Apr 06, 2020

Strategy Bulletin Vol.249

An unprecedented natural disaster has made fiscal discipline obsolete

A devastating natural disaster caused by a worst-case pandemic

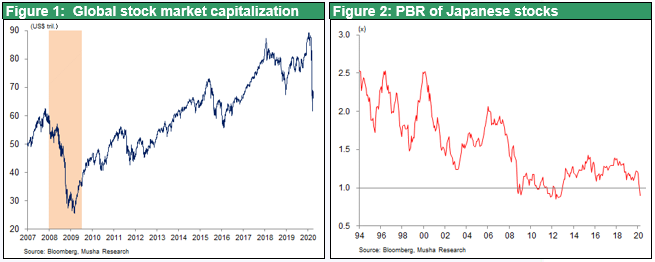

The worst expectations for the new coronavirus outbreak that originated in China have become reality. Healthcare systems have collapsed in Italy and Spain, where the virus has killed more than 10,000 people in each country, far more than the 3,318 reported deaths in China. In the United States, about 300,000 people have been infected, four times more than in China. Economic activity has come to a standstill as countries worldwide shut down cities. The outbreak appears to be settling down in China but there is still no sign of the beginning of a decline in Europe and the United States. Stock prices in the United States and other countries plunged 35% to 40% during the three-week period following the all-time highs of the second half of February. In Japan, stocks have a dividend yield of 3.1% and a PBR of 0.8. At this valuation, stock prices have factored in the constant destruction of corporate value for many years. As a result, stocks in Japan have been sold off to a level that is absolutely undervalued regardless of what happens from now on.

Bold government actions will stop the decline in stock prices

Almost all natural disasters are regional events. However, the magnitude of the COVID-19 crisis is unprecedented because it is happening simultaneously around the world. If this crisis cannot be stopped, sales in the tourism, transportation, restaurant and other industries worldwide will disappear. The result would be a massive economic downturn due to a rapid increase in bankruptcies, unemployment and lost income. This is nothing less than a war. Leaders of countries and monetary authorities have declared their determination to do whatever is needed. Countries are enacting spending programs, monetary easing and financial support measures on a scale never seen before. Stock prices have finally stopped falling because these actions have made people confident that the chain reaction of economic decline will end.

The crisis has eliminated limitations on government spending

One strange effect of this crisis is the instant disappearance of guidelines and restrictions for government spending that countries have been religiously observing for a long time. The United States approved expenditures of $2.2 trillion, which is about 10% of its GDP. Furthermore, the United States plans to spend another $2 trillion on infrastructure projects. Germany, perhaps the country with the strongest commitment to fiscal discipline, has approved expenditures of €156 billion and a rescue fund of €600 billion, a total of €756 billion, which is about 20% of its GDP. In Japan, the government is considering expenditures that will exceed the global financial crisis measures totaling ¥56.8 trillion, which was about 10% of the GDP.

The demise of the “golden rule” for fiscal discipline is good news

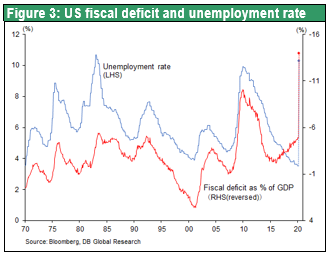

Fiscal discipline has clearly been destroyed by this crisis. The end of this discipline should be regarded as necessary rather than simply an obvious outcome of current events. Removing restraints on public-sector spending will speed up the next economic recovery. This recovery will probably result in only higher stock prices with no inflation or sharp increase in interest rates. The reason is that the global economy had two fundamental problems even before this crisis started. One was downward pressure on prices due to insufficient demand. The other was downward pressure on interest rates due to idle capital. Demand has been inadequate because of the growth in the ability to supply goods resulting from higher productivity fueled by the technology revolution (internet, AI, robots). Interest rates have been declining because companies have let funds from their substantial earnings sit idle rather making new investments. Due to this situation, there was a need to stimulate demand by enacting expansionary fiscal and monetary policies in order to put this idle money back to work.

