Aug 19, 2019

Strategy Bulletin Vol.231

Pain in global financial markets is good news

- Turmoil will trigger new policies and a big market reversal

The banking business will no longer be viable in Japan and Europe

The US-China trade war alone will probably not be enough to start a worldwide recession. Furthermore, Brexit and the Hong Kong demonstrations are likely to end with economically reasonable conclusions. There are suspicions that President Xi Jinping intends to transfer Hong Kong’s economic functions to Shenzhen by prolonging the demonstrations in order to weaken the Hong Kong economy. China is unlikely to use military force in Hong Kong.

The real crisis is the possibility of international financial markets becoming dysfunctional. A variety of negative events could trigger a negative financial cycle. If this happens, the worst-case scenario could become a reality. But is this a significant risk?

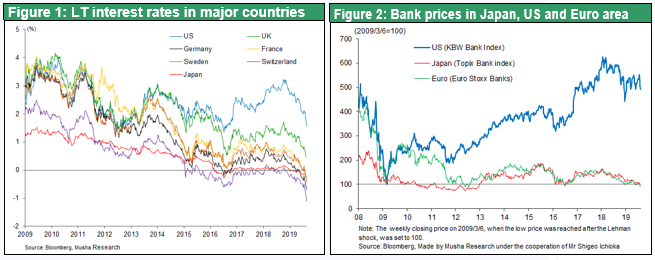

As you can see in Figure 1 and 3, long and short-term interest rates in Japan and Europe have converged as both rates fell to almost nothing. Banks’ interest rate margins have become completely flat or even reversed. Banks are no longer able to generate profits from deposits and loans or from bonds. In this environment, banks have switched from risk takers to a stance of avoiding all risk. Banks have been the worst performing category of the stock market, especially in Japan and Europe. Some bank stocks have fallen below their lows during the global financial crisis, which clearly demonstrates the seriousness of the current situation. Only in the United States are interest rates functioning normally. For now, US bank earnings are still strong. However, people are wondering if the United States will be able to avoid becoming like Japan and Europe with zero interest rates. During the past few weeks, long-term interest rates have fallen sharply worldwide and the US yield curve has become upside-down. Fears are growing about possibility of the Japanification and Europification of the United States. This issue is now the center of attention and is certain to be the most important theme of the upcoming Jackson Hole economic policy symposium.

The gamble by investors on higher bond prices justifies large-scale political initiatives

Today’s Alice in Wonderland environment clearly signals the death of banks, which have long been the nucleus of the financial sector. A deep recession or even a depression is certain to begin if nothing is done. This is why there will undoubtedly be actions to end this situation. But exactly how can a crisis be averted?

In Germany, the 10-year government bond yield has fallen to negative 0.7%. Holding these bonds to maturity will always result in a loss. One possible reason to buy these bonds is to attempt to earn short-term profits by using differences in currency hedge expenses or other techniques. The only other conceivable reason to buy these bonds is the expectation for a further drop in the yield. An editorial in the August 17 Financial Times reported that a bank in Denmark has started offering the world’s first mortgage with a negative interest rate. That means the principal will decrease over time. The editorial stated that the overturning of relationships between borrowers and lenders and between investors and businesses is a sign of an impending crisis. The Financial Times goes on to say that there is an urgent need for fiscal initiatives because nothing more can be done by relying on monetary policies.

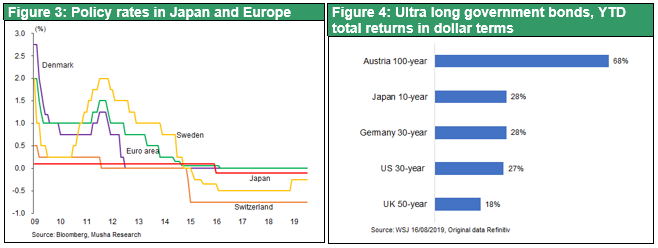

Most significant of all is the abnormal upturn in prices of ultra-long bonds (drop in yields). On August 16, the Wall Street Journal reported that a mood of gambling is prevailing ultra-long bond markets. Since the beginning of 2019, dollar-denominated total returns are 68% for the Austria 100-year bond, 28% for the Japan 40-year bond, 28% for the German 30-year bond, 27% for the US 30-year bond and 18% for the British 50-year bond.

