Jan 14, 2021

Strategy Bulletin Vol.270

Stocks should rise

– Snapshot of the economy and markets at the beginning of the year

(1)Economic recovery is certain and policy support is certain, so it is only natural for stocks to rise

The market has entered a long-term uptrend

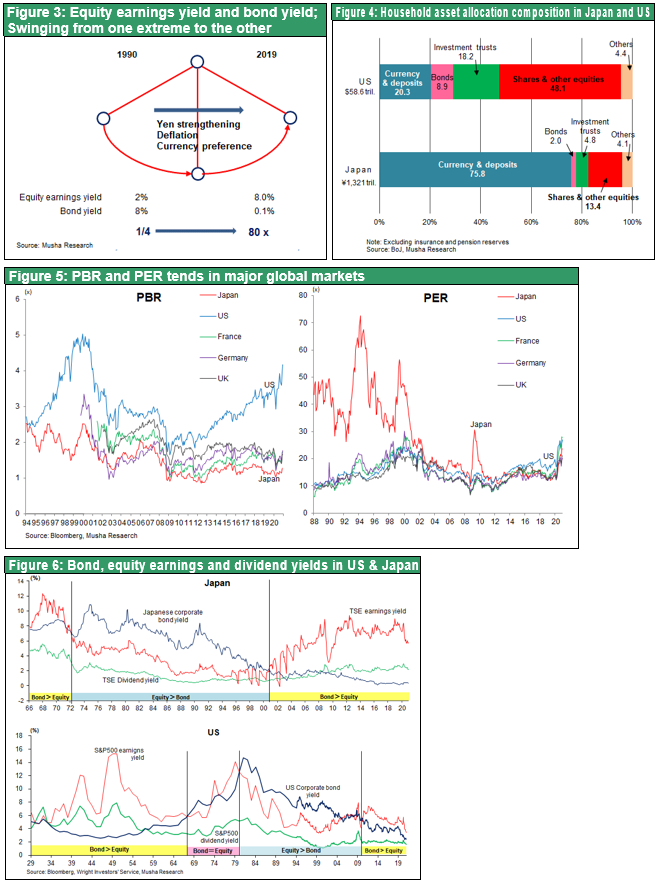

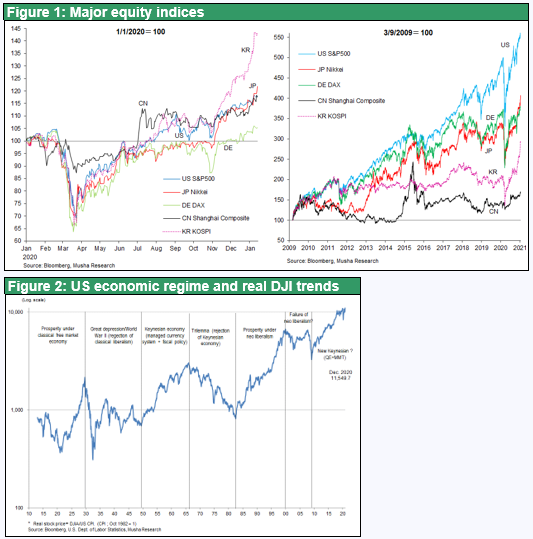

Stock prices are on the up with the US stock market at an all-time high, and the Japanese stock market at a 30-year high (or an all-time high in dollar terms). South Korean and Taiwanese stocks have been rising at a faster pace than Japanese stocks since November, reaching all-time highs. There are concerns about a slowdown in the economy due to an increase in the number of infected people and a lull in the employment recovery from the end of last year to the beginning of this year. In the midst of this, many experts are expressing their discomfort with the surge in stock prices. It is true that a certain amount of adjustment will naturally occur at some point after such a rapid rise, but it is wrong to argue that this is a bubble or the beginning of a catastrophe. The correct interpretation is that the market has entered a long-term uptrend.