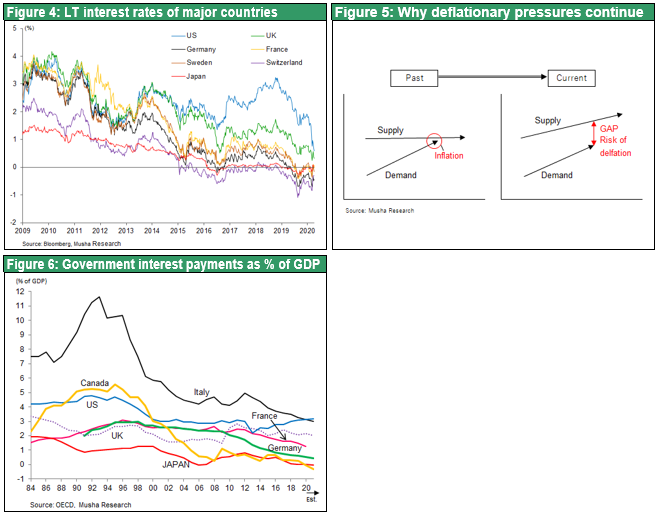

Utilizing idle capital and production capacity will make the economy stronger than before the new coronavirus crisis. For years, what the world needed was to be set free from the long-standing belief that governments should be frugal. But this thinking is not at all applicable to the world today. During the past 20 years, the majority of economists, government officials, reporters and commentators in Japan have constantly issued warnings about budget deficits. They were convinced that deficits would lead to inflation, higher interest rates and a big decline in the yen’s value. In fact, deficits had the opposite effect: the diseases of deflation, lower interest rates and a stronger yen. Warnings of the experts were completely wrong. As Figure 6 shows, Japan has the highest government debt in the world as a percentage of the GDP. However, government interest expenses are the lowest in the world as a percentage of the GDP. Japan is clearly nowhere near a situation that would trigger a public-sector financial crisis.

During the past several years, a number of academics, economic theories have emerged in the United States that justify more government spending. Two examples are the fiscal theory of the price level (FTPL) and the modern monetary theory (MMT). One reason for these new ideas is that they reflect what the global economy of today needs.

