Oct 15, 2019

Strategy Bulletin Vol.235

The US-China struggle for hegemony is the new normal

– Time to buy Japanese stocks?

(1) A temporary trade war truce with the US exerting immense pressure on China

The temporary truce is just what the United States wanted

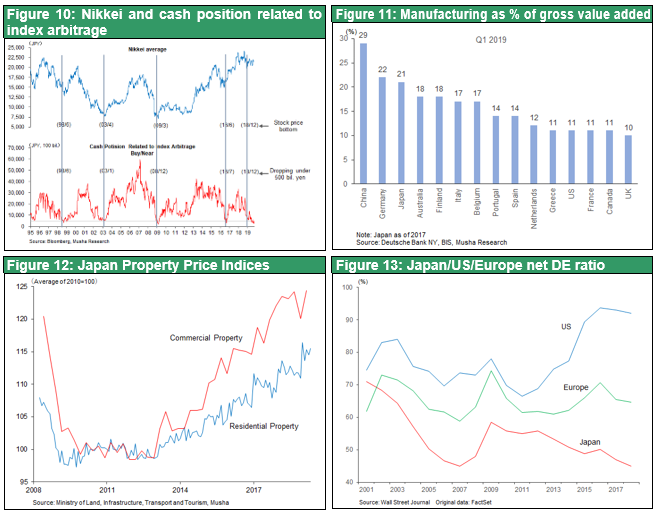

In return for China’s agreement to import US agricultural products worth $40 to $50 billion (according to US sources), the Trump administration has suspended the tariff hike to 30% that was planned for October. There have already been three rounds of tariff hikes that boosted tariffs to 25% on Chinese imports worth about $250 billion. Some people think President Trump gave in to the Chinese because he took this step without any promise from China to end unfair business practices. President Trump certainly wants a big achievement leading up to the next election. The United States appears to have received only a small benefit in return for this truce. However, there has been no US sacrifice at all. The United States is still a threat to China if its trade war concessions are inadequate. Those threats include reviving the tariff hike on the first three rounds and imposing tariffs on the $160 billion of Chinese imports not covered by the fourth round (15% tariff on Chinese imports of $270 billion). At this point, China is expected to give in to US demands. The official signing of an agreement by the US and Chinese presidents is anticipated at the APEC summit meeting to be held on November 16 and 17 in Chile.

The United States has the upper hand

The United States is playing the leading role in trade negotiations. None of the initial US demands have been withdrawn. Furthermore, President Trump has the option of penalizing China repeatedly with tariff hikes if China does not respond to US demands. There is no limit to potential US actions. For example, US-China trade would plummet if the US imposed tariffs of 100% or 200% due to China’s failure to comply with US demands. In this event, China’s economy would quickly collapse and there would be a big (although brief) increase in prices of goods in the United States because of a shortage of goods and the high tariffs.

As a result, the United States will probably punish China only to the extent that there is not a severe impact on the US economy or financial markets. But events of the past year indicate that there will be only a small impact on the US economy and stock prices even if the penalty imposed on China is increased significantly. Stock prices remained near record highs when the tariff on Chinese imports rose to 25% and there are still no signs of a recession in 2020.

Human rights and national security are now used to justify tariffs – The dire position of China

The United States announced new sanctions on China consisting mainly of prohibiting US companies from doing business with Hikvision and seven other Chinese companies. This is in addition to restrictions imposed on Huawei. The reason is human rights violations involving Uighur Muslims and other Muslim ethnic minorities in China. Imposing these sanctions is a severe blow to China. Linking human rights and national security to sanctions on companies allows the United States to target Chinese companies at will in order to inflict serious damage on the Chinese economy.

The Chinese economy will face a crisis if the United States refuses to stop its series of attacks using sanctions. There appears to be no doubt that the pressure on China to concede is even greater than President Trump’s desire for a big accomplishment prior to the 2020 election. At this stage, the trade war has caused China’s imports of US agricultural products to plunge while China’s US trade surplus increased as US companies rushed to buy Chinese goods prior to the tariff hike. But China’s exports to the United States will inevitably start declining and this will probably force China to adopt a more conciliatory stance.

