Oct 31, 2019

Strategy Bulletin Vol.237

Strong condominium sales and the real estate price revolution will finally stop deflation in Japan

- Reiwa Stock Market Rally Series (2)

(1) Rising real estate prices will make people reassess condominium prices

Three key trends – Rising real estate prices as vacancy rates fall, higher rents and lower interest rates

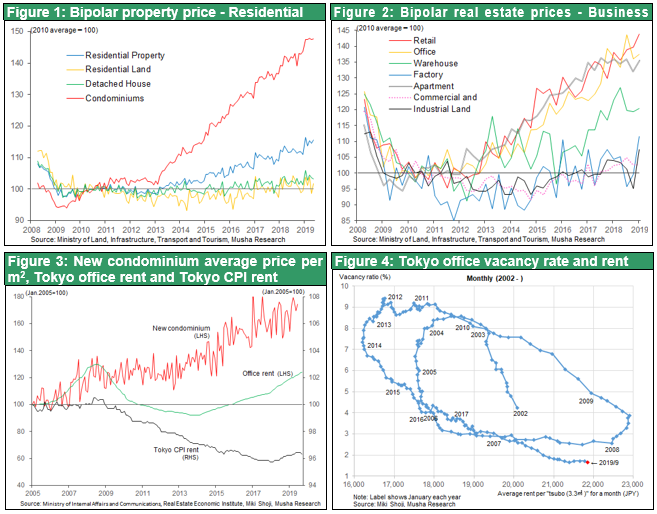

Prices of condominiums in Japan have been climbing rapidly. The upturn in prices is particularly dramatic in central Tokyo and large second-tier cities. Between 2005 and 2008, the price per square meter for newly constructed condominiums increased about 30%. But this price remained flat from 2009 to 2012 in the wake of the global financial crisis. Condominium prices started climbing again in 2013. As a result, price per square meter for new condominiums has increased about 40% between 2013 and 2019. Most people attribute this increase to the higher cost of constructing buildings and the higher cost of land due to a shortage of sites suitable for condominiums. However, during the past two to three years, prices of existing condominiums have probably been rising even faster than at new condominiums

Prices of residential rental properties are much higher as well, chiefly at high-end properties. Real estate industry figures show that rental rates per tsubo (3.3 square meters) at high-end apartments in central Tokyo are up from about ¥13,000 in 2012 to about ¥18,000 in 2019, an increase of roughly 40%. At standard apartments, rent is up more than 10% during this period, rising from about ¥12,500 per tsubo to about ¥14,000.

Apartments are becoming more expensive because of a big drop in vacancy rates. According to real estate industry data, apartment building vacancy rates are down from 11%-12% in 2010 to 5%-6% in 2019. For apartment buildings owned by J-REITs, the average vacancy rate has declined steadily from 8% in 2005 to about 3% in 2019.

The magnitude of this condominium boom is evident in the number of cover stories about this phenomenon in many of Japan’s major economy and business magazines. This news was on the cover of the October 22 issue of Weekly Economist (“Serious condominiums buyers”), the October 19 issue of Weekly Diamond (“Another bubble! Real estate investing”) and the October 20 issue of Nikkei Veritas (“How to own a house with a 100-year perspective”). Normally, these magazines have a negative view of speculation. But now their message is that people must not miss this opportunity because the boom is still far from over.

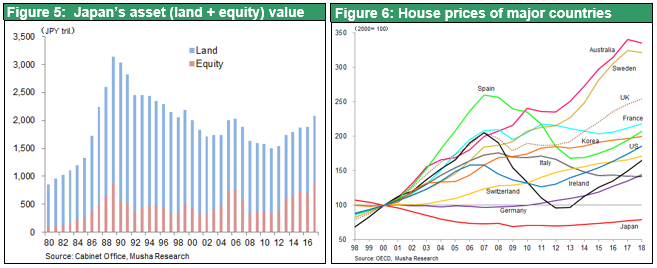

Vacancy rates are falling, rent is climbing and prices per square meter are moving up in the commercial real estate market, too. According to Miki Shoji, the vacancy rate at office buildings in Tokyo’s business districts has declined from 8% in 2012 to 2% in 2019. During the same period, the cost per tsubo of leasing this space is up from ¥16,000 to ¥22,000. Three factors are behind this big increase in prices of condominiums and commercial properties: falling vacancy rates, rising rent and declining interest rates. The real estate market is clearly benefiting from a positive economic cycle.

