Dec 23, 2019

Strategy Bulletin Vol.241

“Buy stocks now” is the only recommendation investors need for 2020

– Reiwa Stock Market Rally Series (4)

Musha Research believes that a powerful rally that will propel the Nikkei Average to ¥30,000 in 2020 has probably started.

(1) Uncertainty is largely behind us and the global economy may create a positive surprise

Most of the storm clouds have gone away

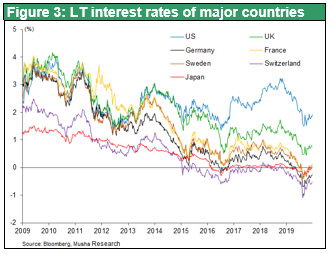

The disappearance of the fog of uncertainty is the biggest difference between now and the beginning of 2019. A truce has been declared in the US-China trade war as a preliminary agreement was reached immediately prior to additional tariff hikes planned for December 15. Another factor is the abnormal monetary environment in which long-term interest rates are negative in all industrialized countries except the United States and Britain. But the situation is now more stable because of the three Fed interest rate cuts and improvement in global economic sentiment. In Britain, the decisive victory of the Conservative Party has greatly reduced options and eliminated uncertainty about Brexit. Another positive development is the start of 5G investments and outlook for a potentially significant economic impact. As a result, most people now believe it is no longer realistic to think that the current period of global economic growth is about to end.

The biggest source of concern is the US election, but President Trump is likely to win

Politics is the most significant uncertainty regarding the outlook, particularly the US presidential election. However, there is a strong possibility that President Trump will win a second term. In the postwar era, only two US presidents failed to win a second term: Jimmy Carter and George H. W. Bush. In both cases, there was an economic recession during the first term. But a recession is unlikely to begin and President Trump has the strong support of the Republican Party. Furthermore, the election tactics of the Democratic Party are unstable with big shifts from time to time. All of these points indicate that there is high probability of a Trump victory in November. Consequently, there is a clear positive outlook for the economy for at least the first half of 2020, which is a rare occurrence. What will happen in financial markets now that the fog of uncertainty has lifted? The answer will probably depend on how the massive amount of capital available for investments is used. The first half of 2020 will be an excellent environment for risk-taking. Stock markets worldwide are very likely to stage rallies that go far beyond what most people are anticipating.

(2) The recovery phase of a mini-cycle, not the end of a long-term upturn

During 2019, economists focused their attention on determining if the multi-year period of US economic growth had come to an end or if instead the economy was simply at the bottom of a mini-recession. Most economists thought that the end was near for the longest-ever period of US economic growth, which started in 2009. But there is no possibility of an end to this growth for the time being. The consensus view now is that US economic expansion will not stop in 2020. After all, economic growth that has continued for more than 20 years in the Netherlands and Australia demonstrates that economic growth cycles do not have a life expectancy.

Demand in China is becoming more stable

International trade and the level of investments have been the primary forces behind the economic mini-cycle of the past three to four years. Both are linked to the economic cycle of the manufacturing sector. Manufacturing is only 11% of national income in the United States compared with 29% in China, 22% in Germany and 21% in Japan. The small US percentage reduces the magnitude of economic swings. In the manufacturing sector, China is the world’s largest market for automobiles, smartphones, steel, cement and many other goods. This is why China has a greater influence on the global manufacturing cycle than the United States does. The decline in China’s internal demand was major cause of the global economic mini-cycle downturn that started in 2018. Now, we are seeing the beginning of a rebound from the bottom of this cycle. China’s falling internal demand was triggered chiefly by lower demand for automobiles. However, this decline has stopped and China has made a big shift away from monetary tightening and restrictions on infrastructure spending, which had been exerting downward pressure on internal demand. A more accommodative monetary policy will probably push up real estate prices as well as real estate investments. Furthermore, we are about to see the end of uncertainty caused by the trade war, which has been a major contributor to China’s downturn since the spring of 2018. China will probably resume making investments that had been postponed and start making investments in Taiwan and other countries.