Gambling may also be behind the higher price of gold. During the past two major gold bull markets (1980 and 2011), the dollar was falling and US long-term interest rates were climbing. But now the dollar is appreciating as these interest rates decline. The loss of confidence in the dollar that usually occurs when the usefulness of gold as an alternate currency increases is not taking place at all this time.

Perhaps panic (or speculative selling) is responsible for the volatile market, sharp rise in bond prices, plunge in stock prices and upturn in gold prices, which were all instigated by bond markets. If so, then some news that eliminates even a small concern and particularly the announcement of a new policy, could spark a powerful market rebound. The following four questions are critical with respect to this outlook.

1) Can the United States avoid Japanification and Europification, where zero interest rates would slash bank earnings and prevent banks from taking on risk? Answer ➞ Very likely

The US economy is healthy and most people believe the Fed’s bold interest rate cuts will prevent a recession. As a result, the likelihood of a further decline in long-term interest rates is small. Furthermore, short-term rate cuts will probably end the yield curve reversal quickly. Consequently, very few people think the United States will become like Japan and Europe unless there is some type of severe shock that does not involve the economy.

First, US economic indicators and economic sentiment are sound. (July retail sales were up 0.7% compared with the consensus forecast of 0.3% and second quarter productivity improved 2.3%, far above the 1.4% consensus outlook. In addition, the recent growth rate of bank loans and M2 has increased to more than 5%. Also, consumer sentiment is still high even though a decline is anticipated in August because of lower stock prices and July’s 0.2% decrease in production due to the trade war).

Second, Warren Buffet is placing bets on financial stocks. On August 16, the Wall Street Journal reported that Berkshire Hathaway’s financial sector weighting has increased from 12% at the end of 2010 to 20%. Berkshire Hathaway is the largest stockholder of most large US financial institutions and financial related companies (Bank of America, Wells Fargo, American Express, U.S. Bancorp, Moody’s). These investments clearly show Mr. Buffet’s stance regarding the risk of the Japanification and Europification of the United States.

Third, a virtuous cycle is emerging as people refinance their mortgages in response to declining interest rates. This is a demonstration of the vigor of US financial markets.

Fourth, we are starting to see signs of the end of the slowdown of China’s economic growth, which has been the epicenter of the decline in global economic expansion. Crude steel output in China this year is 10% higher than in 2018, a much faster growth rate than in recent years. This is a sign of a high level of infrastructure and other investments. Moreover, Alibaba and other e-commerce companies continue to do well and government measures to support automobile sales will probably end the prolonged decline of these sales soon. Taiwan Semiconductor Manufacturing, the world’s largest semiconductor foundry, expects double-digit sales growth because the semiconductor inventory surplus was largely eliminated by the end of the first half of 2019. This indicates that the worst of the high-tech sector downturn is probably behind us. For exports, a big source of concern, China is offsetting the drop in shipments to the United States with exports to the ASEAN region. In July, China’s exports increased 3.3% following the 1.3% decrease in June. These numbers show that China is avoiding the slowdown in economic growth that people have been worrying about.

2) The possibility of policy measures in countries other than the United States ➞ Worldwide monetary easing and fiscal initiatives in Britain and Germany and perhaps Japan as well starting in October or later

First, countries worldwide are stepping up monetary easing. After the Fed’s interest rate cut, India, South Korea, Brazil, Thailand, the Philippines and many other emerging countries reduced rates, too. There is no doubt that the Fed and ECB will enact even larger monetary easing measures in September. At the ECB, there has never been a more positive mood regarding accommodative policies. Now that the dovish Christine Lagarde is the president, the influence of hawkish Germany is weakening because of negative economic growth in Germany.