A rapid shift to prices based on utilization value is polarizing the real estate market

Japan’s vibrant real estate market cannot be attributed solely to an economic upturn. The recent polarization of the real estate shows us that other factors are at work. In the residential category, condominium prices are up significantly while prices single-family houses and home building sites have remained basically unchanged since prices hit bottom in 2009. In the commercial category, prices of office and retail building have increased while there has been absolutely no improvement in prices of industrial and commercial land. The only exceptions are some types of land suitable for the construction of condominiums and hotels. As a result, there is an increasing price gap in Japan’s real estate market between properties that are dead or alive.

Prices of existing condominiums will rise as values reflect US-style utilization valuations

The shift to utilization values is an important cause of the ongoing polarization of Japan’s real estate market. Real estate prices that had been linked to economic utilization value have started to climb far beyond what was previously considered to be reasonable. For example, prices of US real estate usually continue to increase regardless of the age of a house or building, assuming structures are well maintained. But in Japan, age has a decisive impact on the price of a residential property.

An article titled “Common Sense about the Age of Homes Has Been Turned Upside-down” by Osamu Nagashima, chairman of Sakura Office, in the October 29 issue of Weekly Economist includes the following statement. “The Japanese government says that the life of a wood house is usually 27 to 30 years and the life of a reinforced concrete condominium is usually 37 years. These numbers are calculated based on the simplistic method of using the number of years in the rebuilding cycle. Furthermore, many people link the length of depreciation in Japan (22 years for wood structures and 47 years for steel-frame structures) to the useful life of a building. However, these numbers are completely unrelated to the physical life of a building. In the United States, depreciation is 27.5 years for wood, steel and any other type of building. Furthermore, a property’s appraised value for a transaction or as collateral for a loan is determined without reflecting depreciation at all. In Japan, a study by Waseda University Professor Yukio Komatsu determined that the average life of a condominium building in Japan is 68 years. Another study concluded that the average life is 117 years.” Mr. Nagashima believes that the current established thinking about residential property values would change completely if Japan had a larger and better market for existing residences and a scheme for the reassessment of the life of a residential property. He thinks that this would result in residential properties that retain their value for 50 or even 100 years.

The “land standard” and government reports will no longer determine prices

The so-called “land standard” still has a significant influence on the determination of real estate prices in Japan. All real estate appraisals begin with the official values announced by the Ministry of Land, Infrastructure, Transport and Tourism. However, official values are based only on transaction prices of nearby or similar properties. This is only one of the three methods used for appraisals. The other two are the cost of repurchasing the property and discounting future cash flows. Using transactions means that activities in the past are influencing prices in the future. Determining prices like this with government intervention is not at all like the US and British real estate appraisal methods that are based on a property’s utilization value. Japan embraced the myth that real estate had absolute value as an asset that cannot be reproduced or replaced. The result was unshakable faith in the “land standard,” which made collateral for securing debt the most important role of land. Furthermore, official prices announced by the government were the standard for that value. Now that land’s role as collateral has come to an end, people are beginning to look for land that has legitimate economic value of land.

This explains the polarization of real estate prices. On the losing side are properties where economic value (current value of future cash flows) under the land-value myth cannot be justified. On the winning side are properties where economic value is increasing because of the rising utilization value. The result is the beginning of an enormous shift in the valuation of land to discounted cash flows based on utilization value.

The sharing economy is causing people to reevaluate residential prices based on utilization value

The emergence of the new life styles of today’s new era is responsible for the boom in condominium prices. A transition is taking place from ownership to utilization and sharing. People are taking another look at real estate prices by using the utilization value. Japan is well-known as a country of many long-distance commuters. A major cause was the strong desire of people to buy single houses with land in distant places due to their faith in the myth that land prices would rise forever. But today’s generation of dual-income couples who are raising kids refuse to accept this view. In the age of the sharing economy, this new mindset is having a big impact on housing. The shortage of residences in prime locations near where people work is pushing up the demand for condominiums and the cost of renting an apartment.

