Jun 09, 2020

Strategy Bulletin Vol.253

What’s ahead for the HK problem and US-China standoff?

Hong Kong has passed the red line

The National People’s Congress of China that started on May 22 has endorsed a national security law for Hong Kong. Just as with Japan’s pre-war Maintenance of Public Order Act, China’s new law will make criticism of the government a criminal offense equivalent to attempting to overthrow the government. This drastic measure is capable of ending Hong Kong’s self-rule and the democracy movement. Chris Patten, the last British governor of Hong Kong, is extremely critical of the new law. He says the one country, two systems arrangement that guaranteed self-rule after Hong Kong’s return to China has been destroyed. He believes the regime of President Xi Jinping is creating the risk of a new cold war. Furthermore, Hong Kong is in danger of losing its position as a global financial hub. As a result, we are seeing frequent remarks in the media by the Trump administration and others that the U.S.-China standoff has finally crossed the red line.

The Xi Jinping regime is unyielding and the Trump administration is seemingly open to appeasement

China’s unyielding stance is obvious. Already, the government has prohibited the people of Hong Kong from holding a gathering on June 4 for the anniversary of the Tiananmen Square incident. As retribution for the US decision to revoke Hong Kong’s favored trade status, China is apparently thinking about blocking imports of soybeans and pork from the United States. It means , China has indicated that it will scrap the phase one trade deal. Going one more step, China is apparently utilizing the opportunity created by coronavirus turmoil in Europe and the United States to become more belligerent regarding the South China Sea, Senkaku Islands and other areas of conflict.

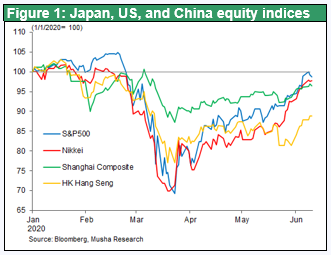

Nevertheless, the US response to the Hong Kong national security law has not been more than what China anticipated. For example, the United States terminated Hong Kong’s special status concerning tariffs and visas. But there was no freeze on the dollar-denominated assets of individuals involved with this matter or other steps that China had feared. This may be an indication of the Trump administration’s willingness to appease China. The Bank of China and two British banks (HSBC, Standard Chartered) issue Hong Kong dollars. Both British banks have expressed their support for the new law. Consequently, there is no need to worry about the stability of Hong Kong’s financial functions and the uproar sparked by China’s high-handed move to suppress Hong Kong will probably quiet down soon. In fact, Hong Kong’s stock market has remained steady following China’s decision to enact the new security law.

Hong Kong is a vital source of dollars for China

China is the largest financial hub in Asia and a critical gateway for China to procure dollars. The most frightening scenario for China is therefore more unrest that eventually prevents Hong Kong from functioning as an international financial center. However, US sanctions are nowhere near the level that would shut down Hong Kong’s financial position.

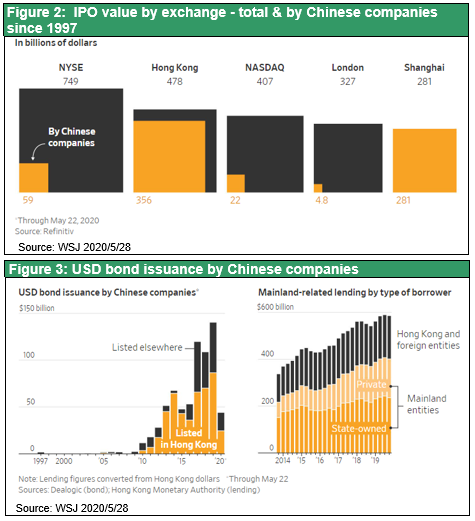

Hong Kong plays a vital role in China’s procurement of foreign currencies. According to the Wall Street Journal, IPOs by Chinese companies since 1997 have raised $336 billion in Hong Kong and $281 billion in Shanghai. Hong Kong is even more important regarding bank loans and corporate bond issues. Chinese companies use Hong Kong for over half of their dollar-denominated bond issues and for listing these bonds. In 2018, Hong Kong was the channel for $90 billion of the $138 billion of inward direct investments to China, a share of about 65%, and $87 billion of China’s outbound direct investments of $143 billion, a share of about 61%.

