Apr 26, 2021

Strategy Bulletin Vol.280

Japan lags behind in the era of big government

- The start of major infrastructure projects by President Biden and the underlying economic ideology

Sudden change in common sense for the global economy and big government with Biden at the helm

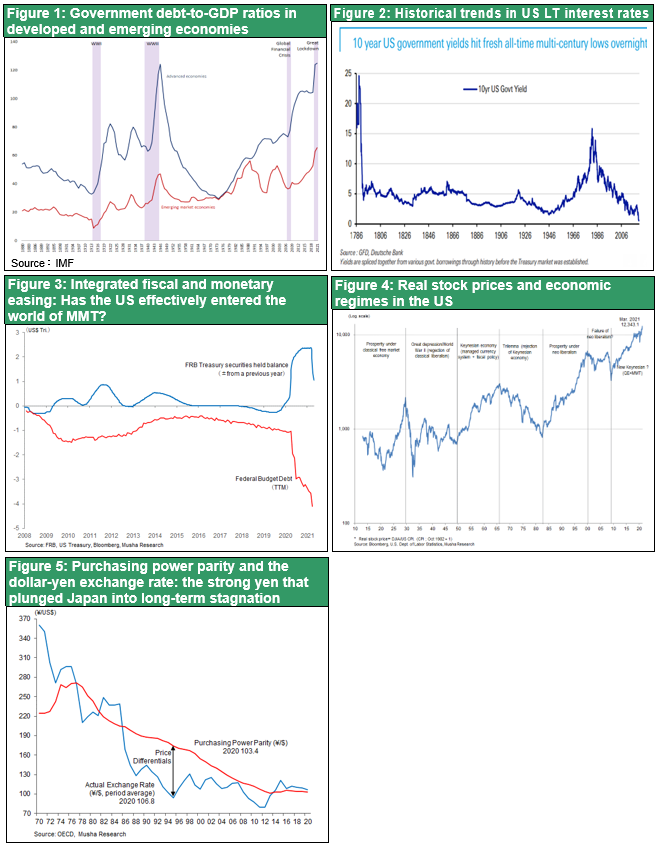

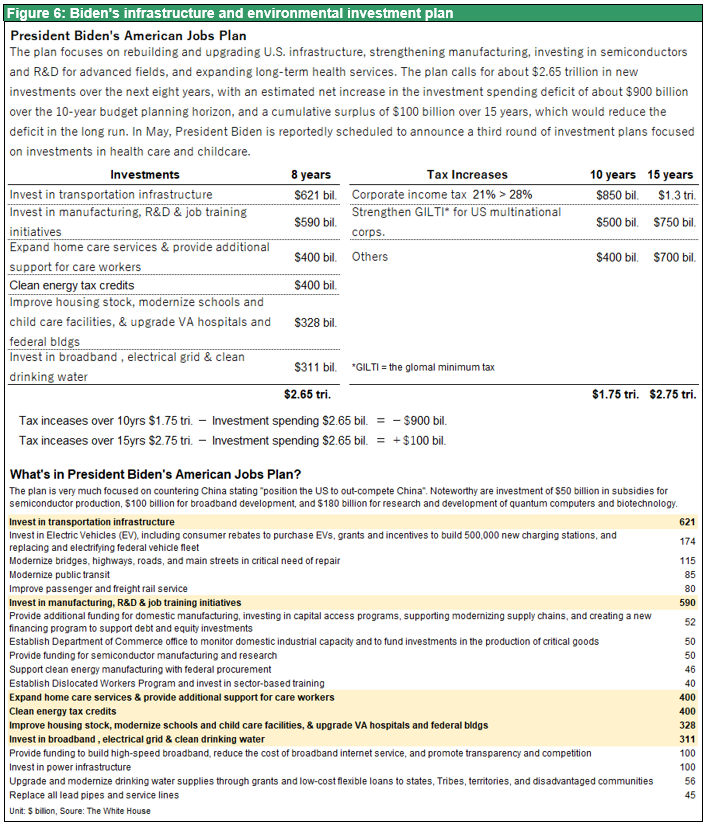

The Covid-19 pandemic has fundamentally changed the common sense of economics and economic policy around the world. The neoliberalism that had dominated the world for nearly 40 years since the Reagan-Thatcher era, i.e. views such as the idea that budget deficits should be avoided, free trade should be respected, and state intervention in industry and markets should be stopped with relaxation of regulations, is being quickly dismissed. Instead, the so-called "New Keynesianism," with its emphasis on big government, has come to the fore. Following the $1.9 trillion COVID relief package, the Biden administration has announced a massive $2.65 trillion investment in the environment and infrastructure over the next eight years. This includes funding for the development of new technology infrastructure such as $50 billion to support domestic production of semiconductors, $174 billion for EV development and charging stations, $46 billion to support the clean energy industry, $100 billion for the construction of high-speed broadband networks, and $100 billion for smart grids and other electric power infrastructure. The Fed will respond to this demand for fiscal funds through quantitative monetary easing. The conventional wisdom that taxes and social security should be minimized because they discourage work ethic that continued during the Trump era has been shelved and consideration is being given to increasing the size of social welfare through higher taxes on the wealthy and companies.