No need to change policy anywhere

Any interruption of the stock market rally would either be due to economic stagnation or a shift in fiscal and monetary easing measures, but neither is likely. There is also no need for a change in policy. It is often assumed that integrated fiscal and monetary easing will fail because it will result in inflation or government bankruptcy. However, inflation reduces the value of real assets such as stocks. It also reduces the government's real debt. That is, inflation provides a peaceful adjustment by cancelling both assets and liabilities This is exactly what happened in the US in the 1970s (as shown in Figure 2, nominal stock prices remained unchanged, but real stock prices depreciated by one-third over 15 years due to 7% annual inflation).

Thus, we can be optimistic that the economic recovery, stock market capitalism and higher stock prices will continue.

Triple Blue promotes de facto MMT

On the first policy front, the Biden administration will have to stick to pro-business economic policies given the Triple Blue . While increasing fiscal spending on items such as strong measures to deal with COVID-19 and infrastructure investment are likely since it will be easier to obtain the approval of Congress, tax hikes are likely to be postponed. In the face of the 2022 mid-term elections, the Biden administration will have to rein in its anti-business and anti-Wall Street policies. The Biden administration will inevitably work with the Fed on policies to boost stock prices. Japan and Europe are also implementing unprecedented ultra-easy macroeconomic policies that integrate fiscal and monetary policies, effective Modern Monetary Theory (MMT) and integrated fiscal and monetary easing. There is absolutely no reason to believe that these market-friendly policies will fail.

Acceleration of short-term economic boom

Second, 2021 is expected to see an acceleration of the short-term economic boom. It turns out that the supply and demand of goods is possible with the avoidance of face-to-face contact. Production levels in the manufacturing sector are rapidly returning to pre- COVID-19 levels. Moreover, a shortage of supply capacity has become apparent and prices of commodities such as copper, aluminum, iron ore, crude oil and scrap have soared. The shortage of semiconductors has forced automobile companies to cut production, causing competition for semiconductor production lines. The outstanding performance of Korean, Taiwanese and Japanese stocks in the global market is due to the tight supply and demand situation, especially for semiconductors.

2020 was originally supposed to be the year of recovery for the global manufacturing business cycle, which peaked in the spring of 2018 and bottomed out at the end of 2019. The global manufacturing mini-cycle had a peak in the spring of 2015, a bottom in mid-2016, a peak in the spring of 2018, and a bottom in the autumn of 2019. The mini-recession that began in mid-2018 was caused by the replacement cycle of smartphones and automobiles, and the shelving of investment projects due to the US-China trade war. The bottom of the mini cycle was extended even further due to COVID-19, which took hold just after the bottoming out of the mini-recession. However, this means even greater potential strength has been stored for a rebound in 2021. We expect to see strong upward pressure on the short-term cycle in the second half of 2021.

Vaccination to control Covid-19

President-elect Biden has said that his administration will administer 100 million doses of the vaccine within 100 days of him taking office, and with more than 600,000 people already being vaccinated daily in the US, this promise is likely to be realized. If this is the case, we will see COVID-19 being contained in the second half of the year.

Correct the pessimists' false assumptions - the risk of not holding is the greatest risk

It is time for pessimists to take off their colored glasses. The long period of deflation and economic stagnation has made us accustomed to the sentiment of Japanese investors and their colored glasses that are tinted with pessimism. However, if they do not change now, they will suffer significant investment losses. In particular, the following two beliefs should be discarded immediately: (1) asset price appreciation will eventually be punished when the bubble bursts, and (2) monetary easing and fiscal stimulus are bad policies that will be paid for later. Investors should have been reminded by last year's performance that the biggest risk in 2021 is the risk of not holding and not the risk that assets prices will fall.

(2) The correction of the negative bubble in Japanese stocks has begun, and there is almost no need to worry about a decline from here

If there is a bubble in the market right now, it is in bonds. There is likely to be an inevitable rise in interest rates and decline in prices. (Since government bonds are not marked-to-market, there is no need to record valuation losses before maturity, which has created excessive speculative demand for bonds.) If we say that Japanese stocks are in a bubble, it is a negative bubble. It appears that the spectacular negative bubble in Japanese stocks is the process of bursting with the market starting to return from excessive lows to more appropriate levels.

