Sep 15, 2020

Strategy Bulletin Vol.262

A big rally may come after the election of Mr Suga and expected LDP's victory at a snap election

Significance of the appearance of the true reformer Mr. Suga

Secretary of State Suga was appointed as the successor president of the Liberal Democratic Party on September 14, and will be appointed as the next prime minister by the extraordinary Diet session held on September 16. Mr. Suga claims to succeed the Abe administration. He is certainly a successor to good Abenomics, but his thorough reform stance is very different from Mr. Abe, who was a hereditary councilor and was brought up by a faction. Abenomics’s three arrows, monetary easing, and fiscal mobilization will continue as they are. However, it will take a big step toward the third arrow of reform. Promotion of reform is an agenda strongly sought by the people and global investors, and it will soon be dissolved and a general election will be launched with an election agenda to accelerate reform. Investors around the world may be surprised to find such a leader in the LDP, which they saw to be overwhelmed by conventions and vested interests.

NHK said Michael Green, a former White House official who oversaw Asian policy under the Republican Bush administration and CSIS = Center for Strategic and International Studies, said, "He is very intelligent and pursuits of new knowledge. He is a politician who is greedy for absorption. He is always looking for the knowledge he needs to make political decisions, and I have never seen a Japanese politician so strict and thoughtful. "

It will accelerate the buying of Japanese stocks by foreign investors who have barely seen Japan, and will change the landscape of the stock market.

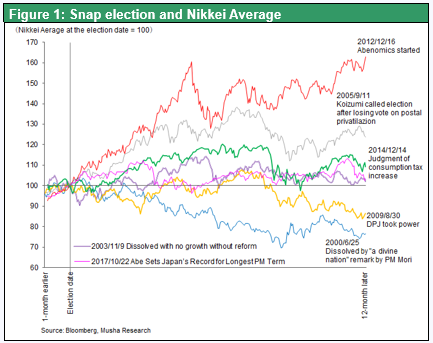

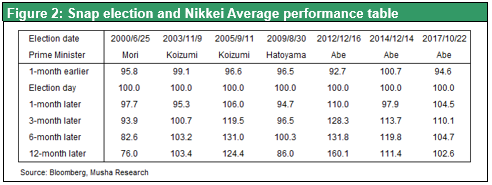

Bull run like Koizumi postal reform’s and Abenomics’s will be starting

The big rise in the market since 2000 was triggered by the emergence of a government that advocated economic reform and a big victory in the election. The Koizumi postal dissolution general election in September 2005 was a case in which Prime Minister Koizumi, who insisted that privatization of the postal service was the main point of reform, sent thugs to members of the Diet objecting the agenda(even the LDP) and won the election. , The stock price rose 38% to a high seven months after the election day. Also, at the time of Abenomics in December 2012, the general election was the start of the big bull market. The Nikkei average rose 67% from the election day to the high one year later. In both cases, it was foreign investors who expected Japan to change, which drove the big stock price appreciation.

The conditions for the same development are in place this time as well. (1) Mr. Suga's reform agenda is clear, and the people will definitely support it, (2) the supply and demand condition of foreign investors, which is the biggest factor for stock prices, is in the extremely bearish and (3) toward the end of Corona. It is clear that the economy is recovering.

Mr. Suga's amazing reform attitude, the Liberal Democratic Party accepting it

"I definitely want to do the work that will convince the people by breaking down the vertical division of the administration, breaking down vested interests, and breaking down the bad precedent principle," said Mr. Suga's speech as president of the Liberal Democratic Party. No fiscal consolidation without growth, establishment of new digital agency, administrative office-led reforms, regional bank restructuring and reforms, lowering communication charges, bringing power to create value in the national and local level, tourism-oriented nations as a means of doing so, raising income at the micro level, GDP Increasing, creating business opportunities for industrial companies, etc. These are policy mixes that foreign investors welcome. The corona pandemic reminded the public of the need for reform. In addition, the establishment of the administrative office -led political reform by the Abe administration has given the Suga administration a great power to promote and execute reforms. Mr. Suga has performed something like economic command tower, such as the BOJ and Administration Accord and the establishment of regular three-party meeting of the Bank of Japan, the Ministry of Finance, and the Financial Services Agency, and he has outstanding confidence in policy implementation.

Global investors who have sold all Japanese stocks, change of attitude is inevitable

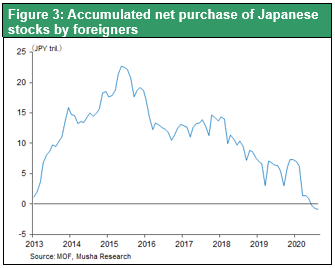

Contrary to such political development in Japan, global investors have thoroughly sold Japanese stocks. Foreign investors bought over 23 trillion yen of Japanese stocks between December 2012, when Mr. Abe won the election, and the end of June 2015. However, since then, it has continued to sell Japanese stocks, and as of August 31, it has sold everything it bought, and the cumulative total since the inauguration of the Abe administration has reached 868.8 billion yen of negatives. (Figure 3).

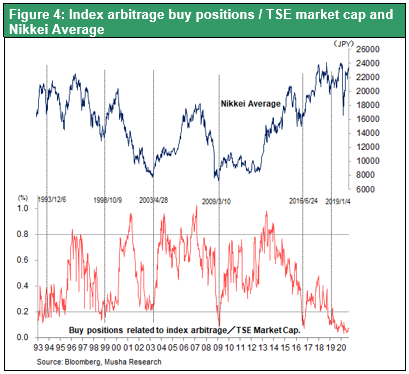

This is remarkable even when looking at the speculative position of foreigners. Speculators' arbitrage long position was over 3 trillion yen at the beginning of 2018, but recently it has fallen far below 500 billion yen. On the contrary, the arbitrage short position is piled up. It turns out that foreign investors are in an extremely bearish position for investing in Japanese equities. As shown in Chart 4, the arbitrage long position / market capitalization ratio of TSE stocks was 0.2%, which was the bottom of Japanese stocks, but it has fallen far beyond that. Japanese stocks are highly sensitive to the economy because the manufacturing industry accounts for 50% of the market capitalization of the Tokyo Stock Exchange, and they are avoided during the global economic downturn. That said, global investors have an extremely bearish bias towards Japanese equities.

This extreme pessimistic bias in Japan may change drastically in the face of the birth of the new Suga administration and the dissolution general election under the banner of reform promotion that Mr. Suga will launch. Buffett's purchase of shares in a Japanese trading company will also push the back.

Mr. Suga will aim for an early dissolution general election to gain the impetus for reform

The dissolution general election is likely to take place later this year. The following three elements are pointed out. (1) High approval rating, opposition party turmoil, (2) Want to obtain national consensus on policy agenda "promotion of reform", (3) High stock prices resulting will give political capital to reform.

Mr. Suga is an extremely rational politician. Now that you have defined your political mission as reform, you should think about what you should do to do so. The dissolution general election will be the first priority for the time being, as it seems to seek the trust and driving force of the people necessary for reform. In Nagatacho, there are many voices saying that it will be disbanded this fall. Scenarios such as dissolution after the end of September, which is the budget request deadline for the 2021 budget, and voting on October 25, are being talked about. If we miss this fall, we will have a winter when corona and influenza are prevalent at the same time. Beginning next year, the budget for next year at the beginning of the year, the Tokyo Metropolitan Assembly election, and the Tokyo Olympics and Paralympics will be held in the summer. The advantage of dissolution within the year is great.

There are hurdles such as whether the conditions imposed by himself to end the corona are met, whether he can withstand the criticism of creating a political gap, and whether the Komeito opposes it. But it will do.