Apr 20, 2020

Strategy Bulletin Vol.250

Stocks have hit bottom – Governments need to determine spending

A sharp stock market rebound as the COVID-19 crisis continues

The spread of COVID-19 shows no signs of stopping. Nevertheless, stock prices have staged a strong comeback following the dramatic plunge. In the United States, the DJIA plummeted 38% from its highest point over a period of only three weeks, the fastest downturn ever. Following this drop, the DJIA set another record by rebounding 32% in only two weeks. Stock prices have already covered half of the initial loss. There is a saying that a rebound that takes prices half way back will lead to an upturn to the level where the bear market started. If so, then a full-scale recovery of the stock market is now within sight.

Can we believe in this rebound? Or is this a deceptive upturn that has not eliminated the possibility of another big stock market collapse? Naturally, the answer depends on how quickly the COVID-19 outbreak can be brought under control. Until this outbreak is stopped, a deep economic downturn will continue as cities are locked down and normal economic activities are prohibited. However, once this crisis comes to an end, the return to normal activities is likely to result in a rapid economic recovery and higher stock prices. My personal belief is that the worst is over for the stock market. I think stock prices will continue moving up, although the market will zig-zag its way upward.

The first reason for this belief is that this crisis is caused by a natural disaster. The economy and financial system are both sound. Both the Great Depression that began in 1929 and the global financial crisis of 2009 were caused by severe economic diseases such as excessive risk-taking, an asset price bubble and deflation. After stock prices plunged, there was a long and difficult road to recovery. Banks failed, a reluctance to extend loans and the growth of bad loans created a credit crunch, and there was a large volume of non-performing loans and other assets. This time, banks, households and companies are all financially healthy, so everything is in place to jump start the economy.

The buck stops here – Bold US actions have eliminated downside risk

The second most important reason is the confidence created by government support for the economy. Every crisis in the past was started by monetary tightening in order to stop inflation, an asset bubble or some other problem. Government policies are the enemy of the economy and markets. But this crisis is precisely the opposite. Governments and central banks of major countries are doing everything they can, resulting in spending and monetary easing of an unprecedented scale.

This confidence is the primary reason for the strength of stock prices in the United States, the center of the crisis with more than 720,000 COVID-19 cases and 37,000 deaths. The US government was first in the world to approve direct payments to individuals, distributing $1,200 for adults and $500 for children. Furthermore, unemployment benefits were doubled. Overall, the US spending package totaled $2 trillion, which is 10% of GDP. The Fed plans to pump an additional $2.3 trillion into the US economy with measures centered on what are essentially direct loans to companies. Furthermore, there are plans for infrastructure investments totaling more than $2 trillion. The US government is prepared to further enlarge this safety net if the COVID-19 crisis does not end soon. All of these actions are shielding the economy and financial system from the impact of this crisis regardless of how bad it eventually becomes.

Currently, orders to stay indoors, close stores and take other preventive actions have wiped out demand for businesses that serve people directly, air travel, restaurants, entertainment and many other activities. Cash flows at these businesses have stopped. Unemployment is climbing fast. New unemployment benefit claims totaled 22 million over four weeks in the United States. One of every eight US workers no longer has a job because of this crisis. Based on these figures, the US unemployment rate is probably around 13%, the highest since the Great Depression.

A natural disaster is the cause of all of these problems. Mistakes or carelessness by companies or individuals are not responsible. Only an irresponsible government would do nothing while hard-working companies and people became insolvent. “The buck stops here” are famous words of President Harry Truman. US government leaders are clearly in unanimous agreement with this spirit as they respond to this crisis.

Japan must be just as resolute as the United States

Japan is considering a massive spending package totaling ¥108 trillion. However, this package is actually not generous at all because it has new spending of merely ¥16.8 trillion. Many people believe that Japan’s delay in declaring a state of emergency was caused by the inability due to financial limitations to make extra payments associated with the shutdown of businesses. But this view puts the cart before the horse. Public opinion surveys show that the people of Japan do not want penurious government policies. Prime Minister Abe initially proposed the payment of ¥300,000 only to households financially hurt by this crisis or with low income. The prime minister then abandoned this idea because of intense criticism from the public, opposition parties and the ruling party. The decision was then made to pay everyone in Japan a flat ¥100,000. This results in total expenditures of ¥12 trillion compared with only ¥3 trillion for the limited household payment scheme. Public opposition destroyed this scheme, which was created with the Ministry of Finance playing a central role. This is probably what gave the prime minister the resolve to take a much bigger step.

News from now on will be overwhelmingly positive

We can expect to see a series of positive news from now on.

- We are almost certainly near the peak of the number of COVID-19 infections and deaths. The outbreak has quickly declined in Wuhan and is likely to start settling down in Italy and Spain too. In the United States as well, there will probably be a big improvement in this crisis by around June.

- Once the extremely cautious step of locking down cities comes to an end, there will be a steady improvement in economic indicators that have plunged since this crisis began.

- (3) We will begin to see progress worldwide with the development of COVID-19 drugs and a vaccine.

All of these events should be able to end this crisis completely by perhaps as soon as the end of 2020 and at the latest within the next two years.

Enormous spending programs and monetary easing will be sufficient to deal with corporate financial problems and unemployment. When this pandemic finally winds down, there will probably be a huge amount of demand and surplus liquidity. The stock market may start to reflect sooner than anyone expects the outlook for this post-crisis V-shaped global economic recovery.

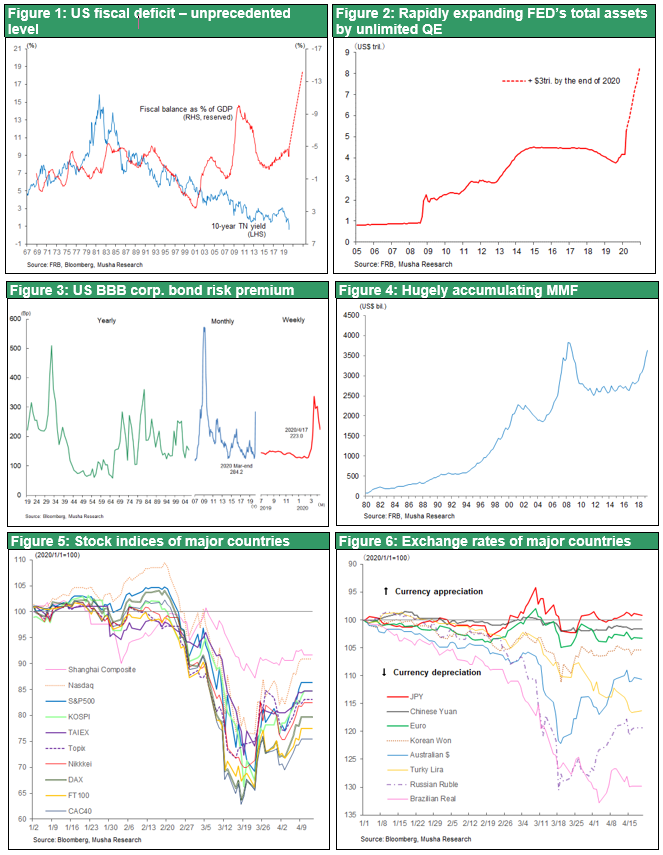

Reference Charts