May 28, 2020

Strategy Bulletin Vol.252

COVID-19 Pandemic Interim Summary

The Nikkei Stock Average and the NY Dow Industrial have now entered a phase in which they have both soared, by ¥1,000 and $1,000 respectively, within the course of just two to three days. From the 40% crash after the COVID-19 shock, a recovery of almost half the value lost has already been achieved, and there is a strong likelihood that, in line with the old adage that a half-value recovery is a full-value recovery, that the markets have now moved into a phase of full-scale price rises. Musha Research has been of the opinion that the collapse triggered by the COVID-19 pandemic is likely to be a stepping-stone towards a long-term rise in Japanese stocks. The grounds for this are detailed in "After-COVID-19, a V-shaped Recovery in the Global Economy" (Business-sha, Inc.), which will be released on June 10. The following is a postcard in advance of its publication.

The COVID-19 pandemic, which was thought at first to be located solely in Wuhan, spread rapidly all over the world, and a medical collapse struck Italy, New York, and locations all across the developed world. The global harm has exceeded 5 million people infected and 300,000 deaths, 70 times more than in China, the source of the infection, and has developed into a pandemic that far exceeded the worst scenario that had been envisaged. Global economic activity has almost ceased, all economic indicators have been at their worst levels since World War Ⅱ, and unemployment rates have reached their highest levels since the Great Depression. This COVID-19 virus is extremely infectious, and the “With COVID-19 Era” will continue until an effective vaccine has been developed and collective immunity has been achieved. In the next six months to a maximum of three years, a complete recovery in the economy will be difficult to achieve. Even if a very nervous and conservative resumption of economic activity, while avoiding human contact, is attempted, whenever any second or third wave epidemics occur such economic activity will be suppressed in response every time.

Global stock prices plunged 40% in the four weeks after the outbreak of the COVID-19 pandemic, the fastest pace ever recorded in history. However, over the course of the following two weeks, it achieved a half-value recovery, which was also the fastest recovery ever. Financial journals such as the Financial Times have conducted campaigns warning that this rapid recovery in stock prices is merely the result of euphoria and so unsustainable. The Economist warns of optimism in a special feature (in its 9th-15th May issue) entitled "A Dangerous Gap - The Markets v Real Economy”. The number of global infections in developed countries peaked at the end of March, and their economies have since picked up from their worst postwar level. The governments and central banks of the United States and other countries have launched a series of fiscal and monetary stimulus measures to avert economic and financial collapse. This has given the markets some sense of security. Clearly, it goes without saying that we are not in a situation where we can be optimistic about letting our guard down and relaxing restraints, but it is also true that the authorities, the press, and the experts are displaying an even greater bias against being optimistic. The economy and the markets really should be more rational.

One pessimist, who remained quiet for a while in the wake of the GFC, appeared just to say, "you see, I told you so," further darkening an already depressing mood. The foundation for this underlying pessimism is the general view that economic growth following the GFC is merely a fragile house of cards built by a series of banned policies and is therefore unsustainable. The COVID-19 pandemic has only brought forward the judgment that was bound to come at some point.

In contrast to this view, Musha Research wants to stress clearly that the wave of long-term economic boom is not over, and that a rising wave will return after COVID-19. The reason for this is that COVID-19 can be thought of as accelerating the flow of history. We believe that the global catastrophe known as the COVID-19 pandemic will swiftly sweep away the obstacles that have stagnated the flow of history, raising economic growth in the long run and boosting stock prices.

Perhaps the most important thing that everyone wants to know is whether the ongoing economic prosperity has now ended, or whether it has merely been temporarily stopped. Just before the COVID-19 pandemic, the world economy was booming, the online information and communication revolution was in progress, the unemployment rate in the United States had dropped to a record low of 3.5%, and stock prices had quadrupled in the 10 years after the GFC. If this long-term economic boom continues, it is unreasonable to claim that the sharp return of stock prices can necessarily be attributed to euphoria. Rather, it can truly be said that the point of a stock market crash is an excellent opportunity build up your equity portfolio.

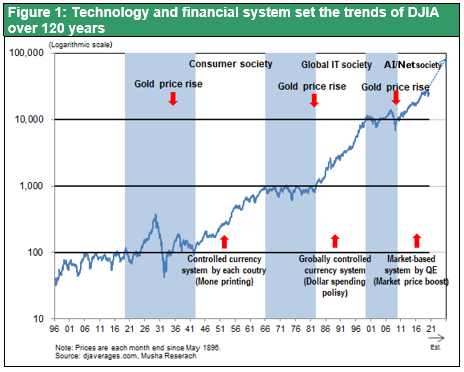

Looking back on US stocks in 100-year spans, both the long-term boom of 20years with a 10-fold increase in stock price and the subsequent adjustment over the course of the next 10 years have been repeated. In the 1950s and 60s, the NY Dow increased tenfold from $100 to $1,000, but during the decade of the 1970s it remained flat at $1,000. In the 20 years from the start of the 1980s to the end of the 1990s, it increased tenfold from $1,000 to $10,000, but in the decade of the 2000s, there were two crashes, the IT bubble collapse and the GFC, and it was flat. In the 2010s, an uptrend may have begun again with a repetition of the 10-fold increase. The question is whether the third big post-war wave has ended.