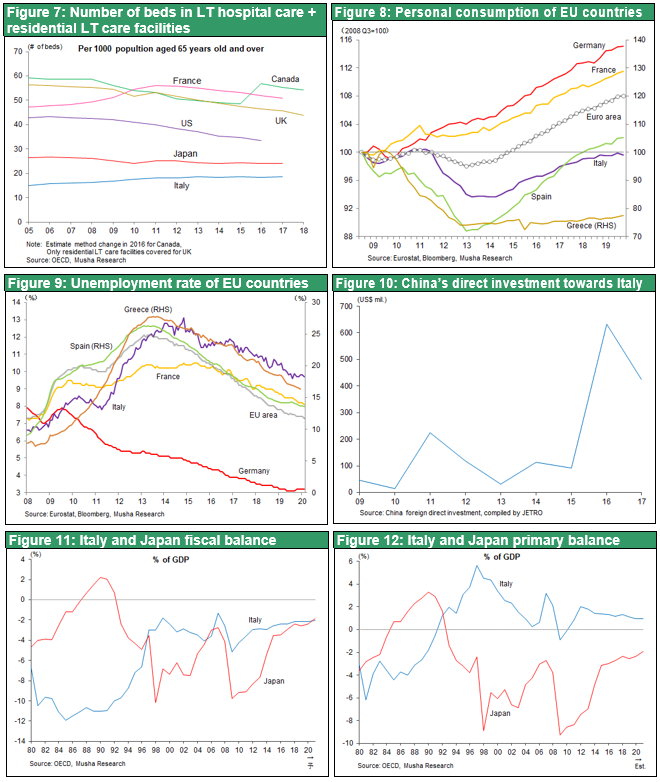

Italy shows the world the dangers of a tight fiscal policy

The collapse of the healthcare system and shocking number of COVID-19 deaths in Italy are events that no one expected to see in an affluent country. Italy’s fiscal discipline is in part responsible for this tragedy. Italy is not competitive in global markets and its internal demand has been sluggish. The EU has insisted that Italy hold its budget deficit below 3% of the GDP and government debt to below 60% of the GDP. To meet these demands, Italy was forced to limit public-sector expenditures with steps that included cutting the healthcare budget. Japan and Italy both have very high public-sector debt relative to their GDP. But the primary budget deficits of the two countries are different. This deficit, which excludes interest payments on debt, represents expenditures that create demand. Japan has an enormous primary budget deficit but Italy has an enormous primary budget surplus. This surplus signifies that Italy’s frugal budget has been consistently creating a burden for the people of Italy by reducing overall demand.

The negative side of Italy’s closer ties with China

During the past 20 years, the number of hospital beds in Italy per 1,000 residents has decreased about 40%. Furthermore, the number of long-term care beds for seniors has dropped to only about half of the levels in Japan and the United States. These downturns are probably an underlying cause of the current healthcare crisis in Italy. Another problem in Italy is the inability to devalue its currency because, even though the country is not very competitive, it must use the euro. With a currency devaluation off the table, Italy instead suffered declines in the number of jobs and consumer spending. To end these problems, Italy became the only G7 country to participate in China’s “one belt one road initiative” in order to increase trade with China. However, the negative consequences of Italy’s decision to rapidly strengthen ties with China are now appearing.

The new Keynesian Era will soon be in full bloom

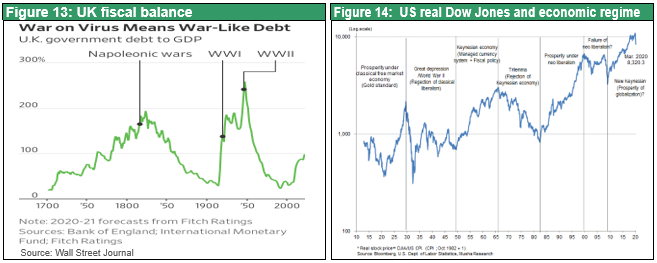

The Wall Street Journal reported that the government debt of Britain surpassed 200% of the GDP only three times during the past three centuries: 1815 due to the Napoleonic Wars, 1920 due to World War I and 1945 due to World War II. The new coronavirus crisis may be following (Figure 13). If this crisis turns out to be the beginning of a new era, it will probably mark the end of the period when government deficits were regarded as unquestionably harmful.

Six economic periods in the United States are evident in Figure 14, which shows the changes in real stock prices. First is the phase of prosperity in a classic free economy (the gold standard), which ended in 1929. Second is the failure of the classic free economy and end of the gold standard (1930-1940s). Third is prosperity in an era of Keynesian policies, non-convertible currencies and government budget deficits (1950-1960s). Fourth is the death of Keynesian economics (1970s). Fifth is the prosperity of neoliberalism with global non-convertible dollar printing(1980-1990s). Sixth is the failure of neoliberalism (2000-2009). Seventh is prosperity since 2009 in an era of new Keynesianism, quantitative easing and the growth of government spending. New Keynesianism started with quantitative easing and may now finally be on the verge of advancing to a period of full-throttle prosperity as governments set huge fiscal initiatives in motion.

The fruit of technology revolution hasn’t brought lifting standard of living of people nor shortening workhour. It’s just resulted in increasing corporate profit and excessive saving. As the transitionary era from agriculture to industry, improvement of productivity must be accompanied by rapid growth of new demand simultaneously as technology improve.

For the time being fiscal policy must bridge between lack of demand and excess saving. Creative policy such as universal basic income must be considered at this occasion. We hope this disaster will mark a new era.