Dec 18, 2019

Strategy Bulletin Vol.240

Anglo-Saxon Alliance, Premonitions of a Restructuring of the Global Order

(1) Trump-Johnson Conservatism Revolution

Will the Reagan-Thatcher Collaboration Return?

A strange and homogeneous conservative party leader is reappearing across the Atlantic Ocean, reminiscent of the Reagan-Thatcher era of the early 1980s. US President Trump-British Prime Minister Johnson. The Conservative Party, led by Johnson in the British general election in December, won the greatest victory and the largest majority since the Thatcher administration in 1979, and Brexit has now been confirmed as a result. President Trump greeted all of this with the most emphatic roar of encouragement.

Both the personalities of the two men and the assertions they are making are surprisingly similar. Portrayed as being populist, but possessing a firm faith in economic rationality, which marks both out as differing greatly from the reception they have had from the mass of those on the left wing of politics. (1) Unprecedented and unheard-of in not following common sense and customs; (2) Loyalty and a pro-business attitude towards the pursuit of profit; (3) Liberalism, and deregulation; (4) Aversion to merely formal democracy and idealism; (5) Emphasis on national interests, and on changing the world order; (6) Reflationary policies with government spending ; (7) Sympathy with the vulnerable members of society, controls on immigration to foster a closer relationship with the victims of globalization, reconstruction of orderly trade systems, and an appearance of favouring protectionism, etc.

Johnson, who has now strengthened his leadership thanks to this Conservative Party victory, will promote deregulation, introduce reflationary policies, establish FTAs with the United States and the former Commonwealth countries, and Japan, etc., and will work together with President Trump to rebuild a hollowed-out world order.

Just as Reagan-Thatcher created the global trend of neo-liberalism and deregulation in the 1980s and 90s, the Trump-Johnson partnership now really does look set to bring new values to revive a purely formulaic democratic world order that has come to the end of its tether, doesn’t it? The fundamental confrontation over global hegemony between the United States and China will surely result in uniting the liberal nations of the world led by the United States and Britain.

Policies that place greater emphasis on deregulation and on prioritising business rather than on any disparities between the two men will have a strong affinity with the ongoing digital and internet industry revolution, and the stock market is likely to welcome warmly. Stock prices are expected to ensure the recovery of the world economy in 2020, and if this does indeed happen, then the conservative, liberal thinking of both Mr. Trump and Mr. Johnson will be both justified and firmly established.

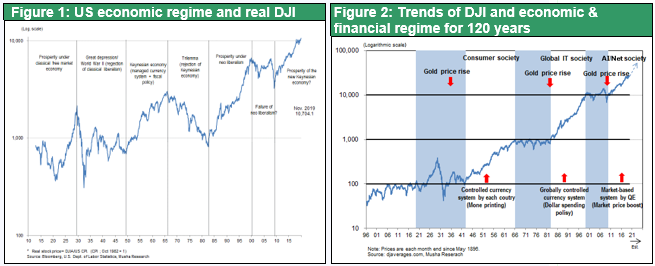

The advent of Reagan-Thatcher, consistently disliked by left wing liberals from the early 1980s onwards, created a period of neoliberalism and ended the Cold War, but the economic prosperity itself was secured by the long-term rise in stock prices that began in 1980.

If conservative liberalism stemming from President Trump's collaboration with Prime Minister Johnson is greeted by rising stock prices, then it may well usher in the beginning of a new era of prosperity for the global economy.

(2) New Era of the British Economy Starting from Brexit

Conservative Party Wins, Future Outlook Now Made Clear by Brexit

The general outline of Brexit, whether hard or soft, has now been determined. The corporate sector’s response has now, after three years of discussion, been completely confirmed and there has been little sign of the overseas exodus from the UK’s financial centre in the City of London that had been feared. Clearly, there was no financial hub in continental Europe that could compete with London’s combination of the rule of law, freedom of capital movement and management, and soft elements such as the English language. In the media headlines, the view that the English manufacturing industry would suffer disadvantages from Brexit stirred up turbulence, but the opposite is true, as described below. The consistent assertion of Musha Research Brexit has been that Brexit is overwhelmingly likely to benefit the UK. The uncertainty that has dominated the past three and a half years is over, and it is highly probable that pent-up investment demand is increasing. The UK's Post-EU strategy is being drawn, and anticipation is growing stronger in the market in response. Reuters reports on the new administration's policy framework as follows:

- Not extending the transition period → The UK will enter the transition period for withdrawal from the day after January 31 and will negotiate a new relationship with the EU during this period. Under the current rules, it is possible to continue the transition period until December 2022, but the Conservative Party has announced in an election commitment that it will not extend this beyond the end of 2020. If the UK cannot reach a new trade agreement by the end of 2020, the UK will effectively face a “No-deal Brexit.” again. Trade experts say it is unrealistic that the UK will be able to establish an agreement by the end of 2020.

- Budget announcement in February → The Conservative Party is to announce its budget after Brexit in February and has promised to increase spending on domestic issues such as medical services (the NHS), education and the police.

- Immigration → The Conservative Party plans to introduce an “Australian-style” points-based immigration system. It promises to reduce the total number of immigrants, especially less-skilled migrants. The new system will treat EU citizens and non-EU citizens equally, and most migrants will not be able to move to the UK without a job offer. Special visa schemes will be established for migrants that are suitable to fill the shortage of personnel in public services, and for leadership roles in areas such as science and technology.

- Government borrowing → The Chancellor of the Exchequer Sajid Javid has announced that he will revise the fiscal rules and increase the ceiling for spending over the next five years by £20 billion. The government plans to increase borrowing for investment in infrastructure from 1.8% to 3.0% of the UK’s current gross domestic product (GDP).

- Foreign Trade → The Conservative Party has expressed its intention to conduct 80% of UK trade under terms of Free Trade Agreements (FTA) within three years and announced that it plans to give priority to negotiating and signing agreements with the United States, Australia, New Zealand and Japan.