Aug 30, 2010

Strategy Bulletin Vol.26

Bernanke statement of readiness to act quells fears

A favorable dialogue with financial markets by regulatory agencies is probably the most inexpensive way to support the economy. The agency states that it has an accurate understanding of economic problems along with proper measures to end the problems. By convincing market participants that using these measures will turn the economy around, the agency can achieve a self-fulfilling recovery as market prices and investor sentiment rebound.

The issue is not whether we have tools. We do!

The August 27 speech by Ben Bernanke in Jackson Hole greatly eased the fears of investors. Mr. Bernanke states that (1) there is a clear enemy and objective (avoid deflation while achieving sustained economic growth and job creation), (2) he has the tools for this fight (a remarkable improvement in economic fundamentals and non-traditional economic initiatives by the Fed), and (3) he will do whatever is needed to win. These statements were very persuasive with regard to the Fed’s belief that (4) prospects for victory are good. This speech halted the steep slide in stock prices which had continued up to the previous day and the market made an about turn, with share prices rising by 1.6%. It also ended the brief upturn in fears about a double dip and start of Japanese-style deflation. This may bring an end to the “fear-driven sentiment of avoiding all risk” that had started to envelop financial markets.The enemy is the belief that deflation is inevitable

In August, the bizarre belief began to emerge among market participants that another economic downturn and financial crisis may be on the horizon. First, another economic downturn would once again bring down prices of houses and other assets. The damage to balance sheets of financial institutions would spark another financial crisis. The resulting credit crunch would create panic in financial markets again. As a result, the economic rebound and stock market rally since 2009 have been nothing more than a “false dawn” and the financial crisis has not been resolved at all. This is the “mentality of fear” that has reemerged. This scenario is precisely the self- fulfilling prophecy that we have been criticizing since 2008. There is no doubt that a second sell-off of assets backed by this mentality of fear would trigger a negative cycle: worsening investor sentiment – falling asset prices – increasing credit problems and a financial crisis – another economic downturn. In other words, this is a situation in which the economy would be destroyed by pessimism and fear. Professor Nouriel Roubini and Professor Nassim Taleb, who was on target with his black swan statement, have been fanning the flames of this crisis sentiment about a return of the panic that occurred in 2008. Former Fed chairman Alan Greenspan submitted the objective view that “the risk of another economic recession will increase if housing prices fall again.” However, like communists who always saw a revolution round the corner, deflation hawks are undeterred. They are already talking about a forthcoming deflationary double dip. But IMF economist André Meier has announced that he has confirmed that wages and prices are sticky enough to prevent the economy from easily entering into a period of deflation.” (Financial Times, August 27, 2010).

Improvement in fundamentals and the Fed’s determination

Bernanke’s speech used facts and theories to convince financial markets of the high probability that pessimists are wrong. There has been a significant improvement in U.S. economic fundamentals since 2009, although this recovery is starting to show signs of losing momentum. Chairman Bernanke stated that he expects the growth rate to increase in 2011. He bases this statement on the outlook for (1) faster than expected progress in rebuilding household balance sheets, (2) support for monetary policies, (3) a return of banks to normal lending policies, (4) the reversion of the asset-income ratio to the long-term average, and other factors. Of course, forecasts are always inaccurate. But there is a sufficient basis for expecting a sustained economic recovery.The bubble has burst and balance sheets are improving

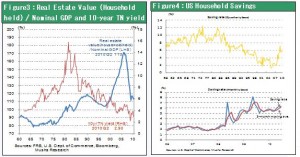

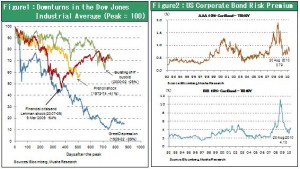

Two questions are particularly significant. First, is everything in place for a recovery in terms of fundamentals? Second, is there still room in the Fed’s monetary policies to improve the economy? Regarding the first question, there has been a rapid improvement in household balance sheets because of a faster than expected upturn in the saving rate (the rate that was first announced has been revised upward significantly). This makes the outlook for households to support growth in spending more persuasive. The end of the asset valuation bubble is used to explain why the asset-income ratio has reverted to its long-term average, which is most likely correct. We cannot be certain what data Chairman Bernanke is using. However, the ratio between the market value of U.S. household real estate holdings and GDP, which is shown in the figure, surged from 110-120% before the bubble to a 170% at the peak of the bubble. By the first quarter of 2010, this figure had retreated to 113%.The Fed has enough bullets

Regarding whether or not the Fed has enough room for new initiatives, the Fed has stated that it has three non- traditional measures that can be used as ways to fight deflation. They are (1) conducting a dialogue with markets (maintaining monetary easing for a long time), (2) lowering interest rates on excess reserves for deposits and (3) buying long-term bonds. In particular, Chairman Bernanke explained that the purchase of long-term bonds (which should be read as Treasury notes) will improve the financial environment by using investors’ portfolio rebalancing channels to lower the risk premium. In fact, the decline in long-term U.S. interest rates has contributed to the significant growth in bond issues. This is greatly beneficial for corporate finances. Furthermore, mortgage loan interest rates that have dropped to an unprecedented level will sooner or later underpin demand for housing. In his conclusion, Chairman Bernanke stated that there are two reasons he believes he will win the fight against deflation. First is the trust that people have in the Fed’s determination and ability to win this fight. Second is the fact that the Fed is prepared for a fight. In the United States, prospects are excellent for the start of the next virtuous economic cycle as purchases of Treasury notes by the Fed cause long-term interest rates to drop. Investors must not underestimate the determination and expertise of the Fed, which succeeded in ending the financial crisis that started in 2008.