Aug 20, 2021

Strategy Bulletin Vol.285

"Cheap Japan" will be the driving force behind Japan's revival

"Cheap Japan" has become a common understanding, and we should use it as a starting point for discussion.

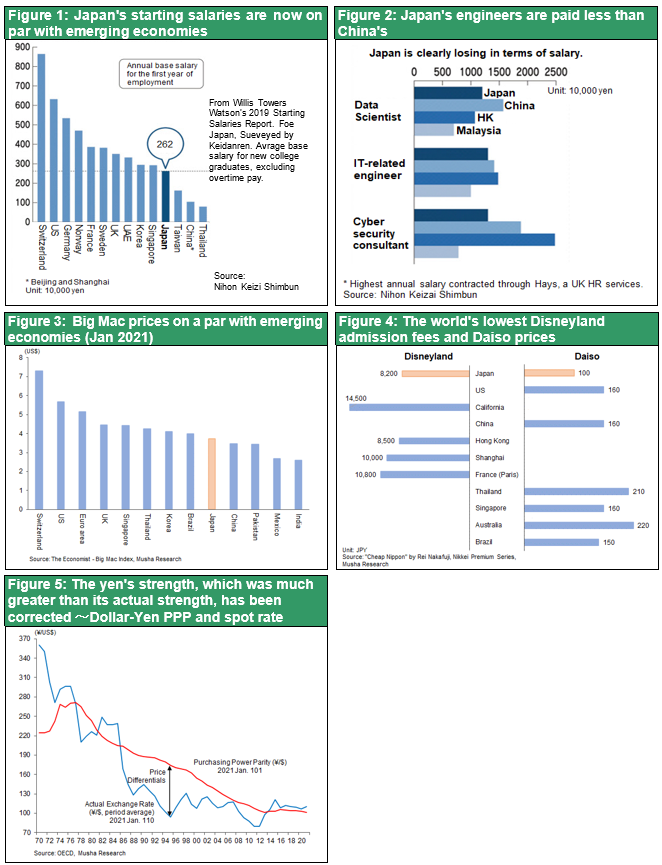

In the past year, the concept of "cheap Japan" has become a common understanding as a starting point for economic discussions. Rei Nakafuji of the corporate news department of the Nikkei Shimbun, who painstakingly researched the reality of Japan's abnormally low prices, has made a significant contribution. In the 21st century, wages in Japan have hardly risen at all. Japan's wages have barely risen in the 21st century, and as a result, the country is tied for last place with Italy in the G7 in terms of average wages, and was overtaken by South Korea in 2015, with the gap only widening. Also, the price of a Big Mac is about half that of the best Swiss, and cheaper than South Korea and Brazil. The international price of snow crab has reportedly soared 2.5 times in the past decade due to increased demand from China and other countries around the world, making it harder for Japanese people to eat. Diamond Inc. reports that not only prices and wages, but also stock prices and real estate prices have become bargain basement prices and are being bought up by foreign capital.

This is good news for Japan, because international price competitiveness is the key to any country's economy, and "cheap Japan" will enhance international competitiveness and create a virtuous cycle for the Japanese economy.

How to correct "cheap Japan": 1) Induce yen appreciation or 2) Raise wages?

However, "cheap Japan" is evidence of Japan's weakness, and there is a growing reaction that this is a problem and that "cheap Japan" must be corrected. At first glance, this seems like a natural response.

How can "cheap Japan" be corrected? There are two possible ways. The first is to correct weakening the yen. If the yen appreciates in line with falling prices, Japan's lost international purchasing power can be restored. Many economists share the argument that a strong yen will allow Japanese people to eat snow crab once again, the price of which has skyrocketed. The second way to correct "cheap Japan" is to forcibly raise wages. David Atkinson, a member of the government's Growth Strategy Council, has called for raising the minimum wage to encourage small and medium-sized companies that depend on cheap labor to change their business model.

