The unstable housing market requires a final government back-up

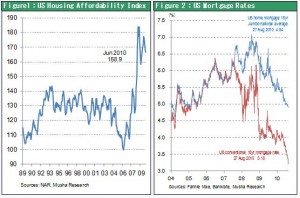

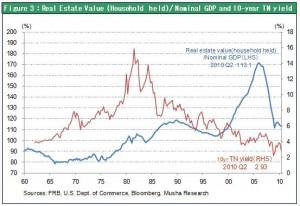

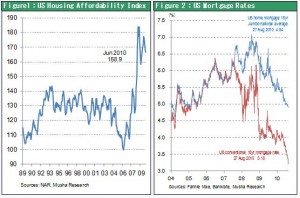

Cautionary signs are appearing about the sustainability of the U.S. economic recovery. Fears are mounting about another plunge in home prices as unemployment stays high. Home prices are down more than 30% from the peak. At this level, houses are clearly undervalued in terms of affordability and in relation to the GDP. Furthermore, interest rates on mortgages have fallen to an all-time low. Nevertheless, many people still expect home prices to decline even more due to strong selling pressure from foreclosures and other sources. There are also signs of limitations on approvals of new mortgages as banks become more cautious about extending credit. Another drop in home prices would very likely trigger another financial crisis. At this point, the economy may need a large-scale program to improve the balance between supply and demand for existing houses that is backed by monetary and fiscal policies.

The U.S. needs to maintain its animal spirit for another six months

Earnings and excess liquidity at U.S. companies have surged following the progress these companies have made in streamlining their operations. In addition, just as in the housing market, stocks are extremely undervalued in relation to interest rates. The liquidity on corporate balance sheets will probably fuel the next upswings in demand and stock prices due mainly to (1) growth in capital expenditures and other spending, (2) higher share repurchases and dividends and (3) more M&A activity. But this will not happen soon. Achieving this growth will require a robust animal spirit. This is another area that requires support from government policies.

The U.S. will avoid a double dip, but investors should avoid risk for the time being

We believe that the U.S. economy will not suffer a double dip because of measures to support home prices and monetary initiatives. Prospects are excellent for a long-term economic recovery. But markets will probably become more nervous over the next few months and perhaps for six months. This is why we expect investors to become increasingly averse to risk during the time that will be needed to set new policies in motion.

Japan is obviously the only loser

Amid news about the instability of the U.S. economy, speculators are equating risk avoidance with an increase in the yen’s value. As a result, Japan’s economy and stock market have suffered a greater blow this year than in any other country. In export-dependent Germany and South Korea, stock prices are at their highest levels this year while Japanese stocks have dropped 16%. This is a classic example of currency devaluations as more countries pursue beggar-thy-neighbor policies. In this environment, the yen has become stronger relative to the currencies of China and South Korea, which are both more competitive than Japan. But there is no policy to correct this injustice.

Will there be an end to the current lack of a policy?

Japan needs to enact a policy for ending its position as “the world’s only loser.” But the enactment of a powerful policy is no longer on the horizon because of dissention within the Democratic Party of Japan. Japan will have to undergo enormous changes that include the realignment of political parties before the country can establish a new framework for leadership.

From a short-term perspective, though, a victory by Ozawa would create a major coalition supporting a large government and a resumption of policies that throw money at the public. If this happens, it would be the end of the Kan administration’s policies that have been held back by fiscal austerity and traditional monetary policies. Japan could start heading in a different direction as a result.

From a longer-term standpoint, it is very likely that current turmoil in the economy and financial markets means that we have reached the absolute bottom of this downturn. There is a high probability that Japan is at a turning point that will lead to a brighter future. However, the investment climate will remain negative for the next several months.