Aug 27, 2021

Strategy Bulletin Vol.286

The long-term trend ahead of tapering (1)

~The end of the 40-year downtrend in interest rates and the risk of U.S. stocks

In this and the next isseues, I will report on the start of the Fed's tapering and its impact. In the next issue, we will look at the long-term trend ahead of tapering (2): A correction in the trajectory of US equity capitalism and the end of Japan's inferiority.

What will tapering do to the financial markets?

The Fed's tapering (reduction of asset purchases) by the end of this year has finally come within sight. In his WSJ column, "What we still don't know about the Fed's bond buying spree?" (8/23/2021), J. Mackintosh writes: 1) Is tapering a factor in rising interest rates or not? (2) Whether rising interest rates are a factor in rising stock prices? (3) Whether the long-term relationship between stock prices and interest rates has changed or not? All of these are essential questions, but they cannot be interpreted at all.

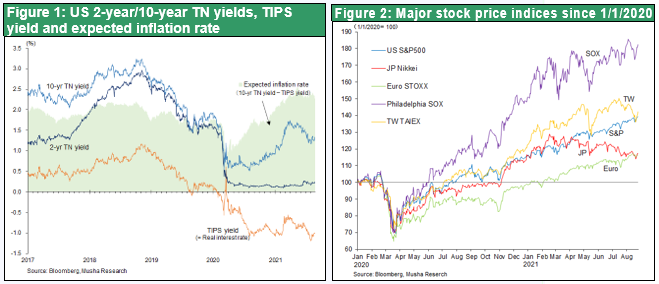

1) Is tapering (decrease in asset purchases) a factor in rising interest rates or not? Common sense suggests that it is a factor in raising interest rates. However, concerns about tapering have been on the rise since February and March 2021, and at the FOMC meeting in July, the majority opinion was that tapering would start within the year. Despite this, long-term interest rates have declined for the past five months. This is the opposite of common sense. The decline in interest rates may be a sign that the Market is anticipating that tapering will cause the economy to slow down, but the fact that U.S. stock prices have been hitting record highs during this period does not support that interpretation.

2) Is interest rise a factor in stock price go up? Common sense dictates that it is a factor for stock market weakness. However, from August 2020 until February 2021, interest rates rose and stocks appreciated. On the other hand, since March 2021, interest rates have been falling and stocks have been rising. Also the differences in sectoral responses cannot be ignored. If we believe that the rise in interest rates was caused by the expected economic expansion, then economy-sensitive value stocks will rise. On the other hand, a rise in interest rates means an increase in the discount rate, which converts future earnings to present value, and this would have a negative impact on growth stocks, which have large future earnings. It is true that when long-term interest rates fell sharply from May to July this year (from 1.69% to 1.17%), the Dow Jones Transportation Average, which represents value stocks, fell by 10%, while the Nasdaq Index, which represents growth stocks, rose by 12%. In other words, the reaction of value stocks and growth stocks to interest rates is contradictory. However, such a relationship also changes over time and cannot necessarily be generalized.

The near-term market is a random walk with plenty of investment capital and high speculative activity

As you can see, the near-term market is difficult to interpret logically, but that is because it is driven by supply and demand, not by fundamentals or logic. The current Wall Street market, with its abundance of investment funds and growing speculative fervor, is driven solely by supply and demand. It would be nicer to think that we are in a world of random walks, like the steps of a drunk. It is impossible to interpret the short-term movements of the market with rationality and laws.

However, if we look at the long term (a year or more), we can almost see major changes in trends. First, the coronary pandemic will come to an end and the damage to the economy will diminish significantly. The yield on 10-year government bonds will easily return to the pre-Corona level of 2.5% to 3% in 2022. Even if interest rates don't rise further after that, it's entirely possible that the market will become more sensitive to the risk of higher rates.

The relationship between long-term interest rates and stock prices has changed dramatically from phase to phase.

So, when the long-term trend of long-term interest rates turns from falling to rising, how will it affect stock prices? Looking back at the past, the relationship between interest rates and stock prices has changed significantly over time, and there is no consistent correlation.

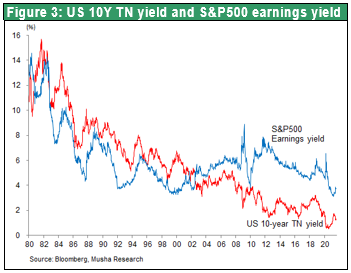

As seen in Figure 3 above,

(1) From 1980 to 1999, the SP500's yield has been almost the same as the 10-year treasury yield. In other words, a decline in interest rates led to a fall in yields (which pushed up the PER), which in turn led to higher stock prices, while a rise in interest rates pushed down the PER, which in turn led to lower stock prices.

(2) From 2000 to around 2012, falling interest rates were a clear factor in weakening stocks because falling interest rates and rising yields (falling PER) occurred simultaneously.

(3) From 2012 to 2018, the yield on 10-years treasury was almost unchanged, but the yield on S&P earnings declined (i.e., PER rose), and stock prices rose independently of interest rates.

(4) Since 2019, however, interest rates appear to be falling and earnings yields are falling (=PER rising). It is quite possible that we are once again entering an era in which yields and long-term interest rates move in parallel, as they did before 1999. If this is the case, the expected rise in interest rates will push up earnings yields and cause stock prices to fall.

This is very important," said J. Mackintosh. "The reason we have bonds in our portfolio is to mitigate the shock of falling stock prices," he said. But if stock prices fall and bonds fall (interest rates rise) at the same time, holding bonds is no longer a hedge against portfolio risk. " The problem is that we may be returning to an economic environment closer to that of the 2000s, when the Fed was more concerned about inflation than supporting the economy. If that is the case, then higher bond yields are not a sign of economic news (economic acceleration) that will be good for stock prices, but rather a sign of economic news (inflation) that will not help stock prices."

The end of the downtrend in ultra-long-term interest rates and potential risks for U.S. stocks

Musha Research believes that J. Mackintosh's concerns are premature. The interest rate hike expected for the time being is likely to be a good one (i.e., due to economic expansion) and not a bad one (i.e., inflation). Even if the relationship between interest rates and stock prices is returning to its pre-1999 level, current earnings yields are much higher than 10-year government bond yields, and stock prices have a valuation buffer that can withstand a 1-2% rise in long-term interest rates. The long-term uptrend in stock prices is likely to remain unchanged.

However, the risk of a short-term plunge cannot be ruled out. The likely trigger is that U.S. companies have over-adjusted to the long-lasting financial environment of lower long-term interest rates. If the market realizes this risk, it may trigger a temporary shock such as a sharp decline in stock prices. (More analysis in the next issue)