Nov 01, 2021

Strategy Bulletin Vol.293

Supply Chain Disruptions and Inflation Outlook, Implications for Japan

- Most supply-side disruptions are transitory, but oil & gas price hikes require caution

(1) Most supply-side disruptions are transitory; friendly monetary policy continues

Supply chain disruptions as an ambush

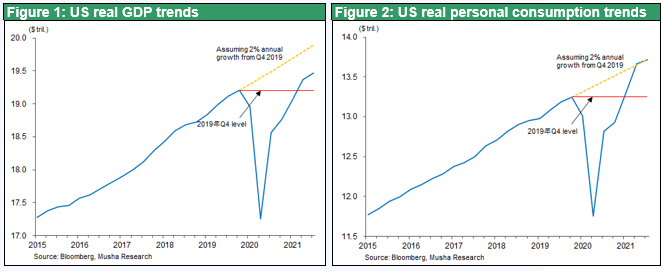

After the corona pandemic, there were fears of a major recession due to lack of demand, but this was averted by decisive policies (integrated fiscal and monetary easing and safety net construction by governments). Now, however, supply constraints are increasing and disturbing the economy. The U.S. GDP growth rate (annualized) in 3Q2021 was 2.0%, a significant drop from 6.3% in 1Q and 6.7% in 2Q, and the main reason for the decline is believed to be the inability to meet latent demand due to supply-side constraints.

Supply constraints are spreading everywhere. Supply chain disruptions have led to a shortage of semiconductors, a decline in automobile production, and soaring natural gas and oil prices due to resource shortages.

Financial Markets Remain Calm

However, the financial markets have remained calm, with U.S. stocks continuing to hit new highs and the rise in long-term interest rates limited. It is probably because people have confidence in the Fed's policies and are convinced that inflation is transitory. However, the more fundamental reason for this sense of security is the Fed's basic policy of not responding to inflation caused by supply constraints by raising interest rates, a lesson learned from the oil shock.

At the time of the oil crisis, the practice of easy wage hikes and passing them on to selling prices had taken root in the U.S., leading to a vicious cycle in which unit labor costs in the manufacturing industry rose significantly every year. Remnants of the prosperous Golden 50's and 60's led to a practice to pass off cost increases between companies with increased monopoly and price control and workers organized in powerful unions affiliated with the AFL/CIO. The high inflation and devaluation of the dollar in the 1970s was a consequence of this. From the perspective of the oil-producing countries, the oil shock was a rational way to recover the depreciating value of the dollar. Under the behavior of easing passing on higher costs to selling prices, higher oil prices led to widespread price hikes, that reached a historic 14.5% in 1980. Today, wages and selling prices are determined in a highly competitive environment, and unit labor costs in manufacturing are under control. The market has been reassured those conditions are not conducive to the kind of stagflation that occurred during the oil crisis. Prices will rise mildly, tapering will begin, and interest rates will start to rise in 2022, but stock prices will rise steadily.

Various causes of supply disruptions, many of them transitory

A quick check of the major factors reveals that the causes of supply disruptions are diverse and cannot be summarized in a single sentence.

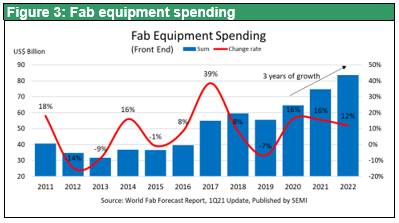

1. Supply disruption on semiconductors → Growing demand for high-tech products under pandemic.(PCs, etc.), Rapid growth in demand in new fields such as in-vehicle use due to the shift to EVs, Investment restraint in 2018-20, Inventory accumulation by China and other countries(?),A sharp decline in parts production in Asia due to the corona disaster.

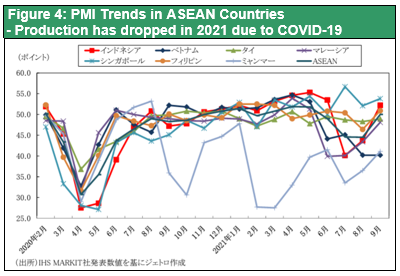

2. Supply disruption on automobiles → Shortage of semiconductors in automobiles, sharp decline in parts production in ASEAN countries due to the corona disaster

