Mar 11, 2021

Strategy Bulletin Vol.276

Thanks to the Bank of Japan

- Japan has started to break free from Japanification

The Bank of Japan has saved Japan

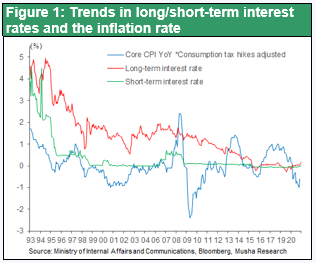

Eight years have passed since Kuroda arrived at the Bank of Japan (BOJ) and since the start of another-dimension of monetary easing with quantitative and qualitative monetary easing (April 2013), while five years have passed since the introduction of negative interest rates (February 2016). The BOJ will release the results of its findings following an assessment of the impact of its policy operations at its Monetary Policy Meeting on March 18/19. Critics of the BOJ point to issues including: (1) the 2% inflation target has not been achieved, (2) negative interest rates have eliminated profit margins and hurt the earnings of financial institutions, and (3) the purchase of ETFs has undermined market discipline. However, without Kuroda’s arrival at BOJ, there is no doubt that the Japanese economy would have suffered unimaginable damage. The Nikkei Stock Average rose from just over 10,000 yen to 30,000 yen, the yen weakened from 80 yen to 120 yen against the dollar, and the price trend changed from deflationary to inflationary.

Another dimension of monetary easing has driven frozen money flows

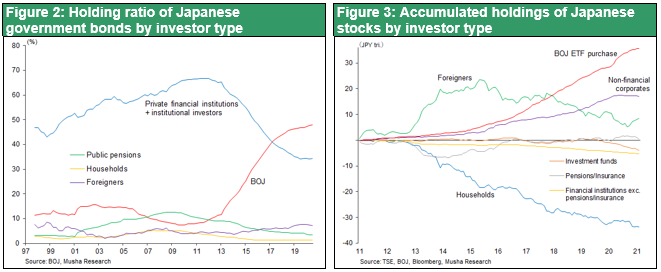

The decisive change triggered by this other dimension of monetary easing has been the substantial stimulation of, what had been, frozen money flow in Japan. Figure 2 shows the ratio of JGB holdings by investor type. The ratio held by the BOJ rose 37 points from 11% to 48%, while the ratio held by domestic financial institutions, investors, and public pensions fell 36 points from 74% to 38%. The significance of the BOJ's large purchases of JGBs is not that they compensated for the government's deficit, but that they lightened the load of private financial institutions, the Japan Post Bank, and public pension funds (GPIF, etc.) that had been stuck holding large amounts of JGBs. By rebalancing their portfolios, domestic financial institutions and investors were able to create new money flows for lending and investing in stocks and overseas assets.

Figure 3 shows the cumulative amount of investment in Japanese stocks. The BOJ purchased a total of 35 trillion yen, making it the single largest buyer and the engine that has driven up stock prices. While the economy has been growing, corporate earnings have been increasing, and the dividend rate has been around 2%. It has been extremely irrational from an economic standpoint for households to sell a cumulative total of 34 trillion yen in stocks and to keep almost all of the proceeds in cash deposits accruing zero interest. It was the BOJ that took a stand against this. Without the BOJ's intervention, stock prices would have remained stagnant, and deflation would have worsened.

The BOJ continued to implement policy innovations ahead of the rest of the world

Japan is the only country in the world that has experienced full-blown deflation, and as such, it has been required to take unusual measures. This is not the world of science where everything can be divided logically but requires an artistic approach. Quantitative easing (QE), stock purchases, and yield curve control (=YCC) are all monetary policy innovations that the BOJ has pioneered in the world.

In the current assessment, it is explained that the price target and the framework of "Quantitative and Qualitative Monetary Easing (QQE) with Yield Curve Control" itself are not subject to review because they are effective. No doubt questions will be raised about (1) leaving room for additional easing and deepening of negative interest rates as a trump card against further financial difficulties and yen appreciation, (2) allowing a certain increase in the volatility of long- and short-term interest rates to secure interest margins for financial institutions (YCC), and (3) making ETF purchases more flexible and agile.

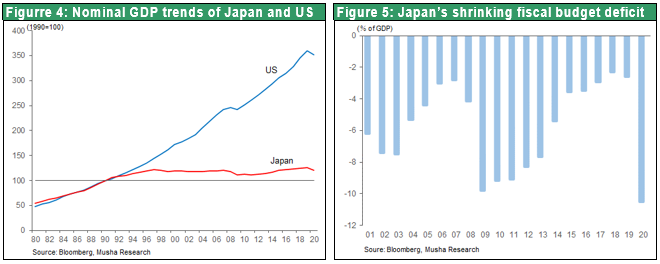

Japan's economic setback: Unable to break out of the 500 trillion yen level of nominal GDP, falling into deflation again under COVID-19

