Oct 25, 2019

Strategy Bulletin Vol.236

The trade war will be overcome by the power of the industrial revolution

- Reiwa Stock Market Rally Series (1)

Stock markets were ruled by pessimism during the past summer. But now stock prices are slowly making their way over this wall of skepticism. In fact, this pessimism is itself a key condition for the start of a powerful rally. Musha Research believe that stocks in Japan are very likely to stage a rally that propels the Nikkei Average toward ¥30,000. This is the first of a series of reports about the impending Reiwa rally.

(1) A remarkable recovery makes Japanese stocks the world’s best performers

Coming back from extreme pessimism

Japanese stocks have recently given investors the highest return in the world. The Nikkei Average is up by about ¥2,000 (12%) since the beginning of September. In the November issue of Toshi Techo magazine, market analyst Kenichi Hirano noted that the sudden increase in stock prices may be caused by investors covering short positions that accumulated during excessive selling when everyone was pessimistic. There are two reasons for this view. First, stock prices are determined by the balance between the volumes of money and stocks, according to Tachibana Securities founder Hisashi Ishii. Now, amid a surplus of money of a magnitude that rarely happens, the volume of stocks is falling because of stock repurchases totaling more than ¥10,000 billion. The second reason is that the winner in the market is always the minority opinions. Investing in stocks involves either buying and then selling stocks or first selling a stock and then buying it back. In both cases, the second transaction is when investors can earn a profit. When the first transaction is conducted based on the view of the majorities, then who will absorb the enormous amount of energy produced by counter transaction at second phase? It is therefore logical to conclude that only investors who based their first transactions on minority opinions will record a profit when the stock is subsequently sold or bought back.

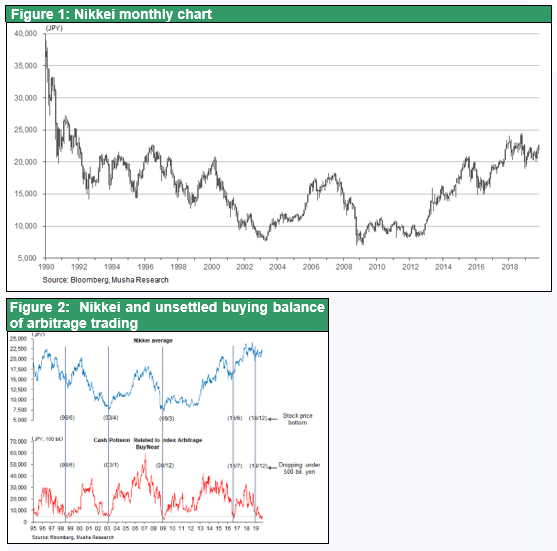

When this rally started at the end of August, Japanese stocks were at rock bottom in terms of supply-demand dynamics, investor sentiment and valuations. Long arbitrage positions, an indicator of the stances of global investors, were at a historic low in Japan. This was a sign that stock prices could go down no lower. Furthermore, the stock market’s PBR around one in August was another sign that valuations had hit the absolute bottom. As you can see in Figure 1, it appears that this is the end of the second downward correction (2018-2019) that has occurred since this prolonged stock market upturn started at the end of 2012.

