May 01, 2020

Strategy Bulletin Vol.251

Pandemic breaks down historical trends and pushes up stock prices

The Positive Historical Role of COVID-19

The numbers of COVID-19 infections and fatalities have now peaked out in Europe and the United States, and the lifting of lockdowns is on schedule. Nonetheless, there are many uncertainties around the development of the crucial, game-changing prescription drugs and vaccines needed, and there is concern about a second wave of infection hitting after the process of locking down cities comes to an end. In the United States, which is the largest epicenter, the number of infected people has now reached 1 million and the number of deaths has hit 60,000 (13 times more than in China), which is more than the number of the victims killed in the Vietnam War. Major economies are now in the midst of the greatest post-war depression since the Great Depression.

In the face of this historic catastrophe, it is natural for people to become pessimistic and to look backwards. However, if we think about the situation a bit more carefully, we can see that the COVID-19 pandemic is likely to deliver an instantaneous burst of impetus to the course of history, which has been held back by various obstacles and opposing forces, that will act to boost the economy and stock prices. It would be a waste to overlook the great opportunities that the rare natural disaster of COVID-19 is, so strangely, creating in its wake.

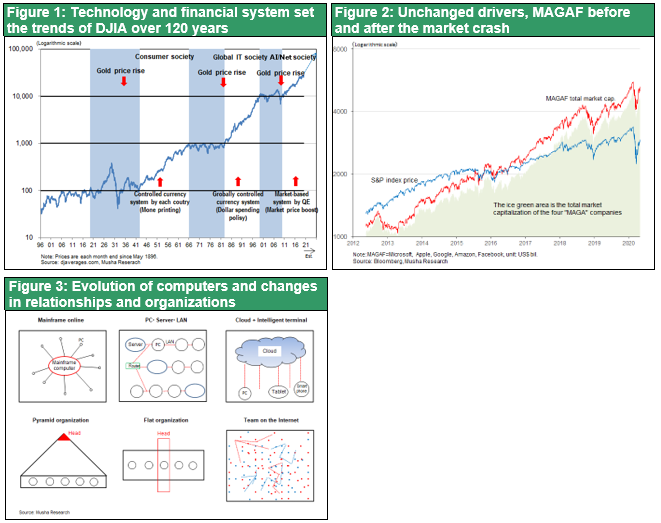

The following four major historical trends began before the onset of the COVID-19 infection.

- The momentum of the online shift that is engulfing all areas of business, life, finance and politics, towards further and further reliance on IT and net-based systems

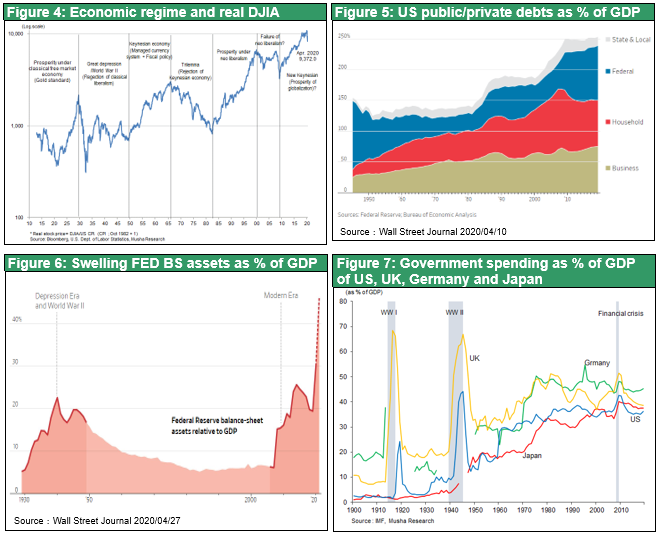

- The move towards a Big Government; New Keynesian system → an era of large government due to the bloated expansion in fiscal policy and extremely expansional monetary policy by central banks,

- China's isolation → a US-China trade war and a US-China Cold War both started, and a restructuring of the international division of labour that is dependent on China,

- Progress of equities capitalism → Economic and financial management centered on stock prices.

However, these trends were hindered from spreading by some impenetrable obstacles. What were these obstacles?

- For the process of online development: existing conventions; institutions; and systems

- For the process of big governmentalization: faith in sound finances and austerity policies

- For China's isolation: harmonious and cooperative habits and customs relating to China

- For stock capitalism: criticism of the Bubble and the neglect of asset prices, etc.

These obstructing factors held back the flow of history, caused stagnation, and created great distortions in areas including politics, institutions, the economy, society, and people’s livelihoods and lifestyles, etc. It can therefore be understood that the illnesses of the world economy that have become apparent in the past few years, (1) deflation (= surplus supply capacity), (2) zero interest rates (= surplus capital), have been caused by these obstacles that have been holding back change. The corrective measures needed to address another illness, that of the widening disparity, was also hindered by the above-mentioned obstructive factors.

The COVID-19 pandemic will destroy all these impediments and so accelerate historical trends. When the COVID-19 outbreak subsides a year or two from now, the vitality of the world economy should increase and quicken. Nowadays, no one disagrees with the maximum use of the Internet in business and life, or the total mobilization of fiscal and monetary measures by the governments. It clearly incontrovertible that the totalitarianism of China’s Communist Party is a trouble of international order.

These conclusions, which would have taken years and many failures to finally reach, can be now be grasped instantly thanks to the impact of the COVID-19 pandemic, and this is a matter of great significance. In fact, the V-shaped recovery in the stock market may have already begun to incorporate it.

The bearish view is strong in the market. The COVID-19 shock is a natural crash that would have happened even without its occurrence, with some foreseeing that it will usher in the collapse of the bubble and mark the end of the system of false prosperity that have both been caused by excessive monetary easing. The WSJ reports that speculative stock short positions in the United States have risen to their highest levels since 2016, in the belief that a double bottom is coming.

Conversely, however, last month's market expansion has rather been supportive of a bullish view. Firstly, if the stock plunge is the end of a bubble and of false prosperity, it should surely be hitting the protagonists who have, to date, been taking the leading roles. However, the US MGAFA (the five internet platformer companies (Microsoft, Google, Apple, Facebook and Amazon), which have led the rise in stocks so far, had the lowest rate of decline in their stock prices, and the largest rebounds thereafter. Amazon, Netflix, etc. have already set record highs. Secondly, if a long-term downtrend really has started, it is pretty unlikely that it could recover half of the fall in the space of just two weeks. It can therefore be assumed that the stock price crash will be temporary, and that the unprecedented fiscal mobilization and super-easy monetary policy will have almost completed the creation of the safety net and that excess liquidity will be caused as a result. The volatility will continue for a while, but I now want to consider it as being a historic investment opportunity.

Reference Charts