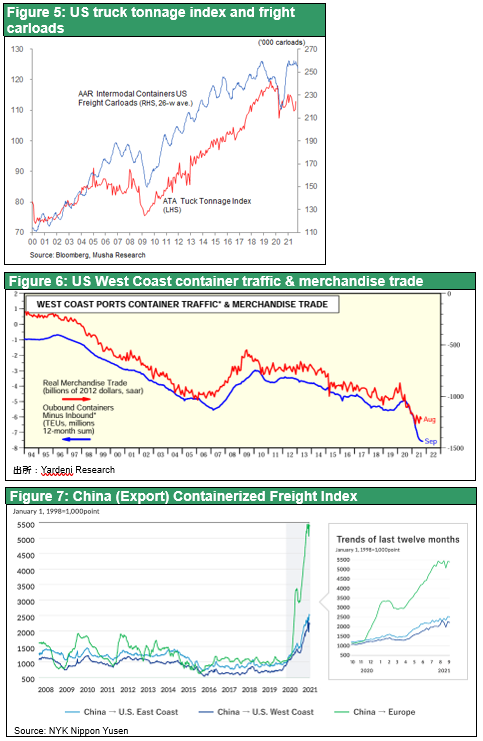

3. Disruption of transportation chain due to shortage of truck drivers → Shortage of truck drivers in the U.S. and the U.K. (the blame for the layoffs immediately after the outbreak of Corona pandemic) caused a clog at the end of the delivery chain for imported goods, Containers to accumulate at the end and stopping the global circulation of containers, which greatly suppressed international logistics. Cargo ships full of containers that could not be landed became stagnant at import ports, causing shipping rates to soar. As shown in Figure 5, container rail transport in the U.S. is recovering, while truck transport is lagging notably behind. Chart 6 shows the difference between container inbound and outbound traffic on the U.S. West Coast, and shows that outbound traffic has fallen significantly in the process of U.S. demand recovering from the Corona pandemic

4. Supply disruption on gas oil, and coal → Decrease in wind power output due to weather (Europe), Decrease in coal production in China (floods, pause for COP26?) Direct factors include the ban on Australian coal imports and Russia's restriction on natural gas supply. However, as will be discussed later, the root cause of shortage is that upstream investment was curtailed during the low price period after 2015.

Most of these supply disruptions are transitory, as the Fed has analyzed, and are expected to be resolved next year. In the semiconductor market, investment to increase production is proceeding, especially in China. The buying spree has run its course, and there may be concerns about oversupply of some products. Automobile production can also be normalized once the corona infection is under control and the semiconductor shortage is resolved. The system of packing goods into containers and transporting them in relays by ship, rail, and truck will cease once the Christmas season is over and there is no longer a backlog of goods at the end of the season. However, the energy sector is the only one that will not return to normal. The price of crude oil has risen above $80 per barrel for WTI, but it may still rise, or at least not fall much from here, according to experts.

(2) Lack of investment that led to high oil and gas prices, energy situation not optimistic

Fossil fuel shortage, lack of investment spurred by decarbonization movement

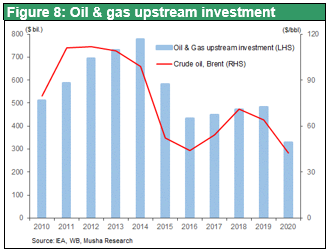

Why are energy-related supply constraints the only thing that cannot be reversed? The reason is that two factors completely unrelated to the corona pandemic are behind the surge in natural gas, oil, and coal prices. The first is the lack of investment since 2015. It is said that upstream investment in oil and gas is linked to supply capacity with a lag of about five years, so supply capacity will not increase for the time being. According to Reistad Energy, a company that conducts energy-related research, upstream investment in oil and gas in 2020 was 55% less than in 2014, when it peaked. They explain that most of this decline was not related to decarbonization but occurred over the course of 2016, when oil prices plummeted from $100/barrel to $40/barrel.

Second, the pressure to decarbonize is causing a major squeeze on upstream oil and gas investment. The WSJ explains, "Global oil and gas exploration spending, excluding shale gas, averaged about $100 billion a year from 2010 to 2015, according to Rystad Energy, but has since fallen to about $50 billion due to the collapse in oil prices." From there, investment has fallen even further in 2021, with the IEA predicting that total global oil and gas investment in 2021 will be $356 billion, down about 26 percent from pre-pandemic levels. Yet the IEA insists that this low level should be maintained for the next decade to meet the goals of the Paris Agreement. On the other hand, the IEA argues that investment in clean energy needs to increase from about $1.1 trillion this year to $3.4 trillion per year by 2030 (WSJ, Oct. 17). The article implies that environmentalist-led IEA's stance of curbing oil and gas investment and promoting investment in clean energy is unrealistic.

Hasty decarbonization is a gift to Russia and China (by WSJ)

Environmentalists, who abound in the financial markets, are also putting a lot of pressure on oil and gas companies. This year, for example, proxy fights have broken out against Exxon, Shell, and Chevron, demanding that they appoint environmentalist directors, curb investments linked to CO2 emissions, and spin off their CO2-emitting divisions. The cost of capital for these private energy companies has become significantly higher, that discouraging investment further. The WSJ was quick to point this out in its editorial "Decarbonization is a Gift from the U.S. to China and Russia" (June 11). "Progressives are willing to give up a key U.S. strategic economic advantage in the name of climate action. But phasing out fossil fuels in the U.S. will not make carbon emissions disappear, they'll just be created elsewhere." That is a gift to tyrannical China and Russia.

