Nov 08, 2019

Strategy Bulletin Vol.238

Are high US stock prices the new normal in the age of stock capitalism?

- Reiwa Stock Market Rally Series (3)

~No reason to believe a bubble is forming, but political risk may become a problem~

(1) US stocks surge to a record high

All three major US stock indices are setting new highs. Stock prices have surged to record highs for the third time this year, following new all-time highs at the end of April, the end of July and the end of October. There are three reasons: the lull in the US-China trade war, monetary easing by the Fed and the health of the US economy (consumption and semiconductors). Furthermore, the Fed’s three interest rate cuts are expected to start producing benefits. As a result, there is now very little likelihood of an economic slowdown prior to November 2020.

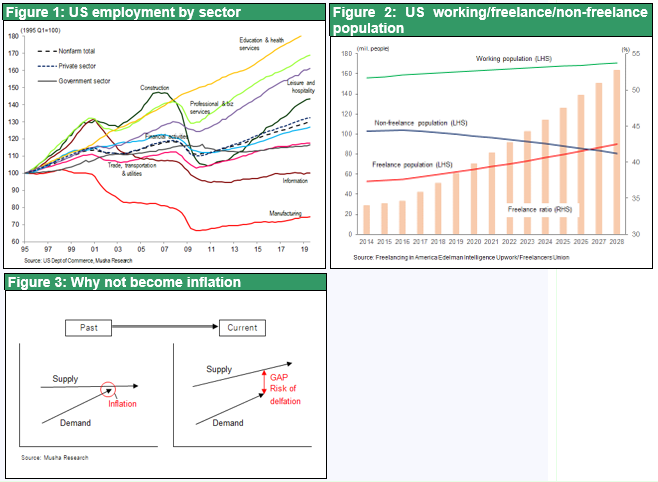

The technology and industrial revolution are the driving forces behind this record-setting period of economic growth. Companies are reporting strong earnings as new technologies boost productivity. A significant change is in life styles is producing new categories of services. The shift from ownership to sharing is a prime example. The number of jobs is increasing in all economic sectors with particularly strong growth in jobs involving education, health care, entertainment and tourism, and professional services.

Skill sharing is increasing as inflation remains low

Inflation is low even as the economy remains healthy. The explanation is probably that people believe there is no need to worry because the discretionary power of central banks is now much greater than in the past. So why is inflation so low even though unemployment is below 4%? There is only one possible explanation. As shown in Figure 3, increasing productivity backed by technological progress is producing constant supply side growth. A higher ceiling for supply means that tighter supplies caused by even a small increase in demand will not trigger inflation.

External forces may be raising the supply of labor and, as a result, slowing the decline in superficial US unemployment rate. For example, people over the age of 65 and other discouraged workers are reentering the workforce and the numbers of free-lance workers and people with second jobs or businesses are growing. The free-lance category has already increased to about one-third of the entire US working-age population and is expected to continue to grow significantly (Figure 2). Labor skills are the biggest sector of the sharing economy. Once these skills are freed from the restrictions of companies through the growth of free-lance work, second jobs and side businesses, there should be a big improvement in labor productivity. Furthermore, this improvement will not appear in conventional labor market statistics.

Sound US financial markets, no accumulation of idle capital, 100% return of earnings to shareholders is contributing

In addition to benefiting from a sound real economy, as was just explained, the US economy is also being supported by a level of financial soundness that is far higher than in any other industrialized country. Japan and Europe, on the other hand, have negative interest rates because a massive volume of surplus savings has accumulated in government bond markets.

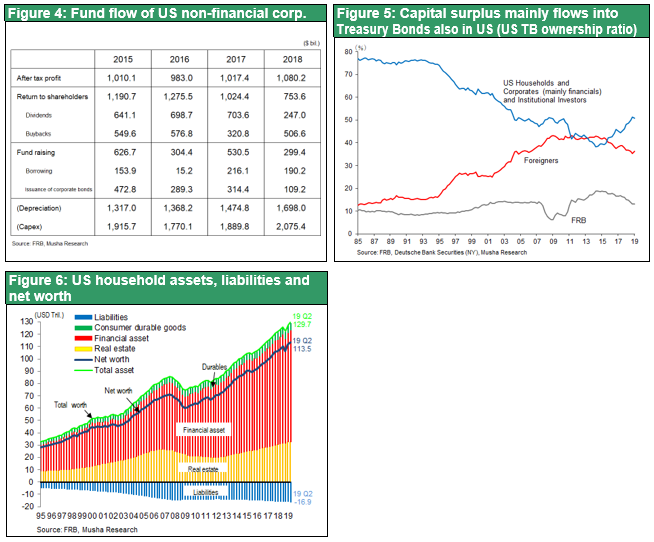

Only the United States is an exception to this phenomenon. The reason is that the capital circulation is still functioning. The US long-term interest rate fell to 1.4% in August but subsequently began to climb. In Japan and Europe, the financial circulation has been paralyzed by the enormous volume of surplus capital that is locked up in government bonds. But this did not happen in the United States. Companies have been returning almost all their earnings to shareholders by repurchasing stock and paying big dividends. The resulting increase in the value of assets held by households as stock prices rose has fueled consumer spending. Between 2015 and 2018, non-financial US companies recorded pretax earnings of $4.09 trillion and distributed $4.24 trillion to shareholders, a payout ratio of more than 100%. These distributions consisted of dividends of $2.29 trillion and stock repurchases of $1.95 trillion (Figure 4).