(2) The semiconductor sector turnaround is leading the rally

Rapid growth of TSMC orders sparks a surge in the company’s investments

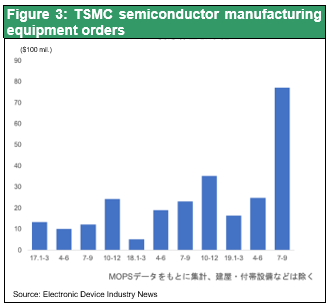

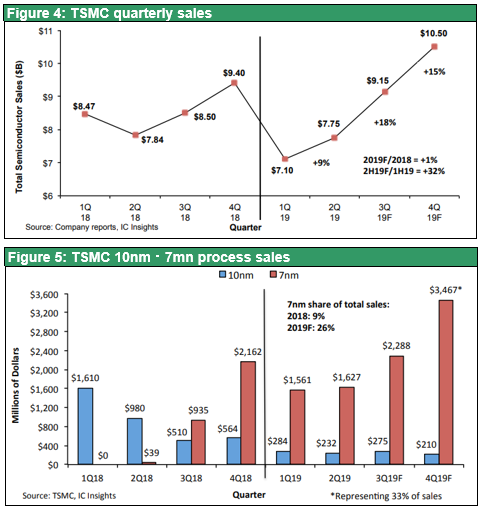

Demand in China has the greatest influence on the manufacturing activity worldwide. At this time, there are still no signs of a recovery in this demand. However, a big change has started in the semiconductor market, which may be a leading indicator of demand. TSMC, the world’s largest semiconductor foundry, has reported a rapid increase in orders received. To fill these orders, the company has started placing a huge volume of orders for production and testing equipment. In an October 18 article in the Nikkei Shimbun, TSMC CEO C. C. Wei stated that he could not have predicted this much growth in semiconductor demand involving 5G mobile communications technology. TSMC has raised its annual capital expenditures for semiconductor machinery and other equipment to $14-$15 billion, which is 40% to 50% more than usual. The majority of these investments are to meet demand for 7nm processors used in Huawei and Apple smartphones and semiconductors used in Huawei base stations. In addition, TSMC is starting to prepare for the production of 5nm semiconductors, which require state-of-the-art extreme ultraviolet (EUV) lithography.

TSMC’s orders for semiconductor production equipment (excluding buildings and associated facilities) totaled $7.7 billion in the third quarter of 2019, according to the Electronic Device Industry News. This is far above the usual quarterly pace of $1-$2 billion. Furthermore, Samsung Electronics announced an expansion of its Xi’an fab and planned investments of about ¥1,000 billion for the production of next-generation organic electroluminescent (OEL) displays. Chinese companies are currently unable to purchase a variety of equipment due to US sanctions. Nevertheless, ChangXin Memory Technologies (CXMT) had already received the equipment it required and has apparently started producing 18-19nm semiconductor devices, which is an outdate technology. According to Tsuneo Murata, president of Murata Manufacturing, “The demand for electronic components has hit bottom and we are seeing the emergence of demand involving 5G base stations, mainly in China.”

Semiconductors will fuel the next upturn in manufacturing

There is still reason to be cautious about the outlook. There is still no recovery in the demand for memory devices. Furthermore, the rebound in demand in China may not last long because of the trade war. However, the trade war brought a halt to investments by Chinese companies in 2019 that had been creating worries about producing an excessive supply. This create tight supplies of various items sooner than expected. In addition, companies have started investing in new technologies like 5G and the IoT. Companies are also beginning to make substantial expenditures in order to remain ahead of competitors in the markets for leading-edge semiconductors and other products. Consequently, many factors that will continue for many years are also supporting the growth of the semiconductor industry.

There are still doubts about whether this pickup in semiconductor demand will continue for a long time or end fairly soon. The answer is clear. Semiconductors have become critical to a broad range of industries just as steel was many years ago. As a result, semiconductors can generate a virtuous cycle in which the demand for semiconductors itself can generate more demand for semiconductors. Falling prices of semiconductors caused by investments in semiconductors and the increasing performance of semiconductors can create more demand for these devices. Furthermore, once an upturn begins it normally gains momentum due to the unique characteristics of the semiconductor industry.

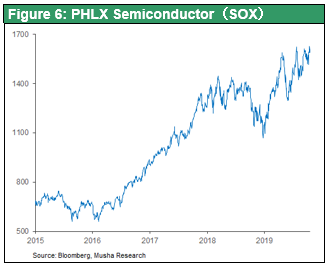

Prices of semiconductor stocks in the United States have been consistently at all-time highs. These high prices may be a sign that the stock market has already factored in this broad-based semiconductor industry strength backed by the growing benefits of the new industrial revolution. China accounts for about half of the sales of US semiconductor companies. Furthermore, China depends on the United States to meet half of its total demand for semiconductors. Consequently, the semiconductor industry is a perfect example of mutual dependence. Semiconductors should therefore be the category that suffers the most damage from the US-China trade war. These points lead to the conclusion that high prices of semiconductor stocks demonstrate that the trade war is not having a significant impact on the semiconductor industry.

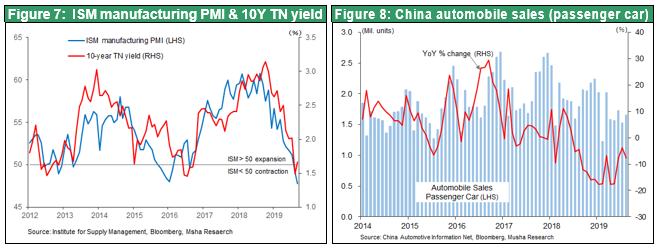

(3) Japanese stocks will benefit greatly from the imminent upturn of the global manufacturing cycle

The downturn in China’s manufacturing sector is entirely responsible for the drop in the global economic mini-cycle that began in 2018. But now this decline is near the end. The first reason is that the semiconductor cycle has hit bottom, as was explained earlier. The second reason is the end of the decline in automobile demand in China and a shift in government policies that were centered on holding down infrastructure investments in order to improve economic soundness. In addition, real estate investments in China will probably increase as monetary easing pushes up real estate prices. The third reason is prospects for the end of uncertainty involving the trade war, which is what triggered the mini-cycle downturn that started in the spring of 2018. Investments in China that had been put off because of the trade war are likely to resume and global manufacturers will probably make new investments in Taiwan, Vietnam and other countries.

