Oct 11, 2019

Strategy Bulletin Vol.234

What is China’s strategy for overcoming its crises as the trade war continues?

Real economic growth has consistently been above 6% in China, a country with a population of 1.4 billion. But the United States, with a population of about 300 million, is content with a growth rate at the 2% level. Although low, this pace of economic expansion is still much higher than in other industrialized countries. At this rate, China’s economy will surpass the US economy about 10 years from now. Where is the US-China trade war headed? This report examines the conflict by focusing on the following three points:

(1)Why was China able to expand its economy so rapidly? I believe this was the result of three rare circumstances that happened to coincide.

(2) Why is China now facing such serious difficulties? The cause is linked to the country’s excessive success in the past.

(3) Is there some miraculous way for China to revive its economy? I believe the only way is more activities in other countries, such as the One Road One Belt initiative, and achieving global high-tech hegemony.

(1) Three factors behind China’s abnormal economic growth

How did China accomplish its remarkable record of economic growth? The explanation is probably the simultaneous occurrence of three factors: the ability to benefit from a shift in the international division of labor; the abuse of the free ride created by the generosity of the United States; and China’s enormous bargaining power in the global economy backed by its massive internal demand. Today, all three have changed and may no longer have any effect.

I. Benefits of the shift in the international division of labor

Nixon Shock ➞ Reliance on exports to the US ➞ Center of Asian manufacturing

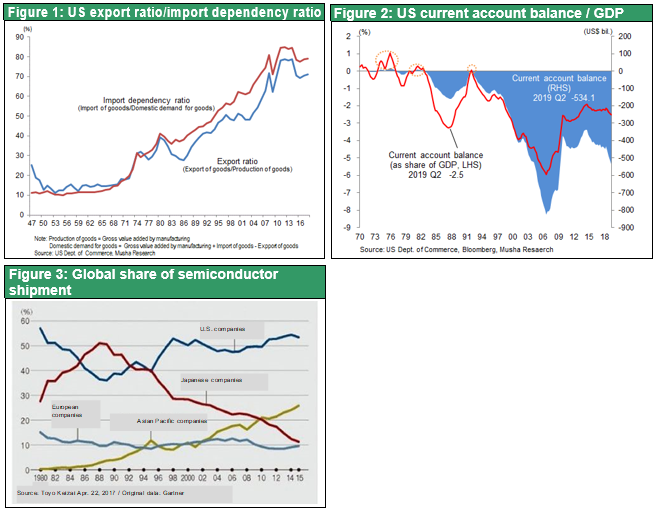

Today’s international division of labor is the result of the Nixon Shock and the flood of dollars worldwide. Until about 1970, the US economy was largely self-sufficient with a reliance on imports of only about 10%. But US reliance on other countries increased rapidly as US companies globalized their operations and the sources of many goods became more diverse on a global scale. US reliance on imports surged to 41% in 1980, 62% in 2000 and 79% in 2018. In the 1980s, Japan emerged as the first major exporter to the United States. Then US imports from Asian NIEs, chiefly South Korea and Taiwan, started to climb. All of these Asian countries achieved economic growth by building economies that were extremely dependent on exports. With the exception of Japan, exports accounted for 50% to more than 100% of GDP. There were three main reasons for this growth: (1) all countries targeted the United States; (2) these countries used US technologies and business models; and (3) the countries’ products had competitive prices because of low wages and advantageous foreign exchange rates. China has followed this successful catch up business model with the largest scale.