Everyone in the United States is enjoying the benefits of higher asset prices

Even in the United States, government bonds are the destination of choice for almost all of the surplus funds of households, pension funds, insurance companies and mutual funds. When the Fed started tapering in 2015, the Fed and foreigners have started to sell as well while investors within the United States (households, banks, institutional investors) consistently bought Treasuries. But this was not like what happened in Japan and Europe. In the United States, huge payments to shareholders pushed up the financial income of household and the stock market rally raised the value of household assets. Consumer spending has been consistently strong as a result. Higher stock prices have produced a dramatic increase in the net assets of households. As you can see in Figure 6, US household net assets fell all the way to $49 trillion in the fourth quarter of 2009 during the global financial crisis. But this figure stood at $113 trillion in the second quarter of 2019, an increase of more than $60 trillion (three times the US GDP) over a period of about 10 years. This growth includes an increase in pension fund assets from $10 trillion to $27 trillion, which improved the soundness of US pension plans.

(2) Why it’s wrong to believe the US has a stock price bubble

Many people see a bubble, but PERs should be high when interest rates fall

No one can deny that rising prices of assets have been supporting the US economy. However, many people are extremely wary because they think high stock prices, the key component of rising asset values, are not sustainable.

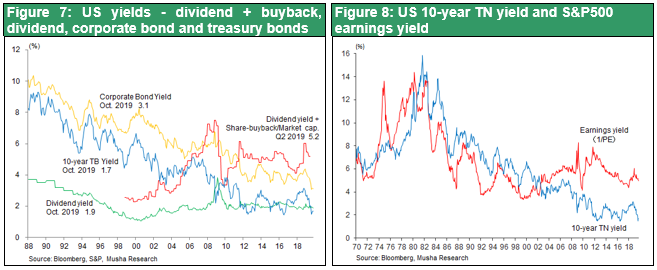

Despite these fears, it is still possible to say that stocks are clearly undervalued in relation to other categories of financial assets. This is because the return on stocks is far higher than the returns on US treasuries and corporate bonds. The return on treasuries and stocks (S&P 500) moved largely in tandem between 1970 and 2007, just before the global financial crisis started. Since 2009, though, the earnings yield of stocks did not decline along with interest rates, resulting in a large and steadily widening gap between the two returns. Arbitrage-like investments involving bonds and stocks were no longer possible and stocks became chronically undervalued.

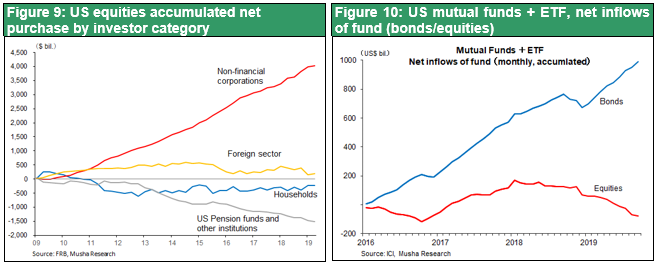

Stock prices are rising even though stocks are unpopular

Is there really a bubble in the stock market? The primary way to determine the sustainability of this rally is by gauging the level of optimism and enthusiasm among investors. But even in the United States, where optimism about stock prices is highest, people are still cautious about buying stocks. During the decade that followed the global financial crisis, all major categories of US investors were net sellers of US stocks: households, pension funds, insurance companies and mutual funds. The only buyer was companies buying back their own stock. These repurchases totaled about $3.9 trillion during the past decade. During the first 10 months of 2019, U.S. money market funds recorded record-high inflows of $500 billion. At the end of October 2019, these money market funds held $3.4 trillion, about the same as the all-time high in 2009 during the financial crisis (November 6 Wall Street Journal). This clearly demonstrates the very high level of negative sentiment about stocks, as well as the magnitude of money that is parked on the sidelines.

At the same time, monetary easing is continuing to generate new money and stock buybacks are reducing the number of shares outstanding. We are obviously not witnessing a bubble. In fact, everything is in place for a rapid upturn in stock prices.

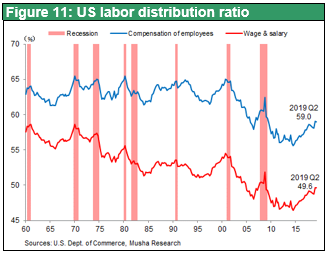

Although the outlook is positive, investors should closely watch for any downward pressure on corporate earnings from wage inflation as labor’s share of income in the United States climbs (Figure 11).