The US government is getting serious about supporting industrial technology

In order to counter China's high-tech hegemony, the US needs to take the lead in fostering state-sponsored technological industries. Because the high-tech industry requires a huge initial investment, reducing the initial cost through government support is vital. In addition, it is no longer possible to compete with China, which has been explicitly fostering industry on a national scale. China is leading the energy revolution and is not only ahead in EVs, but also the largest producer of solar panels and wind turbines, holding a third of the world's renewable energy patents (Secretary of State Blinken). The EU has also launched a plan to strengthen new energy and semiconductors. The US, China, and Europe are now engaged in a national industrial competition.

From supply-side to demand-side reinforcement

From the standpoint of conventional economic wisdom, the criticism is that unprecedented budget deficits will lead to moral hazard, leaving problems such as inflation and higher interest rates. However, the reality is rather the opposite. Even before the Covid-19 pandemic, one-third of the developed economies were in an abnormal situation with negative long-term interest rates. In addition, there was an ongoing crisis in which deflation was pushing economic growth downward. In short, these diseases were caused by extraordinary savings (i.e., the deferral of purchasing power) and insufficient demand. Such an environment is similar to that faced by Keynes during the Great Depression of the 1930s. The typical symptom is a "liquidity trap" in which interest rates reach a critical point, the preference for cash becomes extreme, and monetary policy becomes ineffective. As was the case back then, there is a strong need for demand creation through public finance.

In the post-Reagan-Thatcher era of neoliberalism, insufficient supply and insufficient savings were thought to be the bottlenecks of the economy and inflation was thought to be the greatest economic risk. Therefore, neoliberal economics was a supply-sider that focused on strengthening the supply side. However, the low global interest rates of the last decade indicate that savings are abundant and demand is chronically weak. This means that budget deficits are not damaging or may even be necessary. Modern Monetary Theory (MMT) argues that budget deficits do not eliminate private investment or push up interest rates. It can be said that the axis of economics and economic policy is clearly shifting to the demand side.

US economists support Yellen

US Treasury Secretary Janet Yellen, who is also an economist, has won the support of the majority of US economists by arguing that "at this time of historically low interest rates, large-scale economic stimulus measures will accelerate employment and economic growth, and the benefits will far outweigh the costs”. International organizations such as the IMF and the World Bank, which have been harsh in their criticism of budget deficits due to concerns over insufficient savings, are now changing their stance.

Japan lags behind the changing global tide

Japan has not been able to keep up with this rapid change in global thinking. Japan has a huge amount of surplus savings, but is not making the most of it. The consensus among Japanese economists is the same old neoliberal thinking pattern. Japan, which was one of the first countries in the world to fall into a "liquidity trap" and deflation, has been implementing neoliberal policies for which the main enemies are inflation and rising interest rates. Therefor it is no wonder that the disease has become even more serious. This has clarified how wrong the advice of academics and the policy choices of politicians and bureaucrats have been.

The Ministry of Finance, in particular, is trapped under the spell of the budget deficit and continues to use it to guide public opinion. While the response to the Covid-19 pandemic has resulted in large-scale fiscal spending, it has fallen far short of strengthening international competitiveness by supporting industry and developing technology. The Ministry of Economy, Trade and Industry (METI) has been traumatized by the US criticism of its industrial development policies during the period of Japan-US friction and is unable to formulate a strategy on how to link government support to increased corporate competitiveness.

We need a command post to oversee the economic strategy

The Bank of Japan does not argue, as the Swiss Central Bank does, that the exchange rate is unjustifiably high. Even with an exchange rate of 110 yen to the dollar, the yen should not be considered excessively strong as Japan’s trade surpluses have disappeared and its prices and wages have fallen to emerging market levels. The punitive appreciation of the yen from 1990 to 2012, when it deviated sharply from purchasing power parity, led to Japan's decline. It is not enough that the yen has returned to purchasing power parity. The yen needs to weaken beyond purchasing power parity in order for Japan to revive.

The US needs a strong Japanese economy in the face-off between the US and China, so it is time to stop forcing an unjust appreciation of the yen. If the yen settles at 120-130 yen to the dollar, Japan will immediately begin to overcome deflation completely.

Japan currently needs a strategic center, a command post, to oversee international competition such as in politics, military affairs, geopolitics, economics and finance, and technology.