(2) The US-China hegemony struggle is the new normal – Only a minimal impact on the economies of the two countries

The new normal is the US-China struggle for global dominance

A new normal for the world does not necessarily mean that there is also uncertainty. Investments and other economic activity will continue in this environment and the economy will move up and down as usual. In other words, we can expect an economic recovery. The United States has two goals regarding China. First is to stop allowing China to benefit from unfair trade practices. Second is to prevent China from supremacy in the high-tech sector. Furthermore, these goals must be accomplished quickly in order to stop these problems from damaging the US economy. China, on the other hand, wants to gain time by making any progress toward these goals as slow as possible. The new normal will probably speed up the movement out of China of companies with factories in China and companies that rely on Chinese companies for raw materials and other goods. Moreover, China is likely to continue to take actions for stimulating internal demand in an attempt to offset the downturn in international trade.

(3) A worldwide recovery in manufacturing activity will begin in 2020

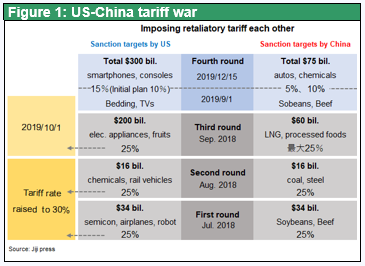

Demand in China largely determines changes in global manufacturing output

The global economic cycle is linked primarily to manufacturing activity that, in turn, is influenced the most by demand in China. The reason is simple: China accounts for the largest share of demand worldwide. China alone accounts for 52% of the world’s crude steel output, far ahead of the second-place country, and has the world’s largest markets for cement, machine tools, construction machinery, high-speed railway systems and railway rolling stock. In 2018, 28.08 million automobiles were sold in China, far more than sales of 17.70 million in the United States, 5.27 million in Japan, 4.40 million in India and 3.82 million in Germany. Worldwide automobile sales in 2018 totaled 94.84 million. China also ranks first in sales of smartphones, televisions and personal computers. Equally significant is China’s per capita GDP of $9,600 in 2018, the upper range for classification of middle income countries.

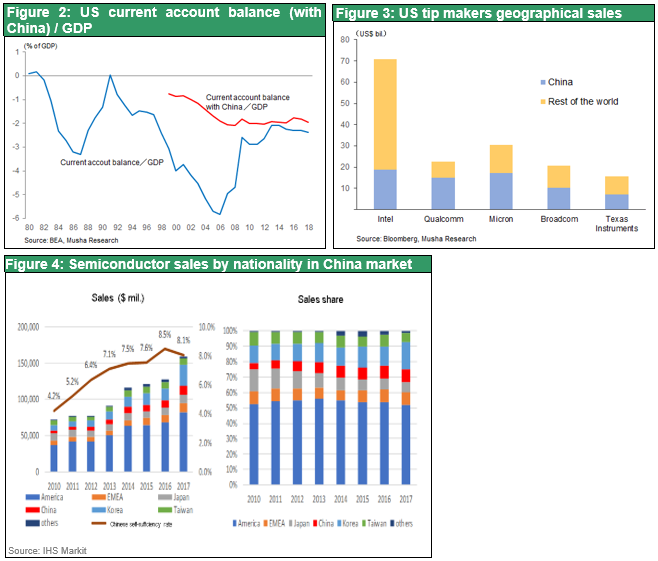

Demand in China will soon stop declining

The weakening of China’s manufacturing sector has been entirely responsible for the downturn in the global economic mini-cycle that started in 2018. Now this decline is about to end. First, the decline in China’s automobile demand, which was the major cause of the economic downturn that began in the spring of 2018, has finally reached the bottom. Also, a big shift is taking place in government policies centered on improving private sector finances and holding down infrastructure investments that had been exerting downward pressure on domestic demand. In addition, rising real estate prices backed by monetary easing will probably boost real estate investments. The second reason to expect an end of the mini-cycle downturn is the imminent decrease in uncertainty regarding the trade war. This uncertainty was a big contributor to the downturn that began in the spring of 2018. Less uncertainty will spark a resumption of investments that had been postponed and new investments in other countries (like Taiwan). The third reason is the start of investments associated with 5G mobile communications and other technologies and the growth of investments to retain a competitive edge, such as for state-of-the-art semiconductors. Illustrating this trend is TSMC’s placement of $7.7 billion of orders for semiconductor manufacturing equipment in the third quarter of 2019, according to an article in the October 10 Electronic Devices newspaper. This is far above TSMC’s recent quarterly pace of $1 to $2 billion. In addition, Samsung Electronics is raising output of semiconductors at its Xi’an plant in China and has announced a plan for expenditures of about 1,000 billion yen for next-generation organic electroluminescence displays.

