Dec 21, 2020

Strategy Bulletin Vol.268

In 2021, the biggest risk is underestimating the resilience

Favorable fundamentals have outweighed the black swan event

One year ago, Musha Research predicted in our report “Buy stocks now” is the only recommendation investors need for 2020" (Strategy Bulletin Vol. 241, Dec. 23, 2019) , that 2020 would be a year of great opportunities for stock investment. The rationale was that (1) the recovery phase of a mini cycle led by the manufacturing sector would start, (2) the new industrial revolution (5G digital revolution) would be underway, (3) the trade war between the US and China would subside, and (4) there would be ample investment capital. We noted that the US presidential election being a risk, but we believed that a Trump victory would maintain pro-business economic policies. A media survey predicted the Nikkei 225 would reach a high for 2021 of between 28,000 and 30,000 yen.

Although it did not materialize this bullish stock price assumption was largely reasonable, despite the assumptions being way off. This unprecedented COVID-19 pandemic has completely paralyzed economic activity around the world. This led to President Trump’s election defeat, even though he had been considered a sure thing, and the inauguration of the Democratic Biden administration. These were unimaginable negative factors and an attack that was truly a black swan event. Nevertheless, the stock market rose. Why?

This extraordinary negative impact from the black swan attack eliminated the strong fundamentals of (1) to (4) above. The favorable fundamentals (1) through (4) will continue as is, while the black swan event will disappear in 2021. Not only will it disappear, but the black swan event will leave behind the benefits of an accelerated new industrial revolution and unprecedented fiscal and monetary easing. President-elect Biden’s nomination of Ms. Yellen to be his Treasury Secretary and the clear indication that the new US administration will follow a pro-business path are also positive signs.

Investors’ focus shifting from downside risk to the risk of not holding stocks

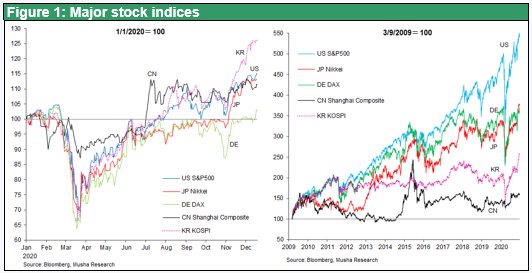

In 2020, the economy and markets digested the negative impacts of the COVID-19 pandemic with remarkable speed. Stock prices made a V-shaped recovery in five months, the economy and manufacturing output recovered to almost the same level as the previous year in one year, and GDP is projected to return to pre-COVID-19 levels in six months in China and 12 to 18 months in the US. After the US presidential election, US stocks (S&P 500) and Japanese stocks (Nikkei 225) rose sharply in November, up 10.0% and 14.4%, respectively. This is attributed to the likelihood that the black swan event had exited the market. The November rally was so sudden that most investors missed the boat. As a result, investors became acutely aware of the risk of not holding stocks. This major shift in market sentiment from "preparing for downside risk" to "preparing for the risk of not holding stocks" may be a prelude to a strong upswing to come.

In fact, the market outlook is uniformly bullish. According to a global survey of 984 market professionals conducted by the Deutsche Bank Group in December, the most promising investments for 2021 are forecast to be equities, including US stocks (72%), and the investments to be most avoided are cash and bonds (62%), indicating an unprecedented preference for risk. So where does the risk lie? Is it the risk that this heightened optimism will be betrayed? No. We think the biggest risk to the outlook for 2021 is underestimating the resilience of the economy and the market, and underestimating the potential upside.

It is almost certain that unprecedented favorable conditions will push up the underlying strength of the stock market through 2021. There are five almost certain factors to note.

(1) The commercialization of COVID-19 vaccines will contain the pandemic in the second half of the year.

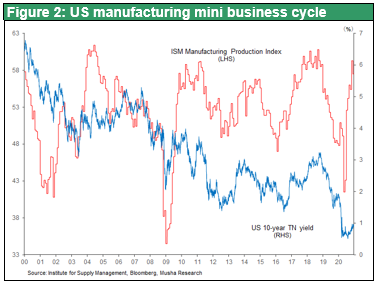

(2) The bottom of the manufacturing mini-cycle was much deeper because of the COVID-19 pandemic, so resilience has been built to that extent (insufficient capacity for supply due to the scarcity of inventory and suppressed investment).

(3) An accumulation of pent-up demand and increased savings is forecast to suddenly appear.

(4) The materialization of the effects of unprecedented global fiscal expansion and monetary easing.

(5) The acceleration of innovation (Internet digitalization, new energy, and the construction of supply chains away from China).

Strong upward pressure on the short-term cycle will become apparent in 2021.

Of the five factors mentioned above, we have previously explained (4) the unprecedented global fiscal expansion and monetary easing, and (5) the acceleration of innovation (Internet digitalization, new energy, and the construction of supply chains away from China) in previous reports and I would like to provide detailed analysis in future. The point I would like to emphasize now is that there is likely to be a strong upturn in the short-term business cycle. In other words, (2) the recovery of the manufacturing mini-cycle and (3) the strength of the pent-up demand. This uptick in the short-term business cycle was the basis for Musha Research's bullish view of 2020 at the end of 2019. In our view, this has been postponed to 2021.

What was Musha Research looking at one year ago?

