Feb 17, 2020

Strategy Bulletin Vol.244

State Capitalism vs. Stock Market Capitalism

- COVID-19 and the US stock market rally series (1)

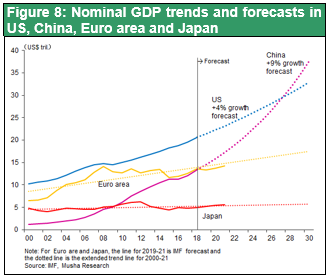

Today, two conflicting facts are attracting the attention of people worldwide. One is the spread of COVID-19. Businesspeople, investors and the public are paralyzed with fear about this pandemic, which is showing no signs of ending. Second is the US stock market rally. Why should people pay attention to these two events? The answer is that they hold the key to the outcome of the US-China confrontation. Musha Research will explain the results of an analysis of these two facts in a series of three reports. The conclusion of this analysis is that the United States will prosper and China will decline.

Record-high US stock prices even as the COVID-19 outbreak spreads

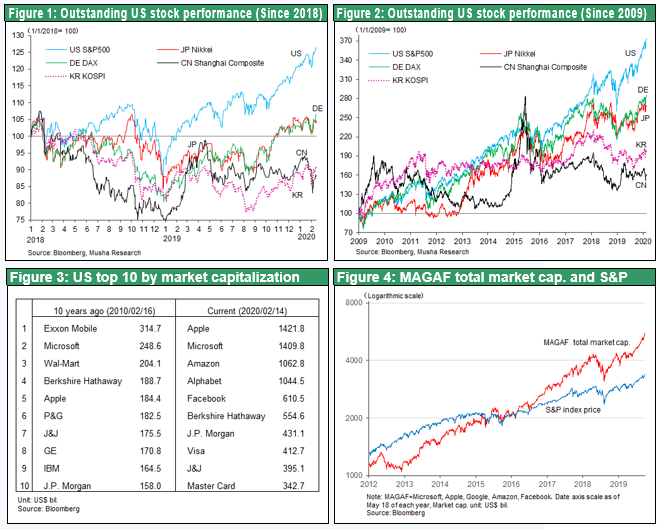

The new year started with a procession of news with negative repercussions, notably the killing of Iranian general Qasem Soleimani and the outbreak of COVID-19. Nevertheless, all three major US stock indices continue to climb to new all-time highs. This situation brings to mind the saying that difficulties are what reveal true strengths. In fact, we are seeing the real strength of the US stock market during this period of disruptive news. The DJIA has surged from a low of $6,547 in March 2009 all the way to $29,400 in February 2020. This equates to an increase of 4.5 times over 11 years, an annual average of about 15%. Since Donald Trump won the 2016 election, the DJIA is up 64% over a period of three years and three months, an annualized rate of about 16%. The driving force behind this growth is the high-tech revolution led by the MAGA companies: Microsoft, Apple, Google and Amazon. All four now have a market cap of more than one trillion dollars. Calling these companies MAGA is appropriate because this is also an abbreviation for President Trump’s slogan “make America great again.”

The two conflicting facts are critically important for determining the outlook for the world. First, the COVID-19 outbreak has exposed the fundamental defect of China’s state capitalism. The spread of this disease may become an event of the same magnitude as the Chernobyl accident that was the beginning of the end of the Soviet Union. COVID-19 could even spark a shift in how China is governed. Second, rising US stock prices are demonstrating the excellent state of health of US stock market capitalism. Some people are no doubt cynical about this rally, believing it to be a sign of excessive optimism despite the ongoing spread of COVID-19. However, as will be explained later, this cynicism is not a rational view.

Money is the key to winning the high-tech investment war, the biggest US national interest of all

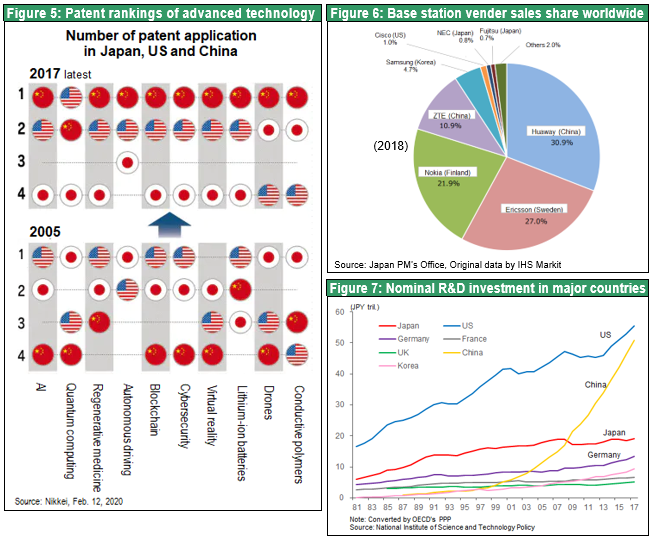

To win the war with China for hegemony, the United States will above all have to ensure that stock market capitalism is successful. This is because the key to the outcome of this struggle will be whether or not leading-edge technology development activities can be held back. Consequently, financial power will ultimately determine the winner. Will the United States or China be the leader in emerging fields of technology such as AI, quantum computing, blockchain, conductive polymers, self-driving cars and regenerative medicine.

On February 12, the Nihon Keizai Shimbun printed an article titled “China passes Japan and US as first in patents in nine of ten advanced technology fields including AI.” China is using state capitalism (which is in fact a command economy) to channel investments to targeted sectors. This article reveals the shocking fact that China will soon overtake the United States in many categories of advanced technologies. In the 5G mobile communications sector, China’s Huawei has an overwhelming lead in terms of technologies and cost. Even US ally Britain was unable to comply with the US policy of shutting out Huawei. Clearly, the United States can no longer allow this situation to continue.

The US must do whatever is needed to strengthen stock market capitalism

Strengthening stock market capitalism is essential for the United States to acquire the financial power to win the high-tech investment war. In fact, this is a geopolitical requirement. US stock market capitalism is doing very well and is sustainable. But can this capitalism enable the United States to meet this geopolitical demand? This question is significant enough to be a threat to the current US position of global leadership.

Musha Research has stated repeatedly that US stock market capitalism is sound and sustainable. In the United States, stocks are the nucleus of the infrastructure for the circulation of capital. Now, we are very likely witnessing the beginning of a new age in which rising stock prices fuel economic progress. Pessimists say that high US stock prices are nothing more than an asset bubble. If this is true, then the US economy should collapse before a downturn in the state capitalism and socialist market economy of China. The result would probably be a Chinese victory in the struggle for hegemony.

However, we can instead say that high US stock prices show that capitalism has advanced to a new stage of development called stock market capitalism. If we embrace this view, the outlook for the economy is bright. Stock market capitalism will remain vibrant for at least the next few years. This environment will create very attractive investment opportunities. Making this bright future a reality requires finding the answers to two questions. First, why will COVID-19 become the downfall of the Chinese system of government? Second, why is US stock market capitalism sustainable rather than just an asset bubble?