The Revenge of Fossil Fuels

Goldman Sachs analyst Jeff Currie calls this the "revenge of the old economy" (FT 10/22), saying that the suppression of old economy investments, which has become more pronounced since the oil plunge at the end of 2014, has begun to take its revenge. (1) a shift in the stock and financial markets toward technology and the new economy, and a disregard for the old economy; (2) a shift toward ESG and green energy investments; and (3) a decline in the income ratio of the low-income group with a high propensity to consume energy due to widening inequality (i.e., a decline in the energy consumption ratio). However, sharp rebound is beginning to occur now. The years of investment restraint and demand pickup will lead to an era of tighter supply and demand. He argues that a new commodity super cycle has begun.

Ultimately, higher prices will change the behavior of the demand side. The price of fossil fuels will have to rise in order to decarbonize. There will be more situations where we will have to choose between accepting high costs and promoting decarbonization. In the future, the threshold for decarbonization will be determined by how fast and how high the price of oil and gas can rise, and to what extent the economy (politically) can withstand it. There is a good chance that a major shock will occur in this process.

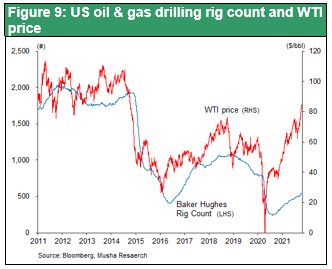

Thus, the fossil fuel supply uncertainty triggered by the sharp rise in oil and natural gas prices has great roots. For the time being, however, the demand for crude oil itself will not exceed the level of pre-Corona 2019 even in 2021. In addition, judging from the number of drilling rigs in operation in the US, there is capacity to increase production, and therefore there will not be a third oil shock immediately, even though oil prices will remain high.

(3) Sluggish inflation is a good thing for Japan

Slow inflation in the US

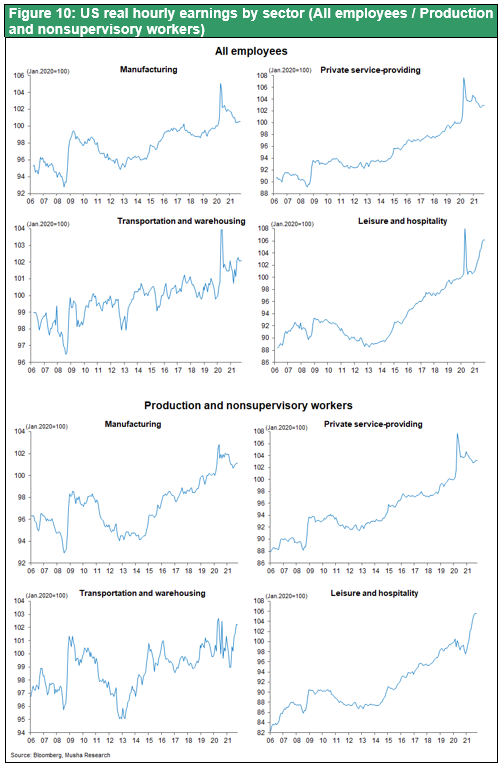

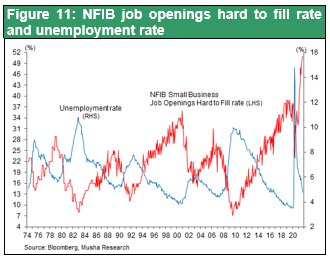

We may not need to think about the possibility of a surge in oil prices leading to higher inflation, surprising the Fed, and shocking the market until 2022. The rise in prices and wages in the U.S. has been partial. As shown in Chart 10, wage growth has been skewed toward the transportation and leisure sectors, where labor shortages are pronounced, especially non-supervisory workers. The supply-demand crunch is limited to a few fields with supply constraints, and there is slack (surplus) overall. It is difficult to imagine that the current bargaining power on the part of workers will last for long, except for highly specialized intellectual labor, entertainment that requires close contact with people, nursing care, and childcare.

However, there is a strong appetite for jobs in the US. Also, housing supply and demand is tight, and rents are rising. This, combined with rising energy prices, could cause a sustained rise in the wage base, and it is clear that the price environment in the US is moving from deflationary to inflationary. The possibility that this trend will accelerate in the future should be kept in mind.

Supply constraints and mild inflation are favorable for the Japanese economy and stocks

The shift to an inflationary environment described above is advantageous for Japan, which has been hurt by deflation. In addition, Japan's manufacturing industry is lagging other countries in renewable energy but excels in technology to make coal and oil energy and carbon saving. Japan is overwhelmingly strong in hybrid vehicles. In the era of the coexistence of carbon and green energy and the high price of carbon energy, there will be many business opportunities.

Moderate inflationary trend and strong dollar will be advantageous for the Japanese economy and Japanese stocks. The global stock market may shift its focus to Japanese stocks. The global stock market is likely to shift from high-tech-centered growth stocks to value stocks including resource stocks. High carbon energy prices will also benefit the valuations of Japanese trading companies, which own many resource interests.