places on manufacturing. Companies require the expertise to properly structure production processes. Japan ranks ahead of all other countries regarding this know-how.

Due to these shifts in the international division of labor, cumulative past investments and hysteresis have become critical to the success of businesses.

Mercantilism requires new ways of doing business

Producing hysteresis benefits will demand political and mercantilistic support. During the 1980s, Japanese companies caught up with the United States in the computer and semiconductor sectors. An R&D organization encompassing many companies, with the predecessor of the Ministry of Economy, Trade and Industry and NTT playing central roles, made a big contribution to this accomplishment. Korea and Taiwan imitated Japan’s initiatives, such as public-sector investments, subsidies and support to develop new industries, but on a much larger scale. China used state capitalism for a national project that achieved the remarkable growth of high-tech companies. The project was very successful, as is evident in the speed at which Huawei grew. China’s overbearing use of its economy to increase state power has placed the country in an extremely advantageous position. President Trump’s policies and trade friction were inevitable actions in order to counter China’s actions.

Japan’s extremely advantageous position in the division of labor

Establishing an international division of labor among a company’s production processes has become the standard business model in high-tech industries. To succeed, this business model requires a head office where almost all of the added value can be allocated. Furthermore, the importance of the cost of labor is steadily diminishing. The positions of countries that specialize in labor-intensive industries will become increasingly weaker and their currencies will decline. Many emerging countries are moving quickly to shift emphasis to high-tech industries in order to avoid this problem.

The points covered in this bulletin clearly demonstrate that the classical free trade theory is no valid. Based on their faith in free trade, the majority of economists are critical of President Trump’s trade policies. But these same economists have no ideas of their own about what to do because of their superficial understanding of new international division of labor and business models in the 21st century.