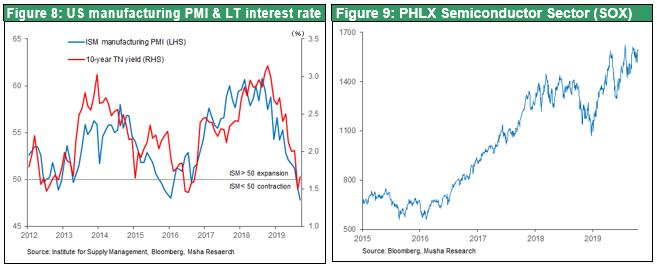

The US mini-cycle too will stop declining

In the United States, semiconductor stocks are at or near all-time highs. No other category of the stock market is more sensitive to changes in manufacturing activity. Strength in the labor market and consumer spending indicate that the US mini-cycle downturn will soon start to stage a rebound. Another positive sign is the likelihood of a return to a normal yield curve due to Fed interest rate cuts. Furthermore, the benefits of monetary easing worldwide are about to begin to appear. All of these factors point to an increase in risk-taking as the end of 2019 approaches.

(4) Is this a big opportunity to make money from Japanese stocks?

A powerful tailwind for Japan

The downturn in the global manufacturing mini-cycle hurt Japanese stocks most of all. No other industrialized country relies on manufacturing more than Japan. For example, manufacturing accounts for approximately half of the total market capitalization of stocks traded on the Tokyo Stock Exchange. This reliance on manufacturing makes the Japanese economy highly vulnerable to economic downturns. This vulnerability is reinforced by the tendency for the yen to appreciate during mini-cycle downturns as investors shun risk. Once the global economy starts to come back, the yen’s decline as investors’ appetite for risk returns will add momentum to the stock market rally in Japan.

Everything about Japanese stocks was negative

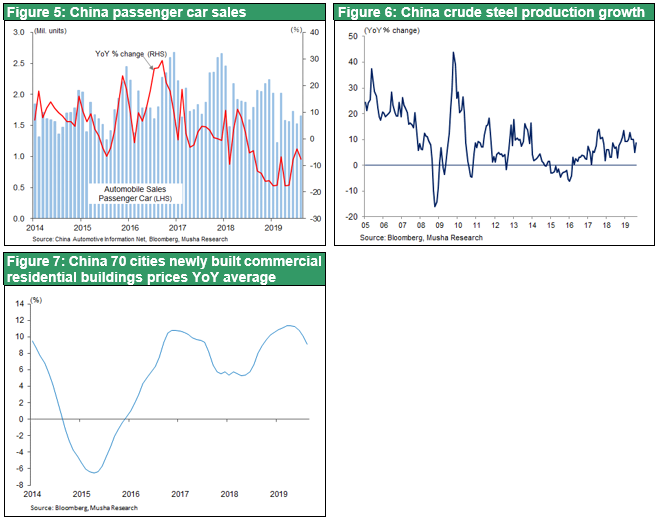

For some time, Japanese stocks languished at historic lows in terms of supply and demand, market sentiment, and valuation. Long arbitrage positions, an indicator of the stances of global investors, were also at a historic low. All indicators were negative. In August, the valuation of Japanese stocks hit rock bottom when the PBR fell to one.

The real estate market may be saying that inflation will speed up

Indications that inflation in Japan is about to increase are beginning to appear. Condominium sales are strong, office building vacancy rates are declining, rents are clearly moving up and real estate prices are increasing. Negative interest rates have increased real estate investment spreads. One result is that REITs are becoming more attractive to investors.

Japan’s prolonged period of deflation was caused primarily by a negative cycle that lasted for two decades. Falling real estate prices brought down rents and, as a broad range of prices fell, wages declined as well. In this environment, Japan became the country with the lowest financial leverage in the world. Deflation, falling leverage and declining purchasing power were all responsible for Japan’s slow growth. Today, Japan is finally on the verge of a dramatic shift in all of these destructive trends.

The low leverage of Japanese companies is proof of their immense potential

As Figure 13 shows, the financial leverage of Japanese companies is lower than at US and European companies. Low leverage means a company has an enormous financial cushion. This makes Japanese companies more resilient to a global recession. Other advantages of low leverage are the ability to capitalize on M&A opportunities and to raise earnings per share by buying back stock. Foreign investors bought Japanese stocks during the first five years of Abenomics but then sold off most of their holdings. Now these investors have most likely reached the point at which their only course of action is to once again quickly raise their weightings of Japanese equities.