The global trend is toward a stock-based system

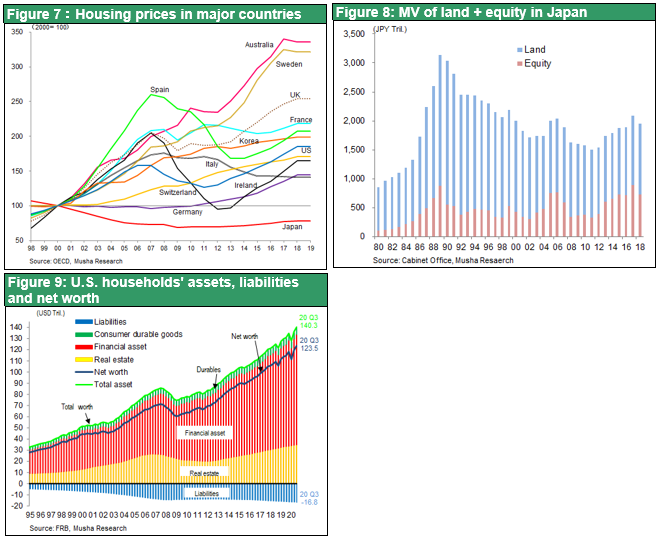

The US financial system is increasingly characterized by what can be called a stock-based system. The main means of creating credit and stimulating effective demand is not bank loans but rising prices of assets such as stocks. Given the risk of deflation (excess supply capacity) and abnormally low interest rates (excess savings), asset prices need to rise, or aggressive fiscal policy is needed. However, rising asset prices are the better way to stimulate private-sector innovation. The net worth of US households doubled from $60 trillion in 1Q 2009 to $124 trillion in 3Q 2020, mainly due to rising asset prices, nearly tripling the wealth of GDP ($20 trillion) over 10 years and driving strong consumption. The rise in stock prices significantly strengthened the capital strength of US companies, spurred innovation, and opened the door to the next industrial revolution.

Japan created a negative asset bubble and suffered from an unforced error

Japan has been the most poorly managed country in terms of asset price management. This has caused a pronounced negative bubble (under-performance) which has led to a loss of national wealth and significant weakness in the capital strength of companies. The P/B ratio is 1.18x in Japan, 3.92x in the US, 1.52x in France, 1.64x in Germany and 1.49x in the UK. Just being valued at the same level as Germany would mean a 40% increase, which would lift the 620 trillion yen market capitalization of the Tokyo Stock Exchange by 250 trillion yen. Taking household financial assets excluding pension insurance reserves to be 100, in the US, stocks and investment trusts account for 48% and cash and deposits account for 20%. By contrast, in Japan, stocks and investment trusts account for 18% and cash and deposits account for 76%. This Japanese portfolio is so unusual because dividend yields of 2% and deposit interest rates of 0% have been the norm for a long time. If the asset allocation is normalized, there would no doubt be a huge shift of funds and a large increase in the market capitalization of stocks. The total of more than 500 trillion yen, which includes the upside potential of stocks (which we calculate at more than 400 trillion yen) and the upside potential of real estate and housing prices, is an asset that the Suga administration can use as a "buried treasure”. Such buried treasure, combined with the purchases of Japanese stocks by foreigners, will be the driving force behind Japan's reforms.

Removal of stock investment restrictions

The correction of this negative bubble has begun. To ensure thoroughness, institutional reform is desirable to correct the unfairly undervalued stock prices. (1) Measures such as revision of the investment tax system (e.g., to allow households to deduct profits and losses) are an example, but (2) the most important thing is to wipe out prejudice against stock investment, and public opinion needs to be formed through media and professionalization measures. (3) First of all, it is necessary to drastically relax the clause prohibiting and restraining investment in stocks, which regulates the majority of professionals, including civil servants, finance and the media. Asset management is a right of the people, and many professionals are deprived of promising investment opportunities and stock investments. Most professionals, including bureaucrats, academics, bankers, securities company employees and news media employees comment on stock prices and the economy without knowing the benefits or experience of investing in stocks. This is unusual compared to the US and other countries. It is hard to believe that fair public opinion is being formed.