May 18, 2021

Strategy Bulletin Vol.281

Post-Corona global economic recovery in sight, Japanese stocks again in spotlight

Sector Rotation Underway in the U.S., Adjustment in Pioneering Stocks

Last week (May 10-14), a sell-off in global stocks broke out. The Nikkei 225 plunged 2,300 yen, or 7.7%, over the three days of May 11, 12, and 13, dropping to 27,358 yen, the level at the beginning of the year, and giving up all of its gains since the beginning of the year (up 11.9% from the end of last year). On Friday the 14th, after the SQ, the price was up 636 yen.

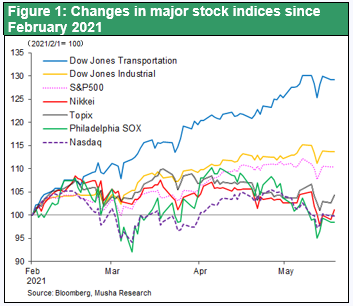

During this period, U.S. stocks such as the S&P 500 and the Dow Jones Industrial Average fell only 4.4% from their highs, and more than half of the decline was recovered on the weekend of the 13th and 14th. It appears that a full-fledged correction has not yet begun. As shown in Chart 1, core high-tech stocks (so-called growth stocks), which drove the post-Corona rise in U.S. stock prices, have been in a correction since February. On the other hand, however, the rate of increase has accelerated in the economic sensitive sectors (resources, transportation, finance, and materials) that have been anticipating economic recovery.

Fed's suggestion, strong speculation but not a bubble

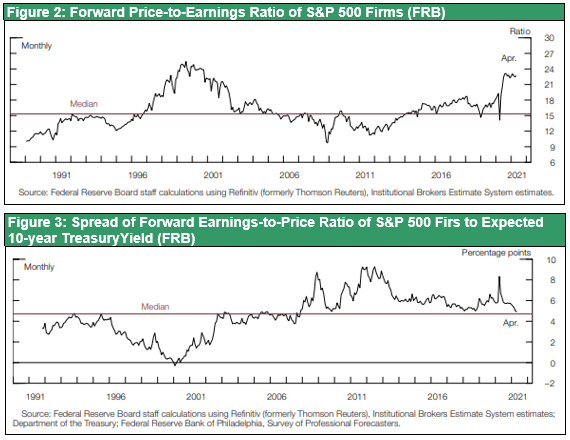

There are signs here and there that the market is turning speculative, including the GameStop retail investor application, speculation and stock price volatility surrounding Robin Hood, the collapse of the Archegos family fund and massive losses at financial institutions, and the crypto currencies surge. The Fed released its Financial Stability Report on May 6, 2021 and acknowledged that asset prices are becoming increasingly risky. The Fed's Financial Stability Report, released on May 6, acknowledges that asset prices are becoming increasingly risky, but points out that while the P/E ratio of stocks is at a record high of 22x, the yield spread between earning yields and 10-year Treasury yields is at a record average of 5%, implying that the market is not in a bubble. Dallas Fed President Kaplan also said that the faster-than-expected pace of economic recovery and rising market imbalances should prompt the Fed to start discussions on reducing monetary easing sooner. These risk signals from the Fed (whether intentional or not is unclear) are also believed to have put the brakes on market speculation.

Japanese stocks caught in the turbulence

Japanese stocks have been in a slump for three months since hitting a post-bubble high on February 16, and their decline of 10% during this period was the largest in the world along with that of Taiwan.

The poor performance of Japanese stocks is probably mainly due to supply and demand factors, although this is not surprising given Japan's poor response to Covid-19 and the disheartening public opinion.

The GPIF and other domestic pension funds have been forced to sell stocks in order to rebalance their portfolios after the rapid rise in stock prices since last year. In February, March and the first week of April, net sales of stocks by trust banks, which are considered to be pension sales, totaled 2.5 trillion yen. In addition to the poor market conditions, the Bank of Japan's decision to stop purchases of ETFs linked to the Nikkei 225 has made Japan a prey for speculators. Japanese stocks have once again become the most speculative market in the world, but this was a reasonable adjustment in the daily and price range required by the world's fastest price increase (32% in just over three months), which was realized between November 2020 and February 2021.

Since the second week of April, pension selling has run its course, and individual investors, who had been waiting for the market to fall, have been buying large amounts of stocks. Overseas investors, who have been underweighting Japanese stocks, are expected to join in the domestic buying, and we may see another catch-up rally in Japanese stocks.