Shifting the focus of sanctions to human rights makes China shudder

The shift in US criticism of China to issues involving human rights will probably result in significant progress with US-China trade negotiations. In addition to restrictions imposed on Huawei, the United States has imposed new sanctions on Hikvision and seven other Chinese companies that include prohibiting US companies from doing business with these companies. The reason is human rights violations involving Uighur Muslims and other Muslim ethnic minorities in China. Furthermore, the US Congress has passed the Hong Kong Human Rights and Democracy Act and the bill now awaits the signature of President Trump. On October 24, Vice President Pence gave a speech consisting mainly of criticism of China’s human rights violations. Placing emphasis on human rights is exerting tremendous pressure on China. Linking corporate sanctions with human rights and national security will allow the United States to deal a severe blow to specific Chinese companies at will. A sense of urgency is probably increasing in China regarding concessions to the United States. A statement on October 24 by China’s Vice Minister of Foreign Affairs Le Yucheng revealed China’s consternation: “China has never wanted to challenge the United States or replace the United States. We have no interest competing for hegemony.”

Japanese stocks were the biggest victim of the drop in the global manufacturing sector mini-cycle. No other industrialized country has a greater reliance on manufacturing. In addition, manufacturers account for approximately half of the market capitalization of companies listed on the Tokyo Stock Exchange. This makes Japan vulnerable to changes in the health of the global economy. Japan suffered more damage during the mini-cycle drop because the yen appreciated as investors adopted a risk-off posture. However, if the global economy starts to recover, a weaker yen linked to a shift to a risk-on posture will add more momentum to a Japanese stock market rally.

(4) The strength of Japan’s “only one” technology-centered business model is emerging

Japanese companies will be one of the first to benefit from the pickup of investments by US and Chinese high-tech companies in next-generation technologies as well as from the growth of TSMC’s capital expenditures. This is because companies in Japan are often the sole suppliers of semiconductor manufacturing equipment, semiconductor materials and other vital high-tech products.

Korea, China and Taiwan now dominate key high-tech business categories (semiconductors, LCDs, PCs, smartphones, TVs and other products) where Japan used to have leading positions. But this does not make Japan a loser. Japan has instead concentrated on crucial peripheral categories of the high-tech sector where Japanese companies can be the supplier of goods that no other country can produce. This “only one” strategy gives Japan monopolies in many markets. Competition is intense in the markets for smartphones, TVs and other core high-tech products. The US-China trade war is making this competition even more heated. On the other hand, there is little to no competition in the markets for peripheral products and materials. Japan is therefore in an advantageous position because of its strategy of focusing on these markets.

The Heisei period, which was on the surface a difficult time for Japan, was actually when Japan guaranteed future success by establishing a superior position within the international division of labor. Japanese companies used outstanding technologies and quality to secure “only one” positions in a large number of product categories. The advancement of the division of labor increased the mutual dependence of countries worldwide. In this environment, scarcity is the key to success. Being one of the few suppliers, or the only one, makes it possible to earn more profits by selling at higher prices, which improves the standard of living and economy of countries in this position. Scarcity is precisely what is supporting the strong performances of Japanese companies today.