The positive cycle of rising rent and condominium prices that has started is not primarily an economic cycle. We should instead regard this as a structural shift. Prices of existing condominiums have been mistakenly undervalued in relation to their utilization value. Once these prices start to rise, people will realize that purchasing these condominiums at very low interest rates will save money by eliminating rent payments and produce capital gains. Condominium buyers also benefit from Japan’s reduced home purchasing tax. The growing awareness of the benefits of owning rather than renting will further boost demand for condominiums. This is why the condominium market is very likely to become even stronger.

(2) Japan’s acceptance of the long-term downturn in asset prices was the cause of deflation

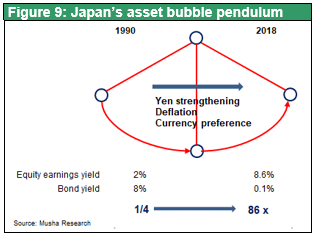

Rising condominium prices along with the recent start of an upturn in stock prices are prompting people to reevaluate prices of many categories of assets that have been erroneously undervalued in relation to their economic value.

Japan’s acceptance (unlike any in other country) of long-term asset price declines and big policy mistakes (the Bank of Japan’s own goal)

For many years, Japan did nothing about a prolonged decline in prices of assets (stocks and real estate). Accepting this situation was one of the biggest causes of Japan’s lost 20 years. Income and credit are the source of purchasing power. In a broad sense, credit can be regarded as consisting of bank loans and rising asset prices. After the asset bubble burst in the early 1990s, Japan’s bank loans fell about 20% from around ¥500 trillion (1993-1997) to around ¥400 trillion (2004). Furthermore, asset prices decreased consistently for 20 years. This situation slowly destroyed purchasing power year after year.

As you can see in Figure 5, the value of stocks and real estate in Japan peaked at ¥3,141 trillion at the end of 1989. In 2011, stocks and real estate were less than half that amount at only ¥1,503 trillion. Wealth totaling ¥1,638 trillion had been lost. During an era when asset prices were the biggest source of credit creation, financial authorities in Japan consistently stood idly by as asset prices declined for two decades. Looking back, it is clear that this negligence dealt a remarkably severe blow to Japan’s economy. Asset prices that had exceeded economic value decreased, which destroyed the asset bubble, but then continued to fall to well below economic value, which produced a negative bubble. For 20 years, there was a negative cycle in which falling asset prices reduced rent that, in turn, pushed down asset prices even more. These events gave Japan a zombie-like economy. Figure 6 shows housing prices in major countries. Housing market bubbles burst all over the world during the past two decades. But in other countries, prices stopped falling after two to five years and then, in most cases, returned to the level before the bubble burst.

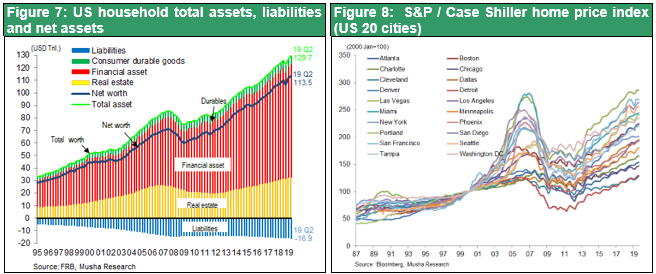

Unlike in Japan, a big increase in asset prices revitalized the US economy

The 20 years of declining housing prices in Japan was a very unusual occurrence. After the US asset bubble burst (the global financial crisis), prices of assets rose steadily. Stock prices have increased by about 3.5 times during the past decade. An enormous amount of wealth was created during that period. Household net assets (assets minus debt) are up 130% from $49 trillion in the fourth quarter of 2009 to $113 trillion in the second quarter of 2019. This growth of $64 trillion is three times larger than the US GDP. The situation in Japan was completely different. Furthermore, higher US asset prices raised the value of household stock investments from $5 trillion to $18 trillion and pension fund assets from $10 trillion to $27 trillion. Consumption surged along with the rising value of assets.

The good news is that only Japan now has substantial potential for an upside asset price correction

The downturn in asset prices that happened only in Japan hit bottom in 2011. Asset prices have been moving up since then. As you can see in Figure 9, the correction to eliminate the negative bubble is starting in the stock market and the condominium market. However, stock and condominium prices are still far below proper levels with respect to their economic value. Prices still have a lot more upside potential. This immense potential for higher asset prices, which exists only in Japan, is a veritable buried treasure for the Japanese economy.