II. A free ride because of US generosity

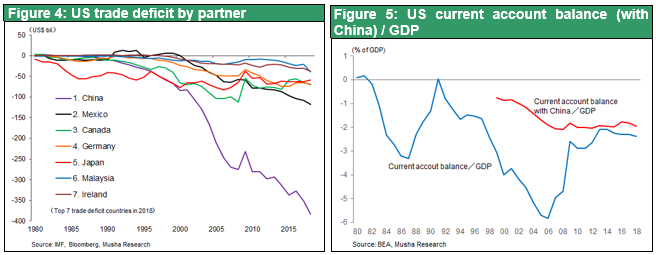

China took advantage of the free ride created by US generosity to the point of abusing this benefit. In 2001, China became a WTO member with the backing of the United States. Joining the WTO allowed China to engage in international trade. In the following years, China used a variety of unfair trade practices to become more and more competitive. Making matters more serious was a huge shift in income to China from the United States. In 2018, China accounted for about half of the entire US merchandise trade deficit, at $420 billion which was equivalent to 2% of the US GDP. China’s enormous income from the United States fueled the country’s internal demand growth (investments and consumption). The series of US tariff hikes on imports from China that began in July 2018 is aimed squarely at these problems. There are five major goals: (1) stop mandatory transfers to China of the technologies of US companies; (2) protect intellectual property rights; (3) eliminate China’s non-tariff trade barriers; (4) stop China’s cyberattacks; and (5) open China’s markets for services and agricultural products. China’s refusal to take any actions regarding these demands is the reason for the apparently endless series of tariff expansions and increases.

III. Massive internal demand and enormous bargaining power

China became the world’s largest market in almost all key industries

China is both the world’s largest market and supplier in most major industries. There are countless examples of vast scale of China’s domestic market. Regarding investments, China produces 60% of the world’s cement and all of this output is used internally. Also, China accounted for 52% of global crude steel output in 2018 with production of 930 million tons (worldwide production was 1,790 million tons). China is also the world’s largest market for machine tools, construction machinery, high-speed railways and rolling stock. Massive internal demand gives China an advantage in terms of its size. Furthermore, the country uses subsidies to sell goods at prices far below those of competitors. The result has been a steadily growing share of global markets, too.

The shift to consumption and rapid rise in living standards are raising China’s stature

Around 2015, China started to shift the focus of its economy from investments to consumption. Rising personal income along with improving standards of living produced a huge consumer market. In 2018, slightly more than 28 million automobiles were sold in China, a significant percentage of global sales of 94.8 million vehicles. By comparison, sales were 17.7 million vehicles in the United States, 5.27 million in Japan and 4.4 million in Germany. China is also the world’s largest market for smartphones, televisions and personal computers. Rising consumption is making services a larger component of the economy. China’s annual tertiary industry growth rate of 8% during the past several years has surpassed the growth rates of the primary and secondary industries. Overall, the tertiary sector has been about 70% of China’s total GDP growth and has increased from 44% of China’s GDP in 2010 to 52% in 2017.

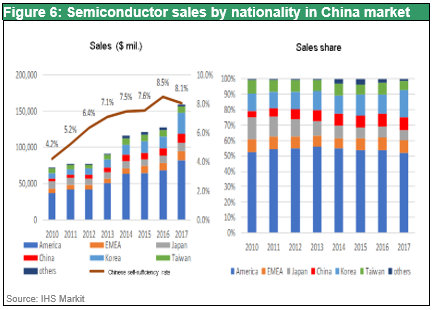

Semiconductors are the only sector with a big overseas reliance

China’s high-tech sector as well has grown to become the world’s largest with the support of massive up-front investments and government subsidies. This growth has altered the composition of global trade in many product categories. China now has overwhelming shares of the global markets for solar cells, surveillance cameras, drones, batteries for electric vehicles and 5G base stations. China’s internet and e-payment companies like Alibaba, Tencent and Baidu have become enormous by monopolizing the domestic market as China shut out foreign companies. They now rank alongside US giants like Google, Apple, Facebook and Amazon in terms of global dominance. Only the semiconductor industry is different. China still relies on other countries to meet 90% of its semiconductor demand. About half of semiconductor imports come from the United States. In addition, China depends on overseas suppliers for parts and materials, including the high-quality, high-tech items made in Japan, that are needed to fabricate semiconductors and other high-tech products.

(2) China’s problem – Excessive success is likely to lead to excessive difficulties

At this point, China’s economic growth rate will probably decline due to the loss of these three “boosters” that raised the speed of this growth in the past. By steadily raising its share of global trade, China became the world’s factory within the international division of labor. But now this excessively dominant position in the manufacturing sector is likely to come to an end for three reasons. First, China is now on the opposite side of the international division of labor as other countries take away its market share. Wages in China are currently higher than in all of the ASEAN member countries. Second, the trade war prevents China from engaging in unfair trade practices. The significant decline in China’s enormous US trade surplus ($420 billion in 2018) will probably bring down the earnings of companies in China. Third, slowing growth of China’s internal demand is likely to erode the bargaining power of Chinese companies. A surplus on the supply side and the growth of debt will probably make it impossible for China to continue increasing investments. Furthermore, consumption-driven economic growth is losing momentum. Demand for home electronics and other consumer products appears to have peaked due to widespread ownership of refrigerators, washing machines, televisions, air conditioners and other durable consumer goods. At 90% to 120%, penetration rates for these products are generally at the saturation point. Moreover, if the growth of credit stops, as I discuss later, there would be a severe impact on consumer spending. Another important point is the decline in China’s working-age population that started in 2012. The total population as well will stop increasing during the next decade. Both of these downturns will have a negative effect on internal demand.