(3) A new era of stock capitalism may be emerging

Higher stock prices are more important than financial soundness at US companies

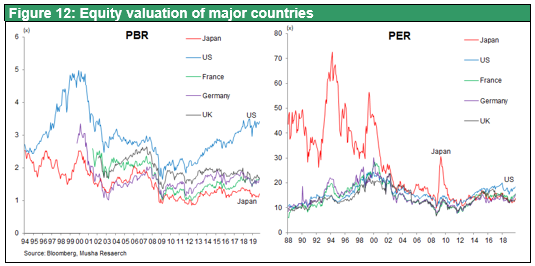

As was just explained, there is no doubt that US stocks are still nowhere near a bubble. However, it is equally clear that valuations of US stocks are currently high in relation to the stocks of other countries as well as valuations in the past. US stocks have much higher valuations than stocks of other countries in terms of both their PER and especially their PBR. The PBR of US stocks is about three times higher than the PBR of Japanese stocks and about twice as high as the PBR of European stocks.

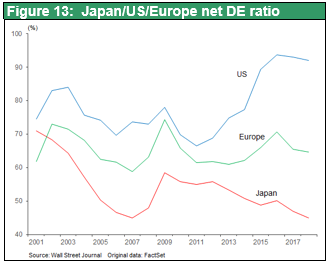

The importance that the financial strategies of companies place on stock prices is a major cause of high US stock valuations. Many US companies are willing to reduce retained earnings in order to buy back stocks. The objective is to boost stock prices by improving the balance between supply and demand and raising the ROE. Growing debt (leverage) at US companies is another result of the priority that financial strategies place on stock prices. This raises questions about whether or not emphasis on stock prices at the expense of financial soundness is the right way to manage a company. From a macroeconomic standpoint, repurchasing stock helps maintain a strong capital circulation by returning excess capital to households. Consequently, US companies should place priority on stock prices. However, highly leveraged balance sheets will make US companies less resilient to rising interest rates and falling earnings during the next recession. But we will have to wait until the next recession begins to see if this resilience has actually declined.

Is this the age of stock capitalism?

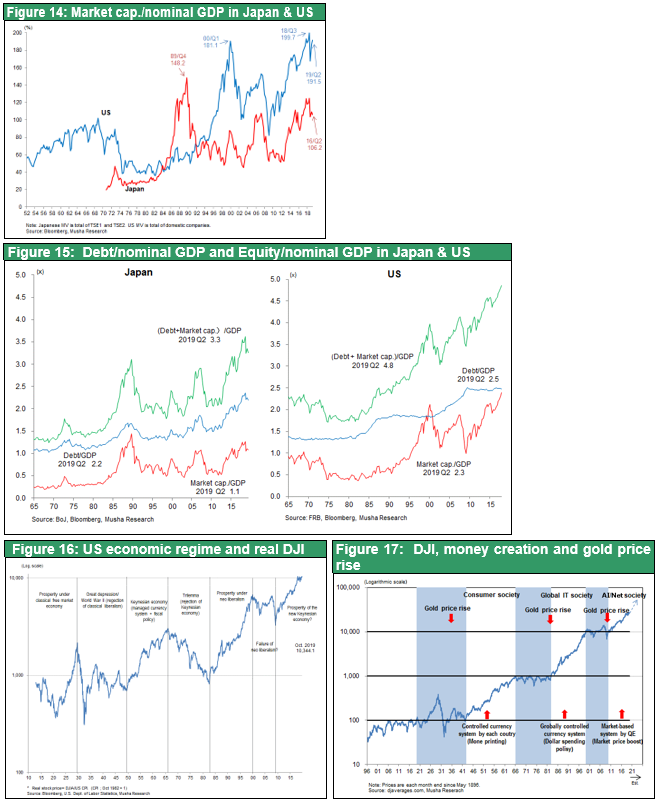

US stock prices are at a historically high level in relation to the GDP (Figures 26, 27). If this is not a bubble, then these high prices may be a sign of the beginning of the age of stock capitalism. In other words, stocks are playing a central role in finance. If we believe that the role of finance is to create credit for the purpose of generating purchasing power, then bank loans are no longer the method used for performing this function. Today, the only conceivable method to create credit is to raise prices of assets, chiefly stocks. Credit creation fueled by rising stock prices was one reason for the ability of the US economy to consistently grow much faster than the economies of other industrialized countries in the wake of the global financial crisis. Maybe we should even regard this socio-economic focus on higher stock prices in the United States as the beginning of a new financial regime.

Economic policies and capital circulation that are centered on stock prices have been the target of criticism due to the perceived link with the growth of wealth inequality. There is some truth to this criticism. For example, if the radical Elizabeth Warren becomes the next US president, there would be a big policy shift centered on stocks. This could have a big negative impact on stock markets even for a short time. We believe the possibility of this policy shift occurring is currently the greatest risk factor for stock investments.