The following is an excerpt from a report we published one year ago (Strategy Bulletin Vol. 241, Dec 23, 2019).

During 2019, economists focused their attention on determining if the multi-year period of US economic growth had come to an end or if instead the economy was simply at the bottom of a mini-recession. Most economists thought that the end was near for the longest-ever period of US economic growth, which started in 2009. But there is no possibility of an end to this growth for the time being. The consensus view now is that US economic expansion will not stop in 2020. After all, economic growth that has continued for more than 20 years in the Netherlands and Australia demonstrates that economic growth cycles do not have a life expectancy.

Demand in China is becoming more stable

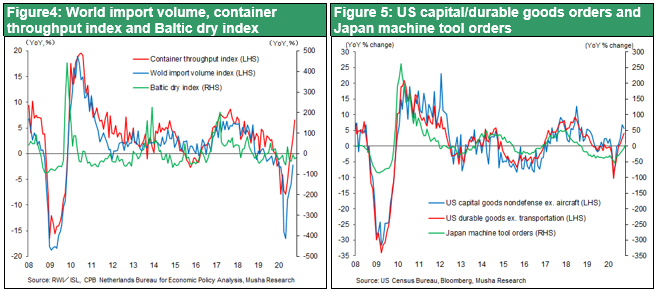

International trade and the level of investments have been the primary forces behind the economic mini-cycle of the past three to four years. Both are linked to the economic cycle of the manufacturing sector. Manufacturing is only 11% of national income in the United States compared with 29% in China, 22% in Germany and 21% in Japan. The small US percentage reduces the magnitude of economic swings. In the manufacturing sector, China is the world’s largest market for automobiles, smartphones, steel, cement and many other goods. This is why China has a greater influence on the global manufacturing cycle than the United States does. The decline in China’s internal demand was major cause of the global economic mini-cycle downturn that started in 2018. Now, we are seeing the beginning of a rebound from the bottom of this cycle. China’s falling internal demand was triggered chiefly by lower demand for automobiles. However, this decline has stopped and China has made a big shift away from monetary tightening and restrictions on infrastructure spending, which had been exerting downward pressure on internal demand. A more accommodative monetary policy will probably push up real estate prices as well as real estate investments. Furthermore, we are about to see the end of uncertainty caused by the trade war, which has been a major contributor to China’s downturn since the spring of 2018. China will probably resume making investments that had been postponed and start making investments in Taiwan and other countries.

Signs of a surge in 5G and semiconductor investments

Investments are starting in the field of 5G mobile communications and other new technologies. Companies are beginning to boost investments in leading-edge semiconductor technologies and other fields in order to stay ahead of competitors. China plans to be the world leader in 5G investments. These investments are increasing rapidly within China and other countries have started raising these expenditures in order to keep up with China. One illustration of this growth is semiconductor manufacturing equipment orders by TSMC. These orders totaled $7.7 billion in the third quarter of 2019, far above $1 billion to $2 billion in the past quarter. Data center investments, which had been sluggish until 2019, are rising as well because of the emergence of 5G. In China, many semiconductor companies have suspended new investments since 2018 because of the trade war. Now, there may be an unexpected improvement in supply-demand dynamics in the semiconductor industry because these investments were pushed back.

Improving market conditions, signs of successive upward revisions in the economy and earnings

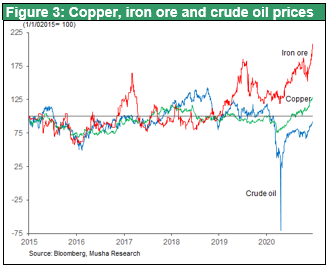

It is important to note that the manufacturing-led business mini-cycle that was the subject of our analysis at the end of 2019, as noted above, is still alive, despite the advent of the black swan event known as COVID-19. Prices of commodities such as iron ore, copper, and aluminum have already rebounded to levels not seen in seven years.

In addition, various countries have successively upwardly revised their economic forecasts. Between September and December, the US Fed revised its GDP growth rate for 2020 from -3.7% to -2.4% and for 2021 from 4.0% to 4.2%. The Bank of Taiwan also revised its GDP forecast for this year from 1.6% to 2.6% and for next year from 3.3% to 3.7% between September and December. Even Australia, which has been under pressure from China through trade sanctions and other measures, raised its GDP forecast for FY2020 from -1.5% to +0.75%. It is believed to be benefiting from the rise in iron ore prices.

Japanese stocks could become the top performers in global financial markets

This environment is also a major tailwind for Japanese stocks. There are some positive factors unique to Japanese stocks. This includes (1) few COVID-19 cases, which is expected to accelerate the normalization of the economy; (2) Japanese stocks are among the most sensitive to economic cycles in the world, and Japanese multinational companies are expected to see an upturn in corporate earnings as the global economy expands; and (3) the Suga administration's reform stance and fiscal stimulus are highly regarded. In particular, foreign investors are likely to be attracted by the fact that the austerity measures (consumption tax hike and primary budget deficit reduction) that led to the economic downturn in the latter half of Abenomics have been shelved with the Japanese government now shifting to a massive fiscal expansionary policy as represented by the 73 trillion-yen supplementary budget.

We should consider that a major uptrend has begun, with the aim for the Nikkei 225 average to reach 32,000 to 35,000 yen.