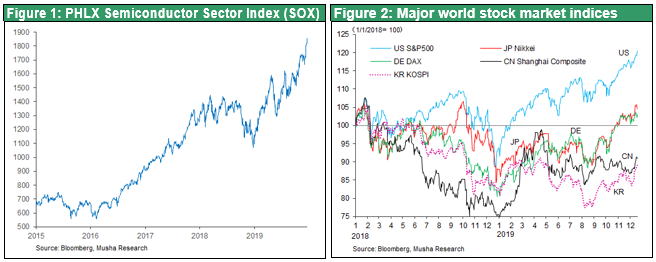

Signs of a surge in 5G and semiconductor investments

Investments are starting in the field of 5G mobile communications and other new technologies. Companies are beginning to boost investments in leading-edge semiconductor technologies and other fields in order to stay ahead of competitors. China plans to be the world leader in 5G investments. These investments are increasing rapidly within China and other countries have started raising these expenditures in order to keep up with China. One illustration of this growth is semiconductor manufacturing equipment orders by TSMC. These orders totaled $7.7 billion in the third quarter of 2019, far above $1 billion to $2 billion in the past quarter. Data center investments, which had been sluggish until 2019, are rising as well because of the emergence of 5G. In China, many semiconductor companies have suspended new investments since 2018 because of the trade war. Now, there may be an unexpected improvement in supply-demand dynamics in the semiconductor industry because these investments were pushed back.

The United States is currently enjoying a record-long period of economic expansion backed by the technology revolution and the industrial revolution. One characteristic of this growth is the consistent expansion of the service sector, with no big swings on the up or downside, due to the technology revolution. Moreover, monetary policy is no longer a headwind for the economy. The yield curve has returned to normal following three rate cuts totaling 0.75% by the Fed. Central banks worldwide are adopting accommodative stances and we can expect to see benefits appear in 2020. For these reasons, there will probably be a powerful resurgence of risk-taking in the first half of 2020. In addition, three positive factors are likely to support the Japanese economy. First is economic stimulus measures totaling ¥13 trillion that will more than outweigh the negative impact of the October 2019 consumption tax hike. Second is the upturn in global manufacturing, particularly due to increasing demand in the high-tech sector. Third is steady progress with asset inflation because of the Bank of Japan’s monetary easing year after year.

(3) 2020 – A year of repentance by people behind the widespread pessimism about stocks

How will the enormous amount of money now on the sidelines be used?

If the fog that shrouds economic fundamentals finally dissipates, investors should turn their attention to how the supply and demand for investment capital changes and what will be purchased with that money. Key questions of 2020 will be where this money comes from and where it goes. Musha Research believes that 2020 will probably be the year of repentance by stock market pessimists. In 2019, the huge global pool of surplus savings was used to buy the government bonds of industrialized countries. The result was falling interest rates worldwide and a bond bubble highlighted by negative interest rates in a few of these countries. In 2020, the expected global economy recovery will undoubtedly push up interest rates. Investors will no longer be able to buy bonds and will instead direct their funds to the only remaining virgin territory: the stock market. Some people may disagree, believing that stocks are no longer virgin territory because prices have been bid up to a bubble-like level. Can this negative thinking be correct?

The 2020 bubble debate will prompt investors to buy stocks

Many questions exist about the stock market. Valuations may be too high or stock prices could still be in a safe range. Also, the large volume of capital available for investments can be regarded as either a danger sign (potential of a price bubble) or a sign of financial soundness (the start of a new era of prosperity). Musha Research backs a positive outlook. There is no need to rush to conclusion. In any case, 2020 is likely to be a year of rising stock prices and risk-taking. The year will begin with rising prices of stocks and other assets. After that, a conclusion will become apparent once we determine where the economy is headed from that point onward.

The urgent need to correct distorted portfolios will produce proper stock valuations

During the past few months, the consensus economic outlook for 2020 has shifted from pessimism to optimism. Despite this change in sentiment, investors have made almost no changes to their portfolios. Among stock investors, there is a widespread mood of expecting higher prices but waiting for a downturn to buy. This is because supply-demand dynamics for stocks worldwide have never been better. But it is precisely at a time like this that a paradigm shift (a big change in the consensus view) can easily occur. In Japan and the United States, many investors have structured their portfolios during the past few years based on the expectation for a recession. Asset allocations were defensive regarding the risk of declines in the dollar, stock prices and interest rates. If these investors realize that these defensive actions were a mistake, there is a significant possibility of an enormous shift of funds to the stock market.

