Jun 06, 2021

Strategy Bulletin Vol.282

The atmosphere around Japan will change dramatically from now on

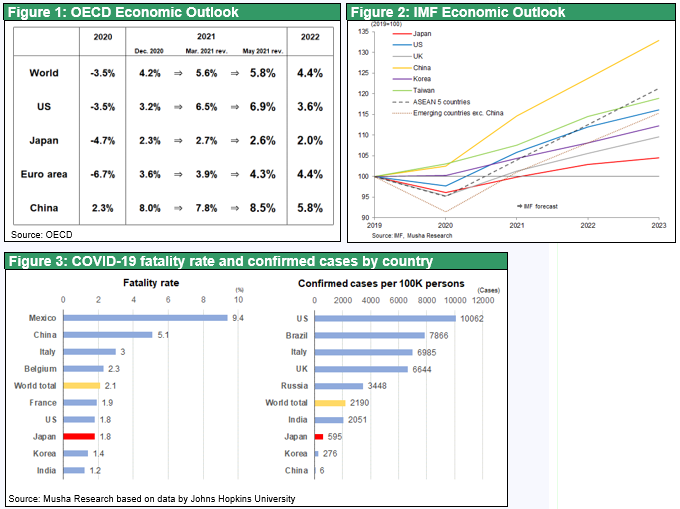

The OECD revised its World Economic Outlook on May 31, showing that the economy is expected to grow 5.8% in 2021 and 4.4% in 2022, recovering in a V-shape from the 3.5% decline in 2020. The U.S. GDP forecast for 2021 has been revised upward in two stages from 3.2% in December last year to 6.9%. Japan is the only country that has revised its GDP forecast downward to 2.6%, and its forecast for 2022 is 2.2%, almost half as low as the Eurozone (4.4%) and the United States (3.6%). Why is Japan, which has the lowest health burden from Covid-19 infection in the developed world, suffering such economic damage? Comparing health hazards with the US, the cumulative number of cases per million people is 100,000 vs. 6,000, and the cumulative number of deaths is 1,800 vs. 104, both only 1/16th of the US rate. Even with the delay in vaccination, this extreme disparity is not a coincidence. Professor Watanabe of the University of Tokyo has analyzed that the significant gap between health and economic damage is solely due to the suppression of activities due to fear of infection. The cause must be self-restraint since Japan has remarkably lax government regulations on behavior such as lockdowns.

An atmosphere of psychological suppression of the Japanese people

Behind the self-restraint of the Japanese is the atmosphere. Many people, including Shichihei Yamamoto, have pointed out the fact that Japan has been distorting rational judgment due to the homogeneity and rigidity of the media and the tendency to exclude divergent opinion. The combination of the economic defeat, the defeat of Covig-19, and the unfortunate Olympic bid has created an atmosphere of public opinion that encourages self-deprecation and endorses a loss of confidence.

Progress in vaccination and the resolute hosting of the Tokyo Olympics will greatly improve the atmosphere

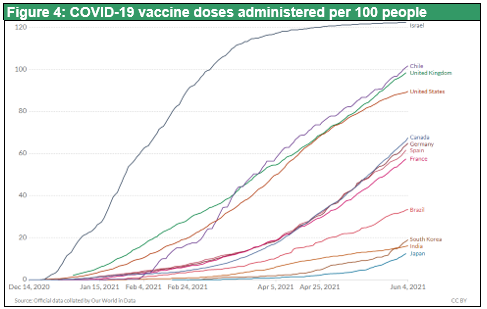

However, Japan's self-doubt is also at a negative extreme. The number of vaccinations per day reached 800,000 late last week, and the prime minister's target of 1 million vaccinations per day is now in sight. If Saturdays and Sundays are taken off, the number of inoculations could reach 5 million a week. If this pace continues for the remaining 30 weeks until the end of the year, the number of vaccinations will reach 150 million doses and the adult completion of vaccination rate will reach 75%, putting the post-coronary era in sight. If the burden of psychological factors has been particularly large in Japan, the rebound will be large after it is removed.

As for the Tokyo Olympics, which have been swirling with controversy, once they are implemented, the drama of the athletes will move the people, and peer pressure will work to increase centripetal force. Japan's gritty efforts under the Covid-19 will give hope to the world and bring a sense of accomplishment to Japanese people. On the other hand, if the project is cancelled at this time, the people will feel a great sense of loss and frustration.