Hong Kong has many advantages: a European/US-style rule of law, a guarantee of unrestricted movements of capital, low taxes, the English language, and its own currency with a link to the dollar. This is a place that global investors can use with confidence. Hong Kong’s immense pool of capital makes it an ideal place for Chinese companies to raise funds. Now President Xi is attempting to hollow out the one country, two systems framework. The convenient double-standard, One country two system is about to be taken away and the power of China’s Communist Party over Hong Kong is increasing. However, , China wants to continue using a free Hong Kong for global fund procurement activities. Thus far, Hong Kong’s financial freedom is still intact.

Three key points about the US-China confrontation: 1. The war will be long, 2. China cannot win, 3. Dollar procurement difficulty will determine the winner

However, there is still no reason for China to be confident about the outcome of U.S.-China tension. In this age of the US-China confrontation, we need to have an understanding of three key points.

First, this will be a protracted war of attrition. The United States and China cannot sever their ties immediately or start a hot war because the two countries depend each other too much. The new reality is therefore a US-China struggle for hegemony that will not end for three to five years. Due to the high level of mutual dependence, cutting off economic relations would be a devastating blow to the economies of both countries. For the United States, the only course of action is a war of starvation. During these starvation tactics, the global supply chain currently centered on China will be reconfigured. Companies with factories in China and companies that rely on China for the supply of parts or finished products will probably move their business to other countries at an increasing speed. China is constantly working on stimulating internal demand in order to offset the downturn in international trade. During this process, both the United States and China are forced to take actions to expand their domestic economies and markets. The reason is that an economic pullback and falling stock prices would give the other country a decisive advantage in the war for hegemony.

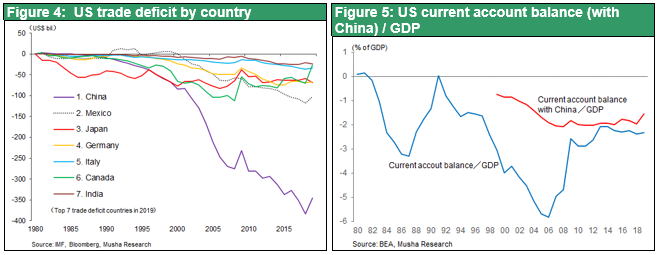

Second, there is no doubt that the United States will end up victorious. China’s annual US trade surplus of around JPY40 trillion or $370 billion is critical to the country’s economic health. At first glance, China appears to be superior in terms of manufacturing and 5G and a few other advanced technologies. But China is still unable to compete with the United States in terms of overall strength. Trade friction has clearly created serious difficulties for the Chinese economy. China’s external demand will continue to decline as the competitive edge of Chinese products is eroded by the trade war and rising wages. In addition, China’s use of debt to prop up internal consumption and investments will further weaken its economy. The result is likely to be a rapid decline in the vitality of the Chinese economy.

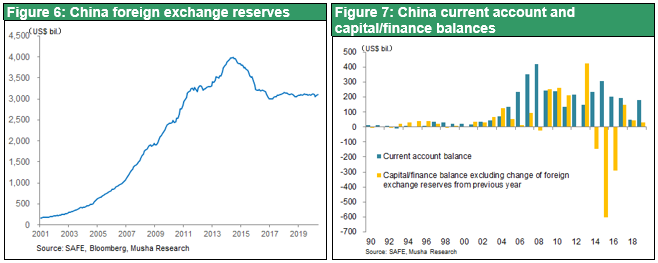

Third, the procurement of foreign currencies is China’s Achilles’ heel. Losing access to foreign currencies would be sudden death for China. The procurement of dollars by China is expected to become increasingly difficult because of the outlook for a big downturn in the country’s current account balance. As this difficulty grows, Hong Kong’s role as the gateway for procuring dollars will becoming even more important. At some point, the US-China confrontation will reach the final stage in which the United States exerts financial pressure on China, including by playing its trump card: prohibiting China from using dollars. When this happens, President Xi will be forced to abandon his hardline tactics.