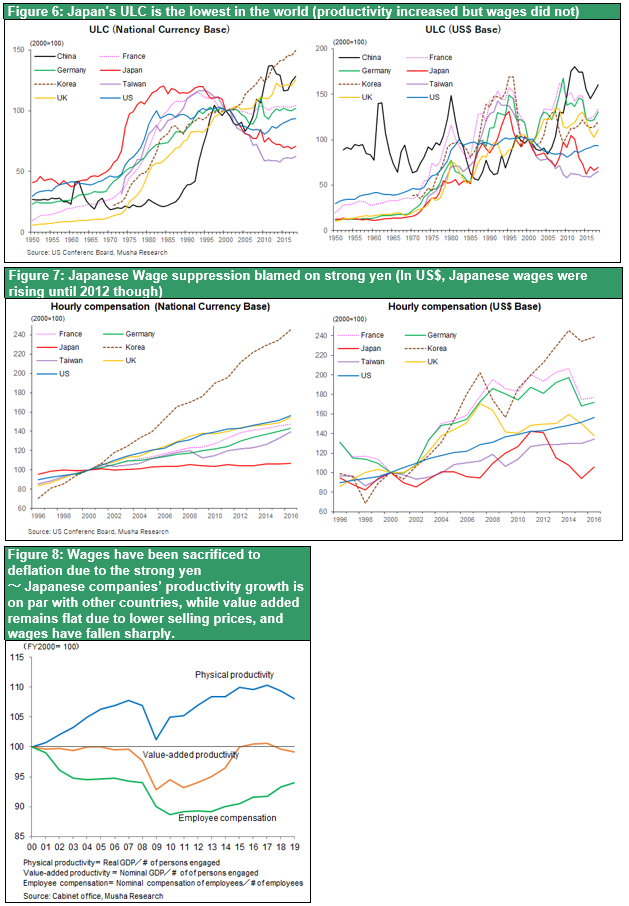

These two measures to correct "cheap Japan" will not be effective because they lack economic rationality. Japan's deflation and falling wages began when Japanese companies lost their competitiveness due to the extremely strong yen and were forced to lower their wages. If the yen appreciates further, companies will be forced to lower wages even further to remain competitive or move factories overseas. This is the anthill of a strong yen and deflation.

In addition, the policy of forcibly raising wages in Japan does not seem to be feasible on its own. Since low wages are caused by the decline in the price competitiveness of Japanese companies, forcing them to raise wages will worsen corporate profits and further reduce their ability to pay wages.

"Cheap Japan is a good thing, and the virtuous cycle of Japan's revival begins here

We should think that "cheap Japan" is a good thing, that there is no need to change it, and that a virtuous circle will start from here. The reason is that "expensive Japan" was the starting point of the vicious circle. This "expensive Japan" has become extreme level with the strong yen, and Japan's price competitiveness has dramatically declined. The root cause of Japan's decline is clearly the decline in price competitiveness, which was caused by the high prices of Japan and the strong yen.

The world's most expensive country was the starting point of Japan's decline

In the early 1990s, Japan was the world's most expensive country. Everything from hotel rates to everything else was the most expensive in the world. The price of land at the Imperial Palace was almost the same as the price of land in California. In 1990, the world's top ten banks by market capitalization were dominated by major Japanese city banks, up to ninth place. In 1995, I testified as a witness in the Diet on the analysis of "Japan's abnormally high prices and the widening gap between domestic and foreign prices," and explained that the high cost structure in Japan and the appreciation of the yen were the causes. From there, prices and asset prices began to fall as if rolling down a hill, and at the same time, the Japanese economy began to decline rapidly.