For these reasons, China will have to deal with serious problems caused by (1) overcapacity and too much infrastructure caused by excessive investments, (2) excessive debt and a large volume of problem loans, and (3) a declining current account surplus.

I. Excessive investments

Investments are expenses that can be recognized over many years rather than immediately. As a result, investments can easily drive economic growth. However, relying on the convenient approach of creating demand without any associated expenses means that the expenses will have to be dealt with in the future. Furthermore, investments must generate sufficient returns. Otherwise, these outlays will only produce an increasing volume of non-performing assets.

In China, there are three main categories of investments: capital expenditures, public-sector infrastructure expenditures, and residential and other real estate expenditures. More growth of capital expenditures will be difficult because most manufacturing sectors in China have surplus capacity. In the public-sector infrastructure category, China has built a vast high-speed rail network during the past decade or so. As of 2018, the network had 29,000km of lines, which is nine times more than Japan’s 3,100km of high-speed rail lines. Total debt for China’s high-speed rail network is ¥86,000 billion. Much of this will probably become problem loans because most of these rail lines in China are unprofitable. Consequently, real estate is the only category where investments can increase. But more expenditures raise the danger of an increase in unsold finished properties and falling prices.

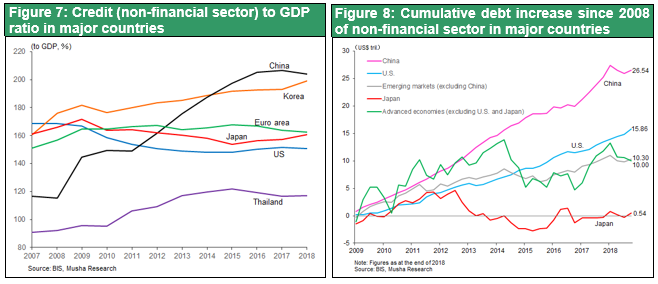

II. Excessive debt

The consequences of China’s accumulation of excessive debt are about to emerge. Rapid economic growth fueled by consumer spending that began around 2015 has greatly increased private-sector financial leverage. Between 2008, when the global financial crisis began, and 2018, worldwide private and public-sector debt increased by $63,240 billion. China alone accounted for $26,500 billion (42%) of this growth. During the same period, debt was up $15,860 billion (25%) in the United States, $10,000 billion (16%) in Europe, $540 billion (0.9%) in Japan and $10,300 billion (16%) in emerging countries except China.

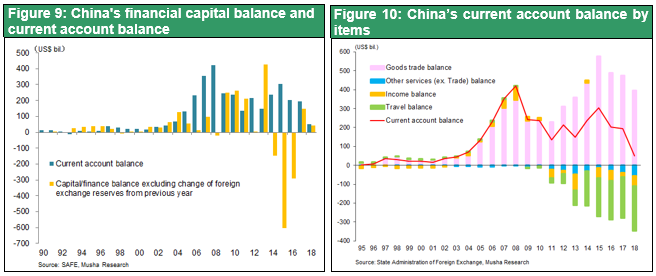

III. The declining current account surplus

China’s current account surplus will undoubtedly become a deficit

China’s declining current account surplus will cause the economy to run out of fuel. A falling trade surplus and sharp increase in the net travel expenditure deficit are bringing down the current account surplus rapidly. In 2018, this surplus was $49.2 billion, 90% less than the all-time high. China may have a current account deficit in the near future as higher wages make Chinese products less cost competitive and US-China trade friction impacts the surplus. If this happens, China’s fragile external balance sheet will be exposed and there would be increasing worries about a drop in the value of the yuan sparked by foreign currency concerns.