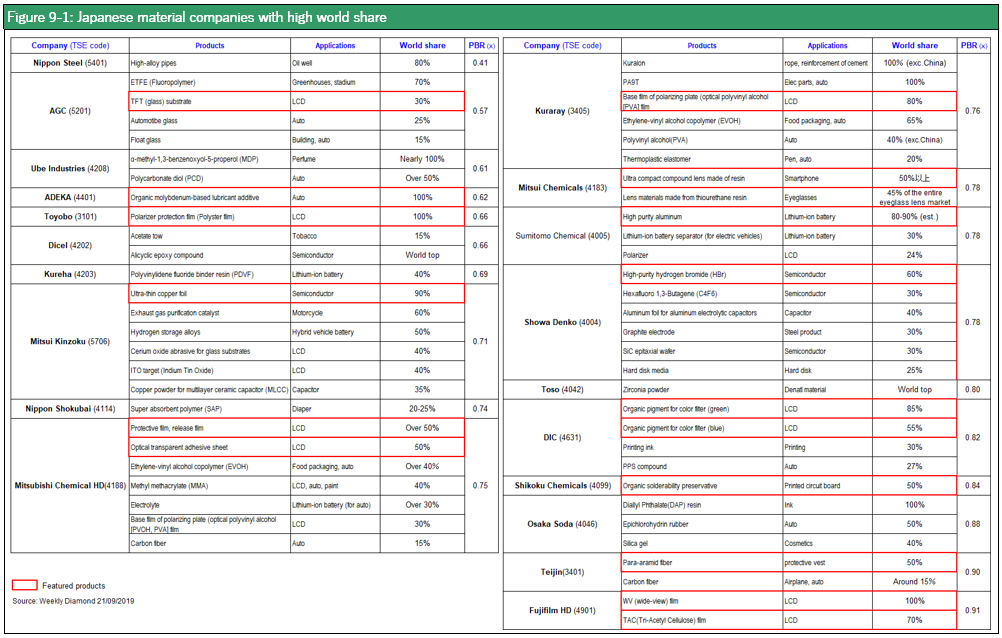

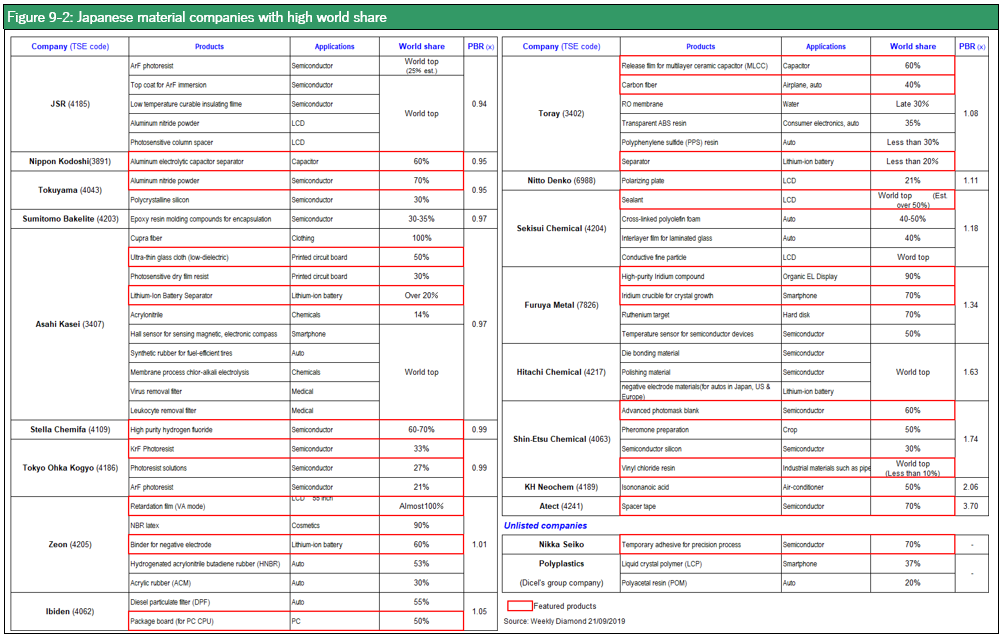

In the high-tech sector, competition is heating up between Korea and China, Taiwan and China and Germany and China. In the internet platform category, China’s Alibaba and Tencent have grown to the point where they can compete with US companies. On the other hand, Japan has a complementary role that eliminates that need to compete with the United States and China. For example, progress in the high-tech industries of China requires equipment, parts and materials made by Japanese companies. Japan’s ability to supply “only one” products will become increasingly valuable for supplying machinery, materials and other items that will be needed as other companies develop new products for the age of 5G mobile communications and the IoT. This will further reinforce Japan’s enviable position within the division of labor. Figure 8 is a list reprinted from the September 2 issue of Diamond magazine of 113 basic materials where Japan is the dominant or only supplier. The length of this list clearly demonstrates the success of the “only one” strategy of Japanese companies.

Akira Minamigawa of IHS Markit is a prominent high-tech sector analyst in Japan. In a recent book titled “Japan – The World’s Most Powerful IoT Country,” he stated that Japanese companies will have an overwhelming advantage as the age of the IoT begins. “The IoT industry is nothing at all like PCs, smartphones and other categories of the electronics industry (where Japan was not price competitive). Products owned by individuals are unnecessary. Instead, the IoT requires items that are shared with others, items that can be used in order to match specific needs and items that can be customized to match preferences. The IoT is therefore an attractive opportunity for Japanese companies, which are highly skilled in customization. Another advantage is that Japan is the only country able to produce all four core elements of the IoT: legacy semiconductors, electronic components, motors and electronic materials.”

For all these reasons, the surge in semiconductor demand as the world stands on the verge of the ages of 5G mobile communications and the IoT is also likely to be the beginning of the full-scale resurgence of Japan’s manufacturing sector.