Questions have been raised about the Nikkei 225 as an investment target. The Bank of Japan's suspension of the purchase of ETFs linked to the Nikkei 225 and the consideration of a change in the calculation method of the Nikkei 225 in order to reduce the excessive influence of certain stocks (bandwagon effect) have made the position of selling Nikkei and buying TOPIX popular. It is unclear what will happen to the TOPIX after the TSE's market reform, and the Nikkei 225 is likely to see another influx of funds when index-driven investors buy Japanese stocks coming weeks and months.

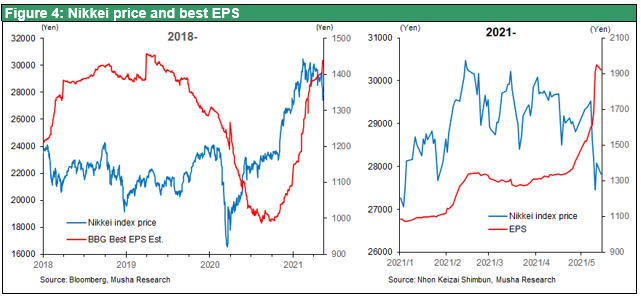

Rapid EPS growth, sharp decline in Japanese PER, the best buying opportunity of the year

The manufacturing sector accounts for as much as 50% of Japanese stocks, making Japan one of the countries most likely to benefit from the global economic recovery. The Bank of Japan's March Tankan survey assumed exchange rates of 106 yen to the dollar and 122 yen to the euro, and a shift to a weaker yen would be a significant factor in upward revisions. Since the end of March until May 14, the Nikkei 225 EPS has risen by almost 50% from 1300 yen to 1950 yen (with a large contribution from SoftBank's investment valuation gain), and the 10% drop in the stock price has caused the PER to drop sharply from 23x to 14x, making the stock more undervalued. This may be the best buying opportunity of the year.

Will the weaker yen trend take hold?

In looking at the Japanese economy and stock market in 2021 and beyond, it is important to consider whether the trend of a weaker yen will take hold.

This is because a weaker yen is the trump card that will allow Japan to overcome deflation and bring the Japanese economy out of its stagnation. And the possibility of this happening is growing.

As the confrontation between the U.S. and China becomes more and more decisive, the U.S.'s almost total dependence on South Korea, Taiwan, and China for the supply of semiconductors and high-tech equipment is becoming a major risk. Korea, Taiwan, and China are potential battlegrounds in the era of U.S.-China hostility, and once a disturbance occurs, the supply of high-tech products will be cut off.

Japan, a beneficiary of the restructuring of the global supply chain

The key to changing the high-tech supply chain that depends on these three countries lies in the exchange rate. The root cause is the Japan bashing by the U.S. and the super-strong yen, which has excessively increased the competitiveness of Korea, Taiwan, and China. In order to rebuild a safe high-tech supply chain, it is necessary to return high-tech production, such as semiconductors, to the United States and Japan, a safe zone in East Asia. The United States and other free economies would like to see the Korean won, the Taiwanese dollar, and the Chinese yuan appreciate against the yen and dollar.

Trade surplus bubbles in Korea, Taiwan, and China will eventually be eliminated by currency appreciation

On the other hand, the three countries of South Korea, Taiwan, and China are also forced to appreciate their currencies. Their currencies have been undervalued in spite of their strong industrial competitiveness, resulting in large trade surpluses that have triggered real estate bubbles. The situation is similar to that of Japan in the 1980s before the bubble burst.

It would be desirable to use the large surplus (i.e., surplus savings) to promote domestic demand, but consumption is stagnant and the surplus funds are going to real estate. In the end, like Japan in the 1980s and 1990s, the three countries will have to raise interest rates to curb bubbles and, as a result, accept the appreciation of their currencies. This will inevitably lead to a weaker yen.

The yen has depreciated to major currencies since the beginning of the year. In particular, the yen has fallen about 15% from its 2020 high against the Korean wen, Taiwan dollar, and Chinese yuan, all of which compete in the trade market, far less than the 8% decline against the US. Geopolitical factors may have played a role in this.

In 2021-22, a sharp rise in corporate profits is in sight

Once this takes hold, the vicious cycle of a strong yen and deflation that has hurt Japan will be completely over, and a virtuous cycle of a weak yen and inflation will begin. The landscape of the Japanese economy will change drastically. Prices in Japan will become even cheaper, and the manufacturing and tourism industries will become more competitive. In the post Covid-19 period, Asian tourists will rush to Japan, which has become cheaper and more attractive. In early autumn, when the contours of the post Covid-19 era become clearer, we can expect to see a sharp increase in the profit margins of Japanese companies.