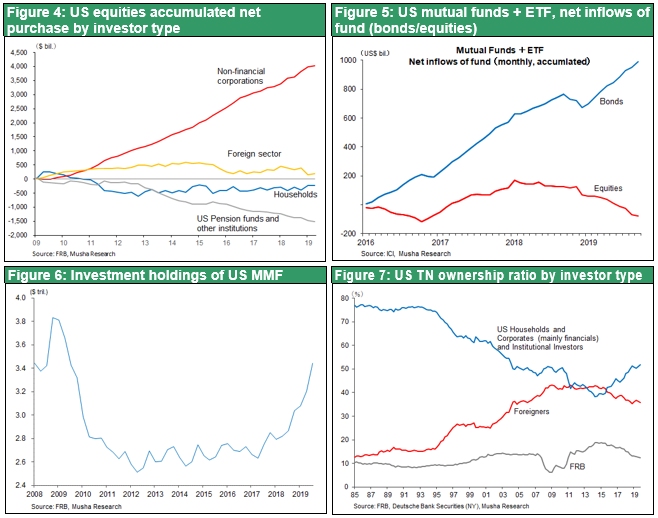

US investors have consistently been net sellers of stocks

In the United States, individuals, pension funds, insurance companies and mutual fund companies have all been net sellers of stocks during the decade following the global financial crisis. Individuals, pension funds, insurers and banks have been constantly extremely cautious about stock investments. They have instead used surplus funds to buy government bonds and other assets except stocks. Buybacks by companies, which totaled $3.9 trillion during this decade, were the only source of net stock purchases. Figure 5 shows the cumulative investments since 2016 in US mutual funds and ETFs. Investors put their money into bond funds but there were no inflows to stock funds. During 2019, there has been an enormous increase in the amount of idle capital. Money market funds recorded record-high inflows of $500 billion during the first 10 months of the year. There were $3.4 trillion in these funds at the end of October, matching the all-time high recorded in 2009 during the global financial crisis. These numbers clearly show the extreme level of cautiousness among investors. At the same time, monetary easing is generating new money and stock buybacks are lowering the supply of stock. There is obviously no stock market bubble. In fact, stocks are now poised for a powerful rally. This is why US stocks can be called virgin territory for investors.

Private-sector money has consistently abandoned stocks in Japan, too

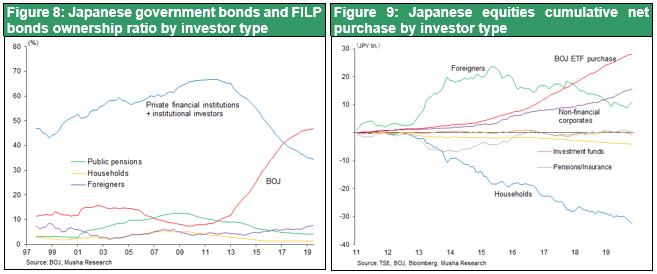

The situation is similar to the United States in Japan but even more so. Quantitative easing by the Bank of Japan has moved a massive amount of Japanese government bonds from Japan Post Bank, the Government Pension Investment Fund and private-sector financial institutions to the Bank of Japan’s balance sheet. Proceeds from these bond sales were used to buy foreign currency-denominated assets (foreign securities and loans) or were simply held as cash. Almost none of this new money was used to buy Japanese stocks. Basically, the large volume of stock sales by individuals was absorbed by ETF purchases by the Bank of Japan and stock repurchases by Japanese companies. Furthermore, foreigners have bought Japanese stocks since 2013 by ¥23 trillion, but they have sold more than half of them. The conclusion is that the sacrificial activities of the Bank of Japan failed to make investors buy more assets with risk by rebalance their portfolios. This is why Japanese stocks can be called virgin territory for investors.