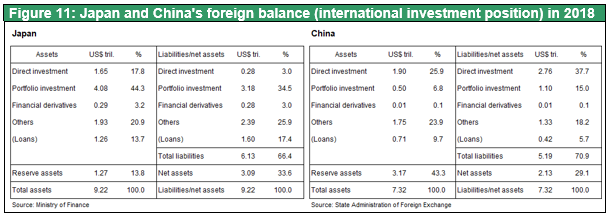

China’s foreign exchange reserves are $3,170 billion. This is the largest in the world and almost three times more than Japan’s reserves of $1,270 billion. However, at the end of 2018, China’s net external assets totaled $2,130 billion, only two-thirds of its foreign exchange reserves. That means one-third of foreign exchange reserves are backed by debt. This is money that cannot be used for emergency payments of overseas obligations. In addition, almost half of China’s large volume of foreign currencies are investments and loans from other countries. These funds could start leaving China if worries about the yuan begin to increase.

Another source of concern is doubts about the liquidity of China’s foreign exchange reserves. Approximately $1,000 billion of these reserves are US treasuries. However, these reserves may also include loans to Venezuela and other assets that cannot be easily sold. China’s foreign exchange reserves fell by about $1,000 billion in two years from a peak of approximately $4,000 billion held in June 2014 amid rapid capital outflows caused by the 2015 China Shock (devaluation of the yuan). These reserves have been generally stable since the second half of 2016 at the $3,000 billion level due to capital controls. However, no one can say with certainty where the danger line for reserves is. In 2015, some people believed that an amount below $2,000 billion would be very dangerous for China.

There is no doubt that China’s foreign exchange reserves are headed in a downward direction. Falling reserves could result in a weaker yuan and a credit crunch within China. There is also the possibility of a chain reaction of events that include 1) defaults on China’s excessive debt, 2) a plunge in real estate prices, which have moved up significantly, and 3) a local government financial crisis caused by falling tax income from gains on real estate sales, the primary source of revenue for these governments. The resulting slowdown of the Chinese economy could trigger a financial crisis.

(3) Can imperialism (One Belt One Road) and high-tech hegemony revitalize China’s economy?

Recent events have clearly exposed the Achilles’ heel of China’s economy. This raises the question of if and how China can eliminate or avoid this problem. Two possibilities exist. The first is imperialism. Global leadership in high-tech industries is the other.

I. Use the One Belt One Road initiative for imperialistic control in order to solve problems by making the yuan a core currency

Why has China abruptly started pursuing a strategy of external expansion? This is not simply to display the country’s power. President Xi Jinping has the dream of transforming China into a global superpower. The growth of overseas markets will be vital to preserving the current regime in China. Overseas markets are needed as outlets for China’s surplus production capacity, as sources of various resources for China, and as channels for China to generate more earnings. Obviously imperialistic expansion has not been a viable strategy since the end of World War II. Therefore, China is attempting to go down a path that has been proven by past events to lead to failure.

Nevertheless, China may be able to use the One Belt One Road initiative to establish an economic zone centered on the yuan. If China succeeds, the country would benefit from seigniorage as the country that issues the region’s key currency. Growth of China’s current account deficit and external debt would directly result in the issuance of more yuan. In this environment, there would be no need to worry about a devaluation of the yuan. If China can replace the dollar with the yuan as the core currency, the Achilles’ heel of China economy would quickly disappear.

II. Aim for a winner-takes-all victory in the high-tech sector

Technological advances over many years have brought China to the point where the goal of global leadership is within sight. If China can establish a competitive edge involving the most advanced technologies, its trade surplus will probably start growing again and there will be no more foreign currency concerns. Furthermore, high-tech superiority will enable China to use the same knowledge for military superiority. The US-China struggle for hegemony is therefore a fight for high-tech leadership.

In the 5G mobile technology sector, China is far ahead of other countries in terms of technologies and competitive prices, with Huawei as the nucleus. Chinese companies are also the global leaders in the smartphone market. As I discuss later, the United States is determined to shut out Huawei from the standpoint of national security. The United States is asking countries to avoid Huawei, but only Japan and Australia agreed. Germany, France and Britain are thinking of using Huawei equipment. Supercomputers are another sector where China is advancing rapidly. The Chinese government is directing various resources to this field with measures such as sector targeting, the payment of subsidies, financial support, and technology alliances spanning the private, public, academic and military sectors. Democratic countries like the United States, Japan and most European countries cannot compete with this type of initiative.

