Aug 30, 2021

Strategy Bulletin Vol.287

The long-term trend ahead of tapering (2)

~ A change in the course of U.S. equity capitalism and the end of Japanese equity inferiority

The end of the downtrend in ultra-long-term interest rates and potential risks for U.S. stocks

Musha Research believes that J. Mackintosh's concern in the previous issue (the risk that a rise in interest rates based on inflation concerns will become a factor in the decline of stock prices) is premature. We believe that the interest rate hikes expected for the time being are good interest rate hikes (due to economic expansion) and not bad interest rate hikes (inflation). Even if the relationship between interest rates and stock prices is returning to its pre-1999 level, current earnings yields are much higher than 10-year government bond yields, and stock prices have a valuation buffer that can withstand a 1-2% rise in long-term interest rates. The long-term uptrend in stock prices is unlikely to change.

However, the risk of a short-term plunge cannot be ruled out. The likely trigger is that U.S. companies have over-adjusted to the long-lasting financial environment of lower long-term interest rates. If the market realizes this risk, it may trigger a temporary shock such as a sharp decline in stock prices.

U.S. companies increase leverage and return 100% of profits to shareholders; is this sustainable?

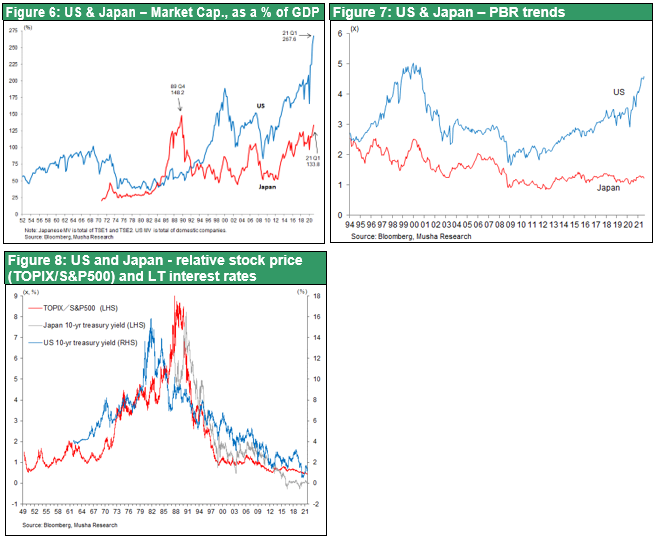

In the past decade or so, U.S. corporate finances have been characterized by a marked increase in leverage. As shown in Figure 1, U.S. companies have been returning almost all of their profits to shareholders in the form of dividends and share buybacks, and over the six years from 2015 to 2020, U.S. companies (excluding financials) posted $6.17 trillion in after-tax profits, of which $3.63 trillion was returned to shareholders in dividends and $2.51 trillion in share buybacks, for a total of $6.14 trillion. In other words, on a book value basis, there has been no increase in equity capital at all. Nevertheless, debt has increased by $3.04 trillion, mainly in the form of bonds. It can be said that corporations' dependence on debt has increased significantly.

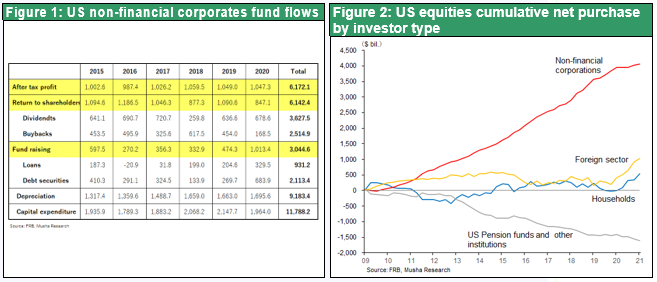

In the 11 years since the GFC, corporate stock buybacks have totaled $4 trillion, making them the single ang largest stock buyer (Figure 2). In other words, the 6.5 times increase well above other countries, in U.S. stocks since the GFC has been supported solely by companies' price-oriented financial strategies (Figure 3).

