Feb 15, 2021

Strategy Bulletin Vol.273

Why the COVID-19 pandemic opens up long-term prospects for the economy

- The root cause of the historic stock market rally

US stocks are hitting new record highs almost every day. The stock market fluctuated wildly due to intensive stock investment by individual investors using the stock investment app "Robinhood," but the effect has disappeared after a week or two. Japanese stocks have also reached a 30-year high, and the Nikkei 225 is on the verge of 30,000 yen. A fear of heights has led to a persistent argument that stock prices are in a bubble. However, this strong stock market rally may foreshadow that the COVID-19 pandemic is opening a new era for humanity.

First, 2021 is expected to see an acceleration of the short-term economic boom. In addition, the world is accumulating desire and savings (so-called "pent-up demand"), which are expected to manifest in a big way when the COVID-19 pandemic ends. Signs of this are seen in the surge in commodity prices, such as iron ore, copper, oil, and shipping rates, as well as in inventory shortages such as for semiconductors.

In the longer term, we are seeing an acceleration of innovation. The COVID-19 pandemic has successfully aligned the three conditions for innovation: technology, market (needs), and capital (risk capital). The technology to digitize all human activities online already existed, and there was plenty of capital, but the needs were lacking. The COVID-19 pandemic, however, brought about the urgent need to shift most business and daily life, such as telecommuting, teleclasses, and home medical examinations online, and the market need was quickly formed. As a result, the trend toward DX has become visible, and there is a race to invest in the digital net revolution in order to stay ahead of innovation. The trend toward decarbonization and the shift to EVs is further accelerating this trend.

However, a more fundamental change is likely to be the diversification of work patterns, causing a dramatic decrease in working hours. The era of physical group work and group education is coming to an end; remote work and flexible work will become the norm, and there will be a dramatic decrease in working hours. Most work will be done on the Internet, which can be accessed anytime, anywhere. The consequent reduction in working hours will greatly increase consumer spending power. Telecommuting will become the norm, while some companies are considering a three-day workweek. The Liberal Democratic Party is reportedly considering a three-day workweek. We are likely to see more dynamic shortening of working hours in the future.

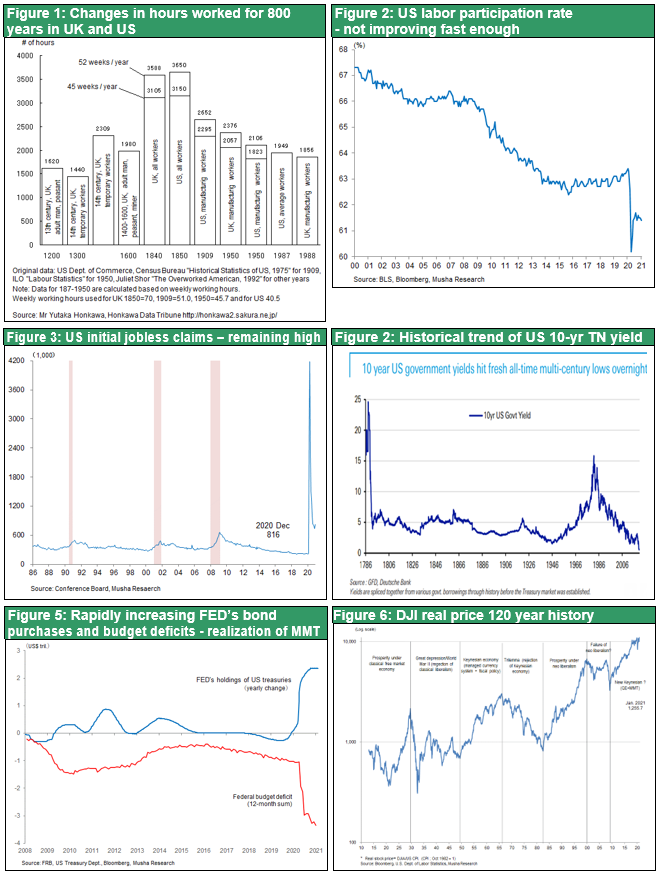

Looking back on history, there has not been a surprising reduction in working hours. In 1919, two years after the Russian Revolution, the International Labor Organization (ILO) was established to raise awareness of the need to protect workers and improve working conditions in order to protect capitalism. The first convention of the ILO set a maximum standard working time of 48 hours per week. This 48 hours per week has not really been achieved by developed countries such as Japan even after 100 years. Despite a tenfold increase in labor productivity over the past 100 years, the number of hours worked by mankind has remained almost the same, and the balance between production and consumption has been severely disrupted. It is a wonder that while human technology and productivity have increased so much, working hours have not changed much since the Middle Ages. Looking back at the history of mankind, we can see that modern people are working longer hours than the people in medieval times who worked from sunrise to sunset.

Overproduction, excess supply, excess capital (=savings), deflation, zero interest rates, etc., are considered to be the main root causes of the problems that developed countries are facing today. In other words, even though productivity (=supply power) has increased remarkably compared to 100 years ago, there has been absolutely no increase in leisure time, which is the foundation of consumption. Therefore, the stagnation of consumption power is considered to be the root cause of all the problems. Now that the demand for goods has reached saturation point and service consumption has become the center of demand, leisure time must be further increased in order to stimulate demand. In other words, overworking can be referred to as the cause of insufficient demand.

Long working hours also make it difficult to manage families and raise children. The main reason for the sharp decline in the birth rate in Asian countries such as Japan, South Korea, and China, which have caught up with the developed countries by working long hours, is the lack of flexibility in long working hours and work patterns.

The dramatic changes in the organization of labor triggered by the COVID-19 pandemic will correct a century of work-life balance (working hours vs. consumption hours). It will also fundamentally change human relationships and organizational forms. The Internet digital revolution is beginning to trigger a new social stage following the primitive gathering economy → agricultural economy → industrial economy. Human society appears to have begun to fundamentally break away from being organized with the factory-based machine industry at its core.

On the other hand, companies will try to keep costs down by cutting jobs instead of reducing working hours. If this trend continues, there is a risk of a Great Depression-like recession. Even in the US, where the pace of economic recovery is the smoothest among the developed countries, employment may not return to pre-COVID-19 levels. As seen in Figures 2 and 3, the labor participation rate and the improvement in the number of new claims for unemployment insurance have stagnated, which is raising concern for the Fed and the US Treasury Department. This is why new demand creation (i.e. job creation) needs to be carried out by the government. In addition to the $1.9 trillion COVID-19 relief measures, the Biden administration has pledged a massive $2 trillion in infrastructure and environmental investment over four years. It is this historical reality that makes US Treasury Secretary Janet Yellen's assertion that “Although debt will increase with large-scale economic stimulus measures, with interest rates at historic lows, the smartest thing we can do is act big. In the long run, I believe the benefits will far outweigh the costs” persuasive.

If this kind of dynamism has started to occur, then the surprise stock market rally may be both natural and sustainable.