Mar 11, 2020

Strategy Bulletin Vol.247

Everything Depends Upon Breaking the Chain of Infection

- Expectations for Chinese cut off and Japanese containment

This is a natural disaster and it will eventually be cured

Stock markets plummeted, the yen soared, the oil market fell sharply, and the financial markets were overwhelmed with panic selling. The contagion of the new virus is now spreading worldwide, and the rate of increase in the number of people infected continues to gain momentum in European countries such as Italy, France and Spain. In Italy, emergency measures were taken that went beyond just school closures to encompass bans on merely going outside at all. The impact of the decline in global demand due to the new coronavirus infection is likely to continue to go from bad to worse. Even in the United States, the infection is now spreading at an accelerating rate, triggering massive restraints on economic activity. Market turmoil, in the trading of stocks and other financial instruments, will continue for some time. But there is certainly some hope ahead about the outlook for the global war on new coronavirus that will be taking place over the coming months. All of these difficulties are due to the disruption of economic activity caused by the natural disaster that is the new corona infection and, once this is resolved, the economy and markets will recover sharply.

In the Financial Times newspaper (March 10th), Mr. Ray Dalio commented that “the corona problem is a natural disaster, and therefore requires the mobilization of all means available to combat it”. Already national governments worldwide seem to be readying to do everything possible, such as providing fundraising support, boosting asset prices and supplementing purchasing power, to assist. In the case of Japan, if measures such as a full-fledged demand-creation policy and a timely consumption tax cut are implemented along with temporary and targeted policy measure, stock prices will rise, and demand will be synergistically increased in response to the asset effects seen in the United States with the result that a boosting effect can be expected. This is exactly what we would want and expect to see happening now.

Economy and markets to recover sharply in the latter half of the year

In the first half of the year, the virus problem will subside (or, at least, no longer completely dominate) and the basic scenario of normalizing economic activity and a sharp recovery in market prices will not need to be disturbed. In the US economy, 1Q and 2Q GDP could be negative and enter a technical recession. But, in that case, the recovery will be all the sharper. It is safe to assume that there will be a threefold combination of sources of upward pressure: inventory shortages due to a sudden fall in production in the first half of the year, the emergence of temporarily suppressed pent-up demand, and the effects of economic measures. Consequently, stock prices will surely rebound in February all at once.

(1) New infections almost ceasing in China, a major step toward normalization of economy

Infection already appears to be calming down in China, economic normalization moves one step closer

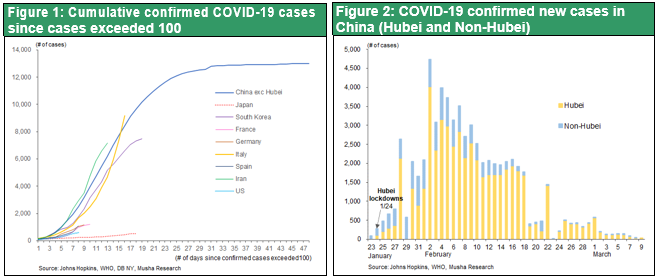

The key lies in reading when and how the chain of infection will stop and when the economic cut-off will be lifted. Figure 1 shows the cumulative number of infected people by country (prepared by Deutsche Bank Securities NY Economist Torsten Slok) and how this is currently strongly polarised. In Europe, the United States and South Korea, the number of cases of infection has been increasing sharply, while in China (excluding Hubei Province), there have been almost no new cases of infection. Countries like Italy, which has implemented regional quarantines and similar measures, will soon follow suit with the earlier experience of China.

In China, four cities in Hubei Province, including Wuhan, were sealed off on January 23, and the number of newly infected people began to decline around 10 days later, peaking around February 3. At the end of February, the number of infected people began to fall below 150 in South Korea and Iran, dropping to 100-150 in early March, and into the tens of cases from March onwards.

A month ago, on February 11, Reuters ran an article entitled “The new pneumonia epidemic will end in April, but top Chinese experts expect it may peak in February” saying that ‘Mr Zhong Nanshan, the leader of the Chinese government's team of experts, commented that “It is likely to peak somewhere between the middle and later on this month. After that, it will level off and then settle down, “and went on to say that “I hope it will end around April.” And he also showed a cautious attitude to the issue by adding that the new virus is “a big problem because we simply don't know why it's so contagious.”

Mr Zhong Nanshan’s prediction, which can fairly be said to be representative of the views of the Chinese health authorities, turned out to be strikingly accurate, and it’s also true to say that the tragedy of Wuhan, which was inevitably forced on the city by the collapse of medical care, the explosive increase in the chain of infections and the sudden rise in the number of deaths, was that it was completely sealed off.

With almost no infections outside Hubei Province, production is expected to recover sharply from the April-June quarter onwards. The Xi Jinping administration is trying every means at its disposal to realize this goal. A report on Bloomberg said that “according to materials released by the National Bureau of Statistics on February 29, the reopening rate of medium-sized and large-scale companies included in the PMI survey taken on the 25th was 78.9%, and that this is expected to rise to 90.8% by the end of March. Medium-sized and large-scale manufacturers say that they were at 85.6% as of the 25th, and at 94.7% as of the end of March.”