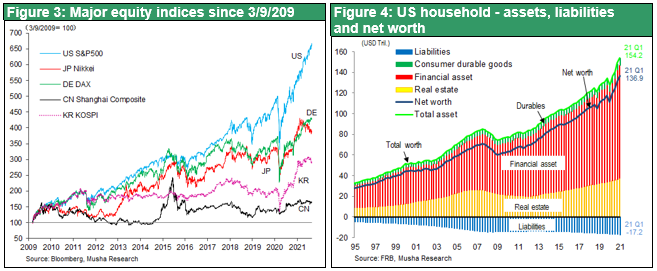

The net worth of U.S. household holdings bottomed out at $60 trillion in the first quarter of 2009 after GFC and rose to $136 trillion in the first quarter of 2021 (Figure 4), an increase of $76 trillion over 12 years (3.6 times the U.S. GDP), providing a driving force for U.S. consumption. This rise in asset prices was made possible by higher stock prices, which in turn were driven by corporate share buybacks. In this way, it is no exaggeration to say that the financial strategy of companies to focus on stock prices was the backbone of the U.S. economic expansion in the 2010s.

High equity valuations brought about by the high leverage of US companies

This stock-price-oriented financial strategy of increasing leverage and realizing the greatest shareholder benefit, i.e., higher stock prices, is particularly strong among U.S. companies. Figure 5, Debt to Equity ratios of U.S., Japanese, and European companies, shows that U.S. companies have become more leveraged.

This chain of events has been particularly strong in the U.S.: return of profits through dividends and share buybacks → increase in ROE (=increase in earnings per share) and higher stock prices due to improved supply and demand → increase in equity capital (market capitalization) based on market prices → increase in debt capacity based on market prices (market capitalization) → increase in debt.

The stock-price-oriented financial policies and highly leveraged structure of U.S. companies, which have played such an important role in worsening the financial balance of U.S. companies, will be put to the test by the durability of corporate earnings during the expected rise in interest rates. We cannot rule out the possibility that the virtuous cycle of rising stock prices triggered by the share buyback mentioned above will be dampened and even reversed. We are entering an era that requires careful observation.

Rising U.S. interest rates, a strong dollar, and the possibility of a period of Japanese stock dominance in 2022

Will rising U.S. interest rates trigger a shift in U.S. corporate financial strategy (from leveraging to deleveraging)? If so, this could have an impact on stock prices. We should keep a close eye on whether this will lead to a reduction in debt or share buybacks.

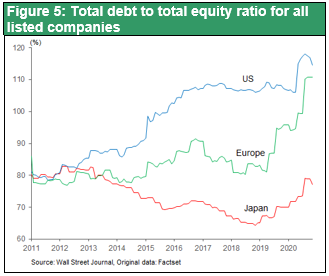

This could mean a correction in the outstanding stock valuations in the U.S., which were brought about by the financial policies of U.S. companies that focus on stock prices. A comparison of stock valuations between Japan and the U.S. shows that the ratio of market capitalization to GDP is 268% in the U.S. and 133% in Japan (Figure 6), while the P/B ratio is 4.59 times in the U.S. and 1.23 times in Japan (Figure 7).

Figure 8 shows that the TOPIX/S&P 500 has declined consistently since reaching 9x during the Japanese stock market bubble in 1990 and is currently at a record low of 0.5x. The process of this decline is almost identical to the decline in long-term interest rates in the US (→ high leverage of US companies). As long-term interest rates declined, U.S. stocks continued to outperform Japanese stocks by increasing their leverage. If the aforementioned disparity in U.S. and Japanese stock valuations is the result of this, then the shift in interest rate trends should lead to a correction in the disparity between U.S. and Japanese stock valuations.

It may be time to end the long period of inferiority of Japanese stocks. A shift in the long-term trend of interest rates will favor the world's least-leveraged Japanese companies and Japanese stocks, which contrast favorably with U.S. companies. The poor performance of Japanese equities, which has continued from February to August 2021, may be greatly corrected in 2022.