Even the Bank of Japan may surprise financial markets. The bank now has much more room to maneuver because of the global deflation crisis and falling interest rates. The ECB’s floor policy rate of negative 0.4% is far below the negative 0.1% of the Bank of Japan. The ECB is considering a further rate reduction and there are growing calls for the ECB to expand its purchases to include ETFs. Due to these developments, the BoJhas much more flexibility regarding rate cuts farther into negative territory and buying ETFs. The result could very well be monetary easing initiatives that surprise financial markets.

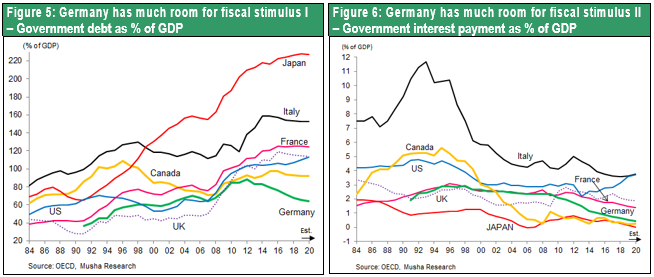

Germany has been the primary cause of economic weakness in Europe. Calls for fiscal measures to support the economy are increasing following the announcement of a 0.1% GDP contraction in the second quarter of 2019. News reports of German government officials considering more spending have alone pushed up interest rates worldwide. This demonstrates the very high expectations in financial markets about the German government’s fiscal policies. Germany has maintained a budget surplus every year since 2014. No other country warrants higher expectations because of Germany’s enormous capacity to increase spending, as shown in Figure 5.6. In Britain, Brexit will free the country from the EU’s fiscal restrictions. This may result in tax cuts and more spending. In the United States, the suspension of the debt ceiling gives the government the ability to make repeated infrastructure investments and tax cuts along with other actions. Japan will probably think about similar actions after the October 2019 consumption tax hike. China is also likely to consider expansionary fiscal policies.

3) Why did the financial system stop functioning = The banking system is unable to recirculate to society the strong earnings and excess savings of companies

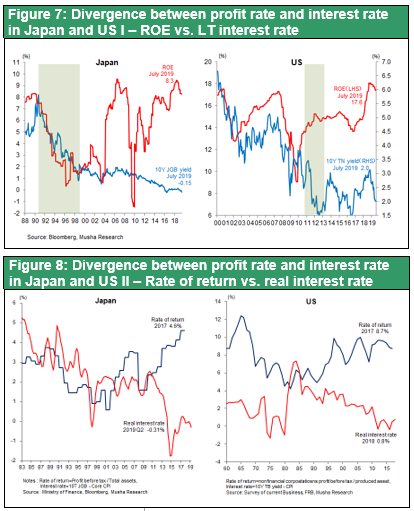

Musha Research believes that the root cause is the steady widening of the gap between profit margins and interest rates during the past decade. The globalization and the IT revolution has produced constant earnings growth. At the same time, there was no longer anywhere for the global surplus of savings to be put to use. Excess savings accumulated in debt instruments and were not channeled to equities, which are generating high returns. Actions are needed to set free this massive amount of capital that has accumulated in debt markets. There are only two ways: shift this money to stocks or use fiscal policies to put excess savings to work. In both cases, government policy initiatives will play a decisive role.

4) What about stock prices and risk-taking? Everything depends on government policies.

President Trump obviously places considerable importance on stock prices. During an August 14 conference call with the heads of three banks, the president received advices about the outlook for the stock market. Depending on the upcoming direction of stock prices, President Trump would probably be open to compromising at trade negotiations and increasing spending, including for infrastructure projects.

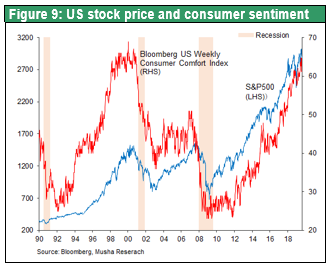

Stock prices are what determine consumer sentiment. Consumption which accounts for approximately 70% of US GDP is strongly influenced by stock price movements. Therefore, consumption will not weaken as long as stock prices can be kept at the current level.

We wonder all of these points lead the conclusion that the policies of President Trump were on target again.