There have been three historical trends that were underway before COVID-19. (1) The IT, and digitalization that spread over all of business, life, finance, and politics; (2) The big government era created by the marked expansion of fiscal as well as monetary policy; (3) The isolation of China and the reconstruction of the international order, international division of labor. However, these historical trends were prevented from spreading due to some impenetrable obstacles, which have been the stumbling block to the world economy over the course of the last decade. These obstacles include existing customs and systems and an unrestrained resistance to the Internet; and, towards big government, faith in the soundness of fiscal policy, and belief and trust in financial austerity policies; and the yielding attitude to Chinese intimidation, because of the threat of Chinese economic power.

These impeding factors held back the flow of history and caused stagnation, which have, in turn, resulted in major distortions to politics, institutions, economics, society, and lifestyles, etc. It can be understood that the problems of the world economy, including deflation (= surplus of supply capacity), and zero interest rates (= surplus of capital), which have been manifest in recent years, have been caused by these obstacles that suppress and obstruct change. The widening disparity has also been hindered the implementation of corrective measures needed to remove by the above-mentioned obstructive factors. The COVID-19 pandemic will obliterate all these impeding factors and accelerate historical trends. When the COVID-19 outbreak subsides, the world economy should become more vital. It has allowed us to reach these conclusions more rapidly, which would, in the past, have only been reached after many failures over the course of many years, and it has therefore been of great significance.

In the face of COVID-19, obstacles to using the Internet, old systems, customs, and unrestrained resistance forces all melted away. The necessity of the avoidance of direct contact between people that it has brought in its wake has made the Internet into a trump card, a supreme command that is a categorical imperative and tolerates no objections. In particular, the spread of remote work has dramatically changed the way people work and has created new lifestyles and business models. Initiatives including reforms to companies’ attitudes of locking out external influences, the shortening of working hours, the regularization of side jobs, and the elimination of Hanko (stamp) culture (which has been an obstacle to remote work), and conversion of documents from paper to data are all making rapid progress. Employees who concoct alibis for coming to work, and those who only attend meetings, will be exposed. Japan, which has a lot of seniority-based employment, has lagged far behind in its introduction of the Internet, but this delay will be made up for all at once. The reform of labor organizations is also being carried out in various ways. Outsourcing of work will progress further, and both cost reductions and new product development will progress further.

Economic theories and policies that promote making effective use of finance, such as MMT and the Sims theory (FTPL), have formerly been difficult to put into practice due to the opposition of most economists. However, strangely, the COVID-19 pandemic has made an incredible expansion in fiscal policy unavoidable. In addition, to protect the financial system, the central bank is expanding its balance sheet more than ever before so as to ease credit. Since the austerity shackles have been removed, the subsequent economic recovery will speed up, but this will not mean any increase in inflation or interest rate spikes, but solely a rise in stock prices. In the first place, the world economy before the COVID-19 outbreak had two problems: downward pressure on prices = insufficient demand, and downward pressure on interest rates = surplus money. The lack of demand was caused by the technological revolution created by the Internet, AI and robots all boosting productivity and increasing supply capacity. The decline in interest rates was caused by the large amounts of profit earned by companies being left idle. Therefore, it was necessary to stimulate demand by utilizing these surplus funds in both fiscal and financial expansion policies. By making use of this idle capital and supply strengths, the economy will be in a better state than it was in before the COVID-19 infection struck. This unleashing from the spell of a standard of fiscal moderation that didn't fit the demands of the time was the most essential thing that needed to be done. Just as the Great Depression was the starting point of the modern, from “cradle to grave” system of social security, it may be that the COVID-19 pandemic will open up an era that delivers a social safety net, the emergence of a universal health system, and a universal basic income.

We knew that China's “overwhelming presence” was a problem in the current international order, but due to China's overwhelming economic power, relentless pressure, and threats, the vectors of the international community were not properly set. However, as a result of COVID-19, the international community has made up its mind to distance itself from China. The shift of production bases from China, the suppression of Chinese tyranny by international organizations, and the rebuilding of the international order, etc. will be a trend that will yield to no objections.

Once this decision had been taken, uncertainty disappeared. Every country and every company will lose their competitiveness unless they find supply sources outside China. Recognizing the dangers of China-dependent supply chains, countries are increasingly likely to move their production bases to ASEAN-Taiwan, the United States, and Japan. European nations that have decided to use Huawei products to appease China may also revise their decisions. These moves away from China will stimulate investment in many other regions and countries. However, China, as one side in the US-China confrontation, will not be able to tolerate a recession in the middle of a battle for hegemony, and will continue to apply its economic leverage. I don't know when the COVID-19 pandemic will end. But when it does end, we believe that there is no telling what fertile fields lie ahead.