Today’s extreme negative bias and excessive expectation for declines in the dollar and stock prices

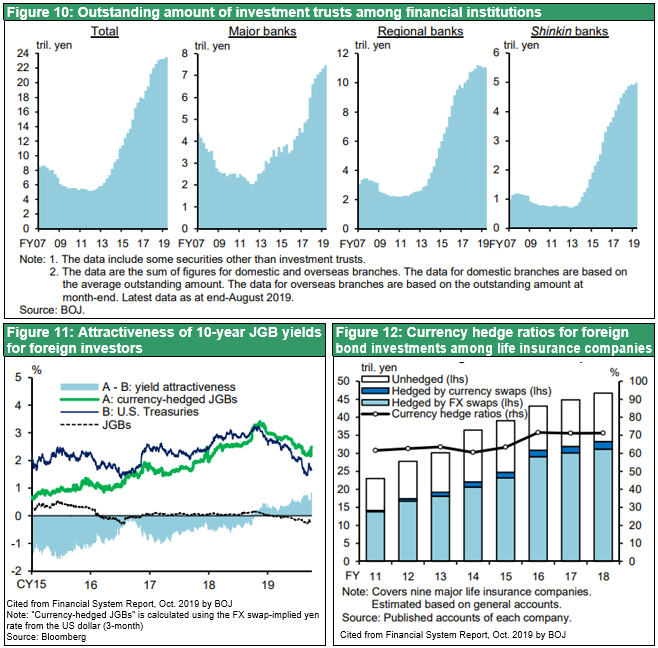

Extreme pessimism is rampant in financial markets today. Two points in the Bank of Japan’s financial system report released in October illustrate this negative bias. First, large banks are rapidly increasing holdings of stock mutual funds and bear mutual funds (to be prepared for a decline in prices of their cross-holding stocks) account for half of these holdings. Second, a risk reversal reflecting the expectation of a stronger yen has created a big gap between the cost of yen and dollar foreign exchange rate hedges. The result is a big increase in purchases of hedged Japanese government bonds by foreigners.

Figure 11 shows the yield on 10-year Japanese government bonds from the standpoint of US investors. A strange situation exists in which the use of yen hedging makes the yield on the Japanese bonds higher than for US Treasuries. Hedging the yen earns US investors a premium of about 2%. However, Japanese investors must pay about 2% in order to buy US Treasuries with a dollar hedge. On a yen basis, this results in a negative return. The imbalance between the supply and demand for hedges is the reason for this unusual difference between the cost of yen and dollar hedges. The imbalance, in turn, is probably caused by the excessive desire of Japanese investors to protect themselves against a downturn in the dollar’s value. At Japanese life insurers, the hedging ratio for foreign currency-denominated bonds has increased to 70% according to the Bank of Japan’s financial system report. Activities like these show that Japanese investors are prepared for downturns in stock prices and the dollar. But these investors will suffer big losses if stock prices go up and the yen goes down. The outlook for a recovery in the global economy in 2020 is therefore likely to force Japanese institutional investors and financial institutions to make significant adjustments in the composition of their investment portfolios.

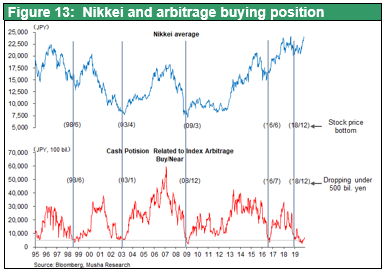

The extreme negative signal of speculative positions, a clear indicator of stock supply and demand

The high volatility of Japanese stocks makes them an ideal vehicle for speculative investments. There are several reasons for this volatility. First, the significant weight of manufacturing in Japan’s economy makes Japan vulnerable to the health of the global economy. Second, foreign exchange rate movements increase the magnitude of changes in stock prices. Third, foreigners account for 70% of trading volume and there are few stable investors in Japan. Many times, Japanese stocks have become oversold, primarily by sales linked to futures, when the global economy weakened and investors worldwide wanted to avoid risk. Long arbitrage positions on the Tokyo Stock Exchange are often used as an indicator of speculative positions. Stock prices have repeatedly reached a major low and then staged a strong recovery whenever long arbitrage positions fell to the ¥500 billion level. However, the good news is the magnitude of volatility due to speculation is neutral with respect to the long-term trend. Regardless of how much stocks are sold by speculators, the selling will have to end at some point. Eventually, short speculative positions will have to be closed by buying stocks back. Purchases to cover short positions will generate strong upward pressure on stock prices. This happened in 1998, 2003, 2009 and 2016. Every time, the Nikkei Average rose about 60% during the following 12 to 18 months. Long arbitrage positions reached the ¥500 billion level around Christmas 2018 and continued to decline to below the ¥400 billion level in July and August, the lowest since the global financial crisis. That means there is a possibility of a sudden resurgence of speculative buying at some point.