(3) Rent is the fundamental difference between the direction of US and Japanese CPI – Higher rent is the key to ending Japan’s deflation

Rising condominium prices will probably be the force that finally eradicates Japan’s persistent deflation. The Bank of Japan’s prolonged phase of monetary easing that began in 2013 under the leadership of Governor Haruhiko Kuroda has at last reached the point of producing results. The reason is that falling rent was the biggest cause of deflation in Japan. Moreover, the long-term decline in asset prices was responsible for the downturn in rent.

Rent was the primary cause of Japanese deflation and US inflation

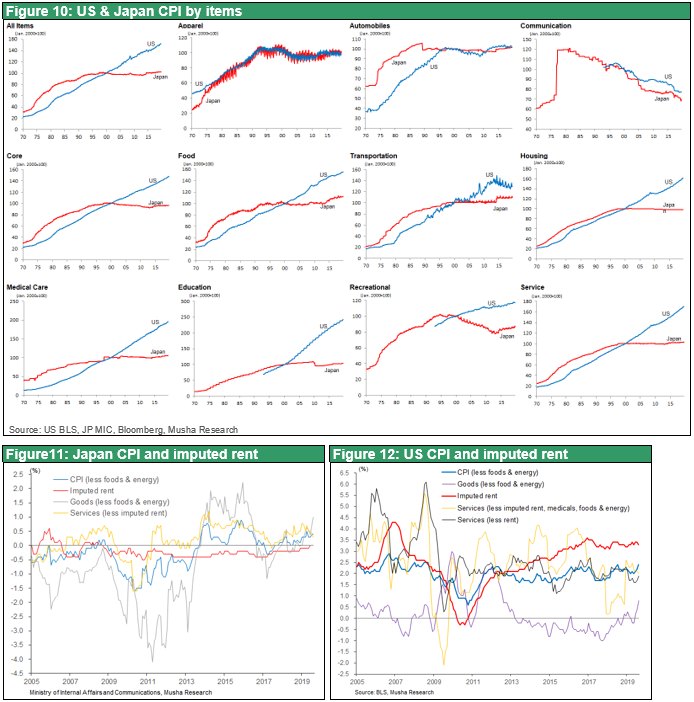

A comparison of the Japanese and US consumer price indices is shown in Figure 10. Deflation occurred in both countries for apparel, automobiles and other manufactured goods and in the telecommunications and other high-tech sectors because of a big improvement in productivity. Rent is what caused each country to go in a different direction: deflation in Japan and inflation in the United States. There are also differences between Japanese and US prices of many services. Nevertheless, rent is still the critical factor because the price of services depends on cost of wages, rent and utilities.

Figures 11 and 12 show the difference between Japanese and US inflation. As you can see, implied rent is the biggest reason for the big gap between Japan and the United States, excluding the effect of Japan’s consumption tax hike. Therefore, we can even say that declining rent was the primary cause of deflation in Japan and rising rent was the main reason for US inflation. Rent accounts for a much higher share of the CPI (excluding food and energy) than any other item. Implied rent is one-third of the US CPI and one-fourth of the Japanese CPI.

The Bank of Japan has repeatedly pointed out the differences between rent in Japan and the United States. One cause of this difference is that, unlike in the United States, residential rent in Japan does not take into account the declining condition of buildings over time. Another cause is the decline in residential rent in Japan caused by rising vacancy rates as people build apartment buildings to reduce inheritance taxes. (Source: Bank of Japan July 2016 Outlook Report)

The excessive decline in asset prices is responsible for low rent in Japan

People are overlooking the most important reason of all: negative feedback created by the drop in asset prices. Figure 5 shows that the price of land in Japan fell by half over a 20-year period, which is an average annual decline of 3.4%. To maintain the same return on capital, rent would also have to decline at this pace. Furthermore, the required rate of return in Japan has been decreasing consistently, too. This made it possible for rent to go even lower. The conclusion is that the excessive decline in real estate prices exerted constant and substantial downward pressure on rent.

Positive feedback has started in Japan due to rising prices of assets

A complete reversal has started that is terminating the negative feedback on rent generated by declining asset prices. Increasing prices of quality real estate that has economic value are beginning to produce positive feedback for rent.

Positive feedback on prices of various goods and services from higher asset prices will probably be the decisive blow that finally stops deflation in Japan. This is a very persuasive reason to adopt the view that we are seeing the start of an upturn in Japanese stock prices that will continue for a long time.