There are already many examples of China’s success with using the winner-takes-all approach in order to dominate global markets. Solar cells, drones and electric car batteries are prime illustrations. Now China plans to use robot AI for further enlarging the scale of this dominance.

III. The front line of the US-China confrontation

China has started to pull ahead of the United States in fields using the latest technological advances. This is why no one should be surprised to see the Trump administration as well as the entire country turn their attention to preventing China from gaining superiority.

The Trump administration is using power to contain China’s high-tech ambitions

The US government has apparently decided to block the activities of Huawei, which has grown to become the world’s preeminent supplier of 5G equipment. Based on the National Defense Authorization Act that was enacted in August 2018, US government agencies are prohibited from buying equipment from Huawei and four other Chinese companies. Furthermore, on May 16, 2019, the US government prohibited US companies from selling any products to Huawei. Panasonic, ARM and many other companies in other countries are also complying with this move.

These actions have made it very difficult for Huawei to develop new products. Huawei says it can create its own semiconductors to replace US-made devices. Huawei owns a highly skilled semiconductor design company called HiSilicon. However, developing new semiconductors will be impossible without access to the technologies of ARM. In addition, although Huawei can still use the Android smartphone OS, which it receives free from Google, Huawei can no longer use Google’s app technologies. As a result, Huawei’s ability to conduct business on a global scale is severely limited.

On October 9, the US government put Hikvision and seven other Chinese companies on a commercial blacklist for human rights violations involving Uighur Muslims and other Muslim ethnic minorities. To exert even more pressure on Chinese companies, the United States could stop take the extreme steps of halting all banking transactions and prohibiting China from using the dollar. According to a Wall Street Journal article on December 21, 2018, HSBC and Standard Chartered have stopped providing global financial services to Huawei and only Citigroup is still serving Huawei.

China’s semiconductor production project is at a standstill

Fabricating semiconductor devices internally is one of China’s highest priorities. However, there has been little progress. Among foreign semiconductor manufacturers, Intel makes semiconductors in Dalian, Samsung Electronics in Xi’an and SK Hynix in Wuxi. Also, TSMC plans to start production at its new Nanjing fab by the end of 2019. Chinese companies are constructing three factories: the DRAM fab of ChangXin Memory Technologies (CXMT) in Hefei, the DRAM plant of Fujian Jinhua Integrated Circuit (JHICC) in Quanzhou and the 3D NAND flash plant of Yangtze Memory Technologies (YMTC) in Wuhan. However, no one can say when construction will be completed. JHICC is prohibited from purchasing equipment from US and Japanese equipment because of litigation alleging illegal copying of the technologies of Micron Technology. Construction of its factory stopped in November 2018 as a result. Construction of the other two factories is also likely to be pushed back as more restrictions are imposed on exports to China of machinery and materials used to fabricate semiconductor devices. The United States is stepping up restrictions on exports of semiconductor production machinery and the transfer of technologies to joint venture in China in order to prevent China from establishing a domestic semiconductor production industry.

Conclusion

China is the world’s largest market in almost every product category and largely controls the direction of the global economy. In the past, there were concerns about China’s growth model due to its overreliance on exports and investments. But now consumption is the main component of this model. An enormous market has emerged in China because of the rapid improvement in the country’s standard of living. Furthermore, economic growth is gradually reducing the gaps between rich and poor and between cities and rural areas. Moreover, the expansion of the service sector has made China a world leader in the internet economy as well.

However, China has paid a high price for these accomplishments. A big increase in debt, quickly decreasing current account surplus and other changes are creating concerns about financial soundness. If China cannot overcome these problems, there could be an economic crisis that results in economic stagnation, a phenomenon known as the middle-income country trap.

There are two keys to overcoming China’s problems. First is high-tech hegemony. China is already the world leader in 5G and other technologies and its AI expertise is on a par with that of Silicon Valley. High-tech may enable China to become competitive in export markets again. The second key is imperialism. If One Belt One Road succeeds in creating a yuan economic zone, China’s debts would be transformed into the issuance of currency, a huge source of money due to seigniorage. China is taking far-reaching actions while compromising and using other measures to prevent the US-China trade war from heating up. China is flexing its muscles as a country with a 3,000-year history, but the United States is standing in the way. The human rights problem in Hong Kong may become the next reason that the United States uses for more measures to contain China.