Hon Hai, which produces the Apple iPhone, released a comment on March 3 saying that “the current situation is that we have now returned to 50% capacity, and will recover to almost the required level of production capacity by the end of March.” Consequently, it is highly likely that a global supply chain, with China as its hub, will be rebuilt between April and May. Moreover, there are also the economic measures. The budget deficit as a percentage of GDP has been rapidly deteriorating to 6.1%, but the government debt balance is, at 55.6% of GDP, the lowest among the principal countries, and there is plenty of room for further action to be taken (according to the IMF’s October 2019 estimates). In light of this, it looks likely that China will be able to exercise its state power to cut off spread of the infection and thereby curb economic recession in the short term.

(2) In the anti-new-coronavirus war, Japan is expected to dominate

The number of newly infected persons in Japan is also expected to peak out in coming weeks

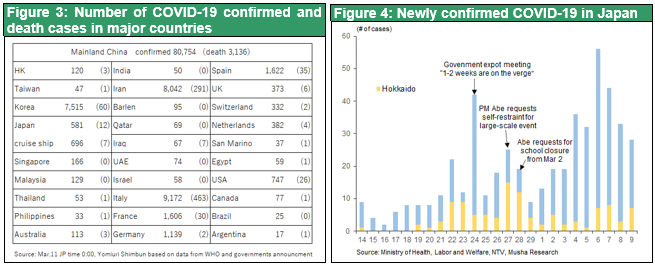

If we critically examine the situation, on the basis of the knowledge that we have to date, it looks likely that Japan will follow the pattern set by China and so we can expect to see the number of infected people peak out and for this to be followed by the subsequent normalization of the economy. As is clearly evident from Figure 1, Japan's stability is remarkable. The increase in the number of infected people has been suppressed, and the number of deaths is 12, which is far fewer than that of China (3,126), Italy (463), Iran (291), South Korea (60), France (30), where the infection started late, Spain (35), and the United States (26).

There was loud criticism of the Japanese government from the media about the measures it took to deal with the new coronavirus.

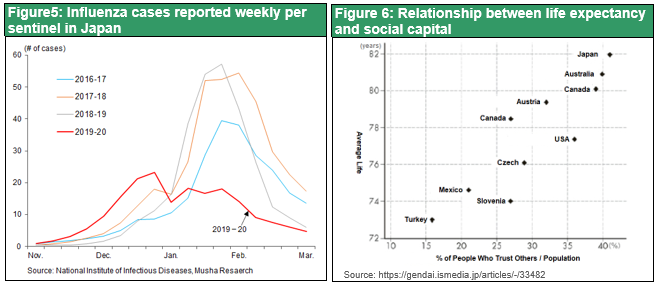

But isn't it absolutely obvious that Japan has been able to avoid a Wuhan-type total collapse in medical care in an appropriate fashion? A meeting of government experts was held on February 24th, at which a policy was hammered out, just one or two weeks away from the brink, to avoid a Wuhan-type transmission of infection. On February 27th, Japanese Prime Minister Abe voluntarily abstained from attending a large-scale event. And on February 28th, he requested a simultaneous school closure on March 2nd onwards with the result that the Japanese people were, from that point on, in a state of preparedness that meant they are engaged in a complete defence from the infection. As a result, the previously increasing trend in the number of newly infected persons has been stopped in its tracks. The route of transmission and the major clusters of infection are still being traced, and if the current national-alert system continues to be maintained, Japan could be the next country, after China, to succeed in suppressing the corona virus.

Japan's virtues, cleanliness, hygiene and the social capital that lies behind it

Since it would appear that it is only criticism of Japan and of its government that is currently overflowing, I would like to highlight the robustness of Japan's medical system and the strength of public awareness in the country. In its article entitled “Precautions Help Japan Control the Flu.”(in Japan, influenza is being curbed thanks to increased preventative precautions being taken), the Wall Street Journal (March 2) highlighted the raised awareness of hygiene prevention issues among the population in response to the advent of the new coronavirus, and also pointed out that the number of patients has decreased significantly (see Figure 5). Moreover, The Economist Magazine (March 7th) commented, in its article entitled “Japan may have to cancel the Olympics” that “if you’d like to choose just one country to stay in to survive infectious diseases, then that country is definitely Japan – the Japanese people have always maintained a strong commitment to cleanliness, as can be clearly seen in their woodblock prints portraying people taking baths.”

There is also a theory that hypothesises that Japan being the country with the longest-lived population among the world's developed countries is related to Japan's high social capital. In the course of a discussion featured in an article in the March issue of Voice entitled “What is well-being ... clarifying the qualitative aspects of life,” the author Yoshiki Ishikawa stated strongly that all of the physical, mental and social aspects of Japan emphasize the height of its wellbeing. Professor Ichiro Kawachi of the Harvard School of Public Health has commented that “Since 1996, researchers from Harvard's Department of Social Epidemiology have been conducting a large-scale survey of countries and regions around the world, including the United States and Japan, and have found that the strong social capital within Japanese culture has a major bearing on longevity and health. “In plain terms, social capital refers to social connections that are mutually represented by each other and when you look at the relationship between this social capital and life expectancy, one can see a clear correlation between them (Figure 6). “

The height of this social capital in Japan is also the height of the trust and the low risk premium in Japan and is the framework of the nation’s business model. Although not described in detail on this occasion, Japanese companies, having been completely defeated in the NUMBER ONE battle in price competition due to the strong appreciation in the yen and the emergence of trade friction between the United States and Japan after the burst of the bubble, nonetheless subsequently succeeded in building the ONLY ONE business model that specializes in technology and quality, and it is also this social foundation that made it possible.

It is my fervent hope that Japan's hidden virtues will similarly emerge during the course of the current war against the new coronavirus.