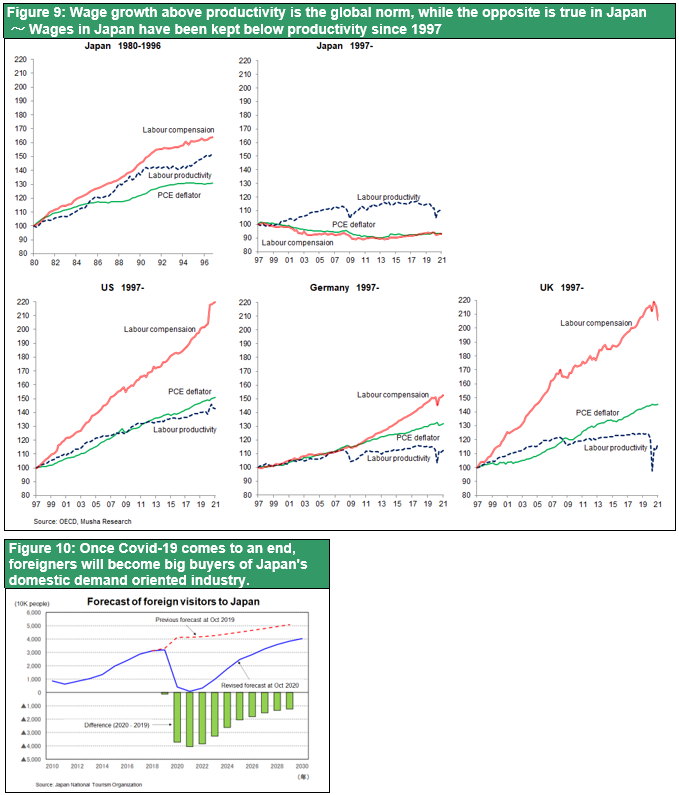

But now, with the depreciation of the yen in addition to the declining prices and wages, the price competitiveness of Japanese companies is improving for the first time in the past 30 years. Since "Cheap Japan" means low costs for Japanese companies, we can expect to see higher profits for Japanese companies in the future. For those companies that produce overseas, this will come in the form of an increase in the yen equivalent of their overseas corporate profits. This will lead to higher wages due to the increased solvency of companies and the tight supply-demand balance for technical workers. The improvement in international competitiveness will become apparent in the global manufacturing industry and in tourism-related domestic industries, which are expected to expand rapidly in the next few years. In this way, "Cheap Japan" will be a driving force for the revival of the Japanese economy. A sustained recovery of Japan's lost international purchasing power can only be realized if the international competitiveness of companies is restored. The most important thing now is to continue the super monetary easing as long as possible in order to weaken the yen.

Why is the tourism industry important?

Without Corona, what would have happened now? The Olympics would have brought a flood of 40 million tourists to Japan, and if each visitor spent 200,000 yen, Japan's domestic industry would have received 8 trillion yen in new foreign demand. Japan's inexpensive, high-quality tourism resources and services would have been offered to the world's middle class, and demand would have skyrocketed. No matter where you travel in the world, there is no place as cheap, safe, and delicious as Japan. Japan's domestic demand is being met by foreigners, a welcome turnaround that would have been unthinkable a decade ago. This is what is sure to happen in Post Corona. We should consider that "cheap Japan" is likely to trigger a virtuous cycle of economic revival in Japan, not only in the export industry but also in the domestic industry, as prices become more competitive and demand increases.

The Balassa-Samuelson hypothesis works for Japan's tourism industry, which is particularly cosmopolitan.

The "cheap Japan" is particularly evident in Japan's domestic industries and service prices, where the cost performance of Japanese tourism is considered very high by foreigners.

The reason why Japan's domestic prices are so attractive to foreigners can be interpreted by the Balassa-Samuelson hypothesis in international economic theory. It starts from the principle that wages in the world are one price and that labor wages in two countries with identical labor productivity will be the same. However, this is only true for tradable goods (mainly manufacturing) that are mutually competitive in the international market. Then, how are the wages of domestic demand industries such as service industries that do not compete in the international market determined? It will follow the level of tradable goods industry’s wages of the country.

In other words, if the productivity of country A is twice that of country B in the tradable goods industry, wages in the tradable goods industry of country A will be twice those of country B. Wages in the service industry of country A will also be twice those of country B. In this case, wages in the service industries of countries A and B are determined regardless of productivity. In general, the productivity of service industries, such as barbers, is not very different in developed countries and emerging countries. However, the wages of a barber in a developed country can be as much as 10 times higher than in an emerging country. In other words, the wage-price gap per unit of productivity is particularly large in the service industry.

However, if international exchange becomes more active and the service industry attracts more foreign customers, the situation will change, and foreign demand will rush to the cheaper service industry in country B (where productivity is not much different, but prices are half as high). It is clear from Nakafuji's book that Japan's tourism-related prices are greatly undervalued in international comparisons, which will greatly increase tourism demand. It is expected that the "cheap Japan" will be greatly corrected by the external demand that appears in the domestic industry of tourism.

In this way, "Cheap Japan" will increase the upside pressure on domestic demand industries even more than the manufacturing industry. The flourishing tourism industry will be the driving force behind Japan's overcoming deflation.