Though not at all due to the Bank of Japan's policy failure, the Japanese economy has yet to break free from falling behind the rest of the world. In the 26 years since the bubble economy burst in 1994, Japan's nominal GDP has hovered in the 500-550 trillion yen range. Whereas nominal GDP was 500 trillion yen in 2021, before Kuroda took up the top job at the BOJ, there had only been an increase of 12% (1.7% annualized) to 561 trillion yen in the 7 years to 2019, before COVID-19. In 2020, prices are expected to fall into negative territory again due to COVID-19 and nominal GDP is expected to fall below 540 trillion yen. Without going into a detailed analysis, I would like to point out two root causes. The first is the impact of fiscal tightening: the budget deficit (as a percentage of GDP) improved from -7.4% in 2012 to -2.6% in 2019 due to two consumption tax hikes. The fiscal improvement has resulted in a cumulative loss of 5% of GDP. It can be said that the effect of the BOJ's different dimension of monetary easing was greatly reduced by the fiscal headwind.

The deadly sin of unfounded pessimism

The second root cause of Japan's stagnation is excessive and unfounded pessimism. From 1990 to 2005, there were growth constraints unique to Japan, such as Japan bashing by the US, the yen's appreciation, and the costs of the bubble economy (bad debt disposal and corporate restructuring costs). However, from around 2005, even though Japan's unique constraints had gone, the growth rate failed to improve. Pessimism had taken hold, and a vicious cycle of economic deterioration and pessimism is thought to have occurred.

For example, why did Japan's high technology lose? Japan had high technical capacity and its engineers worked diligently, but they lost on price competition due to the strong yen, and they also lost on investment competition due to the freezing of risk capital. Why were there so many high-tech companies failing, selling off divisions, and leaking technology, such as the collapse of Elpida Memory? The reason is that although Japan had plenty of money (savings), the risk premium was too high to invest. Why was the risk premium so high? It was because of the loss of animal spirit due to unfounded pessimism.

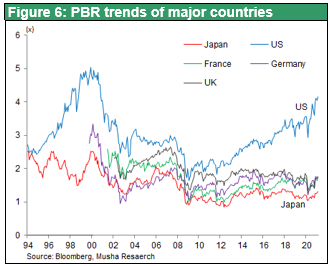

The loss of animal spirit led to the extreme undervaluation of Japanese stocks. A comparison of the P/B ratios of Japan and other countries shows extreme under-valuations: 4.1 times in the US, 1.7 times in the UK, Germany, France, and 1.2 times in Japan. The purpose of the BOJ's purchases of ETFs is to reduce the risk premium, and this is the core of Japan's disease (or Japanification).

Professor Watanabe points out that fear is a major economic constraint

Professor Tsutomu Watanabe of the University of Tokyo analyzes that fear was the biggest cause of the post-COVID economic downturn. In his analysis, fear is the reason why the US, which has a large health burden (COVID-19 infections/deaths), is no different from Japan in terms of economic damage that has been suffered. The economic damage (Professor Watanabe’s calculation of GDP loss) in the US, where there have been more then 1,500 deaths per million population, is 6% and Japan has suffered a similar level of economic damage despite only suffering 54 deaths per million population (i.e., 1/30 the level of the US). The average life expectancy in the US is 77.8 years as of June 2020, a year shorter than the previous year and the shortest life expectancy since 2006.

Despite such health damage, the US economic growth rate is the highest amongst developed countries. On March 9, the OECD revised its economic outlook for 2021 (previously released in December 2020), and while the global outlook improved by 1.4 percentage points from 4.2% to 5.6%, the US showed the largest improvement of 3.3 percentage points, from 3.2% to 6.5%. Japan improved by 0.4 percentage points from 2.3% to 2.7%, the euro zone improved by 0.3 percentage points from 3.6% to 3.9%, and China deteriorated by 0.2 percentage points from 8.0% to 7.8%.

The key is people's fear. They are afraid to go out, and as a result, the demand for services such as restaurants drops drastically, causing a large drop in GDP. This is how economic damage occurs. Fear is an insurmountable thing, and it is difficult to verify directly. However, psychologists are trying to measure people's fears by asking them to answer questions such as "I can't sleep at night because I'm worried about infection" or "I'm worried about losing my life” to search for the correlation between fear and infection control behavior (restraint on going outside, wearing a mask, etc.) (Nikkei Economic Classroom, March 9, 2021). The psychological factors such as fear and pessimism, which became apparent under COVID-19, may be identified as the cause of Japanification.

Breaking free from Japanification has begun

However, I believe that Japan is now beginning to break free from Japanification. COVID-19 has lifted the fiscal yoke that had long been a constraint on the Japanese economy. The fiscal contribution of Japan's COVID-19 measures is much greater than that of other countries. In addition, the benefits of the post-COVID global economic recovery are beginning to emerge. The US economy is recovering, long-term interest rates are rising, and the dollar is strengthening. The Nikkei average has recovered to the 30,000 yen level. We are now entering a phase where economic recovery, higher prices, and higher stock prices can be sustained even without any additional measures by the BOJ. This is likely to wipe out Japan's unfounded pessimism and end Japanification.