The fundamentals of the Japanese economy are actually positive

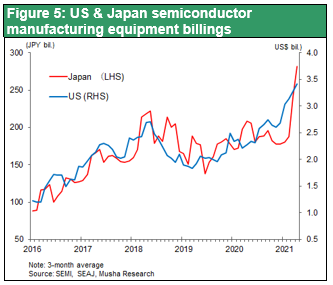

Although psychological repression has darkened the mood of the Japanese economy, the Japanese economy is actually beginning to benefit most from the global economic recovery. Orders for machine tools and semiconductor manufacturing equipment are recovering sharply on the back of a strong recovery in investment demand in China and the U.S., and production is expected to recover sharply, driven by exports. According to the Corporate Business Statistics, recurring profit in the manufacturing sector for the January-March period of 202 surged 63%. In addition, Japan's competitiveness is stealthily recovering under the weaker yen. After Covid-19, inbound tourism will surge, and Japan's tourism industry will once again be under pressure in 2022-23.

Japan is the most resilient country in the world

Japan, on the other hand, is the most stable country in the world, and there is nothing to make it worse. Japan has the least amount of social unrest due to the divide and conquer mentality of the West. In terms of national strategy and values, almost everyone in Japan agrees on adherence to democracy and a market economy, and there is little opposition to strengthening the Japan-U.S. alliance during the new Cold War between the U.S. and China. The unemployment rate is one of the lowest in the world, and while much is made of the government deficit, the country as a whole has one of the world's largest surpluses of savings if you include the private sector, including corporate and household. It is a country that is highly sought after by the United States as an ally and by China as a provider of valuable technology.

The country faces a number of problems, including a declining birthrate and aging population, a shrinking workforce, budget deficits, a rigid government and social system that has been overly adapted to the industrial age of mass production, and prolonged deflation. However, these issues will be common to all countries in future, Japan is one of the first countries to face these issues and is struggling to find solutions.

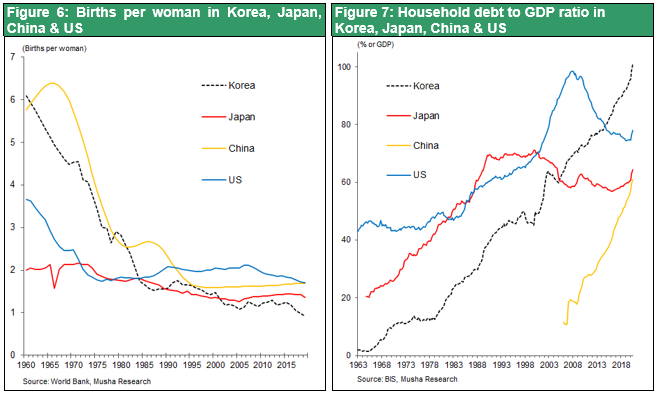

In spite of this stability, Japan's self-assessment is remarkably low and humble, and expectations are low. South Korea and China, which have overtaken Japan as high-tech manufacturing bases, appear to be shining at first glance. However, behind their large trade surpluses, the future of these countries is threatened by a rising housing bubble, a sharp rise in household debt, a trend toward non-marriage due to soaring housing costs, and a rapid decline in the birth rate.

The environment is similar to that of Japan at the end of the 1980s, before the bubble burst. Japan's path since 1990 has been as follows: a sharp increase in trade surplus due to the improvement of competitiveness by fortuitous factors ⇒ huge surplus of funds, huge bank lending and increase in private debt ⇒ real estate bubble ⇒ sharp increase in housing cost ⇒ difficulty in living and increasing social criticism ⇒ criticism of surplus and depreciation of currency by the U.S. ⇒ monetary tightening and currency appreciation ⇒ bubble burst and economic stagnation That was the end of the bubble. Even if South Korea, China, and Taiwan do not follow Japan's trajectory, we should expect that they will face the similar difficulties as Japan.

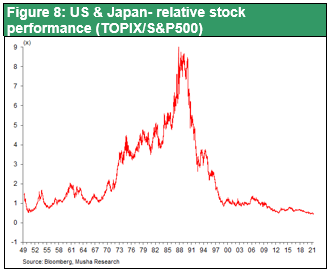

The relative performance of Japanese stocks has bottomed out

Investors around the world should eventually realize this. The ratio of Japanese stocks (TOPIX) to U.S. stocks (S&P 500), which was around 1:1 in 1950, reached 9:1 at the peak of Japan's economic bubble in 1990, but has fallen sharply to an unprecedented low of 0.5:1 today due to the bursting of Japan's bubble and the rising growth of the U.S. economy. There is a very good chance that this is the relative bottom for Japanese stocks.